February 2, 2023 -- InvestorsHub NewsWire --

via NetworkNewsWire Editorial Coverage: It may seem hard

to believe, but the first solar panels were readily available to

homeowners who could afford them in the early 1980’s. Back then,

the U.S. government was providing incentives to try and encourage

consumer adoption. That focus on sustainability has continued — and

grown. Most recently, renewable natural gas (“RNG”), a carbon

neutral alternative to traditional natural gas derived from organic

waste, has been gaining substantial momentum. The honor for the

first RNG facility in North America goes to EverGen

Infrastructure Corp. (TSX.V: EVGN)

(OTCQX: EVGIF)

(Profile), which opened its first facility in

British Columbia, Canada, more than a decade ago. Whether investors

are interested in solar, RNG, wind, green hydrogen or any other

type of renewable energy that can reduce reliance on fossil fuels,

now is a time to be excited. In part, that enthusiasm can be

directly tied to the recent passage of the Inflation Reduction Act

(“IRA”), which earmarked $369 billion for infrastructure and

incentives to accelerate the use of renewable energies in a bid to

combat climate change. That’s big news for companies such as

EverGen, Brookfield Renewable Partners

L.P. (NYSE:

BEP), Clean Energy Fuels

Corp. (NASDAQ:

CLNE), Aemetis

Inc. (NASDAQ:

AMTX), Enphase Energy

Inc. (NASDAQ:

ENPH), and others emerging as stewards to

slashing carbon emissions with innovation.

- If the world is going to reach

net zero carbon emissions in the next 27 years, it is going to take

about $100 trillion in capital investment.

- EverGen Infrastructure is a

pioneer in the renewable gas industry, owning and operating the

continent’s first grid-connected RNG facility with a growing

portfolio of RNG projects.

- At EVGN’s three flagship

facilities in British Columbia, expansion plans will boost

production to 480,000 gigajoules of energy per year, with broader

potential for the company to reach 8 million gigajoules in coming

years.

- EverGen expects 2023 to be

financially transformational as it continues on its growth path to

adjusted EBITDA rising to $13 million for its core portfolio, which

equates to a highly attractive EV/EBITDA ratio compared to industry

peers.

Click here to view the custom infographic of

the EverGen Infrastructure

Corp. editorial.

The Greatest Commercial Opportunity of Our

Age

It took some wrangling to get the IRA through Congress, sealing

the deal for President Joseph Biden’s landmark legislation that

cemented his legacy as the most proactive president on the matter

of climate action. The IRA is the largest

investment ever by the U.S. government in renewable energies,

designating $369 billion to support renewable energies.

If the world is going to meet its carbon-reduction targets, BNY

Melon estimates that about $100 trillion in investments is

necessary to eliminate the 30 billion tons of carbon emissions

which are currently released to achieve net zero by 2050. On its

face, that figure may seem unobtainable, but a closer look shows it

is not out of the realm of possibility.

Presently, more than $1 trillion is invested annually in clean

energy as part of an estimated $20 trillion in in global fixed

capital investments made each year. The International Energy

Agency, whose estimates are aligned with BNY Melon, says green

energy investments will need to climb to $4 trillion per annum,

which is possible now that the massive government incentives are

starting to take effect.

Mark Carney, the former Bank of England Governor,

shared his

opinion on what the push for green energy means on full

display, calling it the “greatest commercial opportunity of our

age.” Carney, like most other experts, foresees capital pouring

into the renewable energy market as the transition away from finite

fossil fuels gains steam. The capital flow will lend to pricing

certainty for project and likely trigger additional merger and

acquisition activity in the RNG sector. Several high-profile

buyouts already occurred pre-IRA, including BlackRock buying

Vanguard Renewables for $700 million, BP acquiring Archaea Energy

for $4.1 billion and Shell paying $2 billion for Nature Energy

Biogas.

RNG is a renewable clean energy produced from decomposing

organic matter, such as wastewater, food waste, agriculture waste,

etc. It is pipeline-quality refined biogas that is

indistinguishable from and completely interchangeable with

conventional natural gas extracted from the earth through drilling.

RNG is a win-win considering it takes waste that typically is

expensive and pollutive to dispose of and turns it into useful

products that can power cars, create electricity, be used in

fertilizers and much more.

