WestFire Energy Ltd. ("WestFire" or the "Company") (TSX:WFE) is pleased to

announce the results of the independent evaluation of the Company's reserves for

the year ended December 31, 2009 (the "GLJ Report") by GLJ Petroleum Consultants

Ltd. ("GLJ") and the independent evaluation of the Company's undeveloped land

holdings as at December 31, 2009 (the "ILI Report") by Independent Land Inc.

("ILI").

WestFire's annual audited consolidated financial statements are not yet complete

and as a result, WestFire will comment on its finding, development and

acquisition costs, operating netback, recycle ratios and net asset value when

WestFire announces its 2009 financial results.

WestFire also announces that Mr. Paul Colborne has resigned from the board of

directors of the Company in order to focus on his other business ventures. Mr.

Colborne has been a director since the first quarter of 2008 and his dedication,

services and vision have been considerable and material to the success of

Company to date. On behalf of the board of directors, management team, staff and

shareholders of WestFire, we sincerely thank Mr. Colborne for his significant

contributions and wish him continued success in the future.

2009 Highlights of GLJ and ILI Reports

- Total proved plus probable reserves increase of 91% to 9.84 million boe;

- Total proved reserves increase of 80% to 5.36 million boe;

- Production replacement ratio of 8.7 for proved plus probable reserves and 4.4

for proved reserves;

- Reserve life index of 14.2 years for proved plus probable reserves (7.7 years

for proved reserves) based on December 2009 average production rate of 1,900

boe/d;

- Reserves value of $175.1 million (10% discount rate) before tax and $194.8

million (8% discount) after tax for proved plus probable reserves;

- Undeveloped land inventory of 205,000 net acres of which 103,000 net acres are

on the Viking light oil resource play regions located at Redwater, Alberta and

West-Central Saskatchewan; and

- Undeveloped land inventory valued at $36.4 million in the ILI Report.

The Company's 2009 capital program included the acquisition of reserves through

one corporate and two asset acquisitions. These acquisitions targeted oil

enhancement projects and the continued advancement of WestFire's Viking light

oil resource play at Redwater, Alberta and West-Central Saskatchewan. These

efforts increased corporate oil and natural gas liquids reserves to 6.31 million

barrels on a proven plus probable basis which represents 64% of the total

corporate reserves.

On the Viking light oil resource play, proved plus probable reserves reached

4.58 million barrels of oil equivalent at year-end 2009. This reserve assignment

is the result of our successful 2009 drilling program, the aforementioned

acquisitions and the positive performance of other horizontal multi-stage sand

fractured Viking oil wells. At December 31, 2009, WestFire had approximately 161

net sections of undeveloped Viking oil prone land which represents a drilling

inventory of over 600 net locations (assuming 4 horizontal wells per section).

Excluded from the undeveloped land inventory are 19 proved undeveloped locations

and 18 probable locations included in the GLJ Report.

Reserves Summary

The following table provides summary information based upon the GLJ Report:

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Natural Gas

Light/Medium Oil Heavy Oil Liquids

----------------------------------------------------------------------------

Gross(1) Net(2) Gross(1) Net(2) Gross(1) Net(2)

(Mbbl) (Mbbl) (Mbbl) (Mbbl) (Mbbl) (Mbbl)

Proved

Producing 1,404 1,258 323 300 136 89

Non-Producing 99 81 62 58 22 16

Undeveloped 952 827 170 154 0 0

----------------------------------------------------------------------------

Total Proved 2,455 2,166 555 512 159 105

Probable 2,435 1,969 618 548 88 60

----------------------------------------------------------------------------

Total Proved &

Probable 4,890 4,135 1,173 1,060 247 165

----------------------------------------------------------------------------

----------------------------------------------------------------------------

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Barrels of Oil

Natural Gas Equivalent(3)

----------------------------------------------------------------------------

Gross(1) Net (2) Gross (1) Net(2)

(MMcf) (MMcf) (Mboe) (Mboe)

Proved

Producing 9,527 7,865 3,452 2,958

Non-Producing 3,176 2,446 712 563

Undeveloped 461 426 1,199 1,052

----------------------------------------------------------------------------

Total Proved 13,164 10,737 5,363 4,572

Probable 8,013 6,628 4,476 3,681

----------------------------------------------------------------------------

Total Proved & Probable 21,177 17,365 9,839 8,253

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Notes:

(1) "Gross" reserves means WestFire's working interest (operating and non-

operating) share of reserves before deduction of royalties and include

royalty interests of the Company.

