Emgold Provides Update on Transactions Involving Its Buckskin Rawhide East Property and Non-Brokered Private Placement Financ...

20 November 2012 - 10:22AM

Marketwired Canada

THIS NEWS RELEASE IS INTENDED FOR DISTRIBUTION IN CANADA ONLY AND IS NOT FOR

AUTHORIZED DISTRIBUTION TO THE UNITED STATES NEWSWIRE SERVICES OR FOR

DISSEMINATION IN THE UNITED STATES.

Emgold Mining Corporation (TSX VENTURE:EMR)(OTCQB:EGMCF)(FRANKFURT:EML)

("Emgold" or the "Company") announces that, subject to TSX Venture Exchange

acceptance, the second part of the private placement, announced by the Company

in its November 14, 2012 press release will be completed at $0.07 per unit.

On November 14, 2012, Emgold announced that it had signed an Option Agreement

that will allow it to complete an early buyout (the "Option") of all underlying

property rights, including royalty rights, in its Buckskin Rawhide East Property

(the "Property") in Nevada. The Option provides that Emgold may pay two

arm's-length parties an aggregate of US$510,000 to allow Emgold to consolidate a

100% interest in the 52 unpatented mineral claims, totaling 835 acres, that make

up the Property.

In order to finance the exercise of the Option, Emgold announced that it had

signed an Agreement (the "Agreement") with Rawhide Mining LLC ("RMC") pursuant

to which Emgold would issue to RMC on a private placement basis, common shares

and warrants in an amount of CDN$1.0 million. RMC operates the Rawhide Gold Mine

in Nevada. In addition to the Property, Emgold has two additional exploration

properties adjacent to or near RMC's Denton-Rawhide Mine, namely the Buckskin

Rawhide West and the Koegel Rawhide Properties.

Also pursuant to the Agreement, upon completion of the title transfer of the

Property to Emgold, Emgold will subsequently lease the Property to RMC. RMC

plans to complete exploration activity on the Property with the goal of defining

a mineral resource that, if successful, could ultimately be developed,

permitted, and processed at the adjacent Rawhide Mine. RMC will have the option

of acquiring a 100% interest in the Property by achieving commercial production

from any resources discovered, at which time Emgold's interest would be

converted to a "Bonus Payment", based on ounces of gold mined from the Property.

In addition, to the above transactions, Emgold proposes to carry out a

concurrent non-brokered private placement, to raise up to an additional

CDN$1,500,000. Details of the various transactions are outlined in Emgold's

November 14, 2012 press release, with additional details on the private

placement outlined below.

Details of the Private Placement

Pursuant to the Agreement, Emgold and RMC have a binding agreement pursuant to

which RMC will subscribe for 8,571,428 units at a price of CDN$0.07 per unit

("Units"), for total proceeds of CDN$600,000. Each Unit will consist of one

common share of the Company and one half of one non-transferable share purchase

warrant. Each full warrant would entitle the holder to purchase for a period of

24 months, one additional common share of the Company at a price of CDN$0.12 per

share. No finder's fees are payable in connection with this financing. Shares

issued will be subject to a four month and one day hold period. This portion of

the private placement will be utilized by the Company to complete the

acquisition of the Property.

Also pursuant to the Agreement, RMC agreed to subscribe for additional Units for

CDN$400,000. The price of these Units has now been set at CDN $0.07. As a

result, RMC will subscribe for an additional 5,714,285 Units, at CDN $0.07, for

proceeds of CDN$400,000. Each Unit will consist of one common share of the

Company and one half of one non-transferable share purchase warrant. Each full

warrant would entitle the holder to purchase for a period of 24 months, one

additional common share of the Company at a price of CDN$0.12 per share. No

finder's fees are payable in connection with this financing. Shares issued will

be subject to a four month and one day hold period.

Emgold also proposes to carry out a concurrent non-brokered private placement of

up to an additional 21,428,571 Units, at a price of CDN$0.07 per share to raise

up to an additional CDN$1,500,000. Each Unit will consist of one common share of

the Company and one half of one non-transferable share purchase warrant. Each

full warrant would entitle the holder to purchase for a period of 24 months, one

additional common share of the Company at a price of CDN$0.12 per share. Shares

issued will be subject to a four month and one day hold period.

Finder's fees and finder's warrants may be paid in connection with some or all

of this concurrent private placement in accordance with TSX-Venture Exchange

policies. Eligible finders (the "Finders") meeting regulatory requirements will

be paid a cash fee equal to 8% of the gross proceeds raised from the respective

accredited investors in the private placement found by the Finders. Each

eligible Finder will also receive that number of non-transferable finder's

warrants as is equal to 4% of the number of Units sold to accredited investors

found by the Finder. Each finder's warrant would be exercisable for one common

share of the Company at a price of $0.12 per share, for a period of 24 months

from the date of issuance. Shares issued on the exercise of the finder's

warrants would also be subject to a minimum hold period of four months and one

day.

