Monument Mining Limited (TSX-V: MMY and FSE: D7Q1) “Monument” or

the “Company” today announced its first quarter production and

financial results for the three months ended September 30, 2020.

All amounts are expressed in United States dollars (“US$”) unless

otherwise indicated (refer to www.sedar.com for full financial

results).

President and CEO Cathy Zhai commented: “Fiscal

2021 started with new challenging as a global COVID-19 pandemic

carried forward from fiscal 2020. The Company has fully resumed its

production in the first quarter from eight-week’s mining ban at

Selinsing in the first quarter, the Selinsing Sulphide gold plant

upgrade is however still pending for financing.

“On the other hand, gold price surged to record

high and the gold mining sector was very active in Western

Australia, gold mining producers enjoyed high production margins,

and investment is flowing into that region for gold explorations.

The Company continues try hard to access to financing, and it is

very closely monitoring the market and looking for divesting of

base metal portfolio to focus on primary gold assets, as well as

new corporate development opportunities to lift up market value for

the best interest of its shareholders.”

First Quarter

Highlights:

- 3,504 ounces (“oz”) of gold

produced (Q1 2020: 4,852oz) with 3,100oz of gold sold for gross

revenue of $5.92 million (Q1 2020: 4,323oz of gold sold for revenue

of $6.34 million); Gross margin of $3.06 million (Q1 2020: $2.65

million);

- Average realized price per ounce,

excluding prepaid gold sales, of $1,909/oz (Q1 2020:

$1,475/oz);

- Cash cost per ounce of $923/oz (Q1

2020: $855/oz); All-in sustaining costs per ounce (“AISC”) of

$1,055/oz (Q1 2020: $1,158/oz);

- Peranggih grade control drilling

after positive trial mining results identified 58,662 tonnes at

0.93g/t Au materials;

- Production resumed at Selinsing

after lifting eight weeks mining ban in last quarter during

COVID-19 pandemic

- Entering into a Tuckanarra JV

arrangement with Odyssey subsequent to the quarter opens corporate

development opportunities in WA region.

First Quarter

Production and Financial

Highlights

|

|

Three months ended

September 30, |

|

|

2020 |

2019 |

| Production |

|

|

| Ore mined (t) |

81,576 |

46,797 |

| Ore processed (t) |

166,432 |

234,030 |

| Average mill feed grade

(g/t) |

0.98 |

0.99 |

| Processing recovery rate

(%) |

64% |

71% |

| Gold recovery (oz) |

3,343 |

5,327 |

| Gold production (1) (oz) |

3,504 |

4,852 |

| Gold sold (oz) |

3,100 |

4,323 |

| Financial (expressed in

thousands of US$) |

$ |

$ |

| Revenue |

5,919 |

6,343 |

| Gross margin from mining

operations |

3,059 |

2,646 |

| Income before other items |

1,943 |

745 |

| Net income |

138 |

208 |

| Cash flows provided from

operations |

747 |

1,212 |

| Working capital |

18,482 |

23,288 |

| Earnings per share - basic and

diluted (US$/share) |

0.00 |

0.00 |

|

|

Three months ended September 30, |

|

|

2020 |

2019 |

|

|

|

|

| Other |

US$/oz |

US$/oz |

| Average realized gold price

per ounce sold(2) |

1,909 |

1,475 |

| |

|

|

| Cash cost per ounce (3) |

|

|

| Mining |

274 |

178 |

| Processing |

481 |

538 |

| Royalties |

163 |

121 |

| Operations, net of silver

recovery |

5 |

18 |

| Total cash cost per

ounce |

923 |

855 |

| All-in sustaining costs per

ounce (4) |

|

|

| By-product silver

recovery |

1 |

1 |

| Operation expenses |

9 |

- |

| Corporate expenses |

9 |

15 |

| Accretion of asset retirement

obligation |

11 |

11 |

| Exploration and evaluation

expenditures |

13 |

49 |

| Sustaining capital

expenditures |

89 |

227 |

|

Total all-in sustaining costs

per ounce |

1,055 |

1,158 |

(1) Defined as good delivery gold bullion

according to London Bullion Market Association (“LBMA”), net of

gold doŕe in transit and refinery adjustment.(2) Monument realized

1,909US$/oz for the three months ended September 30, 2020.(3) Total

cash cost per ounce includes production costs such as mining,

processing, tailing facility maintenance and camp administration,

royalties and operating costs such as storage, temporary mine

production closure, community development cost and property fees,

net of by-product credits. Cash cost excludes amortization,

depletion, accretion expenses, idle production costs, capital

costs, exploration costs and corporate administration costs.

Readers should refer to section 14 “Non-IFRS Performance

Measures”.

All-in sustaining cost per ounce includes total

cash costs and adds sustaining capital expenditures, corporate

administrative expenses for the Selinsing Gold Mine including

share-based compensation, exploration and evaluation costs, and

accretion of asset retirement obligations. Certain other cash

expenditures, including tax payments and acquisition costs, are not

included. Readers should refer to section 14 “Non-IFRS Performance

Measures”.

Q1 2021 Production

Analysis

- Gold production of 3,504oz, a 28%

decrease as compared to 4,852oz of Q1 2020. The decrease mainly

resulted from lower mining rates and mill feed and more leachable

sulphide ore with lower recovery as compared to Q1 2020.

- Ore processed decreased to 166,432t

from 234,030t of Q1 2020. The decreased mill feed was mainly due to

a decrease in stockpiled super low-grade oxide ore, shortage of

explosives resulting in less oxide ore being mined and processed.

Average mill feed grade was 0.98g/t and was comparable to 0.99g/t

of Q1 2020. The decrease in processing recovery rate to 64% from

71% of Q1 2020 was mainly due to lower recoveries obtained from

processing leachable sulphide ore materials.

