Massive Fed Spending Points

to

Sharply

Higher

Gold

Prices

-

Inca

One (OTC:

INCAF) Gold

Production Mushrooming

-

Inca

One Gold Corp has generated over $100 million in sales over the

past 5 years - $35 million in 2019

-

After

brief slowdown in 2020

from Covid-19, Inca One Gold Corp

production is soaring again with $10.1 million reported in Q4

2020

-

Inca

One is exposed to less risk because they do not own operating

mines

-

Peru is

6th largest gold producer in the world and

IncaOne Gold has 2 large production facilities in

Peru

-

Only

32.4 million shares outstanding – small float of 20.3 million

shares – market cap under $14 million – rising gold prices

and strong sales suggest

strong upside potential

March 9, 2021 --

InvestorsHub NewsWire -- via BioResearch Alert -- Congress is

expected to soon pass another trillion-dollar-plus stimulus bill

that is likely to repeat another sharp rise in the price of

gold.

Inca One Gold Corp.

(INCAF:

OTC) recently reported strong sales gains that are benefiting

from rising gold and silver prices and that could see

dramatic increases in it share price.

Vancouver, British

Columbia--(Newsfile

Corp. -

February 2, 2021) - INCA

ONE GOLD CORP. (TSXV:

IO) (OTC

Pink: INCAF) (FSE: SU92) ("Inca

One" or the "Company") a gold producer operating two, fully

integrated mineral processing facilities in Peru reports

consolidated gold production and deliveries for the three months

ending December 2020 ("Q4

2020" or

"the

Quarter") from its

Chala

One

Plant ("Chala

One")

and Kori One Plant ("Kori

One").

All

comparative year-over-year ("YoY")

production numbers represent consolidated operations from both

facilities.

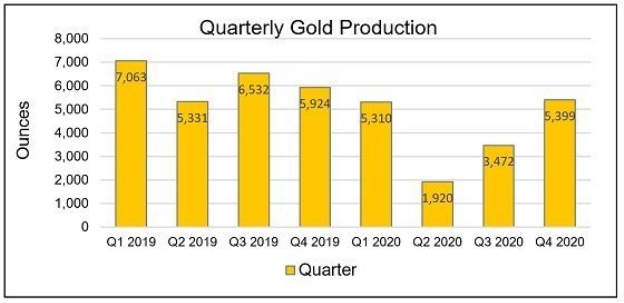

Q4

2020 Highlights

-

Total

revenue of US$10.1 million, up 3% from Q4 2019 revenue ($9.79

million).

-

Gold

production reached 5,399 ounces.

-

Deliveries of

11,385 tonnes

for the

quarter.

-

Processed

11,459 tonnes,

averaging 125 tonnes

per day

("tpd")

throughput.

|

Consolidated

Operations

|

|

|

Q4

2020

|

Q4

2019

|

YoY

Change

|

Q3

2020

|

QoQ

Change

|

|

Deliveries

(tonnes)

|

11,385

|

14,293

|

-20%

|

7,978

|

43%

|

|

Throughput

(tonnes)

|

11,459

|

13,666

|

-16%

|

6,347

|

81%

|

|

Gold Produced

(oz)

|

5,399

|

5,924

|

-9%

|

3,472

|

56%

|

| |

|

|

|

|

|

Q4

2020 Production Results

Highlighting

operations in Q4 2020 was the sharp increase in ore supply, as

deliveries to our plants were 11,385 tonnes

for the

Quarter, an increase of 43% from the prior Q3 2020 (7,978

tonnes).

This increase was driven by strong demand for ore processing

services, from an expanded customer base that emerged from the

additional 34,600 small-scale miners that entered the marketplace

under the formalization amnesty announced early in 2020 by the

Peruvian Mining Ministry. Specifically, deliveries in December

alone reached their highest single monthly total in two years, as

5,011 tonnes

of raw

material was delivered to both Chala

One and

Kori One plants, an increase of 57% from the prior month of

November 2020 (3,194 tonnes).

Additionally, the

Company processed 11,459 tonnes

of

material in the Quarter, an increase of 81% from the prior Q3 2020

(6,347 tonnes).

This represented a throughput of approximately 125

tpd

in Q4

2020, which also was a high for the year. Inca One also had its

highest daily throughput this past December as the Company

processed an average of 134 tpd

for the

month, an increase of 21% on a monthly basis. Of particular note,

Inca One reached an all-time daily production record of 322

tonnes

per day

during December.

Gold production

during Q4 2020 reached 5,399 ounces, an increase of 56% over the

previous Q3 2020, (3,472 oz). Production this quarter also included

silver production of 10,713 ounces. Of note, YoY gold production

was only off 9% as compared to Q4 2019 (5,924 ounces). This is

significant as the promise of increased miners and mining activity

from the formalization amnesty and a rebounding gold market began

to reflect in increased deliveries and new miners requiring custom

milling services with excess processing capacity, reversing the

negative effects of the Coronavirus ("COVID-19")

pandemic observed in prior quarterly performance.

