Emgold Provides Properties Update and Closes CDN $285,000 Private Placement

02 February 2013 - 6:30AM

Marketwired Canada

Emgold Mining Corporation (the "Company" or "Emgold") (TSX

VENTURE:EMR)(OTCQB:EGMCF)(FRANKFURT:EML) provides the following update on its

exploration and development properties and its recently announced private

placement:

Idaho-Maryland Project, CA

Further to the Company's October 26, 2011 and September 7, 2012 press releases,

permitting activities associated with the Idaho-Maryland Project (the "Project")

remain on hold pending the resurgence of the junior mining equity markets.

Emgold reiterates what it stated in its past press releases that, despite the

current price of gold, financing for projects in the junior mining sector is

extremely difficult. In the event that insufficient funds can be raised to move

the Project forward, Emgold will continue to delay the Project until market

conditions improve or, as a worst case, drop it to focus on the other assets the

Company currently has in its portfolio.

The current extension of the Lease and Option to Purchase Agreement (the "BET

Agreement") expires today. The BET Agreement, signed in 2002, originally had a

five year term. It has been extended three times to date, in two year

increments, with the last extension taking effect on February 1, 2011. Emgold is

currently in negotiations with the BET Trust to extend the agreement, which

covers the lease and option to purchase of approximately 2,750 acres of mineral

rights and 91 acres of surface rights associated with the Project. If

negotiations to extend the BET Agreement are unsuccessful, Emgold will terminate

the Project and focus on the other assets the Company currently has in its

portfolio.

Stewart and Rozan Properties, BC

Emgold completed a diamond drilling program on the Stewart Property in late

2012. The drill program totaled 1,447 metres of drilling in 11 drill holes

spread over the Free Silver, Stewart Creek and Stewart Moly target areas. Core

samples taken from that program are currently being processed at Acme Labs in

Vancouver, with all results expected in the next few weeks.

As announced in its January 28, 2012 press release, Emgold successfully

completed its 2012 exploration program at its Rozan Property in 2012, totaling

1,495 metres of drilling in 15 drill holes focusing on the Main, Sheeted Vein,

and West Vein Zones.

The two exploration programs on the Stewart and Rozan Properties completed

Emgold's flow-through expenditure requirements for 2012. Assessment reports and

assessment work filings will be made with the B.C. Ministry of Energy and Mines

in the first quarter of 2013, keeping these properties in good standing.

Buckskin Rawhide East and West Properties, NV

Emgold is in the process of acquiring the Buckskin Rawhide East Property from

two underlying owners, as announced in recent press releases (November 14, 19,

and 26, 2012; December 28, 2012; and January 30, 2013). This acquisition is

being funded by a series of three private placements by Rawhide Mining LLC

("RMC"), which operates the adjacent Denton Rawhide Mine.

Emgold understands that RMC is also in the process of acquiring the Regent

Property from Pilot Gold Corporation. The Buckskin Rawhide East Property is

surrounded by the Denton Rawhide Mine on the east and south and by the Regent

Property on the west and north.

Emgold announces it has made its 2013 advance royalty payment to the underlying

claimholder of the Buckskin Rawhide West Property, as per a Lease and Option to

Purchase Agreement dated January 24, 2012, by issuing 125,000 shares at CDN

$0.08 per share, representing the US$10,000 payment. This property is adjacent

to and west of the Regent Property.

Koegel Rawhide Property, NV

Emgold announces it has made its 2013 advance royalty payment to the underlying

claimholder, as per a Lease and Option to Purchase Agreement dated January 24,

2012, by issuing 111,000 shares at CDN $0.09 per share, representing a US$10,000

payment. This property is approximately three miles south of the Denton Rawhide

Mine.

Closing of Private Placement

Emgold is pleased to announce it has closed a previously announced private

placement (see January 30, 2013 press release) for gross proceeds of CDN

$285,000. The private placement involved the issuance of 5,700,000 units

("Units") to RMC at a price of CDN$0.05 per Unit. Each Unit consists of one

common share (a "Share") of the Company and one half of one non-transferable

share purchase warrant. Each full warrant entitles RMC to purchase, for a period

of 24 months, one additional Share at a price of CDN$0.12. The Shares are

subject to a minimum hold period of four months plus one day, expiring June 2,

2013. No finder's fees were paid as part of this private placement.

The proceeds of the private placement will be used for fees associated with the

Buckskin Rawhide East Property transactions, exploration of Emgold's Nevada and

B.C. properties, and for general working capital.

The securities issued pursuant to the private placement have not been and will

not be registered under the U.S. Securities Act of 1933 and may not be offered

or sold in the United States absent registration or an applicable exemption from

registration.

Qualified Person

Technical information in this press release related to Canadian properties has

been reviewed and approved by Mr. Perry Grunenberg, P.Geo., a Qualified Person

as defined in National Instrument 43-101. Mr. Grunenberg supervises technical

work related to Emgold's Canadian properties. Similarly, technical information

in this press release related to U.S. properties has been reviewed and approved

by Mr. Robert Pease, P.Geo., a Qualified Person as defined in National

Instrument 43-101. Mr. Pease is responsible for supervising the technical work

related to Emgold's U.S. Properties.

On behalf of the Board of Directors

David G. Watkinson, P.Eng., President & CEO

This release was prepared by the Company's management. For more information on

the Company, investors should review the Company's filings that are available at

www.sedar.com or the Company's website at www.emgold.com. This news release

includes certain statements that are "forward-looking statements" within the

meaning of applicable securities laws including statements regarding use of

proceeds of the financing and the statement of Emgold's understanding as to the

possible acquisition of the Regent Property by RMC (see Pilot Gold Corporations

news release dated January 10, 2013). They assume that no other matters arise

that require a diversion of funds from the anticipated use. Although the Company

believes the expectations expressed in such forward-looking statements are based

on reasonable assumptions, such statements are not guarantees of future

performance and actual results or developments may differ materially from those

in the forward-looking statements. Factors that could cause actual results to

differ materially from those in forward-looking statements include legal

impediments to the transfer of title to the Buckskin Rawhide East property to

the Company, which could prevent the property transfer from proceeding in the

time period anticipated or at all, and the failure of RMC to acquire the Regent

property, which is outside the control of Emgold and as to which it has very

limited knowledge. Investors are cautioned that any such statements are not

guarantees of future performance and actual results or developments may differ

materially from those projected in the forward-looking statements. The Company

does not intend to update or revise any forward-looking information whether as

to a result of new information, future events or otherwise, except as required

by law. Whether RMC acquires the Regent property is out of Emgold's control, and

Emgold disclaims any responsibility with respect thereto.

U.S. 20-F Registration: 000-51411

FOR FURTHER INFORMATION PLEASE CONTACT:

Emgold Mining Corporation

David G. Watkinson, P.Eng.

President & CEO

778-375-3106

info@emgold.com

www.emgold.com

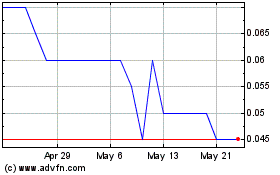

Emergent Metals (TSXV:EMR)

Historical Stock Chart

From May 2024 to Jun 2024

Emergent Metals (TSXV:EMR)

Historical Stock Chart

From Jun 2023 to Jun 2024