(2) "Net" reserves means WestFire's working interest (operated and

non-operated) share of reserves after deduction of royalties and include

royalty interests of the Company.

(3) Oil equivalent amounts have been calculated using a conversion rate of

six thousand cubic feet of natural gas to one barrel of oil.

(4) Columns may not add due to rounding.

Reserves Value

The net present value (before tax and at various discount rates) of WestFire's

reserves effective December 31, 2009 and based on the GLJ 's (2010 - 01)

forecast prices and costs are summarized in the following table:

----------------------------------------------------------------------------

----------------------------------------------------------------------------

($ thousands)(1)(2) 0% 5% 10% 15% 20%

----------------------------------------------------------------------------

Proved

Producing 95,814 78,239 66,691 58,546 52,484

Non-Producing 20,766 14,882 11,457 9,291 7,822

Undeveloped 51,126 34,880 24,822 18,203 13,621

----------------------------------------------------------------------------

Total Proved(3) 167,705 128,001 102,971 86,040 73,927

Probable 165,640 104,733 72,099 52,567 39,846

----------------------------------------------------------------------------

Total Proved plus Probable(3) 333,345 232,734 175,069 138,608 113,774

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Notes:

(1) The estimated future net revenues are stated before deducting future

estimated site restoration costs and are reduced for estimated future

abandonment costs and estimated capital for future development

associated with the reserves.

(2) The impact of the changes to the Alberta royalty regime announced by the

Alberta Government on March 11, 2010 was not taken into account for the

above evaluations of net present values.

(3) Columns may not add due to rounding.

Price Forecast

The GLJ (2010-01) forecast prices(1)(2) are summarized as follows:

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Natural Gas Natural Gas

Edmonton Heavy at at

Exchange WTI @ Light Crude Crude at AECO-C Plant Gate

Year Rate Cushing Oil Hardisty Spot Spot

$US/$Cdn $US/bbl(3) $Cdn/bbl(4) $Cdn/bbl(5) $Cdn/MMBtu(6) $Cdn/MMBtu(7)

----------------------------------------------------------------------------

2010 0.950 80.00 83.26 64.99 5.96 5.75

2011 0.950 83.00 86.42 65.24 6.79 6.58

2012 0.950 86.00 89.58 65.33 6.89 6.68

2013 0.950 89.00 92.74 65.26 6.95 6.73

2014 0.950 92.00 95.90 67.52 7.05 6.84

2015 0.950 93.84 97.84 68.90 7.16 6.94

2016 0.950 95.72 99.81 70.32 7.42 7.20

2017 0.950 97.64 101.83 71.76 7.95 7.72

2018 0.950 99.59 103.88 73.22 8.52 8.29

2019 0.950 101.58 105.98 74.72 8.69 8.47

2020 + 0.950 +2.0%/yr +2.0%/yr +2.0%/yr +2.0%/yr +2.0%/yr

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Note:

(1) Inflation is accounted for at 2.0% per year.

(2) Then current dollars.

(3) NYMEX WTI Near Month Futures Contract Crude Oil at Cushing, Oklahoma.

(4) Light, Sweet Crude Oil (40 API, 0.3%S) at Edmonton.

(5) Heavy Crude Oil Proxy (12 API) at Hardisty.

(6) AECO-C Spot refers to the one month price averaged for the year.

(7) The plant gate price represents the price before raw gas gathering and

processing charges are deducted.

Reserves Reconciliation

The following reconciliation of WestFire's gross(1) reserves compares changes in

the Company's reserves as at December 31, 2008 to the reserves as at December

31, 2009, based on the GLJ (2010 - 01) forecast prices and costs.

