February 28, 2022 -- InvestorsHub NewsWire -- via NetworkNewsWire

Editorial Coverage: Almost everything in the online gaming

market produces eye-popping numbers. Even pre-COVID, online

gambling was accelerating at a brisk pace as ever more people

discovered mobile apps and demand surged with the younger

tech-savvy demographic. Enter the coronavirus pandemic in 2020 and

millions more people suddenly became familiar with remote gaming.

Operators were caught off guard by the tsunami of demand and

continue to scramble to capture market share in the booming digital

sector. As the technology continues to gain ground and more

effectively recreate the casino experience, companies with

innovative technologies and insight, such as Playgon

Games Inc. (TSX.V: DEAL)

(OTCQB:

PLGNF) (Profile), are providing operators with a

variety of new turnkey packages to capitalize on strong consumer

demand. Other players in the space, including Bragg Gaming Group

Inc. (NASDAQ:

BRAG), DraftKings

Inc. (NASDAQ: DKNG), Penn

National Gaming Inc. (NASDAQ: PENN) and Wynn

Resorts Limited (NASDAQ: WYNN), are also focused on

making the most of a variety of opportunities in the burgeoning

online gambling market.

- Total gambling revenue worldwide is forecast to reach $525

billion in 2023, with online gambling expected to climb to $92.9

billion.

- Playgon develops, licenses its software platform and suite of

games, including HD-quality live streaming dealer casino games and

multiplayer e-table games.

- Playgon’s live-dealer technology went live in May 2021,

exploding to 23 operators and processing more than $54 million in

bets by October.

- Seasoned leadership team has now onboarded 30 operators, raised

$10.5 million for growth, and is preparing to enter the coveted

U.S. online betting market.

Click here to view the custom infographic of

the Playgon Games Inc. editorial.

Online Gambling Growth Outstripping Broad

Market

Hard

numbers provide some clarity to the outsized growth of

online gambling (sometimes called iGaming). In 2019, total online

gambling revenue was $58.9 billion, forecast to nearly double and

reach $92.9 billion in 2023. At the same time, mobile online

gambling revenue will grow even faster, jumping from $24.8 billion

to $42.5 billion. Even with the tremendous growth, the online

segment is still only a small percentage of the total gambling

revenue (both land bases and online), which is expected to reach

$525 billion next year. However, online gambling has gained

traction, capturing growing market share, and big-name Vegas

casinos are going all in.

Nevada isn’t the only state paying attention. Since the federal

government legalized online betting in 2018, states are

increasingly warming up to the idea of online gaming, looking to

seize a revenue and job-creation opportunity. To date, more than 30

states have abandoned moribund laws blocking online gambling and

are now either live or in the process of launching sports betting

and iGaming. According to MGM, the total addressable North American

market (“TAM”) will reach $27.5 billion per year, broken down into

$14 billion in online sports betting and $13.5 billion in iGaming.

iGaming by definition involves any betting online on games of

chance.

Technology Is Pivotal

The technology infrastructure that is foundational to operators

that offer live dealer content is a bit of an oligopoly, dominated

by Evolution Gaming, Playtech and Microgaming.

Playgon Games Inc. (TSX.V: DEAL)

(OTCQB:

PLGNF) is the savvy upstart, recognizing that the

current suppliers have overlooked mobile and offer largely the same

or generically similar products. This pioneering

Software-as-a-Service (“SaaS”) company has taken a

business-to-business (“B2B”) strategy to provide a multitenant

gateway allowing online operators the ability to offer their

customers innovative iGaming software solutions that outclass the

competition. Playgon prides itself on innovation, modernizing live

dealer games while developing designs specifically for mobile,

rather than desktop like most peers, making a superior user

interface (“UI”) and user experience (“UX”).

With a B2B model, Playgon doesn’t get involved with consumers,

which can cripple margins at the hands of high customer acquisition

costs and marketing costs. Rather, the company develops and

licenses its software platform and suite of games that include four

live-dealer casino games (HD-quality streaming content from its

studio Live from Las Vegas), four multiplayer e-table games (with

nine more in development), Playgon’s innovative platform is built

for seamless integration at the operator level without compromising

any sensitive customer data.

From aesthetics to performance, Playgon offers the most advanced

and ingenious mobile offering in the live-dealer space. The

company’s live-dealer games currently include Blackjack, Baccarat,

Tiger Bonus Baccarat (a proprietary game of Playgon) and Roulette.

Management was mindful in its design, using ProgressiveWeb App

technology to make the product device and store agnostic. By

focusing on mobile, Playgon was able to enhance the player UI and

UX, which attracts the most sought-after player segment, those that

can return remotely.

Playgon went so far as to build its technology to allow for

portrait mode only play, meaning games can easily be played with

one hand on a mobile phone. Top it off with realistic graphics and

live streamed dealers, and architecture built on cloud-based

technology for robustness, scalability and high-speed play, Playgon

is capturing the attention of online operators, casinos,

sportsbooks, and even big database companies.

