January 31, 2023 -- InvestorsHub NewsWire --

via NetworkNewsWire Editorial Coverage: The market for

renewable energy enjoys considerable tailwinds due to growing

concerns about climate change, energy security and global

initiatives to reign in carbon emissions. The tailwinds turned into

a tempest late in 2022 when the Inflation Reduction Act (“IRA”) was

signed into law. The IRA is the largest

investment ever by the U.S. government in renewable energies,

earmarking $369 billion to accelerate efforts to reduce dependence

on fossil fuels. According to some experts,

the IRA is expected to more than triple America’s clean-energy

production by 2030, resulting in about 40% of the nation’s energy

coming from sources such as wind, solar and renewable natural gas

(“RNG”). For this to happen, about 550 gigawatts of new energy

supply from green sources will come online over the next seven

years. Against the backdrop of this generational

opportunity, EverGen Infrastructure Corp. (TSX.V:

EVGN) (OTCQX: EVGIF) (Profile), a specialist in RNG, has positioned

itself as an emerging leader in the booming renewables sector.

Others in the space that are recognized as leaders include oil

juggernaut BP

plc (NYSE: BP), utility Fortis Inc. (NYSE: FTS),

cleantech 347Water Inc. (NASDAQ:

SCWO) and Anaergia Inc. (TSX: ANRG).

- To achieve net-zero carbon

emissions by 2050, it is estimated that $100 trillion in capital

investment is necessary, creating unprecedented upside for

innovators.

- EverGen Infrastructure, which

owns and operates the first grid-connected renewable natural gas

facility in North America that has been producing RNG for more than

a decade, has a growing portfolio of projects.

- Expansion at EVGN’s three

flagship facilities will result in the generation of ~480,000

gigajoules of energy annually.

- The company expects to

significantly grow its Adjusted EBITDA to $13M from its core

portfolio versus ~$3M in existing adjusted EBITDA, placing it at an

attractive EV/EBITDA ratio compared to peers.

Click here to view the custom infographic of

the EverGen Infrastructure

Corp. editorial.

The Global Green-Energy Transformation

According to a BNY Melon study, it will take investments of

approximately $100 trillion to reduce the current 30 billion tons

of carbon emissions to reach net zero by 2050, a figure that

closely mirrors estimates from the International Energy Agency

(“IEA”). While that figure may seem astronomical, it actually is

not out of line with global fixed capital investments every year,

which currently run around $20

trillion. More than $1 trillion annually is already being

invested in clean energy pre-IRA, a figure the IEA says needs to

rise to $4 trillion.

Former Bank of England Governor Mark

Carney calls this the “greatest commercial opportunity of

our age.” It is anticipated that additional capital will pour into

the space, lending to pricing certainty for projects as well as

supporting merger and acquisition activity across the RNG sector.

In 2022, jockeying for green-energy market share was on full

display in several high-profile acquisitions, including BlackRock

buying Vanguard Renewables for $700 million, BP acquiring Archaea

Energy for $4.1 billion and Shell paying $2 billion for Nature

Energy Biogas.

RNG is a renewable clean energy derived from decomposing organic

matter, such as wastewater, food waste, agriculture waste, etc. It

is pipeline-quality refined biogas that is indistinguishable from

and completely interchangeable with conventional natural gas

extracted from the earth.

At the epicenter of the green-energy

transformation, EverGen Infrastructure Corp. (TSX.V:

EVGN) (OTCQX: EVGIF) is an emerging leader in the

renewable energy space, owning and operating a portfolio of biogas

and RNG projects across Canada. Joining the growing chorus of RNG

projects planned or

under construction in North America, EverGen’s subsidiary,

Fraser Valley Biogas, was the first facility to produce renewable

natural gas in Canada, running since 2011. EverGen’s initial

operations consisted of its Fraser Valley Biogas, Net Zero Waste

Abbotsford and Sea to Sky Soils businesses, all operating in

British Colombia. In 2022, EverGen began to expand across Canada

and acquired a majority position in GrowTEC in Alberta and a 50%

stake in a large joint venture in Ontario comprised of three

high-quality, on-farm RNG projects.

