MedMira Eliminates $11.8 Million in Debt through Debt Holder Settlement Plan

13 June 2012 - 4:11PM

PR Newswire (Canada)

HALIFAX, June 13, 2012 /CNW/ - MedMira Inc., (MedMira) , a

developer of rapid diagnostic technology and solutions, announced

today that it has been successful in reducing the Company's debt

position by CAD$11,834,592, representing a nearly 60% reduction in

the Company's current liabilities associated with promissory notes,

long-term debt, and convertible debentures. To achieve this

strengthened financial position, MedMira has paid CAD$1,806,481,

through various compromise and negotiated debt holder

settlements. The net impact of this gain is $10,028,111 or

$0.026 per share. "The Company's interest expense associated with

these debts will be reduced by more than half a million dollars per

quarter. MedMira is committed to strengthening its balance

sheet and the impact of these debt settlements will be reflected in

the upcoming annual financial statements for fiscal year 2012,"

said Daniel Frid, CFO, MedMira Inc. "Using our debt

settlement plan, we began negotiations with several of the

Company's largest debt holders nearly one year ago and we are

pleased to see the successful implementation of the plan thus far.

Additional debt reduction and financial stabilization initiatives

are ongoing, and a key piece of MedMira's broader strategy for long

term growth and profitability." MedMira's debt reduction

initiatives enable the resources and support required for global

marketing and business development initiatives aimed at fully

exploiting the true value of the MedMira's patented technology

platform and advanced rapid diagnostics. "We are confident that

this significant reduction in debt together with a recent

investment from Andurja Beteiligungen AG, positions MedMira to

deliver on business development targets and achieve growth and

increased revenues in the near future," said Hermes Chan, CEO,

MedMira Inc. "Key elements of our strategic business plan,

including increased financial stability, a global strategic partner

network, and a strong technology platform validated by world class

organizations such as the Canadian Forces and U.S. Army, are now

aligned." About MedMira MedMira is a leading developer and

manufacturer of flow-through rapid diagnostics and technologies.

The Company's tests provide hospitals, labs, clinics and

individuals with reliable, rapid diagnosis for diseases such as HIV

and hepatitis C in just three minutes. The company's tests are sold

under the Reveal®, Multiplo™ and Miriad brands in global markets.

MedMira's rapid flow-through HIV test is the only one in the world

to achieve regulatory approvals in Canada, the United States, China

and the European Union. MedMira's corporate offices and

manufacturing facilities are located in Halifax, Nova Scotia,

Canada. For more information visit MedMira's website at

www.medmira.com. This news release contains forward-looking

statements, including statements relating to growth in the

Company's business, earnings and profitability, and trends in

demand for the Company's products, which involve risk and

uncertainties and reflect the Company's current expectation

regarding future events including statements regarding possible

future growth and new business opportunities. Actual events

could materially differ from those projected herein and depend on a

number of factors including, but not limited to, changing market

conditions, successful and timely completion of clinical studies,

uncertainties related to the regulatory approval process,

establishment of corporate alliances and other risks detailed from

time to time in the company quarterly filings. Neither TSX Venture

Exchange nor its Regulation Services Provider (as that term is

defined in the policies of the TSX Venture Exchange) accepts

responsibility for the adequacy or accuracy of this release.

MEDMIRA INC. CONTACT: Andrea Young, Corporate CommunicationsTel:

902-450-1588Email: ayoung@medmira.com

Copyright

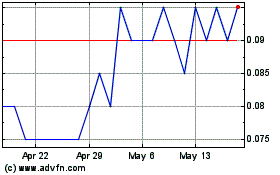

MedMira (TSXV:MIR)

Historical Stock Chart

From Dec 2024 to Jan 2025

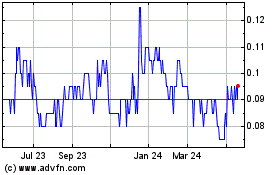

MedMira (TSXV:MIR)

Historical Stock Chart

From Jan 2024 to Jan 2025