Galane Gold Ltd. (“Galane Gold” or the “Company”) (TSX-V: GG;

OTCQB: GGGOF) is pleased to announce the release of an independent

updated National Instrument 43-101 (“NI 43-101”) technical report

supporting the positive preliminary economic assessment (“PEA”) for

its currently operating Galaxy property (the “Mine”) in South

Africa (the “Technical Report”). Unless otherwise indicated, all

references to “$” in this press release refer to United States

dollars.

Highlights

- A 60% increase, 891,773 ounces, in all resource categories when

compared to the previous technical report to give a new total of

970,904 ounces of measured and indicated mineral resources, and

1,409,764 ounces of inferred mineral resources.

- New PEA, modelled at an average gold price of $1,466 per ounce,

with:

- an initial 11 year mine plan;

- producing 413,421 ounces;

- an all in sustainable cost of $747 per ounce; and

- a peak funding requirement of approximately $600,000.

- Based on the PEA with a gold price of $1,700 per ounce and 11

year life, the project has a pre-tax internal rate of return of

1,498% and a NPV (5%) of $147 million (CAD$ 199

million).(1)(2)

Galane Gold CEO, Nick Brodie commented: “We

believe that our new independent technical report confirms that we

have a ‘generational’ asset with the potential for further

expansion in resource, throughput, and mine life with minimal

capital requirement and robust ongoing economics.

The decision to undertake a new technical report

was made so that we could advise the market on the actual potential

of Galaxy and how we plan to expand the current operation. Given

our progress to date at Galaxy in the Phase 1 ramp up to

approximately 26,000 ounces per annum, generation of positive cash

flows (as announced on November 15, 2019) at Galaxy, and upgrade of

the plant, we expect to make a decision in the near future to

implement the Phase 2 growth plan to target production of over

50,000 ounces per annum.(3)

The Galaxy mine camp currently hosts 21 known

mineralised zones and we continue our expansion objectives, by

first implementing our Phase 3 expansion plan. We have thus far

increased our compliant resource by concentrating on data already

available for the three existing orebodies we have been targeting,

and improving the economics on those orebodies. We will now start

the same process on the remaining 18 mineralised zones. In

addition, we will start a drilling campaign to prove extension of

the mineralised zones at depth. We are optimistic that we can

present a plan to double production again once we have proved the

resource to support the data.”(3)

The Technical Report entitled “NI 43-101

Technical Report on the Galaxy Gold Mine, South Africa” was issued

on July 3, 2020, with an effective date of June 29, 2020. The

Technical Report was prepared by Minxcon (Pty) Ltd and approved by

Mr. Uwe Engelmann, BSc (Zoo. & Bot.), BSc Hons (Geol.)

Pr.Sci.Nat., MGSSA, and Mr. Daniel (Daan) van Heerden, B Eng

(Min.), MCom (Bus. Admin.), MMC, Pr.Eng., FSAIMM, AMMSA, both

“qualified persons” as defined by NI 43-101, and independent of the

Company for the purposes of NI 43-101. A copy of the Technical

Report will be available under the Company’s profile on

www.sedar.com, and on the Company’s website on

www.galanegold.com.

It should be noted that the PEA is preliminary

in nature as the resources included in the PEA are comprised 54% of

Inferred Mineral Resources. Inferred Mineral Resources are

considered too speculative geologically to have the economic

considerations applied to them that would enable them to be

categorized as Mineral Reserves. There is no certainty that the PEA

will be realized.

Mineral Resource

The mineral resources for the Mine (the “Mineral

Resources”) were previously declared in a technical report titled

"A Technical Report on the Galaxy Gold Mine, Mpumalanga Province,

South Africa" issued on January 4, 2016 with an effective date of

September 1, 2015, and prepared by Minxcon (Pty) Ltd (the “2015

Report”). The Mineral Resources in the Technical Report compared to

the Mineral Resources in the 2015 Report are as follows:

|

Resource Category |

New Technical Report |

2015 Technical Report |

Content |

|

|

Tonnes |

Grade |

Ounces |

Tonnes |

Grade |

Ounces |

Change % |

|

Measured |

3,208,575 |

2.97 |

306,122 |

1,876,126 |

3.37 |

203,435 |

50% |

|

Indicated |

7,694,349 |

2.69 |

664,783 |

4,350,781 |

2.85 |

399,261 |

67% |

|

Total Measured and Indicated |

10,902,925 |

2.77 |

970,904 |

6,226,907 |

3.01 |

602,696 |

61% |

|

Inferred |

16,734,418 |

2.62 |

1,409,764 |

8,095,521 |

3.40 |

886,199 |

59% |

The Mineral Resources have been reviewed and

updated as follows:

- The Princeton orebody has been remodelled due to newly captured

historical data that was made available. This enabled the

delineation of lenses PS5, PS19 and a new middling PS12. In

addition, the previous upper and lower orebodies have been linked

to constitute one continuous model. Thickness and grade continuity

can be correlated from the upper to the lower models. An Indicated

Mineral Resource and Inferred Mineral Resource can be declared at

Princeton, with a significant increase in reported tonnage with a

slight decrease in grade. This is due to the new interpretation of

the geological models, and significant addition of tonnage linking

the upper and lower orebodies at Princeton.