More Customers, More Players

With the incumbents controlling most of the market and a strict

regulatory environment, there are high barriers to entry into the

iGaming space. Playgon has cleared the hurdles on the strength of

its technology as evidenced by its growing client base and

increased player activity following the award of its Malta Gaming

Authority License last March. The license gave the green

light to Playgon partner SWINTT Malta Ltd, a fast-growing iGaming

content supplier and subsidiary of Glitnor Group, to offer the

Playgon suite of products to its online gaming operator

customers.

Subsequently, international deal flow has been steady. Playgon

went live in South Africa with its partner Intelligent Gaming

(“PTY”) Ltd. By June, six

operators were onboarded, hosting more than 220,000 bets

and 6,000-plus unique visitors in the first month of operations,

with a seventh operator onboarded at the end of the month. Come

August of last year, and the number of operators

leveraging Playgon’s

Vegas Lounge live-dealer platform was up to 14. In

September, SWINTT onboarded three more operators. By October things

were starting to hop. The number of live operators stood at 23, and

Playgon’s platform had exploded to $54

million in player betting turnover in the first half of

the month, up from $1.6 million for the entire month of September.

Since the end of October, 7 more live operators have been

onboarded, bringing the total overseas to 30.

Savvy Team Leads Expansion into Lucrative U.S.

Market

Playgon is led by CEO Darcy Krogh, an iGaming industry vet with

more than 20 years senior-level management experience, including

founding iGaming pioneer Chartwell Technology in 1999, which he

subsequently sold to Amaya Gaming Group in 2011. He served as VP of

Amaya post merger, ultimately facilitating the sale of the B2B

asset portfolio to NYX Gaming Group in 2015.

A recognized subject matter expert in developing real-time,

live-dealer tech and platforms, Playgon Interactive president Guido

Ganschow successfully built and launched state-of-the-art iGaming

technology throughout Asia and Europe.

Playgon COO Steve Baker was previously VP of operations for Shaw

Communications, managing M&A activity and spurring sales growth

from $300 million to $2.8 billion.

The acumen of the team is evidenced in the stellar international

growth and domestic growth should easily follow. In October,

Playgon hit a major

milestone in going live with Solid Gaming, a Bally’s

Corporation company. Bally’s is a big hitter, and after months of

work customizing, integrating, and testing with the Solid Gaming

integration team to ensure performance, Playgon got rave reviews

and is now live with Bally’s Solid gaming. To meet demand and

continue expansion, Playgon opened a private placement in October

to raise $5.0 million, but due to strong interest, the raise was

increased with the company raising $10.5

million, which is likely to increase Playgon’s

velocity and entry to the U.S. markets.

News about Playgon penetrating the U.S. iGaming market should

come soon. The company has engaged Duane Morris LLP to represent it

in its application process to license its live-dealer technology in

legal markets throughout the country. The play is to first submit

applications in New Jersey, Pennsylvania and Michigan. The U.S. is

a coveted market that is regulating quickly since 2018 for online

gaming, with a projected TAM of $27.5 billion per year and includes

about 400 casino hotels and 465 nonhotel casinos. Based on those

numbers, interest in Playgon’s new technology should be extremely

high.

Online Action

Other players are paying attention to the online gambling

market, making moves to leverage their expertise and strengthen

their positions, both in the United States and around the

world.

Bragg Gaming Group

Inc. (NASDAQ:

BRAG) is a global gaming technology and content

group and owner of leading B2B iGaming companies. The company

offers full turnkey solutions in North American, European and other

regulated international markets. Most recently, the

company debuted its

exclusive iGaming content in the Czech Republic in

partnership with SYNOT Group, via its SYNOT INTERACTIVE platform,

marking its debut in the country and strengthening its presence in

central Europe. The announcement marks Bragg’s sixth new market

entry in the last 10 months.

DraftKings

Inc. (NASDAQ: DKNG) has a vision to build

the best, most-trusted and most customer-centric destination for

skin-in-the-game fans; to develop the most innovative and

entertaining real money products and offers; and to forever

transform the manner in which people experience sports. As part of

that plan, the company launched its

mobile sportsbook in Louisiana in January. With the

launch, Louisiana became the 17th state to offer DraftKings’ online

sportsbook, and the company is now live in 18 states including

retail-only jurisdictions.

Penn

National Gaming Inc. (NASDAQ: PENN) offers Penn Interactive, the online gaming arm of the

company. Penn Interactive is focused on creating the best online

gaming customer experience available using creative outreach,

innovative product design and world-class engineering. Penn

Interactive operates the mobile and desktop

apps mychoicecasino.com, Viva Slots

and HollywoodRaces.com, which offer more than 100 of the most

exciting online Vegas-style slots that can be played for free on

any device and easy wagering for horse racing online,

respectively.

