Gold Reserve Inc. (TSX.V:GRZ) (OTCQX:GDRZF) ("Gold

Reserve" or the "Company") is pleased to announce that

it was granted a conditional writ of attachment fieri facias from

the U.S. District Court of Delaware (the Delaware Court)

regarding the shares of PDV Holding, Inc. (PDVH), the

indirect parent company of CITGO Petroleum Corp.

This order furthers the decision of the Delaware Court in

January 2023 that Gold Reserve’s request for an attachment writ be

treated the same as that of certain Other Creditors (as detailed in

the applicable court documents of the Delaware Court) of the

Bolivarian Republic of Venezuela (the Republic of

Venezuela). On March 23, 2023, the Delaware Court granted the

Other Creditors conditional writs of attachment regarding the

shares of PDVH on the basis that Petroleos de Venezuela, S.A. (also

known as PDVSA), the holding company of PDVH, is the alter ego of

the Republic of Venezuela, and therefore its property is subject to

attachment and execution by judgement creditors of the Republic of

Venezuela.

The writ of attachment is conditional and will not be effective

unless and until the U.S. Office of Foreign Assets Control (also

known as OFAC) has authorized transactions in the PDVH shares. On

the March 30, 2023 hearings, the Delaware Court stated that OFAC

expected to provide a status report to the court-appointed Special

Master overseeing the potential sale of the PDVH shares.

Thereafter, the Special Master is to file a status report on April

30, 2023, to update the Delaware Court on OFAC’s position.

The Delaware Court directed the Company, and the Other

Creditors, to file a joint status report seven days after the

Special Master’s status report, and to include a proposed briefing

schedule for including additional judgements, such as the

Company’s, in the existing sales process for the PDVH shares. The

Company and the Other Creditors need to individually attempt to add

their judgements to the existing sales process and abide by the

Delaware Court’s terms related to the process.

PDVSA stated that it would oppose the inclusion of any

additional judgements in the existing sales process and appeal the

decision of the Delaware Court to grant the Company, and the Other

Creditors, the conditional writs of attachment fieri facias. It is

expected that the resolution of such appeal would take between six

to eighteen months, with no assurances as to timing or outcome.

The conditional writ of attachment provides Gold Reserve the

opportunity to potentially enforce its September 2014 arbitral

award and corresponding November 2015 U.S. judgement by

participating in the potential sale of the PDVH shares. The amount

of Gold Reserve’s award and judgement is approximately U.S.$990

million, inclusive of interest. Further information regarding the

award and judgement can be found in the Company’s most recent

interim financial statements for the period ended September 30,

2022 and the Company’s annual information form for the year ended

December 31, 2021. These documents can be found under the Company’s

profile on SEDAR at www.sedar.com.

If OFAC authorizes the transactions in the PDVH shares, the

Delaware court bailiff will serve the Company’s writ of attachment

fieri facias (and the writs of the Other Creditors), and thereafter

the attachment would be effective.

Rockne J. Timm, CEO, stated, “Today’s announcement is a

confirmation of our rigorous ongoing efforts to take steps in

various jurisdictions to collect U.S. $990 million including

interest, owed by the government of Venezuela. Currently, we have

judgements in multiple jurisdictions confirming our arbitration

award and we have succeeded in attaching funds in another

jurisdiction. Also, the Company remains open, in compliance with

applicable U.S. and Canadian Sanctions, to resolving these matters

outside of our various legal cases and potential new arbitration

with respect to the collection of amounts owed and the restoration

of Siembra Minera’s mining rights.”

Further information on PDVH and CITGO Petroleum Corp.

PDVH is the indirect parent company of CITGO Petroleum Corp.

Based on public disclosure, CITGO Petroleum Corp. operates three

refineries in the U.S, and wholly and/or jointly owns 38 active

terminals, six pipelines and three lubricants blending and

packaging plants. CITGO Petroleum Corp. ranks itself as the

fifth-largest independent refiner in the U.S. with approximately

3,300 employees and a combined crude capacity of approximately

769,000 barrels-per-day (bpd).

