Maple Leaf Enters Yellowhorn Project Alliances

18 January 2012 - 2:00AM

Marketwired Canada

Maple Leaf Reforestation Inc. (TSX VENTURE:MPE) ("Maple Leaf") is pleased to

announce that is has entered a Yellowhorn Project Collaboration Agreement for

the exclusive distribution of Yellowhorn products in Europe and for the joint

development of Yellowhorn planting projects in Europe (the "Agreement") with

Vinomatos Espana, S.L. ("Vinomatos"), a Spain-based company that specializes in

planting fruit trees, vineyards, olive trees and agro-energetic planting

projects. Vinomatos utilizes a "Super High Intensive" technique for its planting

which includes a semi-automatic GPS guided machine. Vinomatos has developed a

program for applying its planting techniques to Yellowhorn production. The

Agreement will be effective for 3 years and will be renewable by the agreement

of both parties.

Maple Leaf and Vinomatos' parent-company, Gaia Group ("Gaia"), have also entered

a Letter of Intent with Horqin Youyi Qianqi County, Inner Mongolia (the

"County"), for the planting of Yellowhorn seedlings on approximately 82,000

acres of land in Inner Mongolia (the "LOI") over the next 2 years. The LOI

allows for MPE and Gaia to sell up to 57 million Yellowhorn seedlings to the

County over the next 2 years at a price of 1 RMB ($0.16 CDN) per seedling for

planting, with the right to buy back certain amounts of the Yellowhorn seeds

once mature for 10 RMB ($1.60 CDN) per kilogram, instead of the current market

price in China of approximately 58 RMB ($9.28 CDN) per kg.

Maple Leaf's management is excited about both the Agreement and the LOI, and its

new relationships with Vinomatos/Gaia and the County, and it hopes to continue

to be able to secure partnerships and agreements relating to its operations that

provide near term revenue and value to the company. The County is keen on

attracting 'Green' development projects in its region and has presented Maple

Leaf and Vinomatos/Gaia with several opportunities. The Agreement and the LOI

are key pieces for having success with Maple Leaf's 2012 corporate plans.

Maple Leaf has spent considerable time and resources in recent years growing

agro-energetic crops like Yellowhorn in China and testing and developing agro &

process technologies that can assist with the growth and development of

Yellowhorn products. Maple Leaf's goal has been, and remains to be, to become

the owner of Yellowhorn Plantations within China that provide a significant

Yellowhorn product source for its own use and distribution. Maple Leaf is also

committed to continuing to improve, develop and create a global value for

Yellowhorn products, which to date has only existed within China. Maple Leaf's

efforts surrounding Yellowhorn products has created significant public awareness

and interest from companies worldwide who are seeking to incorporate Yellowhorn

products into their environments, businesses and markets. Maple Leaf has become

the first information source regarding Yellowhorn products for several companies

in Europe and the United States, being a valuable provider of Yellowhorn

research and products. Both Maple Leaf and Vinomatos/Gaia are convinced of the

potential for Yellowhorn to become "the bio-energy crop for the world", and

therefore both are equally interested and excited to collaborate with each other

to develop Yellowhorn products and growth processes, and expand the market

consumption of Yellowhorn around the world.

Given Maple Leaf's new arrangements with Vinomatos/Gaia and the County, and due

to the results of the extensive due diligence undertaken, Maple Leaf will be

cancelling its proposed asset purchase from KS Ecology (Canada) Inc. ("KS"), a

Vancouver, B.C. based Yellowhorn plantation company with operations in China.

Maple Leaf's new partnerships with Vinomatos/Gaia and the County will provide

for a much larger supply of Yellowhorn products and will do so at significantly

lower costs. Pursuant to its Asset Purchase Agreement with KS, Maple Leaf had

until January 27, 2012 to conduct due diligence on KS's assets and is permitted

to cancel the Asset Purchase Agreement entirely, and at no penalty, due to KS's

assets being primarily inconsistent with the details provided to Maple Leaf at

the time that the Asset Purchase Agreement was entered. For more information on

Maple Leaf's proposed transaction with KS investors are encouraged to see Maple

Leaf's previous news releases dated May 30, 2011, August 1, 2011 and November 9,

2011.

Maple Leaf will be continuing to update investors regularly in the coming weeks

regarding its ongoing operational initiatives and it is excited about being in a

position to release these details to current and potential shareholders.

About Maple Leaf Reforestation Inc.

Maple Leaf is a Canadian company that focuses in the environmental industry with

2 main operating arms:

1. Eco-Agriculture - it operates a large-scale nursery business in Inner

Mongolia, China that is focused on growing value-added tree seedlings

and nursery products that assist with anti-desertification.

2. Renewable Energy - it is undertaking to commence a Yellowhorn seedling

and tree operation which would provide valuable Yellowhorn seeds and

ultimately oil from such seeds for the manufacture of bio-diesel fuel

and premium healthy cooking oil.

Maple Leaf is a wholly-owned foreign enterprise which allows the Company to

control 100% of the direction and operations of the company in China while

permitting the cash generated from operations in China to flow back to Canada.

For further information regarding Maple Leaf Reforestation Inc., visit

www.mlreforestation.com or contact:

Certain statements in this news release including (i) statements that may

contain words such as "anticipate", "could", "expect", "seek", "may" "intend",

"will", "believe", "should", "project", "forecast", "plan" and similar

expressions, including the negatives thereof, (ii) statements that are based on

current expectations and estimates about the markets in which Maple Leaf

operates and (iii) statements of belief, intentions and expectations about

developments, results and events that will or may occur in the future,

constitute "forward-looking statements" and are based on certain assumptions and

analysis made by Maple Leaf. Forward-looking statements in this news release

include, but are not limited to, statements with respect to future capital

expenditures, including the amount, nature and timing thereof; other development

trends within the China's seedling industry; business strategy; expansion and

growth of Maple Leaf's business and operations and other such matters. Such

forward-looking statements are subject to important risks and uncertainties,

which are difficult to predict and that may affect Maple Leaf's operations,

including, but are not limited to: the impact of general economic conditions;

industry conditions; government and regulatory developments; seedling product

supply and demand; competition; and Maple Leaf's ability to attract and retain

qualified personnel. Maple Leaf's actual results, performance or achievements

could differ materially from those expressed in, or implied by, these

forward-looking statements and, accordingly, no assurance can be given that any

of the events anticipated by the forward-looking statements will transpire or

occur, or if any of them do transpire or occur, what benefits Maple Leaf will

derive there from.

Maple Leaf maintains a forward-looking statement database which is reviewed by

management on a regular basis to ensure that no material change has occurred

with respect to such forecasts. The Company will publicly disclose such material

changes to its forward-looking statements as soon as they are known to

management.

Last Close: January 16, 2012 - $0.04

Shares Issued: 80,682,875

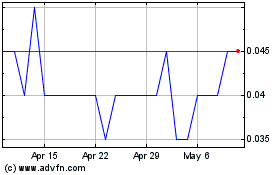

Klondike Silver (TSXV:KS)

Historical Stock Chart

From Jan 2025 to Feb 2025

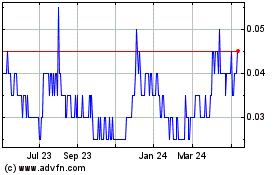

Klondike Silver (TSXV:KS)

Historical Stock Chart

From Feb 2024 to Feb 2025