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Oil/NGLs Natural Gas Combined

Proved Proved Proved

Total Plus Total Plus Total Plus

Proved Probable Proved Probable Proved Probable

(Mbbls) (Mbbls) (MMcf) (MMcf) (Mboe) (Mboe)

----------------------------------------------------------------------------

Balance, December

31, 2008 1,583 3,012 8,385 12,756 2,981 5,138

Extensions 918 1,983 1,515 2,977 1,170 2,479

Technical Revisions 7 (376) 1,048 1,083 182 (196)

Acquisitions 860 1,893 4,350 6,519 1,585 2,979

Dispositions (4) (6) (66) (89) (15) (21)

Production (196) (196) (2,068) (2,068) (540) (540)

----------------------------------------------------------------------------

Balance, December

31, 2009(2) 3,169 6,310 13,164 21,177 5,363 9,839

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Notes:

(1) "Gross" reserves means WestFire's working interest (operating and non-

operating) share of reserves before deduction of royalties and include

royalty interests of the Company.

(2) Columns may not add due to rounding.

Land Holdings

During 2009, WestFire was very active acquiring developed and undeveloped lands

through acquisitions and Crown land sales in Alberta and Saskatchewan.

The Company retained ILI to complete an independent evaluation of the Company's

undeveloped land holdings as at December 31, 2009. The ILI Report has estimated

the value of WestFire's net undeveloped acreage at $36.421 million.

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Developed Undeveloped Total

(acres) Gross Net Gross Net Gross Net

----------------------------------------------------------------------------

Alberta 54,000 32,000 145,000 109,000 199,000 141,000

Saskatchewan 42,000 35,000 110,000 95,000 152,000 130,000

Other 700 200 3,000 1,000 3,700 1,200

----------------------------------------------------------------------------

Total 96,700 67,200 258,000 205,000 354,700 272,200

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Undeveloped acreage on the Viking light oil resource play located at Redwater,

Alberta and West-Central Saskatchewan comprises approximately 50% of the total

or 103,000 net acres.

Cautionary Statements

Reserves and Operational Information

The reserves data set forth in this press release is based upon an independent

reserve assessment and evaluation prepared by GLJ with an effective date of

December 31, 2009 and dated March 4, 2010 and summarizes the Company's crude

oil, natural gas liquids and natural gas reserves and the net present values

before income taxes of future net revenue for the Company's reserves using

forecast prices and costs based on the GLJ Report. The GLJ Report has been

prepared in accordance with the standards contained in National Instrument

51-101 "Standards of Disclosure for Oil and Gas Activities" of the Canadian

Securities Administrators ("NI 51-101").

All evaluations of future net cash flows are stated prior to any provisions for

interest costs or general and administrative costs and after the deduction of

estimated future capital expenditures for wells to which reserves have been

assigned. It should not be assumed that the estimates of future net revenues

presented in the tables in this press release represent the fair market value of

the reserves. There is no assurance that the forecast prices and costs

assumptions will be attained and variances could be material. The recovery and

reserve estimates of our crude oil, natural gas liquids and natural gas reserves

provided herein are estimates only and there is no guarantee that the estimated

reserves will be recovered. Actual crude oil, natural gas and natural gas

liquids reserves may be greater than or less than the estimates provided herein.

The reserve data provided in this release only represents a summary of the

disclosure required under NI 51-101. Additional disclosure will be provided in

the Company's Annual Information Form filed at www.sedar.com on or before March

31, 2010.

Forward-looking information and statements

This news release contains certain forward-looking information and statements

within the meaning of applicable securities laws. The use of any of the words

"expect", "anticipate", "continue", "estimate", "may", "will", "project",

"should", "believe", "plans", "intends" and similar expressions are intended to

identify forward-looking information or statements. In particular, but without

limiting the forgoing, this news release contains forward-looking information

and statements pertaining to the following: the volumes and estimated value of

WestFire's oil and gas reserves; the life of WestFire's reserves; the volume and

product mix of WestFire's oil and gas production; future oil and natural gas

prices; future results from operations and operating metrics; future costs,

expenses and royalty rates; future interest costs and the exchange rate between

the $US and $Cdn.

