Kutcho Copper Outlines Potential Open Pit & Underground Resource Expansion Targets

05 October 2021 - 10:30PM

Kutcho Copper Corp. (TSXV: KC, OTCQX: KCCFF)

(“Kutcho Copper” or the “Company”) is pleased to provide an

overview of exploration targets at the Kutcho project (the

“Project”) with an emphasis on open pit and underground targets at

the Main, Sumac and Esso deposits that have the potential to expand

the open pit and underground mineral resources beyond those

contemplated for inclusion in the upcoming feasibility study.

“We are finalizing a detailed exploration plan

for the Project that provides numerous opportunities to increase

the open pit and underground mineral resources available for

inclusion in future mine plans at the existing Main, Sumac and Esso

deposits,” said Vince Sorace, President & CEO of Kutcho Copper.

“In addition, we plan to advance a number of green fields targets

that show potential for discovery of completely new deposits and

which have not seen any exploration conducted since 1990. The

prospective mineralized horizons that host the three existing

deposits repeat three times across our land position and VMS

deposits typically occur in clusters along favourable horizons.

With three deposits already identified along the Main-Sumac-Esso

horizon and multiple underexplored targets, the Project has the

making of a classic VMS district with significant upside

potential.”

The Kutcho Project mineral rights encompass ~90%

of the prospective Kutcho formation rocks east of Dease Lake, B.C.

These prospective volcanic rocks are folded, repeating the

favourable mineralized horizon that hosts the Main, Sumac and Esso

volcanogenic massive sulphide (“VMS”) deposits three times within

the Project boundary, including the areas hosting the known

deposits. Following an updated comprehensive review of available

technical information, significant exploration opportunities have

been identified, including several priority, drill-ready targets

prospective for the discovery and definition of additional mineral

resources.

Near Resource Targets (Figure

1)

Main Deposit

- Open Pit Shell (Target

1): 459,000 tonnes of inferred mineral resources grading

1.35% copper equivalent (“CuEq”) (comprised of 0.78% Cu, 1.24% Zn,

0.60g/t Au and 16.8g/t Ag) lie within a 0.45% CuEq cut-off grade

pit shell for the Main deposit. and available for potential

conversion into the measured and indicated mineral resource

categories through additional drilling. This represents about 2.3%

of the total combined estimate of open pit mineral resources for

the Main deposit and has the potential to not only increase the

material available processing but also reduce the strip ratio by

converting material being treated as waste in the upcoming

feasibility study into material available to feed the mill.

- Main-Sumac Gap (Target

2): The western margin of the Main deposit is partially

open and joins the ‘Main-Sumac Gap’ where a 400m by 380m panel

between the adjacent Main and Sumac deposits is untested by

drilling. The near surface portion of this target could have

potential to be an open pit target. A conductive geophysical

anomaly coincides with the area and is ~360m long. K003, the most

eastern hole to intersect the Sumac deposit and located on the

western margin of the gap, returned 5.12m (estimated true thickness

of 4.32m) of 1.29% Cu, 0.49% Zn and 7g/t Ag). Discovery of

additional mineralization in this area could potentially result in

an expanded open pit or be accessed from the proposed underground

decline connecting the Main and Esso deposits.

- Underground & Down dip

(Target 3): 1,717,000 tonnes grading 1.87% CuEq (comprised

of 1.19% Cu, 1.90% Zn, 0.49g/t Au, 26.1g/t Ag) of Main deposit

Inferred mineral resources lies below the pit shell using a 1.05%

CuEq cut-off grade. This represents about 68.4% of the total

combined estimate of underground mineral resources for the Main

deposit and are available for potential conversion into the

measured and indicated mineral resource categories. In addition,

over 35% of the Main deposit remains open down-dip.

- Footwall Zone (“FWZ”)

(Target 4): The FWZ target comes near to surface, lies

stratigraphically beneath the Main deposit and south of the open

pit design. The FWZ is open to the east and partially down

dip. Drill hole E057, near its eastern margin,

intersected 1.5 m of 3.54% Cu, 6.94% Zn, 316.9g/t Ag and 1.47g/t

Au. The FWZ is also open at depth and could represent a parallel

mineralizing horizon. Stacked mineralizing horizons are common in

VMS districts and could open up additional prospective areas to

future exploration.

