Galantas Gold Corporation (the 'Company') (TSX VENTURE:GAL) (AIM:GAL) is pleased

to announce its annual financial results for the Year Ended December 31, 2013.

Financial Highlights

The Net Loss for the Year Ended December 31, 2013 amounted to $ 1,944,355 which

compared with a Net Loss of $ 593,866 for the Year Ended December 31, 2012.

Highlights of the 2013 results, which are expressed in Canadian Dollars, are:

----------------------------------------------------------------------------

Year Ended December 31

----------------------------------------------------------------------------

All in CDN$ 2013 2012

----------------------------------------------------------------------------

Revenue $ 1,531,473 $ 4,659,330

----------------------------------------------------------------------------

Cost of Sales $ 1,591,069 $ 3,167,126

----------------------------------------------------------------------------

(Loss)Income before the undernoted $ (59,596) $ 1,492,204

----------------------------------------------------------------------------

Amortization $ 500,756 $ 748,711

----------------------------------------------------------------------------

General administrative expenses $ 1,188,397 $ 1,604,162

----------------------------------------------------------------------------

Loss(Gain) on disposal of property, plant and $ (86,816)

equipment $ 105,811

----------------------------------------------------------------------------

(Gain) on debt extinguishment $ - $ (190,624)

----------------------------------------------------------------------------

Foreign exchange loss $ 89,795 $ 10,637

----------------------------------------------------------------------------

Net (Loss) for the year $ (1,944,355) $ ( 593,866)

----------------------------------------------------------------------------

Working Capital (Deficit) $ (3,904,304) $ (2,309,307)

----------------------------------------------------------------------------

Cash (loss)generated from operations before $ 177,737

changes in non-cash working capital $ (1,396,019)

----------------------------------------------------------------------------

Cash at December 31, 2012 $ 166,617 $ 1,164,868

----------------------------------------------------------------------------

Sales revenues for the year ended December 31, 2013 amounted to CDN$ 1,531,473

(2012: CDN$ 4,659,330). The reduction in sales revenues when compared to 2012

was due to the lower level of metal produced and shipped during the year. The

lower production levels were primarily due to the requirement to process lower

grade ore from stockpile as a result of difficulties in accessing ore from the

open pits. In addition the gold price in 2013 was below the price which

prevailed during 2012 which also adversely impacted sales revenues. Lower

concentrate gold grade during the third and fourth quarters coupled with falling

gold prices resulted in the Company suspending the processing of low grade ore

during the fourth quarter. The Company has commenced pilot tests with regards to

the processing of tailing cells filled during the earlier operation of the mine.

Concentrate grades produced by the pilot study were higher than grades for

flotation concentrate from mined vein material. The Company is presently

reviewing the economics of continuing production through the processing of

tailings cells.

Cost of sales for the year ended December 31, 2013 amounted to CDN$ 1,591,069

(2012: CDN$ 3,167,126). There was a decrease in various production costs at the

Omagh mine during 2013 which reductions were mainly attributable to the reduced

level of open pit activity during 2013.

The Net Loss for the year ended December 31, 2013, amounted to CDN$ 1,944,355

(2012: Net Loss CDN$ 593,866). The cash loss generated from operating activities

before changes in non-cash working capital for 2013 amounted to CDN$ 1,396,019

(2012: $ 177,737 gain). The cash loss generated from operating activities after

changes in non-cash working capital for 2013 amounted to CDN$ 869,781 (2011: $

569,610 gain). The Company had cash balances at December 31, 2013 of CDN$

166,617 compared to CDN$ 1,164,868 at December 31, 2012. The working capital

deficit at December 31, 2013 amounted to CDN$ 3,904,304 which compared with a

deficit of CDN$ 2,309,307 at December 31, 2012.

The Company's auditors (McCarney Greenwood LLP), without qualifying their

opinion, drew attention to the note within the accounts which described that the

Company required additional financing to fund its planned activities and to

continue as a going concern. On 8th April 2014, the Company announced a

consolidation, exchange of shares for debt and a proposed Private Placing for

GBP 500,000, which is still in progress.