Wynn

Resorts Limited (NASDAQ: WYNN) online gambling

offering is WynnBET, which has a world-class collection of casino

and sports-betting mobile options for discerning players who

understand the difference between placing a bet and experiencing a

bet. The company announced last year that WynnBET opened its

mobile sports book in Tennessee, marking the sixth state where

the app has launched in less than nine months. With the

announcement, the WynnBET app became available for download

anywhere in Tennessee on Apple and Android devices.

Already generating tens of billions in revenue, there are

multiple drivers that support analyst’s calls for the online gaming

market to soon cross $100 billion globally. The pandemic only

accelerated the online action as new users gravitate to iGaming.

The trend is now a pattern, and it will continue to drive consumer

demand going forward.

For more information about Playgon Games,

please visit Playgon

Games Inc.

About NetworkNewsWire

NetworkNewsWire (“NNW”) is a financial news and

content distribution company, one of 50+ brands within

the InvestorBrandNetwork (“IBN”), that

provides: (1) access to a network of wire

solutions via InvestorWire to reach all target markets,

industries and demographics in the most effective manner

possible; (2) article and editorial

syndication to 5,000+ news outlets; (3)

enhanced press release solutions to ensure maximum

impact; (4) social media distribution via IBN

millions of social media followers; and (5) a

full array of corporate communications solutions. As a multifaceted

organization with an extensive team of contributing journalists and

writers, NNW is uniquely positioned to best serve private and

public companies that desire to reach a wide audience comprising

investors, consumers, journalists and the general public. By

cutting through the overload of information in today’s market, NNW

brings its clients unparalleled visibility, recognition and brand

awareness. NNW is where news, content and information converge.

To receive SMS text alerts from NetworkNewsWire, text

“STOCKS” to 77948 (U.S. Mobile Phones Only)

For more information, please visit https://www.NetworkNewsWire.com

Please see full terms of use and disclaimers on the

NetworkNewsWire website applicable to all content provided by NNW,

wherever published or re-published: http://NNW.fm/Disclaimer

NetworkNewsWire (NNW)

New York, New York

www.NetworkNewsWire.com

212.418.1217 Office

Editor@NetworkNewsWire.com

NetworkNewsWire is part of the InvestorBrandNetwork

DISCLAIMER: NetworkNewsWire (NNW) is the source of the Article

and content set forth above. References to any issuer other than

the profiled issuer are intended solely to identify industry

participants and do not constitute an endorsement of any issuer and

do not constitute a comparison to the profiled issuer. The

commentary, views and opinions expressed in this release by NNW are

solely those of NNW. Readers of this Article and content agree that

they cannot and will not seek to hold liable NNW for any investment

decisions by their readers or subscribers. NNW is a news

dissemination and financial marketing solutions provider and are

NOT registered broker-dealers/analysts/investment advisers, hold no

investment licenses and may NOT sell, offer to sell or offer to buy

any security.

The Article and content related to the profiled company

represent the personal and subjective views of the Author, and are

subject to change at any time without notice. The information

provided in the Article and the content has been obtained from

sources which the Author believes to be reliable. However, the

Author has not independently verified or otherwise investigated all

such information. None of the Author, NNW, or any of their

respective affiliates, guarantee the accuracy or completeness of

any such information. This Article and content are not, and should

not be regarded as investment advice or as a recommendation

regarding any particular security or course of action; readers are

strongly urged to speak with their own investment advisor and

review all of the profiled issuer’s filings made with the

Securities and Exchange Commission before making any investment

decisions and should understand the risks associated with an

investment in the profiled issuer’s securities, including, but not

limited to, the complete loss of your investment.

NNW HOLDS NO SHARES OF ANY COMPANY NAMED IN THIS RELEASE.

This release contains “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E the Securities Exchange Act of 1934, as amended and

such forward-looking statements are made pursuant to the safe

harbor provisions of the Private Securities Litigation Reform Act

of 1995. “Forward-looking statements” describe future expectations,

plans, results, or strategies and are generally preceded by words

such as “may”, “future”, “plan” or “planned”, “will” or “should”,

“expected,” “anticipates”, “draft”, “eventually” or “projected”.

You are cautioned that such statements are subject to a multitude

of risks and uncertainties that could cause future circumstances,

events, or results to differ materially from those projected in the

forward-looking statements, including the risks that actual results

may differ materially from those projected in the forward-looking

statements as a result of various factors, and other risks

identified in a company’s annual report on Form 10-K or 10-KSB and

other filings made by such company with the Securities and Exchange

Commission. You should consider these factors in evaluating the

forward-looking statements included herein, and not place undue

reliance on such statements. The forward-looking statements in this

release are made as of the date hereof and NNW undertakes no

obligation to update such statements.

SOURCE: NetworkNewsWire

Editorial Coverage

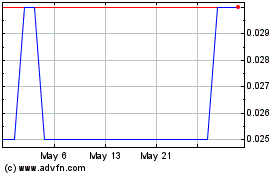

Playgon Games (TSXV:DEAL)

Historical Stock Chart

From Jan 2025 to Feb 2025

Playgon Games (TSXV:DEAL)

Historical Stock Chart

From Feb 2024 to Feb 2025