Emgold Completes Re-Pricing and Extension of Warrants

18 August 2012 - 12:27AM

Marketwired Canada

Emgold Mining Corporation ("Emgold" or the "Company") (TSX

VENTURE:EMR)(OTCQB:EGMCF)(FRANKFURT:EML) is pleased to announce that, as

outlined in its July 13, 2012 press release, it has completed the re-pricing and

extension of the expiry date of certain existing common share purchase warrants

("warrants"). One hundred percent of Group 1 warrant holders responded by

signing Warrant Amendment Agreements and Emgold has obtained TSX Venture

Exchange approval for the amendment of 11.8 million eligible warrants in this

Group.

A total of 11.8 million warrants, the original exercise price of which was

US$0.35, have been re-priced at CDN$0.15 per share and been given a 12 month

extension. Those eligible warrant holders in Group 1 may now elect to exercise

an "Early Conversion Option" whereby they can convert their warrants to shares

at CDN$0.10 per share, if exercised by August 31st, 2012.

Warrant holders were given until August 10, 2012 to return Warrant Amendment

Agreements to the Company if they wished to have their warrants re-priced and/or

extended, as applicable. One hundred percent of the Warrant Amendment Agreements

for Group 2, 3, and 4 warrant holders were not obtained and those warrants will

not be re-priced or extended. Group 5 Warrants were ineligible for amendment

pursuant to TSX Venture Exchange Policy. Any Warrant Amendment Agreements

completed for Group 2 through 5 warrant holders are now voided, and the terms of

the warrants are unchanged.

About Emgold Mining Corporation

Emgold plans to complete an Environmental Impact Report ("EIR") for the

Idaho-Maryland Project in California, with a targeted completion date of 2013,

subject to financing. The Idaho-Maryland Mine produced 2.4 million ounces of

gold at an average recovered grade of 0.43 ounces per ton between 1862 and 1956.

Once the EIR is complete and permits are obtained, the Company plans to dewater

and rehabilitate the historic underground workings, conduct underground

exploration, and ultimately construct a high grade underground gold operation

capable of producing over 200,000 ounces of gold per year.

Management believes the exploration target at Idaho-Maryland is 3 to 5 million

ounces of gold, subject to additional diamond drilling that will be completed

from underground once the mine is permitted and dewatered. Note that this target

is conceptual in nature, and there has been insufficient exploration to define a

mineral resource and it is uncertain if further exploration will result in any

further delineation of a mineral resource. The target is based on projecting

historic production and current resources to a depth of 5,000 feet.

Emgold has several other early to mid stage exploration properties. These

include the Buckskin Rawhide and Koegel Rawhide gold properties in Nevada and

the Stewart and Rozan poly-metallic properties in British Columbia where it is

conducting exploration activities.

Note that technical information in this press release has been reviewed and

approved by Mr. Robert Pease, P.Geo., a Qualified Persons as defined in National

Instrument 43-101. Mr. Pease is responsible for supervising the technical work

related to the Idaho-Maryland Project.

On behalf of the Board of Directors

David G. Watkinson, P.Eng., President & CEO

This release was prepared by the Company's management. For more information on

the Company, investors should review the Company's filings that are available at

www.sedar.com or the Company's website at www.emgold.com. This news release

includes certain statements that are "forward-looking statements" within the

meaning of applicable securities laws including statements regarding the

re-pricing and extension of the warrants, the timing of completion of the Final

EIR on the Idaho-Maryland Project, the Company's planned work programs,

exploration potential, expected results, and other statements. Forward-looking

statements are based on certain assumptions that the City of Grass Valley and

its consultants, which are funded by Emgold, will complete the EIR in a

reasonable timeframe, the City of Grass Valley will certify the EIR as complete,

and the City of Grass Valley will approve the Conditional Use Permit for the

mine and approve other entitlements under their authority. They assume other

permitting agencies overseeing the project on a local, state and federal level

will grant the permits needed for mining construction and operation. They assume

that actual results of exploration, development, and production activities are

consistent with management's expectations, that assumptions relating to mineral

resource estimates and exploration targets are accurate, and that necessary

financing is available to complete the required exploration work. They include

assumptions about production rates, production grades, and gold recoveries.

Although the Company believes the expectations expressed in such forward-looking

statements are based on reasonable assumptions, such statements are not

guarantees of future performance and actual results or developments may differ

materially from those in the forward-looking statements.

Factors that could cause actual results to differ materially from those in

forward-looking statements include the failure to obtain Exchange or warrant

holder approval for the re-pricing of one or more of the Groups, exploration

results that are different than those anticipated, inability to raise or

otherwise secure capital to fund planned permitting, exploration, mine

construction and development, and mine operations. Other risk factors include

changes in metal prices, the price of the Company's shares, the costs of labour,

the cost of equipment, the cost of supplies, actual development and mining

operation successes, exploitation and exploration successes, approvals by

federal, state, and local agencies, permitting delays, legal challenges to

permits, general economic, market or business conditions, and other factors

beyond the control of the Company. Investors are cautioned that any such

statements are not guarantees of future performance and actual results or

developments may differ materially from those projected in the forward-looking

statements. The Company does not intend to update or revise any forward-looking

information whether as to a result of new information, future events or

otherwise, except as required by law.

U.S. 20-F Registration: 000-51411

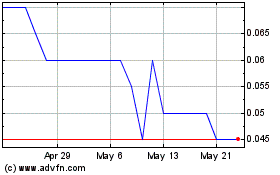

Emergent Metals (TSXV:EMR)

Historical Stock Chart

From May 2024 to Jun 2024

Emergent Metals (TSXV:EMR)

Historical Stock Chart

From Jun 2023 to Jun 2024