Production Highlights

Production at the Omagh mine for the year ended December 31, 2013 is summarized

below:

----------------------------------------------------------------------------

Year Ended Year Ended

December 31 December 31

2013 2012

----------------------------------------------------------------------------

Tonnes Milled 40,711 44,112

----------------------------------------------------------------------------

Average Grade g/t gold 1.0 2.3

----------------------------------------------------------------------------

Concentrate Dry Tonnes 499 1,008

----------------------------------------------------------------------------

Concentrate Gold Grade g/t 84.1 100.9

----------------------------------------------------------------------------

Gold Produced (oz) 1,349 3,271

----------------------------------------------------------------------------

Gold Produced (kg) 41.9 101.7

----------------------------------------------------------------------------

Concentrate Silver Grade g/t 163.5 227.6

----------------------------------------------------------------------------

Silver Produced (oz) 2,622 7,379

----------------------------------------------------------------------------

Silver Produced (kg) 81.5 229.5

----------------------------------------------------------------------------

Lead Produced tonnes 36.3 61.4

----------------------------------------------------------------------------

Gold Equivalent (oz) 1,448 3,507

----------------------------------------------------------------------------

Production in 2013 was significantly below 2012 production which was primarily

due to the processing of low grade stockpiled ore during the year. Earlier in

the year there had been some limited open pit mining on the Kerr vein which

ceased during the first quarter when the pit met its planned design limit. From

the second half of 2012 mining from the Kearney pit had become totally

restricted as a result of the surplus rock stockpile on the site reaching

capacity levels. This surplus rock was due to be transported from the site in

2012 with the Omagh mine having completed construction of public road

improvements at its own cost to comply with the conditions of the planning

consent. However, following a judicial review brought by a private individual on

the grounds of procedural failings by Planning Service, the planning consent was

quashed with the surplus rock remaining on site. This ongoing limitation

resulted in production continuing to be from low grade sources. To generate cash

from its operations the Company continued to improve efficiencies and cut costs

during 2013.

Due to the mill being fed with the lower grade ore during 2013 production

continued to be hampered by both the ongoing variations in the metallurgy due to

the inconsistent grade of ore being milled and the clay content of stocked

material. The concentrate gold grade fell further during the third and fourth

quarter and this coupled with falling gold prices resulted in the Company

suspending the processing of low grade ore during the fourth quarter which

resulted in further cost reduction measures being implemented at the Omagh mine.

Later in the fourth quarter the Company commenced pilot tests with regards to

the processing of tailing cells filled during the earlier operation of the mine.

The results confirm pre-existing data that indicated the tailings contain

between 0.5g/t gold and 1 g/t gold and meet European Union standards for

definition as inert material. A low energy cost processing solution, based upon

a Knelson CD12 centrifugal gravity concentrator, which was already utilised in

the gold processing plant in a secondary role, has been successfully pilot

tested as a prime re-treatment component for flotation tailings. The tailings do

not require comminution (crushing and grinding) for re-processing by this

method. Concentrate grades produced by the pilot study were higher than grades

for flotation concentrate from mined vein material. The Company is presently

reviewing the economics of continuing production through the processing of

tailings cells and is evaluating alternative re-processing techniques.

Exploration

The major focus of exploration activities in 2012 and 2013 has been the

continuation of the successful drilling program. In total, 17,348 metres have

been drilled since the program commenced in March 2011 with significant gold

intersects being reported.

The drilling program began in 2011 with the objective of extending the depth and

extent of the Joshua vein and providing data for a potential underground

operation based upon the Joshua and Kearney veins. During 2011 and 2012 ninety

five holes were drilled totalling 16,347 metres. Channel sampling was also

carried out, during this period, on the Joshua, Kearney and Kerr vein systems.

On Joshua, a total strike length of 213 metres was sampled. On Kerr, an increase

in average vein width and gold grade was identified within depth over a 30 metre

strike length.