Subject to Emgold's success at completing a concurrent private placement, the

transaction with RMC could result in RMC holding between 15 and 20% of Emgold's

outstanding shares and therefore, pursuant to the rules of the TSX Venture

Exchange, would require shareholder approval. Accordingly, it is expected that

closing of the second portion of the subscription by RMC may be put to Emgold's

shareholders for consideration at its AGM scheduled for December 12, 2012.

The proposed financing is subject to all necessary regulatory approvals. The

proceeds of the financing will be used for acquisition of the Property, fees

associated with the transactions, exploration of Emgold's Nevada and B.C.

properties, and for general working capital.

About the Buckskin Rawhide Property

The Property is an exploration property located in the Rawhide Mining District,

about 40 miles southeast of Fallon. It consists of 52 unpatented mineral lode

claims totaling approximately 835 acres. Six of these claims, totaling 120 acres

were staked by Emgold. The balance is currently under an option and lease to

Emgold from Nevada Sunrise, with Castagne holding a 25% carried interest in a

portion of the claims. It contains occurrences of gold and silver mineralization

and was sampled and drilled historically by Kennecott Minerals Company

("Kennecott") and others. It is surrounded by RMC's Denton-Rawhide Mine and

Pilot Gold Corporation's ("Pilot Gold's") Regent exploration property.

The Denton-Rawhide Mine was owned and operated by Kennecott from 1988 to 2010.

From 1990 through 2010, the Denton-Rawhide Mine produced 1.5 million ounces of

gold and 12.7 million ounces of silver, according to Muntean (in Nevada Bureau

of Mines and Geology Special Publication MI-2010, 2011). In 2010, the

Denton-Rawhide Mine was acquired by RMC, who advise that they continue to

produce gold from historic heap leach pads and are in the process of re-opening

the mine.

The Regent property is owned by Pilot Gold and was previously explored and

drilled by Kennecott in the 1990's. Since its formation, Pilot Gold has been

conducting exploration on the property, including reverse circulation and

diamond drilling according to Pilot's public disclosures.

It should be noted that proximity of the Buckskin Rawhide East to other

exploration properties in the area does not mean a resource will be identified

or delineated at Buckskin Rawhide East. However, the presence of similar geology

and structures on the three properties does increase the potential for

exploration success.

Historically, based on internal records, Kennecott drilled over 80 reverse

circulation holes on the Buckskin-Rawhide Property. Those results indicated

potential for delineation of both high grade mineralized gold/silver veins and

bulk minable disseminated gold/silver zones, which led to Emgold acquiring the

Property. Emgold reviewed historic data, conducted geological mapping and field

sampling, and subsequently discovered the Black Eagle High Grade Vein Target and

the Chicago Mountain Bulk Disseminated Target. Information on the Property can

be found at www.emgold.com.

The scientific or technical information contained in this news release has been

reviewed and approved by Mr. Robert Pease, P.Geo., Chief Geologist of the

Company, a Qualified Person as defined in National Instrument 43-101.

On behalf of the Board of Directors

David G. Watkinson, P.Eng., President & CEO

This release was prepared by the Company's management.

For more information on the Company, investors should review the Company's

filings that are available at www.sedar.com or the Company's website at

www.emgold.com. This news release includes certain statements that are

"forward-looking statements" within the meaning of applicable securities laws

including statements regarding the various transactions proposed herein,

exploration potential, and other statements. Forward-looking statements are

based on certain assumptions that the counterparties to the proposed

transactions act in good faith, that financing is available on acceptable terms,

that Emgold receives TSX Venture Exchange acceptance for the transactions, that

any required shareholder approval for part of the financing involving RMC, that

RMC will be able to raise funding to conduct exploration, obtain the necessary

permits to conduct exploration activities, and be successful in conducting such

exploration activities. Although the Company believes the expectations expressed

in such forward-looking statements are based on reasonable assumptions, such

statements are not guarantees of future performance and actual results or

developments may differ materially from those in the forward-looking statements.

Factors that could cause actual results to differ materially from those in

forward-looking statements include the failure to obtain the required financing,

failure of counterparties to perform their obligations or commitments pursuant

to the Option and the LA, failure to obtain the required permits, and failure to

achieve exploration success. Other risk factors include changes in metal prices,

the price of the Company's shares, the costs of labour, the cost of equipment,

the cost of supplies, approvals by federal, state, and local agencies,

permitting delays, legal challenges to permits, general economic, market or

business conditions, and other factors beyond the control of the Company. The

Company does not intend to update or revise any forward-looking information

whether as to a result of new information, future events or otherwise, except as

required by law.

U.S. 20-F Registration: 000-51411

FOR FURTHER INFORMATION PLEASE CONTACT:

Emgold Mining Corporation

David G. Watkinson, P.Eng.

President & CEO

(778) 375-3106

info@emgold.com

www.emgold.com

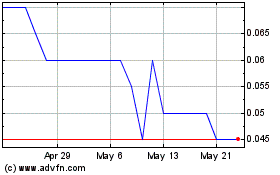

Emergent Metals (TSXV:EMR)

Historical Stock Chart

From May 2024 to Jun 2024

Emergent Metals (TSXV:EMR)

Historical Stock Chart

From Jun 2023 to Jun 2024