Jura Energy Corporation ("Jura" or the "Company") announced today

that its wholly owned operating subsidiary Spud Energy (Pty)

Limited (“Spud”) has entered into agreements with its joint venture

partner Mari Petroleum Company Limited (“MPCL”) for the sale of

Spud’s 40% working interest in the Zarghun South concession and

27.55% working interest in the Nareli Block in Pakistan. MPCL is

the operator of both assets. Jura’s management is of the considered

view that Spud should exit from Zarghun South as the field is

approaching its economic limit in which case significant

abandonment and reclamation obligations would be triggered, unless

further successful in-fill drilling is undertaken. Further, Jura

anticipates significant near-term cash calls related to both the

Zarghun South and Nareli assets for which funding is not readily

available. The transactions remain subject to regulatory approval

in Pakistan as well as customary closing conditions, and are

anticipated to close near the end of Q2 2024.

Zarghun South

Spud is a party to, among other related

agreements, the Zarghun South Development and Production Lease

dated September 16, 2004 among the Government of Pakistan (the

“GoP”), Spud, MPCL and the other joint venture partners (the

“Zarghun South Lease”), as amended and supplemented. Spud has a 40%

Working Interest in the Zarghun South Lease under the November 30,

1994 Bolan Petroleum Concession Agreement. It covers an area of

124.22 square kilometers and is located in the western part of the

Sulaiman Fold and Thrust Belt of the Middle Indus Basin in Pakistan

and is located near the gas demand center of the city of

Quetta.

Spud will assign its entire 40% working interest

in and under the Zarghun South Lease to MPCL (the “Zarghun South

Assignment”) with effect from November 1, 2023, subject to the

GoP’s approval and other customary closing conditions, pursuant to

a farm out agreement and deed of assignment between Spud and MPCL

dated January 30, 2024. In consideration for the assignment of

Spud’s 40% working interest, MPCL agreed to assume all present and

future obligations of Spud related to the Zarghun South Lease.

The impact of the Zarghun South Assignment on

Jura will be as follows: the current production at Zarghun South is

approximately 3 million cubic feet per day (1.2 MMcf/d net to

Spud). Spud’s monthly revenue from Zarghun South is approximately

US$225,000, and after deducting operating costs and royalties, the

net monthly cashflow to Spud is approximately US$20,000. As at

December 31, 2022, Zarghun South had proved plus probable reserves

of 3.197 billion cubic feet (1.279 Bcf net to Spud) with a net

present value of US$3.4 million. However, unless further successful

in-fill drilling is undertaken, the Zarghun South field is expected

to reach its economic limit in early Q2 of 2024, and the current

estimated abandonment cost is approximately US$16 million (US$6.4

million net to Spud).

Nareli Block

Spud is a party to the Nareli Petroleum

Exploration License No. 502/PAK/2021 over Nareli Block No. 3068-9

dated October 13, 2021 (the “Nareli License”) and the Nareli

Petroleum Concession Agreement dated October 13, 2021 executed with

the GoP (the “Nareli PCA”) as well as a joint operating agreement

(the “Nareli JOA”, and together with the Nareli License and the

Nareli PCA, the “Nareli Concession Documents”). The Nareli Block

covers an area of approximately 2,414.95 square kilometers and is

located in the Harnai, Sibi and Loralai districts in the

Balochistan Province of Pakistan.

Spud will assign its entire 27.55% working

interest in and under the Nareli Concession Documents to MPCL (the

“Nareli Assignment”), with effect from October 13, 2021, subject to

the GoP’s approval and other customary closing conditions, pursuant

to a farm out agreement and deed of assignment with regard to the

Nareli Assignment between Spud and MPCL dated January 31, 2024. In

consideration for the assignment of Spud’s 27.55% working interest

MPCL will assume Spud’s share of all present and future work

commitments related to the Nareli Concession Documents.

The Nareli block has significant exploration

potential but no established reserves. Jura has retained a back-in

right to acquire a 10% working interest in Nareli, subject to

certain conditions including that it must be exercised prior to

approval of an exploration well, and reimbursement of the full

amount of past costs corresponding to a 10% working interest plus

US$500,000.

About Jura Energy

Corporation

Jura is an international energy company engaged

in the exploration, development and production of petroleum and

natural gas properties in Pakistan. Jura is based in Calgary,

Alberta, and listed on the TSX-V trading under the symbol JEC. Jura

conducts its business in Pakistan through its subsidiaries,

Frontier Holdings Limited and Spud Energy Pty Limited.

Forward Looking Advisory

This press release contains certain

forward-looking statements and forward-looking information

(collectively referred to herein as "forward-looking statements")

within the meaning of Canadian securities laws. The words "will",

"approximately", and similar expressions are used to identify

forward looking information. Specific forward-looking statements in

this press release include information regarding the completion of

the sale of the Company’s indirect 40% working interest in the

Zarghun South asset and its indirect 27.55% working interest in the

Nareli asset, and the regulatory approvals and closing conditions

required therefor.

The forward-looking statements contained in this

press release are based on management's beliefs, estimates and

opinions on the date the statements are made in light of

management's experience, current conditions and expected future

development in the areas in which Jura is currently active and

other factors management believes are appropriate in the

circumstances. Jura undertakes no obligation to update publicly or

revise any forward-looking statement or information, whether as a

result of new information, future events or otherwise, unless

required by applicable law.

Readers are cautioned not to place undue

reliance on forward-looking information. By their nature,

forward-looking statements are subject to numerous assumptions,

risks and uncertainties that contribute to the possibility that the

predicted outcome will not occur, including some of which are

beyond Jura's control. These assumptions and risks include, but are

not limited to: the risks associated with the oil and gas industry

in general such as operational risks in exploration, development

and production, delays or changes in plans with respect to

exploration or development projects or capital expenditures, the

imprecision of resource and reserve estimates, assumptions

regarding the timing and costs relating to production and

development as well as the availability and price of labour and

equipment, weather, volatility of and assumptions regarding

commodity prices and exchange rates, marketing and transportation

risks, environmental risks, the ability to access sufficient

capital from internal and external sources, changes in applicable

law, and risks resulting from the potential for ongoing or future

global pandemics and their effects on general economic conditions

and public markets, Jura’s business, and the ability of Jura to

prepare and approve required filings in a timely manner.

Additionally, there are economic, political, social and other risks

inherent in carrying on business in Pakistan. There can be no

assurance that forward-looking statements will prove to be accurate

as actual results and future events could vary or differ materially

from those anticipated in such statements. See Jura's Management’s

Discussion and Analysis for the year ended December 31, 2022,

available on SEDAR+ at www.sedarplus.ca, for further description of

the risks and uncertainties associated with Jura's business.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Mr. Nadeem Farooq, CEO Tel: +92 51 2270702-5Fax: +92 51 227

0701Website: www.juraenergy.comE‐Mail: info@juraenergy.com

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

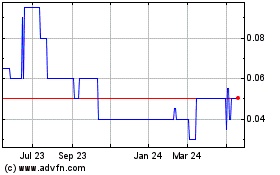

Jura Energy (TSXV:JEC)

Historical Stock Chart

From Nov 2024 to Dec 2024

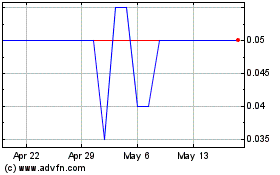

Jura Energy (TSXV:JEC)

Historical Stock Chart

From Dec 2023 to Dec 2024