The exploration program had expanded considerably in 2012 with six drills

operational during the first half of the year. The second half of the year saw

the number of rigs progressively reduce with one rig, owned by the Company,

remaining in operation by the end of 2012. The two principal objectives of the

drilling program were to complete the deeper holes on Kearney in order to gain a

more accurate picture of the zone of mineralization for the purpose of the

underground mine plan and to extend the strike of Joshua to the north and the

south, and begin to target deeper sections of the vein. Drilling continued at a

reduced rate in 2013 with four holes being drilled - one in North Kearney and

three in Joshua central. These hole locations were defined with the aim of

upgrading areas of inferred resource to the indicated category. During the first

quarter, assay results were received showing a grade of 9 ppm Au over a vein

width of 1 m for hole OM-DD-12-144. This is a significant result as the location

is 100 m south of where the Joshua vein appears to narrow, suggesting that the

vein continues south of the property. Drilling was suspended during the third

quarter pending the availability of cash for future exploration. Following the

scale back of drilling in 2013, more time was dedicated to logging remaining

drill cores, the sealing off of all accessible drill holes, updating databases

and progressing towards a revised resource estimate using the Micromine

geological modelling computer program.

Assay results released to date from both the drilling and channel sampling

programme have been encouraging with significant gold intersections being

identified. The updated resource estimate (Technical Report July 2013) contains

all data related to the programme up to May 2013. Results to date have been

positive, in particular the assays from the ten drill holes on Joshua released

in January 2013 with thirteen significant mineral intersects. During the third

quarter Galantas reported positive assay results from the first of two drill

holes completed on the Joshua vein during the third quarter. This drill hole is

the second deepest intersect yet drilled on Joshua vein and averaged 12.4 g/t

gold, over a true width of vein of 2.8 metres. The top of the mineralised

intersect is estimated to be at a vertical depth of 137.2 metres. The hole was

terminated at a down-hole length of 171.8 metres (see press release dated August

27, 2013).

Once additional funding becomes available this drilling programme will continue.

Up to a further 1,000 metres of drilling are planned following up the recently

reported gold intersects on the Joshua vein.

During 2012 ACA Howe International Ltd (Howe UK) completed an Interim Resource

to Canadian National Instrument NI 43-101 compliant mineral resource estimate

and a Preliminary Economic Assessment for the Omagh Gold Project (see press

release dated July 3, 2012) This report, which was based on drilling results and

analyses received to June 8, 2012, identified all resources discovered at that

date. The Company subsequently filed a complete Technical Report on SEDAR in

August 2012. An updated resource estimate was prepared by the Company during the

second quarter of 2013 based on drilling results received to May 5, 2013 (see

press release dated June 12, 2013). The drilling programme, subsequent to June

2012, was targeted to increase the amount of measured and indicated resources

related to the potential development of an underground mine. When compared to

the resource estimate prepared in 2012 there has been an 50% increase in

resources classified as measured and indicated from a total of 95,300 troy

ounces gold (2012) to 142,533 troy ounces gold and a 28% increase in Resources

classified as inferred, from 231,000 troy ounces gold (2012) to 295,599 troy

ounces gold (2013). The overall increase is 34%. Galantas subsequently filed an

updated Technical Report on SEDAR in July 2013. An updated report which includes

data acquired after May 5th 2013 is in preparation.

Three new licence areas in the Republic, covering 121.1 km2, were granted during

2013. These join, and extend south-westwards, our existing four ROI licences.

Geochemical soil sampling, stream sediment and geophysical data generated by the

Tellus Border Project, a cross border initiative funded by the EU regional

development fund, was released earlier in the year. The data revealed the

continuation of a trend established on licence OM4, into the OML-held ROI

licences, with anomalously high concentrations of gold pathfinder elements. This

data has assisted in the design of a field programme which was carried out

during the third quarter. Earlier in the year Omagh Minerals were awarded a

grant to complete a project to determine the prospectivity potential of the

Tellus border zone as a whole. This research is supported by the EU INTERREG

IVA-funded Tellus Border initiative funded by the EU regional development fund,

was based around the new Tellus Border data. The associated fieldwork was

completed during the third quarter and focussed on four areas with excellent

mineral potential. A prospectivity map and a comprehensive report were submitted

to GSI for publication on the Tellus Border website. Following this exploration

work, an application was submitted for a further two prospecting licences in the

Manorhamilton area of Co. Leitrim, this was acknowledged during the third

quarter and has now been awarded. These areas bring the total number of licences

held by Omagh Minerals to eleven and the total area to 766.5 square kilometres.