EverGen is Canada’s leading RNG platform capitalizing on strong

decarbonization initiatives, while providing a solution to one of

the main greenhouse gas (“GHG”) emitting sources for

municipalities: organic waste. To capture these emissions and

produce RNG from organic waste, there is a significant need for

additional RNG projects and room for growth in the industry, with

only about 27% of organic waste in Canada currently being diverted

from landfill. Corporations, governments and utilities are

supporting EverGen’s growth through attractive, low-risk,

long-term, off-take agreements to purchase RNG and achieve

greenhouse gas emission reduction goals.

At EverGen facilities, organic waste goes into an aerobic

digester where it exits as digestate — where organic nutrients are

recovered and recycled as fertilizer and soil amendments — and

biogas, which is further refined into RNG and sold to utility

partners. The company faces an abundance of feedstock supply

considering that more than 144 million metric tons of food waste

are produced annually and there are more than 19,000 large farms

and dairies in North America.

Expanding Footprint

EverGen’s flagship assets are in British Columbia. Fraser Valley

Biogas (“FVB”) uses blended feedstock from agricultural and

commercial organic waste, and the operation has a current capacity

of 50,000 tonnes annually generating about 80,000 gigajoules of

energy. Expansion is underway to increase capacity to 100,000

tonnes per year for 160,000 gigajoules output.

Net Zero Waste Abbotsford (“NZWA”) is an operational

organics-processing facility utilizing agricultural, municipal and

commercial organic waste. The plant has capacity of 40,000 tonnes

per year, which is being expanded to 135,000 tonnes. At capacity,

following the construction of an anerobic digestor, the plant will

produce RNG equal to 180,000 gigajoules of energy. (Note: To lend

some reference, consider one gigajoule is equivalent to about 277

kilowatt-hours of electricity. As a fuel, RNG is equivalent to 26

liters of gasoline.) FortisBC has a 20-year offtake agreement for

the RNG produced at NZWA.

Also in British Columbia is EverGen’s Sea to Sky Soils, an

organics-processing facility that produces up to 40,000 tonnes of

municipal and agricultural waste annually, with expansion plans to

increase to 60,000 tonnes.

Last year was a watershed year for EverGen as it expanded to

cement its position as a market leader. The company acquired a 67%

stake in GrowTEC, a multifaceted bioenergy venture of sustainable

agriculture near Lethbridge, Alberta. The facility is a biogas

operation with an anaerobic digester; additions are being made to

upgrade the system to process the biogas into RNG. An agreement is

already in place for FortisBC to buy the RNG, where it will be tied

into the local natural gas pipeline.

In aggregate, these facilities will generate approximately

480,000 gigajoules of energy annually when expansion is complete.

That’s about 133 million kilowatt-hours of electricity and

compelling upside with the current spot price for RNG above $60 per

gigajoule. According to the Energy Information Agency, the average

annual electricity consumption for a U.S. residential utility

customer was 10,632 kilowatt-hours, meaning the RNG from EverGen’s

three plants could power an estimated 12,509 homes with clean

energy.

Project Radius in Ontario is a model for growth at EverGen. The

cluster of projects is a late-development-stage portfolio of three

high-quality, agricultural RNG projects serving as the cornerstone

of EverGen’s RNG presence in Ontario. Collectively, these projects

are expected to produce about 1.7 million gigajoules of RNG per

year. EverGen is expected to announce a final investment decision

and notice-to-proceed early this year with construction targeted

across 2023 and 2024. EverGen is a 50-50 partner on Project Radius

with Northeast Renewables LP.

EverGen forecasts RNG production from portfolio projects

collectively at more than 2 million gigajoules per year, with the

potential to grow to 8 million gigajoules with consideration for

the 25-plus projects it is evaluating in its pipeline. Some of

those projects are abandoned plans in the fragmented industry that

EverGen can scoop up at attractive prices and integrate into its

ecosystem. The company has access to capital and the technical

expertise to optimize projects at any stage or condition.

EBITDA on the Rise

In its latest quarterly report, covering the quarter and nine

months ended Sept. 30, 2022, EverGen showed adjusted earnings

before interest, taxes, depreciation and amortization (EBITDA) of

$1.7 million year to date. Management has guided EBITDA of ~$2

million for 2022, which it expects to grow to $13 million from its

fully funded three core expansion projects.