- The Galaxy orebody has been re-estimated to populate the

existing manually estimated gap area. As a result of improved

variogram ranges and improved sub-celling, additional areas have

also been estimated for the 24 Level and 17 Level domains.

- The Giles and Woodbine orebodies have been reviewed in detail.

All estimation performed in 2015, is of sufficient quality to

enable reporting of Measured Mineral Resources, Indicated Mineral

Resources and Inferred Mineral Resources. The input parameters and

resulting estimate compare well with the data and can be

reproduced. Mineral Resource categories have been optimised to

increase connectivity between them. In addition, the classification

has been adjusted where less than two drillholes were utilised to

define a Measured Mineral Resource.

- The Hostel West, Woodbine West and Woodbine South tailings

storage facilities have been updated to account for mining activity

that occurred since the 2015 Report.

- A higher gold price in 2020 of $1,600/oz has been applied,

lowering the cut-off grade for the underground Mineral Resources

from 1.85 g/t (2015) to 1.4 g/t (2020).

Preliminary Economic

Assessment

A new life of mine (“LoM”) plan was created with

mining plans produced around the newly delineated resources.

The mining strategy is to produce a concentrate with a grade

greater than 25 g/t from the Princeton, Galaxy, Woodbine and Giles

orebodies. For the PEA, the cut-off grades were used instead of

pay-limits. A mine stope optimiser (“MSO”) was used to generate

optimal stope configurations for mining the Galaxy, Princeton,

Woodbine and Giles orebodies. The MSO uses a block model of the

resource and applies a set of user defined criteria including

minimum stope dimensions and economic parameters to identify the

most profitable regions within the resource. The optimisation

generates stope wireframes which were used for the mine

designs.

The stope optimiser results were analysed at a

range of cut-off grades for each orebody to determine at what

cut-offs the correct mix of tonnes and grade are obtained to

satisfy the mining strategy and provide sufficient LoM.

The processing plant was recommissioned in April

2019 and is producing and selling a gold flotation concentrate. The

plant consists of crushing, milling, flotation and concentrate

filtration circuits. The existing infrastructure was used for as

long possible, with crucial expansions and refurbishments completed

in order to meet the interim production target of 15 ktpm. Further

expansions have already commenced to meet the 30 ktpm (for Phase 1,

26,000 ounces per annum) and then eventually the 50 ktpm (for Phase

2, over 50,000 ounces per annum) production targets.(3) A new ball

mill with a capacity of 50 ktpm is being built and is due to be

commissioned. Once this has been completed the only constraint to

meeting the 50 ktpm target will be upgrading the float capacity

from its current limit of 30 ktpm.

The metallurgical recoveries of the various

orebodies are well known from both historic production and current

production.

With this information the following production

schedule for the PEA was created:

|

Production Values |

|

Item |

Measure |

|

|

Waste Tonnes Mined |

kt |

3,107 |

|

Ore Tonnes Mined |

kt |

4,335 |

|

Total Tonnes Mined |

kt |

7,442 |

|

Average Mined Grade |

g/t |

3.35 |

|

Total Oz in Mine Plan |

oz |

466,447 |

|

Grade Delivered to Plant |

g/t |

3.35 |

|

Recovered grade |

g/t |

2.97 |

|

Yield/Recovery |

% |

88.60% |

|

Total Oz Recovered |

oz |

413,421 |

|

Concentrate Tonnes Produced |

dmt |

435,819 |

|

Concentrate Tonnes Produced |

wmt |

479,401 |

|

Concentrate Grade |

g/t |

29.50 |

|

LoM |

Years |

11 |

About Galane Gold

Galane Gold is an un-hedged gold producer and

explorer with mining operations and exploration tenements in

Botswana and South Africa. Galane Gold is a public company and its

shares are quoted on the TSX Venture Exchange under the symbol “GG”

and the OTCQB under the symbol “GGGOF”. Galane Gold’s management

team is comprised of senior mining professionals with extensive

experience in managing mining and processing operations and

large-scale exploration programmes. Galane Gold is committed to

operating at world-class standards and is focused on the safety of

its employees, respecting the environment, and contributing to the

communities in which it operates.

Notes:

(1) Based on the

valuation information and assumptions contained in the Technical

Report, with the exception of the replacement of the gold price of

$1,466 as stated in the Technical Report, with a gold price of

$1,700.