The recovery and reserve estimates of WestFire's reserves provided herein are

estimates only and there is no guarantee that the estimated reserves will be

recovered. In addition, forward-looking statements or information are based on a

number of material factors, expectations or assumptions of WestFire which have

been used to develop such statements and information but which may prove to be

incorrect. Although WestFire believes that the expectations reflected in such

forward-looking statements or information are reasonable, undue reliance should

not be placed on forward-looking statements because WestFire can give no

assurance that such expectations will prove to be correct. In addition to other

factors and assumptions which may be identified herein, assumptions have been

made regarding, among other things: results from drilling and development

activities consistent with past operations; the continued and timely development

of infrastructure in areas of new production; continued availability of debt and

equity financing and cash flow to fund WestFire's current and future plans and

expenditures; the impact of increasing competition; the general stability of the

economic and political environment in which WestFire operates; the timely

receipt of any required regulatory approvals; the ability of WestFire to obtain

qualified staff, equipment and services in a timely and cost efficient manner;

drilling results; the ability of the operator of the projects in which WestFire

has an interest in to operate the field in a safe, efficient and effective

manner; the ability of WestFire to obtain financing on acceptable terms; field

production rates and decline rates; the ability to replace and expand oil and

natural gas reserves through acquisition, development and exploration; the

timing and cost of pipeline, storage and facility construction and expansion and

the ability of WestFire to secure adequate product transportation; future

commodity prices; currency, exchange and interest rates; regulatory framework

regarding royalties, taxes and environmental matters in the jurisdictions in

which WestFire operates; and the ability of WestFire to successfully market its

oil and natural gas products.

The forward-looking information and statements included in this news release are

not guarantees of future performance and should not be unduly relied upon. Such

information and statement, including the assumptions made in respect thereof,

involve known and unknown risks, uncertainties and other factors that may cause

actual results or events to defer materially from those anticipated in such

forward-looking information or statements including, without limitation: changes

in commodity prices; changes in the demand for or supply of WestFire's products;

unanticipated operating results or production declines; changes in tax or

environmental laws, royalty rates or other regulatory matters; changes in

development plans of WestFire or by third party operators of WestFire's

properties, increased debt levels or debt service requirements; inaccurate

estimation of WestFire's oil and gas reserve and resource volumes; limited,

unfavourable or a lack of access to capital markets; increased costs; a lack of

adequate insurance coverage; the impact of competitors; and certain other risks

detailed from time-to-time in WestFire's public disclosure documents,

(including, without limitation, those risks identified in this news release and

WestFire's Annual Information Form to be filed on SEDAR on or before March 31,

2010).

The forward-looking information and statements contained in this news release

speak only as of the date of this news release, and WestFire does not assume any

obligation to publicly update or revise any of the included forward-looking

statements or information, whether as a result of new information, future events

or otherwise, except as may be expressly required by applicable securities laws.

BOE Equivalent

Barrel of oil equivalents or BOEs may be misleading, particularly if used in

isolation. A BOE conversion ratio of 6 mcf: 1 bbl is based on an energy

equivalency conversion method primarily applicable at the burner tip and does

not represent a value equivalency at the wellhead.

About WestFire

WestFire is a Calgary, Alberta based oil and gas exploration, development and

production company whose shares are traded on the Toronto Stock Exchange under

the trading symbol of "WFE". Currently, the Company has 35.2 million shares

outstanding - basic and 37.1 million shares outstanding - fully diluted.

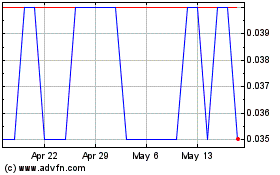

Imagine Lithium (TSXV:ILI)

Historical Stock Chart

From Apr 2024 to May 2024

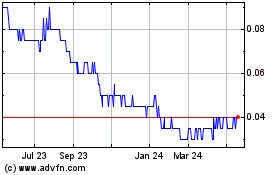

Imagine Lithium (TSXV:ILI)

Historical Stock Chart

From May 2023 to May 2024