A look at the EverGen

corporate presentation is enlightening to the importance

of its EBITDA estimate. The company’s RNG peers are trading at

13-times multiple of enterprise value to EBITDA. EverGen is trading

at a substantial discount to peers at only three times 2023 analyst

forecasts, despite its strong and funded growth profile.

Utility Partners Onboard

The $369 billion commitment by the U.S. government is catalyzing

investments throughout the energy market, including gas utilities

hustling to catch up with electric utilities. In North America,

renewables currently comprise less than 1% of the gas market, a

figure that is expected to change dramatically soon. This change is

evidenced through legislation such as Oregon’s SB98 setting a

volumetric goal of 30% RNG by

2030. Utilities are on board, including EverGen partner

FortisBC, which is aiming for 15% of its volume to come from RNG by

2030.

FortisBC is not alone with its climate-friendly ambitions.

Energir in Quebec has a similar sustainability goal, and American

counterparts such as NW Natural and Vermont Gas are spearheading an

energy transition in the United States. As governments and

corporations strive for decarbonization targets, the shift to RNG

is logical and cost effective, putting EverGen in a position to

thrive.

Incredible Headroom for Growth

According to Rested

Energy, the oil exploration and production industry generated

$2.47 trillion in revenues worldwide in 2019. Fossil fuels (crude,

coal, and natural gas) comprise the lion’s share of the industry,

evidenced by renewable energy sources only accounting

for approximately 12.4% of total U.S. energy consumption

in 2021.

BP plc

(NYSE: BP), one of the biggest oil companies in

the world, is a pioneer in low-carbon energy. The company has

a broad

spectrum of initiatives centered on decarbonization,

including bioenergy, EV charging, renewables, and hydrogen and

carbon capture and storage. Its renewables pipeline has more than

quadrupled in three years. In addition, the company added 5,000 EV

charging points in 12 months, decreased its oil and gas production

emissions by 16% while shrinking its overall operational emissions

by 35%, growing its offshore wind energy from zero to 5.2

gigawatts, and kickstarting 10 different hydrogen projects, among

other things.

Fortis Inc. (NYSE: FTS) is a

pioneer in the RNG business, working with local farms, landfills,

green-energy companies and municipalities for more than a decade to

capture methane from waste and purify it to make RNG. In

2019, Fortis

announced its first-ever emissions reduction goal, its

“30BY30” target. This is an ambitious target to reduce Fortis

customers’ GHG emissions by 30% overall by 2030. The company’s

Clean Growth Pathway to 2050 sets out four key areas to help

achieve substantial GHG emissions reductions, including supporting

the growth of renewable gas.

347Water Inc. (NASDAQ: SCWO) is

a global clean-tech, social-impact company whose mission is to

preserve a clean and healthy environment. The company is pioneering

a new era of sustainable waste management that supports a circular

economy and enables organizations to achieve their environmental,

social, and governance (“ESG”) and sustainability goals. 347Water

was selected by

the U.S. Navy to utilize 374Water’s AirSCWO(TM) technology

to validate its efficacy in the destruction of “forever chemicals”

for potential remediation efforts at military bases worldwide.

Anaergia Inc. (TSX: ANRG) was

created to eliminate a major source of greenhouse gases by cost

effectively turning organic waste into RNG, fertilizer and water,

using proprietary technologies. With a proven track record from

delivering world-leading projects on four continents, Anaergia is uniquely positioned to provide

end-to-end solutions for extracting organics from waste,

implementing high efficiency anaerobic digestion, upgrading biogas,

producing fertilizer and cleaning water. Anaergia has built many

successful plants, including some of the largest in the world.

A carbon time bomb is ticking, and the world can’t wait. A

titanic energy shift has begun, and it’s time to recognize the

opportunities at hand and the companies that are stewards of this

change.

For more information about EverGen Infrastructure Corp., please

visit EverGen

Infrastructure Corp.