Permitting

Discussions continued with the planning services in Northern Ireland during 2013

with regards to the planning application for an underground mine plan and

accompanying Environmental Statement which were submitted to the Planning

Services in 2012. Shareholders may see progress on the public planning portal at

http://epicpublic.planningni.gov.uk/PublicAccess/zd/zdApplication/application_detailview.aspx?caseno=M6QQVVSV30000

Roland Phelps, President & CEO, Galantas Gold Corporation, commented, "The

Company continues to work with Planning Service and consultees to achieve

underground planning consent. The Company has been advised by its consultants

that, due to bureaucratic delays, the time-line for planning determination may

now be in the second quarter 2014, although the date is undefined because it is

in the hands of other parties. A Technical Report is being prepared which will

include drilling results obtained since May 2013. The report will also include

details of a detailed feasibility study. We look forward to updating

shareholders in due course."

The detailed results and Management Discussion and Analysis (MD&A) are available

on www.sedar.com and www.galantas.com and the highlights in this release should

be read in conjunction with the detailed results and MD&A. The MD&A provides an

analysis of comparisons with previous periods, trends affecting the business and

risk factors. Some of the production and metal figures are provisional and

subject to averaging or umpiring provisions under the concentrate off-take

contract with Xstrata Corporation detailed in a press release dated 3rd October

2007.

Qualified Person

The financial components of this disclosure has been reviewed by Leo O'

Shaughnessy (Chief Financial Officer) and the production, exploration and

permitting components by Roland Phelps (President & CEO), qualified persons

under the meaning of NI. 43-101. The information is based upon local production

and financial data prepared under their supervision.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS: This press release contains

forward-looking statements within the meaning of the United States Private

Securities Litigation Reform Act of 1995 and applicable Canadian securities

laws, including revenues and cost estimates, for the Omagh Gold project.

Forward-looking statements are based on estimates and assumptions made by

Galantas in light of its experience and perception of historical trends, current

conditions and expected future developments, as well as other factors that

Galantas believes are appropriate in the circumstances. Many factors could cause

Galantas' actual results, the performance or achievements to differ materially

from those expressed or implied by the forward looking statements or strategy,

including: gold price volatility; discrepancies between actual and estimated

production, actual and estimated metallurgical recoveries and throughputs;

mining operational risk, geological uncertainties; regulatory restrictions,

including environmental regulatory restrictions and liability; risks of

sovereign involvement; speculative nature of gold exploration; dilution;

competition; loss of or availability of key employees; additional funding

requirements; uncertainties regarding planning and other permitting issues; and

defective title to mineral claims or property. These factors and others that

could affect Galantas's forward-looking statements are discussed in greater

detail in the section entitled "Risk Factors" in Galantas' Management Discussion

& Analysis of the financial statements of Galantas and elsewhere in documents

filed from time to time with the Canadian provincial securities regulators and

other regulatory authorities. These factors should be considered carefully, and

persons reviewing this press release should not place undue reliance on

forward-looking statements. Galantas has no intention and undertakes no

obligation to update or revise any forward-looking statements in this press

release, except as required by law.

Galantas Gold Corporation Issued and Outstanding Shares total 51,242,016 (post

consolidation 14th April 2014))

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term

is defined in the policies of the TSX Venture Exchange) accepts responsibility

for the adequacy or accuracy of this release.

FOR FURTHER INFORMATION PLEASE CONTACT:

Galantas Gold Corporation

Jack Gunter P.Eng

Chairman

+44 (0) 2882 241100

Galantas Gold Corporation

Roland Phelps C.Eng

President & CEO

+44 (0) 2882 241100

info@galantas.com

www.galantas.com

Charles Stanley Securities (AIM Nomad & Broker)

Mark Taylor

+44 (0)20 7149 6000

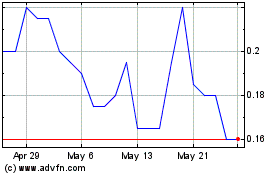

Galantas Gold (TSXV:GAL)

Historical Stock Chart

From May 2024 to Jun 2024

Galantas Gold (TSXV:GAL)

Historical Stock Chart

From Jun 2023 to Jun 2024