Iberian Minerals Reports 2011 Production Results Met Targets

17 January 2012 - 10:00PM

Marketwired Canada

Iberian Minerals Corp. (TSX VENTURE:IZN) today announced preliminary production

results for the fourth quarter and year ended December 31, 2011.

Iberian is pleased to report that it has met previously issued 2011 guidance.

Preliminary 2011 production results are presented below.

Spanish Operations - Aguas Tenidas Mine:

----------------------------------------------------------------------------

Production Unit Q4 2011 YTD

----------------------------------------------------------------------------

Copper ores

----------------------------------------------------------------------------

Ore processed T 293,600 1,161,000

----------------------------------------------------------------------------

Copper grade % 2.22 2.21

----------------------------------------------------------------------------

Concentrate DMT 24,300 97,500

----------------------------------------------------------------------------

Contained copper FMT 5,520 21,930

----------------------------------------------------------------------------

Recovery rate % 84 85

----------------------------------------------------------------------------

Fine silver Oz 66,700 283,900

----------------------------------------------------------------------------

Polymetallic ores

----------------------------------------------------------------------------

Ore processed T 238,200 870,100

----------------------------------------------------------------------------

Zinc grade % 5.34 5.61

----------------------------------------------------------------------------

Zinc concentrate DMT 18,370 69,270

----------------------------------------------------------------------------

Contained zinc FMT 8,800 33,200

----------------------------------------------------------------------------

Recovery rate % 69 68

----------------------------------------------------------------------------

Copper grade % 1.06 1.09

----------------------------------------------------------------------------

Copper concentrate DMT 5,800 16,990

----------------------------------------------------------------------------

Contained copper FMT 1,370 3,950

----------------------------------------------------------------------------

Copper recovery rate % 54 42

----------------------------------------------------------------------------

Lead grade % 1.57 1.66

----------------------------------------------------------------------------

Lead concentrate DMT 7,140 30,670

----------------------------------------------------------------------------

Contained lead FMT 1,490 5,700

----------------------------------------------------------------------------

Lead recovery rate % 40 40

----------------------------------------------------------------------------

Fine silver Oz 173,600 678,000

----------------------------------------------------------------------------

Comments for Aguas Tenidas operation:

-- Contained copper metal production was 4% above budget.

-- The copper ore circuit copper recovery was 85% versus budget of 83%.

-- The zinc recovery rate for the polymetallic circuit was 68% (target of

66%).

-- Ores processed (combined copper and polymetallic) were 5,565 tpd. Ore

throughput was impacted by the rolling strikes in August and September

with a loss of 4 days of production. Despite lower ore throughput the

metallurgical performance of the poly-metallic circuit was improved as a

better grinding of the ore was achieved. This resulted in metal

production within budgeted parameters.

Peruvian Operations - Condestable Mine:

----------------------------------------------------------------------------

Production Unit Q4 2011 YTD

----------------------------------------------------------------------------

Ore processed T 594,900 2,364,000

----------------------------------------------------------------------------

Copper grade % 0.96 1.06

----------------------------------------------------------------------------

Concentrate DMT 21,800 94,000

----------------------------------------------------------------------------

Contained copper FMT 5,200 22,600

----------------------------------------------------------------------------

Fine gold Oz 3,260 13,850

----------------------------------------------------------------------------

Fine silver Oz 76,100 317,000

----------------------------------------------------------------------------

About Iberian Minerals Corp.

Iberian Minerals Corp. is a Canadian listed global base metals company with

interests in Spain and Peru. The Condestable Mine, located in Peru approximately

90 km south of Lima operates at 2.2 million tonnes per year producing copper,

and associated silver and gold in a concentrate. The Aguas Tenidas Mine is in

the Andalucia region of Spain approximately 110 km north-west of Seville and

operates a 2.2 million tonnes per year underground mine and concentrator that

produces copper, zinc and lead concentrates that also contain gold and silver.

FORWARD LOOKING STATEMENTS:

This news release contains certain "forward-looking statements" and

"forward-looking information" under applicable securities laws. Except for

statements of historical fact, certain information contained herein constitutes

forward-looking statements. Forward-looking statements are frequently

characterized by words such as "plan", "expect", "project", "intend", "believe",

"anticipate", "estimate", and other similar words, or statements that certain

events or conditions "may" or "will" occur. Forward looking information may

include, but is not limited to, statements with respect to the future financial

or operating performances of the Corporation, its subsidiaries and their

respective projects, the timing and amount of estimated future production,

estimated costs of future production, capital, operating and exploration

expenditures, the future price of copper, gold and zinc, the estimation of

mineral reserves and resources, the realization of mineral reserve estimates,

the costs and timing of future exploration, requirements for additional capital,

government regulation of exploration, development and mining operations,

environmental risks, reclamation and rehabilitation expenses, title disputes or

claims, and limitations of insurance coverage. Forward-looking statements are

based on the opinions and estimates of management at the date the statements are

made, and are based on a number of assumptions and subject to a variety of risks

and uncertainties and other factors that could cause actual events or results to

differ materially from those projected in the forward-looking statements. Many

of these assumptions are based on factors and events that are not within the

control of the Corporation and there is no assurance they will prove to be

correct. Factors that could cause actual results to vary materially from results

anticipated by such forward-looking statements include changes in market

conditions and other risk factors discussed or referred to in the section

entitled "Risk Factors" in the Corporation's annual information form dated March

29, 2010. Although the Corporation has attempted to identify important factors

that could cause actual actions, events or results to differ materially from

those described in forward-looking statements, there may be other factors that

cause actions, events or results not to be anticipated, estimated or intended.

There can be no assurance that forward-looking statements will prove to be

accurate, as actual results and future events could differ materially from those

anticipated in such statements. The Corporation undertakes no obligation to

update forward-looking statements if circumstances or management's estimates or

opinions should change except as required by applicable securities laws. The

reader is cautioned not to place undue reliance on forward-looking statements.

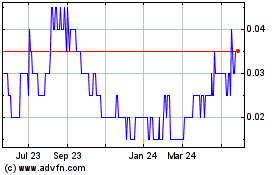

InZinc Mining (TSXV:IZN)

Historical Stock Chart

From Dec 2024 to Jan 2025

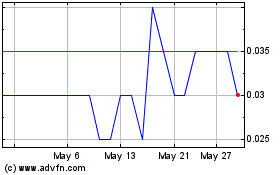

InZinc Mining (TSXV:IZN)

Historical Stock Chart

From Jan 2024 to Jan 2025