Esso Deposit

- Underground & Down Dip

(Target 3): 1,624,000 tonnes grading 2.15% CuEq,

(comprised of 1.32% Cu, 1.59% Zn, 0.42g/t Au, 35.8g/t Ag) of Esso

deposit are characterized as inferred mineral resources using a

0.95% CuEq cut-off grade. This represents about 38.5% of the total

combined estimate of underground mineral resources for the Esso

deposit and have potential for conversion to measured and indicated

mineral resource through additional drilling. Conversion would

significantly increase the quantity of mineral resources available

for inclusion in potential future mine plans with minimal

additional development capital required for access. In

addition, over 50% of the strike extent of the Esso deposit remains

open down-dip.Esso West (Target

5): The Esso West expansion target is represented by a

geophysical anomaly extending 1,500m westward from the Esso

deposit, with approximately only 150m (10%) of the anomaly being

drill tested. This drilling returned several mineralized intercepts

including 7.2m of 2.0% Cu, 5.2% Zn and 17g/t Ag in hole E094B3

(estimated true thickness of 6.12m), which lies 300m west of the

Esso deposit. The 300m of prospective Kutcho horizon between hole

E094B3 and the Esso deposit is untested by drilling, as is the

further 1,000 m of prospective Kutcho horizon to the west of hole

E094B3. Any discoveries in these areas could take advantage of the

proposed underground development for the Esso deposit.

Sumac Deposit

- Sumac (Target 6):

The entire inferred mineral resource at the Sumac deposit,

consisting of 9,086,000 tonnes grading 1.49% CuEq (comprised of

1.06% Cu, 1.53% Zn, 0.16g/t Au and 16.2g/t Ag), is open down dip

and available for potential resource expansion and resource

conversion from the inferred to measured and indicated resource

categories. The underground access decline design for the Esso

deposit passes across the entire length of the Sumac deposit which

could provide drill platforms for underground drilling to convert

the Sumac deposit into higher categories of mineralization,

allowing incorporation into future mine plans with minimal

additional development.

Details regarding the estimate of mineral

resources are presented in a press release dated Sept 13, 2021 and

can be seen on the Company's web site.

Figure 1 is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/c3a2d233-b7a8-415f-a194-c843822b66be.

Regional Targets (Figure 2)

- Target 1 – the IRJ

Northwest target was first identified as a conductor in a 1990

ground-based survey and was tested with two drill holes. The holes

intersected intensely altered and weakly copper-mineralized

intervals, as well as a thick sequence of altered lapilli tuff and

ash. The size and strength of the alteration in both holes suggests

a prospective target down dip from prior drilling efforts and is

prospective for the discovery of a new VMS deposit.

- Target 2 – the IRJ

Northeast target has been intersected by three holes drilled in

1990 that returned massive to semi-massive sulphide layers up to 1m

thick that were associated with argillaceous material. Hole E017

returned ~3m of a stringer zone with an average of 20% pyrite that

includes some massive bands, which assayed 7.3m of 0.27% Cu. The

geochemical trends suggest that a hydrothermal vent area lies

further east and that targeting higher grade mineralization should

focus on this vector in order to potentially discover a new VMS

deposit.

- Target 3 – This

target is a significant VMS-type showing located on the flank of a

felsic dome. A prospect pit was excavated and reached “mineralized

bedrock” at a depth of 1.6 m, returning assays of 0.3% Cu, 0.1% Pb,

0.1% Zn and 7g/t Ag. Soil sampling over the area defined a 400m x

500m cluster of strong Cu-Zn anomalies that are coincident with a

strong, linear, chargeability anomaly. A Cu-Zn soil anomaly

containing up to 0.15% Zn and 0.03% Cu occurs on the southwestern

flank of the same rhyolite flow/dome complex that has not been

drill tested either. Rhyolite domes are often associated with vent

areas in VMS deposits, with massive sulphides often lying on the

flanks, suggesting that Target R3 may represent a new mineralizing

centre.

- Target 4 – B-C

East is a 3.5km long conductor inferred to be overlain by 30m of

silica exhalite. Host rocks comprise a narrow band of sericite

schist with narrow lenses of massive pyrite and silica exhalite

hosted in mafic rocks. Gravity surveys produced a broad and shallow

response that suggests a diffuse zone of increased density that

could indicate disseminated or stringer-style sulphide

mineralization commonly associated with VMS deposits.

- Target 5 – The

I-PC area is associated with cherts hosted in crystal lithic tuffs

and is interpreted as a hydrothermal exhalative horizon. E024 and

90K16 are proximal drill holes which show alteration in lithic

tuffs and the presence of massive to laminated pyrite with minor

disseminated sphalerite and chalcopyrite, indicating proximity to a

productive VMS environment. This tuff unit has an apparent

thickness of 70m and occurs upstream from numerous rounded boulders

of finely banded, sphalerite- and galena-bearing chert and

exhalate, suggesting potential for a nearby sub-cropping VMS

system.