(2) At a CAD:USD

exchange rate of 1:0.7378.

(3) This is

forward-looking information and is based on a number of

assumptions. See “Cautionary Notes”.

Cautionary Notes

Certain statements contained in this press

release constitute “forward-looking statements”. All statements

other than statements of historical fact contained in this press

release, including, without limitation, those regarding the

Company’s future expansion at the Mine, capital requirements for

such expansion, mining strategies at the Mine, technical, financial

and business prospects of the Company, future financial position

and results of operations, strategy, proposed acquisitions, plans,

objectives, goals and targets, and any statements preceded by,

followed by or that include the words “believe”, “expect”, “aim”,

“intend”, “plan”, “continue”, “will”, “may”, “would”, “anticipate”,

“estimate”, “forecast”, “predict”, “project”, “seek”, “should” or

similar expressions or the negative thereof, are forward-looking

statements. These statements are not historical facts but instead

represent only the Company’s expectations, estimates and

projections regarding future events. These statements are not

guarantees of future performance and involve assumptions, risks and

uncertainties that are difficult to predict. Therefore, actual

results may differ materially from what is expressed, implied or

forecasted in such forward-looking statements.

Additional factors that could cause actual

results, performance or achievements to differ materially include,

but are not limited to: the Company’s dependence on two mineral

projects; gold price volatility; risks associated with the conduct

of the Company’s mining activities in Botswana and South Africa;

regulatory, consent or permitting delays; risks relating to the

Company’s exploration, development and mining activities being

situated in Botswana and South Africa; risks relating to reliance

on the Company’s management team and outside contractors; risks

regarding mineral resources and reserves; the Company’s inability

to obtain insurance to cover all risks, on a commercially

reasonable basis or at all; currency fluctuations; risks regarding

the failure to generate sufficient cash flow from operations; risks

relating to project financing and equity issuances; risks arising

from the Company’s fair value estimates with respect to the

carrying amount of mineral interests; mining tax regimes; risks

arising from holding derivative instruments; the Company’s need to

replace reserves depleted by production; risks and unknowns

inherent in all mining projects, including the inaccuracy of

reserves and resources, metallurgical recoveries and capital and

operating costs of such projects; contests over title to

properties, particularly title to undeveloped properties; laws and

regulations governing the environment, health and safety; the

ability of the communities in which the Company operates to manage

and cope with the implications of COVID-19; the economic and

financial implications of COVID-19 to the Company; operating or

technical difficulties in connection with mining or development

activities; lack of infrastructure; employee relations, labour

unrest or unavailability; health risks in Africa; the Company’s

interactions with surrounding communities and artisanal miners; the

Company’s ability to successfully integrate acquired assets; risks

related to restarting production; the speculative nature of

exploration and development, including the risks of diminishing

quantities or grades of reserves; development of the Company’s

exploration properties into commercially viable mines; stock market

volatility; conflicts of interest among certain directors and

officers; lack of liquidity for shareholders of the Company; risks

related to the market perception of junior gold companies; and

litigation risk. Management provides forward-looking statements

because it believes they provide useful information to investors

when considering their investment objectives and cautions investors

not to place undue reliance on forward-looking information.

Consequently, all of the forward-looking statements made in this

press release are qualified by these cautionary statements and

other cautionary statements or factors contained herein, and there

can be no assurance that the actual results or developments will be

realized or, even if substantially realized, that they will have

the expected consequences to, or effects on, the Company. These

forward-looking statements are made as of the date of this press

release and the Company assumes no obligation to update or revise

them to reflect subsequent information, events or circumstances or

otherwise, except as required by law.

Information of a technical and scientific nature

that forms the basis of the disclosure in the press release has

been prepared and approved by Kevin Crossling Pr. Sci. Nat.,

MAusIMM. and Business Development Manager for Galane Gold, and a

“qualified person” as defined by NI 43-101. Mr. Crossling has

verified the technical and scientific data disclosed herein and has

conducted appropriate verification on the underlying data.

Neither the TSX Venture Exchange nor its

regulation services provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

For further information please

contact:Nick BrodieCEO, Galane Gold Ltd.+ 44 7905

089878Nick.Brodie@GalaneGold.comwww.GalaneGold.com

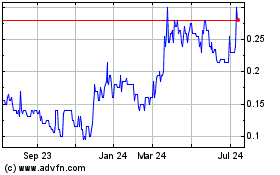

Golconda Gold (TSXV:GG)

Historical Stock Chart

From Dec 2024 to Jan 2025

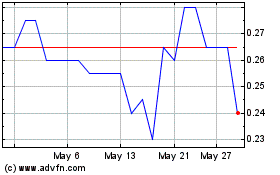

Golconda Gold (TSXV:GG)

Historical Stock Chart

From Jan 2024 to Jan 2025