EverGen Infrastructure Corp. (TSX.V: EVGN)

(OTCQX:

EVGIF) is at the epicenter of the shift to

renewables. The Vancouver-based company owns and operates a

portfolio of biogas and RNG projects across Canada. After acquiring

the first Canadian RNG plant in its home province to add to its

portfolio of two other facilities in British Columbia, the company

started expanding east. EverGen’s BC assets include Fraser Valley

Biogas (“FVB”), which has been producing RNG since 2011; Net Zero

Waste Abbotsford; and Sea to Sky Soils. During 2022, EverGen

widened its Canadian footprint with investments to establish a 67%

stake in GrowTEC in Alberta and 50% ownership in a large joint

venture consisting of three high-quality, on-farm RNG projects in

Ontario dubbed Project Radius.

While capitalizing on a number of strong decarbonization

efforts, EverGen is also providing a solution to one of Canada’s

municipalities biggest greenhouse gas (“GHG”) emitting sources:

organic waste. Productive organic waste disposal is a tremendous

opportunity for EverGen, with roughly 73% of the country’s organic

waste ending up in landfills where it rots and releases GHGs. As

such, corporations, governments and utilities are supporting

EverGen’s expansion through low-risk, long-term, off-take

agreements to purchase RNG produced at EverGen facilities while

effectively working toward carbon targets.

At EverGen facilities, organic waste is used as feedstock,

entering an anaerobic digester, which is an oxygen-less tank where

microbes break down organic matter into biogas and digestate.

Digestate is recovered as useful farm products, including soil

amendments, fertilizer and animal bedding, while the biogas is

refined into RNG and piped into existing natural gas pipelines of

EverGen off-take partners. EverGen is likely never going to need to

look for any alternative feedstock considering 19,000-plus large

farms and dairies in North America generate more than 144 million

metric tons of waste every year.

The Name Brand and Growing

EverGen’s flagship projects in BC are cornerstones for a growing

franchise. FVB uses blended feedstock from agricultural and

commercial organic waste. FVB’s current capacity sits at 50,000

tonnes of feedstock per annum generating about 80,000 gigajoules of

energy. Expansion is underway to increase capacity to 100,000

tonnes per year for 160,000 gigajoules output.

Net Zero Waste Abbotsford (“NZWA”) is EverGen’s

organics-processing facility using a combination of agricultural,

municipal and commercial organic waste as feedstock. Current

capacity is 40,000 tonnes per year, which is being expanded to

135,000 tonnes. The renovation includes construction of an

anaerobic digester and boosting capacity to produce RNG equal to

180,000 gigajoules of energy. For reference, one gigajoule is

equivalent to approximately 277 kilowatt-hours of electricity. As a

fuel, it is equal to 26 liters of gasoline.

FortisBC, a unit of NYSE- and TSX-listed utility giant Fortis

Inc., has a 20-year offtake agreement for the RNG produced at NZWA.

Finally, the Sea to Sky Soils is an organics processing facility

the processes up to 40,000 metric tons of municipal and

agricultural waste every year. Expansion plans will increase that

to 60,000 tonnes.

With a firm grasp on the BC markets, EverGen made two

significant investments to capitalize on opportunities nationwide.

The company holds a two-thirds interest in GrowTEC, a multifaceted

bioenergy venture of sustainable agriculture near Lethbridge,

Alberta. GrowTEC’s facility produces biogas via an anaerobic

digester presently. The system is being upgraded to further process

the biogas into RNG, with an agreement already in place pursuant to

which Fortis is buying the RNG where it will be tied into the local

pipeline.

When the expansion is completed at the three B.C. facilities,

EverGen operations will generate about 480,000 gigajoules of energy

combined. That translates to 133 million kilowatt-hours of

electricity and a formidable revenue stream with RNG commanding

more than $60 per gigajoule. As for practicality, the RNG output

would provide enough clean electricity for more than 12,500 homes

based upon stats from the Energy Information Administration

indicating an average American home consumes 10,632 kilowatt-hours

of electricity per year.

While impressive on its own, the JV in Ontario with 50-50

partner Northeast Renewables LP has the potential for multiple-fold

growth while serving as a model for EverGen as an aggregator of

projects into clusters. Project Radius is three

late-development-stage agricultural RNG projects. Each of the

projects is theorized to generated about 550,000 gigajoules of RNG

per year. EverGen is expected to make a final investment decision

on the project this year with construction planned for 2023 and

2024.

Executing on this strategy, EverGen will have RNG production in

excess of 2 million gigajoules in its portfolio, with the potential

to expand that to 8 million gigajoules as the company makes

decisions on the more than 25 projects it is evaluating for its

pipeline. The company has a diverse group of projects to pick from,

including some that were started and abandoned that are looking for

a suitor to acquire at discounted prices. These are ideal

candidates for EverGen, which has access to capital and the

technical expertise to revive and optimize regardless of

condition.