Figure 2 is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/c4399a12-cddb-4199-b72e-19a17bddebe4.

Future Exploration Plans

Kutcho Copper is assessing plans to aggressively

test these priority targets in 2022 where they have the potential

to enhance the size and scale of the Project. In conjunction with

these efforts, Kutcho Copper will also conduct an airborne

geophysical VTEM survey over portions of the property that have not

been covered by geophysical surveys in the past (Figure 2). A VTEM

survey carried out in 2011 was highly effective at confirming known

mineralization and identifying new anomalies for follow-up.

Qualified Persons

Robert Sim, P.Geo., a Qualified Person as

defined by NI 43-101, is responsible for the estimate of mineral

resources presented in this news release and has reviewed, verified

and approved the contents of this news release as they relate to

the mineral resource estimate, including the sampling, analytical,

and test data underlying the mineral resource estimate. Mr. Sim is

a consultant to the Company, independent from Kutcho Copper and

confirms there were no limitations from the Company in verifying

the drilling and sample data with site visit observations and

monitoring of the QA/QC program. The technical or scientific

information in this press release has been reviewed and approved by

Mr. Garth Kirkham, P.Geo., Technical Advisor for Kutcho Copper

Corp., who serves as a Qualified Person under the definition of NI

43-101.

About Kutcho Copper Corp.

Kutcho Copper Corp. is a Canadian resource

development company focused on expanding and developing the Kutcho

high grade copper-zinc project in northern British Columbia.

Committed to social responsibility and the highest environmental

standards, the Company intends to progress the Kutcho Project

through feasibility and permitting to a positive construction

decision.

Vince SoracePresident & CEO, Kutcho Copper Corp.

For further information regarding Kutcho Copper

Corp, please email info@kutcho.ca or visit our website at

www.kutcho.ca.

Cautionary Note Regarding Forward-Looking

Statements

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

This news release contains certain statements

that may be deemed “forward-looking statements” with respect to the

Company within the meaning of applicable securities laws.

Forward-looking statements are statements that are not historical

facts and are generally, but not always, identified by the words

“expects”, “plans”, “anticipates”, “believes”, “intends”,

“estimates”, “projects”, “potential”, “indicates”, “opportunity”,

“possible” and similar expressions, or that events or conditions

“will”, “would”, “may”, “could” or “should” occur. Although Kutcho

Copper believes the expectations expressed in such forward-looking

statements are based on reasonable assumptions, such statements are

not guarantees of future performance, are subject to risks and

uncertainties, and actual results or realities may differ

materially from those in the forward-looking statements. Such

material risks and uncertainties include, but are not limited to,

the Company’s ability to raise sufficient capital to fund its

obligations under its property agreements going forward, to

maintain its mineral tenures and concessions in good standing, to

explore and develop the Kutcho project or its other projects, to

repay its debt and for general working capital purposes; changes in

economic conditions or financial markets; the inherent hazards

associates with mineral exploration and mining operations, future

prices of copper and other metals, changes in general economic

conditions, accuracy of mineral resource and reserve estimates, the

potential for new discoveries, the potential to convert inferred

resources to indicated or measured resources, the potential to

optimize the mine plan, the ability of the Company to obtain the

necessary permits and consents required to explore, drill and

develop the Kutcho project and if obtained, to obtain such permits

and consents in a timely fashion relative to the Company’s plans

and business objectives for the projects; the general ability of

the Company to monetize its mineral resources; and changes in

environmental and other laws or regulations that could have an

impact on the Company’s operations, compliance with environmental

laws and regulations, aboriginal title claims and rights to

consultation and accommodation, dependence on key management

personnel and general competition in the mining industry.

Forward-looking statements are based on the reasonable beliefs,

estimates and opinions of the Company’s management on the date the

statements are made. Except as required by law, the Company

undertakes no obligation to update these forward-looking statements

in the event that management’s beliefs, estimates or opinions, or

other factors, should change.

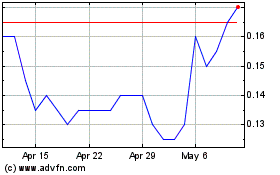

Kutcho Copper (TSXV:KC)

Historical Stock Chart

From Feb 2025 to Mar 2025

Kutcho Copper (TSXV:KC)

Historical Stock Chart

From Mar 2024 to Mar 2025