About NetworkNewsWire

NetworkNewsWire (“NNW”) is a financial news and

content distribution company, one of 50+ brands within

the InvestorBrandNetwork (“IBN”), that

provides: (1) access to a network of wire

solutions via InvestorWire to reach all target markets,

industries and demographics in the most effective manner

possible; (2) article and editorial

syndication to 5,000+ news outlets; (3)

enhanced press release solutions to ensure maximum

impact; (4) social media distribution via IBN

millions of social media followers; and (5) a

full array of corporate communications solutions. As a multifaceted

organization with an extensive team of contributing journalists and

writers, NNW is uniquely positioned to best serve private and

public companies that desire to reach a wide audience comprising

investors, consumers, journalists and the general public. By

cutting through the overload of information in today’s market, NNW

brings its clients unparalleled visibility, recognition and brand

awareness. NNW is where news, content and information converge.

To receive SMS text alerts from NetworkNewsWire, text

“STOCKS” to 77948 (U.S. Mobile Phones Only)

For more information, please visit https://www.networknewswire.com

Please see full terms of use and disclaimers on the

NetworkNewsWire website applicable to all content provided by NNW,

wherever published or re-published: http://NNW.fm/Disclaimer

NetworkNewsWire (NNW)

New York, New York

www.networknewswire.com

212.418.1217 Office

Editor@NetworkNewsWire.com

NetworkNewsWire is part of the InvestorBrandNetwork

DISCLAIMER: NetworkNewsWire (NNW) is the source of the Article

and content set forth above. References to any issuer other than

the profiled issuer are intended solely to identify industry

participants and do not constitute an endorsement of any issuer and

do not constitute a comparison to the profiled issuer. The

commentary, views and opinions expressed in this release by NNW are

solely those of NNW. Readers of this Article and content agree that

they cannot and will not seek to hold liable NNW for any investment

decisions by their readers or subscribers. NNW is a news

dissemination and financial marketing solutions provider and are

NOT registered broker-dealers/analysts/investment advisers, hold no

investment licenses and may NOT sell, offer to sell or offer to buy

any security.

The Article and content related to the profiled company

represent the personal and subjective views of the Author, and are

subject to change at any time without notice. The information

provided in the Article and the content has been obtained from

sources which the Author believes to be reliable. However, the

Author has not independently verified or otherwise investigated all

such information. None of the Author, NNW, or any of their

respective affiliates, guarantee the accuracy or completeness of

any such information. This Article and content are not, and should

not be regarded as investment advice or as a recommendation

regarding any particular security or course of action; readers are

strongly urged to speak with their own investment advisor and

review all of the profiled issuer’s filings made with the

Securities and Exchange Commission before making any investment

decisions and should understand the risks associated with an

investment in the profiled issuer’s securities, including, but not

limited to, the complete loss of your investment.

NNW HOLDS NO SHARES OF ANY COMPANY NAMED IN THIS RELEASE.

This release contains “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E the Securities Exchange Act of 1934, as amended and

such forward-looking statements are made pursuant to the safe

harbor provisions of the Private Securities Litigation Reform Act

of 1995. “Forward-looking statements” describe future expectations,

plans, results, or strategies and are generally preceded by words

such as “may”, “future”, “plan” or “planned”, “will” or “should”,

“expected,” “anticipates”, “draft”, “eventually” or “projected”.

You are cautioned that such statements are subject to a multitude

of risks and uncertainties that could cause future circumstances,

events, or results to differ materially from those projected in the

forward-looking statements, including the risks that actual results

may differ materially from those projected in the forward-looking

statements as a result of various factors, and other risks

identified in a company’s annual report on Form 10-K or 10-KSB and

other filings made by such company with the Securities and Exchange

Commission. You should consider these factors in evaluating the

forward-looking statements included herein, and not place undue

reliance on such statements. The forward-looking statements in this

release are made as of the date hereof and NNW undertakes no

obligation to update such statements.

SOURCE: NetworkNewswire

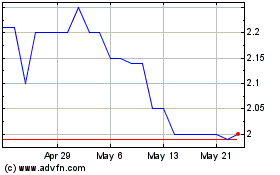

Evergen Infrastructure (TSXV:EVGN)

Historical Stock Chart

From Jan 2025 to Feb 2025

Evergen Infrastructure (TSXV:EVGN)

Historical Stock Chart

From Feb 2024 to Feb 2025