Improving Earnings

EverGen’s last quarterly report covered the three-month and

nine-month periods ended Sept. 30, 2022. Adjusted EBITDA (earnings

before interest, taxes, depreciation and amortization) for the year

to date was $1.7 million, which is in line with management’s

guidance to exit 2022 with EBITDA about $2.0 million. Looking

ahead, EverGen’s

presentation indicates intentions to grow EBITDA to $13

million from its fully funded three core expansion projects.

The presentation is informative as to the importance of its

EBITDA estimate as it relates to industry valuations. EverGen’s RNG

peers are trading at a multiple of 13 times enterprise value to

EBITDA. Looking at its guidance, EverGen is trading at a notable

discount (~3 times) compared to peers despite its current

operations and funded growth pipeline.

Major Utilities Want EverGen’s RNG

The U.S. government committing $369 billion to catalyze

investments in renewable energy has utilities highly motivated to

capitalize on this once-in-a-generation opportunity. Renewables

constitute less than 1% of the gas market in North America, a

paltry figure that speaks to the incredible upside. A real-world

example of the desire to move quickly at all levels is Oregon’s

legislation SB98 calling for a volumetric goal of 30% RNG by

2030. Utilities are setting aggressive targets for themselves

too, such as EverGen partner FortisBC aiming for 15% of its volume

to come from RNG by 2030.

Quebec-based Energir has a similar target, while American peers

NW Natural and Vermont Gas are shepherding change in the United

States. In a nutshell, the self-imposed mandates by governments and

companies throughout North America to make the logical shift away

from conventional natural gas to Earth-friendly RNG puts EverGen in

an optimal position to thrive.

Incredible Headroom for Growth

A look at the oil E&P (exploration and production) market is

mind numbing regarding size. Rested

Energy estimates the industry generated a stunning $2.47

trillion in revenues globally in 2019. Almost all of that revenue

comes from crude oil, coal, and natural gas, with renewable energy

sources such as solar, wind, RNG and other zero carbon energies

only accounting

for approximately 12.4% of total U.S. energy consumption

in 2021.

Brookfield Renewable Partners

L.P. (NYSE:

BEP) is a portfolio asset of Brookfield

Renewable, the operator of one of the world’s largest publicly

traded, pure-play renewable power platforms. Brookfield’s portfolio

consists of hydroelectric, wind, solar and storage facilities in

North America, South America, Europe and Asia. In December,

California Bioenergy LLC announced a funding partnership,

of up to $500 million, with Brookfield Renewable and its

institutional partners to scale CalBio’s growth in RNG and other

waste-to-energy opportunities.

Clean Energy Fuels

Corp. (NASDAQ:

CLNE) is the U.S.’s largest provider of the

cleanest fuel for the transportation market. The California-based

company’s mission is to decarbonize transportation through the

development and delivery of RGN. Clean Energy allows thousands of

vehicles, from airport shuttles to city buses to waste and

heavy-duty trucks, to reduce their levels of climate-harming

greenhouse gas, operating a vast network of fueling stations across

the U.S. and Canada. This month, Clean Energy was awarded a

contract by San Diego Metropolitan Transit System to

provide an expected 86 million gallons of RNG to operate its bus

fleet.

Aemetis Inc. (NASDAQ:

AMTX) is an RNG, renewable fuel and biochemicals

company focused on the acquisition, development and

commercialization of innovative technologies that replace

petroleum-based products and reduce greenhouse gas

emissions. Aemetis has launched the Carbon Zero production

process to decarbonize the transportation sector using today’s

infrastructure. Aemetis Carbon Zero products include zero-carbon

fuels that can “drop-in” to be used in airplanes, truck, and ship

fleets.

Enphase Energy

Inc. (NASDAQ:

ENPH) is the world’s leading supplier of

microinverter-based solar and battery systems that enable people to

harness the sun to make, use, save and sell their own power—and

control it all with a smart mobile app. The company revolutionized

the solar industry with its microinverter-based technology and

builds all-in-one solar, battery, and software

solutions. Enphase has

shipped more than 52 million microinverters, and more than

2.7 million Enphase-based systems have been deployed in more than

145 countries.

The carbon fuse is running short, and it is only a matter of

time before something has to give. Governments and corporations

know it and are moving with a purpose to make changes before it is

too late. Luckily for investors, these aggressive actions are

providing growth opportunities that may never be seen again in the

energy space.

