InZinc Files Positive Preliminary Economic Assessment for West Desert Project

08 May 2014 - 1:04AM

Marketwired

InZinc Files Positive Preliminary Economic Assessment for West

Desert Project

VANCOUVER, BRITISH COLUMBIA--(Marketwired - May 7, 2014) -

InZinc Mining Ltd. (TSX-VENTURE:IZN) (the "Company") is pleased to

announce that the technical report on the Preliminary Economic

Assessment ("PEA") of its 100% owned West Desert zinc-iron-copper

project (the "Project") in western Utah has been filed on SEDAR.

The results of the PEA were announced in an April 1, 2014 news

release and illustrated the potential for low-cost zinc, copper and

iron production through conventional bulk underground mining and

processing methods while generating strong cash-flow and a high

rate of return.

Key PEA Economic

Parameters:

|

After-tax Economics: |

NPV@

8% US$258.1 million; IRR 23%; 3.7 year payback from start of

production |

|

Capital Costs: |

Initial US$247.4 million; Life of Mine US$388.9 million |

| Life

of Mine Production: |

1,594.3 Mlbs zinc; 146.7 Mlbs copper; 14.9 Mt iron (magnetite)

concentrate |

| Cash

Cost per Lb Zinc: |

US$(0.04) C1 direct cash cost; US$0.50 C3 fully allocated cost |

| Mine

Life: |

14.8

years |

* Long-term metal prices used in the study included zinc at

$1/lb, copper at $3/lb, iron ore at $105/t (62% Fe, CFR-Tianjin),

gold at $1,300/oz and silver at $21/oz; C1 and C3 costs as per

Brook Hunt definitions and include sustaining capital

Metallurgical test work confirmed that the underground resources

of the West Desert project are amenable to conventional flotation

processing to produce marketable zinc and copper concentrates. The

concentrates will respectively contain significant levels of indium

and precious metals and are clean, with no deleterious elements at

penalty levels. Test work also demonstrated that a marketable iron

(magnetite) concentrate can be produced at very high recoveries and

low expense using traditional magnetic separation. Efficient

removal of a magnetite concentrate in advance of flotation improves

the overall zinc and copper grades of feed to the flotation plant

and is expected to enhance base metal recoveries.

The Project benefits from all-weather road access, on-site grid

power, proximity to natural gas pipelines and is located 90 km from

multiple transcontinental rail networks servicing western US ports

and major North American markets. In addition, the West Desert

Project also benefits from large and potentially expandable

resources. The Project is fully permitted and bonded for future

exploration.

Key PEA

Conclusions:

- The potential for a multi-commodity revenue stream generated

from the three concentrate products over an extended period (14.8

years in this study) is financially attractive

- Substantial resources at West Desert remain open for expansion

to the east, west, and south; there is also potential for the

discovery of new zones beyond these extensions

- West Desert is a project meriting substantial amounts of

additional exploration and development work

The PEA was prepared by Mine Development Associates with

contributions from International Metallurgical and Environmental

Inc. in accordance with the definitions in Canadian National

Instrument 43-101. All dollar amounts are US currency. The PEA is

considered preliminary in nature. It includes Inferred mineral

resources that are considered too speculative to have the economic

considerations applied that would enable classification as mineral

reserves. There is no certainty that the conclusions within the PEA

will be realized. Mineral resources that are not mineral reserves

do not have demonstrated economic viability.

The technical report is entitled "Technical Report on the West

Desert Zinc-Copper-Indium-Magnetite Project - Preliminary Economic

Assessment - Juab County, Utah" and is available both at

www.sedar.com and the Company's website at

www.inzincmining.com.

Chris Staargaard, P.Geo., a Qualified Person as defined in

NI43-101, has approved the technical content of this news

release.

InZinc Mining Ltd.

C.F. Staargaard, President and CEO

Cautionary Note

Regarding Forward-Looking Statements

This news release contains forward-looking statements and

forward-looking information (collectively, "forward-looking

statements") within the meaning of applicable Canadian and US

securities legislation. All statements, other than statements of

historical fact, included herein including, without limitation,

statements regarding the Company's next shareholder meeting.

Although the Company believes that such statements are reasonable,

it can give no assurance that such expectations will prove to be

correct. Forward-looking statements are typically identified by

words such as: believe, expect, anticipate, intend, estimate,

postulate and similar expressions, or are those, which, by their

nature, refer to future events. The Company cautions investors that

any forward-looking statements by the Company are not guarantees of

future results, performance, or actions and that actual results and

actions may differ materially from those in forward-looking

statements as a result of various factors, including, but not

limited to, those risks and uncertainties disclosed in the

Company's Management Discussion and Analysis for the year ended

December 31, 2013 filed with certain securities commissions in

Canada and other information released by the Company and filed with

the appropriate regulatory agencies. All of the Company's Canadian

public disclosure filings may be accessed via www.sedar.com and

readers are urged to review these materials, including the

technical reports filed with respect to the Company's mineral

properties.

Neither the

TSX Venture Exchange nor its Regulation Services Provider (as that

term is defined in the policies of the TSX Venture Exchange)

accepts responsibility for the adequacy or accuracy of this

release.

InZinc Mining Ltd.C.F. Staargaard President and CEO(604)

687-7211InZinc Mining Ltd.Joyce MusialCorporate Communications(604)

317-2728joyce@inzincmining.comwww.inzincmining.com

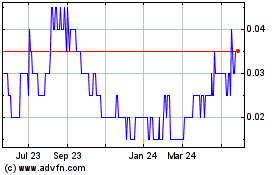

InZinc Mining (TSXV:IZN)

Historical Stock Chart

From Dec 2024 to Jan 2025

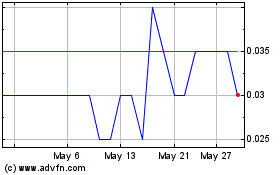

InZinc Mining (TSXV:IZN)

Historical Stock Chart

From Jan 2024 to Jan 2025