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

STATEMENTS

This release contains “forward-looking statements” within the

meaning of applicable U.S. federal securities laws and

“forward-looking information” within the meaning of applicable

Canadian provincial and territorial securities laws and state Gold

Reserve’s and its management’s intentions, hopes, beliefs,

expectations or predictions for the future. Forward-looking

statements are necessarily based upon a number of estimates and

assumptions that, while considered reasonable by management at this

time, are inherently subject to significant business, economic and

competitive uncertainties and contingencies. We caution that such

forward-looking statements involve known and unknown risks,

uncertainties and other risks that may cause the actual outcomes,

financial results, performance, or achievements of Gold Reserve to

be materially different from our estimated outcomes, future

results, performance, or achievements expressed or implied by those

forward-looking statements, including without limitation, the

conditionality of the writ of attachment fieri facias granted to

Gold Reserve, if and when OFAC, and any terms upon which it,

authorizes the issuance and service of such writ or removes the

prohibition and sanctions currently in place that prevent

transactions in the PDVH shares, that PDVSA will oppose the

inclusion of any additional judgements in the existing sales

process and appeal the Delaware Court’s decision to grant the

conditional writs of attachment fieri facias, including the

potential time and cost associated with such appeal and whether

PDVSA will be successful, that the Company will be granted such

order from the Delaware Court such that the Company can formally

participate in any sales process of the PDVH shares, the timing set

for various reports will not be met, the ability to otherwise

participate in the potential sales process in connection with the

PDVH shares (and related costs associated therewith), the amount,

if any, of proceeds associated therewith; the competing claims of

certain creditors, the Other Creditors and the Company, and the

proceeds from the sale of the PDVH shares may not be sufficient to

satisfy the amounts outstanding under the September 2014 arbitral

award and/or corresponding November 15, 2015 U.S. judgement in

full. This list is not exhaustive of the factors that may affect

any of Gold Reserve’s forward-looking statements. For a more

detailed discussion of the risk factors affecting the Company’s

business, see the Company’s Annual Information Form and

Management’s Discussion & Analysis for the year ended December

31, 2021 and other reports that have been filed on SEDAR and are

available under the Company’s profile at www.sedar.com and which

form part of the Company’s Form 40-F for the year ended December

31, 2021 which have been filed on EDGAR and are available under the

Company’s profile at www.sec.gov/edgar.

Investors are cautioned not to put undue reliance on

forward-looking statements. All subsequent written and oral

forward-looking statements attributable to Gold Reserve or persons

acting on its behalf are expressly qualified in their entirety by

this notice. Gold Reserve disclaims any intent or obligation to

update publicly or otherwise revise any forward-looking statements

or the foregoing list of assumptions or factors, whether as a

result of new information, future events or otherwise, subject to

its disclosure obligations under applicable rules promulgated by

the Securities and Exchange Commission and applicable Canadian

provincial and territorial securities laws.

Neither the TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in policies of the TSX Venture

Exchange) accepts responsibility for the adequacy or accuracy of

this release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230404005785/en/

Gold Reserve Inc. Contact Jean Charles Potvin 999 W.

Riverside Ave., Suite 401 Spokane, WA 99201 USA Tel: (509) 623-1500

Fax: (509) 623-1634

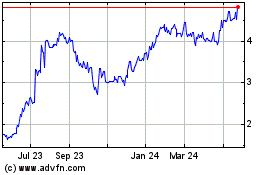

Gold Reserve (TSXV:GRZ)

Historical Stock Chart

From Oct 2024 to Nov 2024

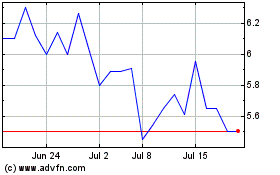

Gold Reserve (TSXV:GRZ)

Historical Stock Chart

From Nov 2023 to Nov 2024