For more information about EverGen Infrastructure Corp., please

visit EverGen

Infrastructure Corp.

About NetworkNewsWire

NetworkNewsWire (“NNW”) is a financial news and

content distribution company, one of 50+ brands within

the InvestorBrandNetwork (“IBN”), that

provides: (1) access to a network of wire

solutions via InvestorWire to reach all target markets,

industries and demographics in the most effective manner

possible; (2) article and editorial

syndication to 5,000+ news outlets; (3)

enhanced press release solutions to ensure maximum

impact; (4) social media distribution via IBN

millions of social media followers; and (5) a

full array of corporate communications solutions. As a multifaceted

organization with an extensive team of contributing journalists and

writers, NNW is uniquely positioned to best serve private and

public companies that desire to reach a wide audience comprising

investors, consumers, journalists and the general public. By

cutting through the overload of information in today’s market, NNW

brings its clients unparalleled visibility, recognition and brand

awareness. NNW is where news, content and information converge.

To receive SMS text alerts from NetworkNewsWire, text

“STOCKS” to 77948 (U.S. Mobile Phones Only)

For more information, please visit https://www.networknewswire.com

Please see full terms of use and disclaimers on the

NetworkNewsWire website applicable to all content provided by NNW,

wherever published or re-published: http://NNW.fm/Disclaimer

NetworkNewsWire (NNW)

New York, New York

www.networknewswire.com

212.418.1217 Office

Editor@NetworkNewsWire.com

NetworkNewsWire is part of the InvestorBrandNetwork

DISCLAIMER: NetworkNewsWire (NNW) is the source of the Article

and content set forth above. References to any issuer other than

the profiled issuer are intended solely to identify industry

participants and do not constitute an endorsement of any issuer and

do not constitute a comparison to the profiled issuer. The

commentary, views and opinions expressed in this release by NNW are

solely those of NNW. Readers of this Article and content agree that

they cannot and will not seek to hold liable NNW for any investment

decisions by their readers or subscribers. NNW is a news

dissemination and financial marketing solutions provider and are

NOT registered broker-dealers/analysts/investment advisers, hold no

investment licenses and may NOT sell, offer to sell or offer to buy

any security.

The Article and content related to the profiled company

represent the personal and subjective views of the Author, and are

subject to change at any time without notice. The information

provided in the Article and the content has been obtained from

sources which the Author believes to be reliable. However, the

Author has not independently verified or otherwise investigated all

such information. None of the Author, NNW, or any of their

respective affiliates, guarantee the accuracy or completeness of

any such information. This Article and content are not, and should

not be regarded as investment advice or as a recommendation

regarding any particular security or course of action; readers are

strongly urged to speak with their own investment advisor and

review all of the profiled issuer’s filings made with the

Securities and Exchange Commission before making any investment

decisions and should understand the risks associated with an

investment in the profiled issuer’s securities, including, but not

limited to, the complete loss of your investment.

NNW HOLDS NO SHARES OF ANY COMPANY NAMED IN THIS RELEASE.

This release contains “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E the Securities Exchange Act of 1934, as amended and

such forward-looking statements are made pursuant to the safe

harbor provisions of the Private Securities Litigation Reform Act

of 1995. “Forward-looking statements” describe future expectations,

plans, results, or strategies and are generally preceded by words

such as “may”, “future”, “plan” or “planned”, “will” or “should”,

“expected,” “anticipates”, “draft”, “eventually” or “projected”.

You are cautioned that such statements are subject to a multitude

of risks and uncertainties that could cause future circumstances,

events, or results to differ materially from those projected in the

forward-looking statements, including the risks that actual results

may differ materially from those projected in the forward-looking

statements as a result of various factors, and other risks

identified in a company’s annual report on Form 10-K or 10-KSB and

other filings made by such company with the Securities and Exchange

Commission. You should consider these factors in evaluating the

forward-looking statements included herein, and not place undue

reliance on such statements. The forward-looking statements in this

release are made as of the date hereof and NNW undertakes no

obligation to update such statements.

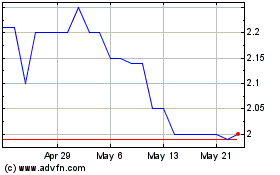

Evergen Infrastructure (TSXV:EVGN)

Historical Stock Chart

From Nov 2024 to Dec 2024

Evergen Infrastructure (TSXV:EVGN)

Historical Stock Chart

From Dec 2023 to Dec 2024