This increase in

mining activity post COVID-19 continued into the first month of

2021 as Inca One had positive YoY increases of 11% in both

deliveries and processing and a 38% YoY increase in gold

production. Again, helping drive these YoY gains was a strong gold

price and more miners in the small-scale mining sector.

"This past year

will be remembered as being influenced by a global pandemic that

gravely impacted the world and economic prospects of the global

economy," stated Inca One President and CEO, Edward Kelly.

"Although the effects of COVID-19 lasted throughout the entire

year, the Company focused on efficiency and sales, finishing 2020

on a strong note, with robust production and near record deliveries

in December, including our strong start to 2021. However, our most

significant achievement was the tremendous operational performance

of our Peruvian team in the face of a challenging business

environment that

drove not only our quarterly results but our entire 2020 sales. We

are encouraged by this strong finish to the year

and we

look forward on building on this momentum, supported by a

strengthened gold price and re-established gold market."

"I am grateful to

our board of directors and management teams, both in Vancouver and

Peru, for their dedication and unwavering support. Additionally, I

want to thank our Peruvian staff who have allowed Inca One to

continue on its path to become Peru's finest gold processing

company. Every year will bring its challenges or obstacles, whether

internal or external, and knowing the professionalism displayed by

everyone instills confidence we have assembled the right team and

are on the correct path to make this year our very best

yet."

Chart

1

To

view an enhanced version of Chart 1, please visit:

https://orders.newsfilecorp.com/files/2645/73411_chart1.jpg

Looking ahead in

2021, Inca One will continue to focus on technical execution and

expanding its mineral buying, securing future supplies

of mill

feed in an expanded small-scale mining sector and a revitalized

gold space. The Company believes that it has the ability to fill

its remaining capacity at both plants and achieve new highs in both

processing and production in 2021 and future years to

follow.

About Inca One

Inca

One Gold Corp is a TSXV listed, gold producer operating two, fully

permitted, gold mineral processing facilities in Peru. The Company

produced nearly 25,000 ounces of gold from its operations in 2019

and has generated over US$100 million in revenue over the last five

years. Inca One, now in its sixth year of commercial production, is

led by an experienced and capable management team that has

established the Company as a trusted leader in servicing government

permitted, small scale miners in Peru. Peru is the world's

sixth-largest producer of gold and its small-scale mining sector is

estimated by government officials to be valued in the billions of

dollars annually. Inca One possesses a combined 450 tonnes

per

day permitted operating capacity at its two fully integrated

plants, Chala

One

and Kori One, and is targeting a fourth consecutive year of

increased production and sales growth. To learn more

visit www.incaone.com.

Figure 1. Inca One's gold processing facilities in Peru (left:

Chala One facility; right: Kori One facility)

To

view an enhanced version of Figure 1, please visit:

https://orders.newsfilecorp.com/files/2645/73411_facab09b44a369e8_005full.jpg

List of low-priced

actively traded gold stocks that could also

benefit from enormous new Fed

stimulus: NGD,

MUX,

PLG, GORO, GPL, IAG, HMY, UEC, GSS, AUY, ASM, MDW, PZG, VGZ, TLR,

GDRZF, MGH, CLGRF, LODE, HL, UA, GOLD, CTNXF, DRCMF, EGO, AG, GFI,

GG, NCAUF, NEM, TRX, EQX,

ERDCF, FFMGF, FURY

Conclusion

Inca One Gold Corp

appears to be undervalued plus is positioned for substantial sales

and share price gains in the near term and throughout

2021.

Forward-Looking

Statements Disclaimer:

This press

release contains forward-looking statements within the meaning of

Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended. In some

cases, you can identify forward-looking statements by the following

words: "anticipate," "believe," "continue," "could," "estimate,"

"expect," "intend," "may," "ongoing," "plan," "potential,"

"predict," "project," "should," "will," "would," or the negative of

these terms or other comparable terminology, although not all

forward-looking statements contain these words. Forward-looking

statements are not a guarantee of future performance or results and

will not necessarily be accurate indications of the times at, or

by, which such performance or results will be achieved.

Forward-looking statements are based on information available at

the time the statements are made and involve known and unknown

risks, uncertainty and other factors that may cause our results,

levels of activity, performance or achievements to be materially

different from the information expressed or implied by the

forward-looking statements in this press release. This press

release should be considered in light of all filings of the Company

that are contained in the Edgar Archives of the Securities and

Exchange Commission at www.sec.gov.

SOURCE: BioResearch

Alert

Inca One Gold (TSXV:IO)

Historical Stock Chart

From Feb 2025 to Mar 2025

Inca One Gold (TSXV:IO)

Historical Stock Chart

From Mar 2024 to Mar 2025