- Cash cost per ounce increased by 8%

to $923/oz from $855/oz of Q1 2020. The increase was mainly due to

additional reagents, processing time and energy required in

leaching sulphide materials.

- Ore stockpile has reduced mainly

due to adverse impact from lower mining rate in previous year that

has yet be caught up. Certain mining facilities were used to

deliver material borrowed from mining waste for tailing

development. Despite the impact from COVID-19 pandemic and

explosive supply shortage, the Company has devoted its effort to

improve the stockpile balance.

Q1 2021 Financial

Analysis

- Gold sales generated revenue of

$5.92 million for the period as compared to $6.34 million from Q1

2020. Gold sales revenue was derived from the sale of 3,100oz (Q1

2020: 4,323oz) of gold at an average realized gold price of $1,909

per ounce (Q1 2020: $1,475 per ounce) and the delivery of nil oz

(Q1 2020: 723oz) in fulfilling gold prepaid obligations at an

average London Fix PM gold price of $nil per ounce (Q1 2020: $1,429

per ounce).

- Total production costs decreased by

23% to $2.86 million as compared to $3.70 million from Q1 2020. The

decrease in production costs reflected less gold sold, offset by

higher mining and processing costs as compared to Q1 2020.

- Gross margin for the period was

$3.06 million before operation expenses and non-cash amortization

and accretion. That represented a 16% increase as compared to $2.65

million from Q1 2020. The increase in gross margin was attributable

to an increase in a higher average realized gold price but offset

by less gold sold and higher mining and processing costs.

- Net income for the period was $0.14

million, or $nil per share as compared to net income of $0.21

million or $nil per share from Q1 2020. The negative variance was

caused by higher foreign currency exchange loss and higher tax

expenses, offset by higher income from mining operations and less

corporate expenses.

- Cash and cash equivalents balance

as at September 30, 2020 was $13.94 million, an increase of $3.81

million from the balance at June 30, 2020 of $10.13 million. As at

September 30, 2020, the Company had positive working capital $18.48

million which was comparable to that at June 30, 2020 of $18.79

million.

- Cash provided from investing

activities for the period was $3.07 million (Q1 2020: used in

investing activities of $3.07 million), which was represented by

$0.39 million invested in Selinsing for cutbacks and sulphide

project development and tailings storage facility upgrades (Q1

2020: $1.26 million), $0.26 million and $0.03 million invested in

Murchison exploration and evaluation projects and Mengapur

exploration and evaluation projects, respectively (Q1 2020: $0.27

million and $0.04 million, respectively), and offset by the receipt

of $3.75 million (Q1 2020: nil) with respect to a refundable

deposit for the due diligence of a potential transaction.

Development

Selinsing Gold Mine

During the first quarter, project development

work include research and development (“R&D”) of gold

treatment, underground mining desktop study, TSF development/mining

cutback and test work for oxide mining assessment at Peranggih.

The sulphide gold project plan refinement is

ongoing to achieve maximum feasible return. The procurement team is

assessing project inputs, aiming to reduce the completion time for

long lead items such as stainless steels for BIOX® based

applications, the provision of HV power supply, BIOX® agitators,

flotation cells and thickeners.

R&D work included: improvement of the

sulphide treatment performance through the projected sulphide

treatment plant; maximize recoveries of leachable sulphide ore in

transition and oxide ore from Selinsing Deep, Buffalo Reef, Felda

land, and test third party gold concentrates to increase production

grade.

The TSF development construction lift to 535.5

mRL continued through the quarter, towards meeting fiscal 2021

production requirements. The final stage TSF lift planning to

540mRL continued for sulphide gold production capacity.

The Peranggih phase 1 GC drill program was

completed during Q1 2021 with additional 1,466 meters drilled

bringing total drilling to 5,002 meters. The drill program

identified a total of 58,662 tonnes at 0.93g/t Au, which increased

the mining inventory. The GC delineated indicates 54.2% higher

contained ounces, 63% higher gold grade, and 5.2% less tonnage gold

materials to be extracted than the initial assay results from 2017

GC drilling program at the same area. A further GC drill program

was planned, with 5,000m designed to target shallow mineralisation

and 2,000m allocated to continue to drill down dip from previous

drilling at the bottom of the pit.

Based on the new Grade Control, trial mining at

Peranggih resumed in late September 2020. The widening and gradient

improvement of the hauled road from Peranggih to Pantos Stockpile

was undertaken to increase material transportation efficiency. Site

clearing and sterilisation of the waste dump, stockpiling of

topsoil, and siltation pond construction were carried out to

facilitate the site's ongoing trial mining work.

Transaction

During the quarter, the Company reviewed its

Murchison gold portfolio and development strategy and decided to

divest Tuckanarra Gold Project, allowing it to be advanced faster;

and focus on the primary highly prospective gold projects Burnakura

and Gabanintha, and move these two projects closer to production

through the existing infrastructure.

Subsequent to the end of the first quarter in

October 2020, a joint venture arrangement was entered with Odyssey,

under which ODY will own 80% of the Tuckanarra interest. Monument

will hold 20% free carry interest till mining with consideration of

a total AUD$5 million cash payments and 1% royalty on Odyssey

shared interest. After closing of the Transaction, ODY will own

tenements covering 25km of strike of highly fertile banded iron

formation (“BIF”) and greenstones with extensive gold mining

history. The ore produced shall be preferentially processed by

Burnakura mill subject to commercial terms. The Odyssey team, a

part of Apollo Group in Perth has a long and successful history of

exploring and developing mining assets around the world. Apollo

Group collectively has financed in excess of $1bn of mining

projects. Establishment of an alliance with Odyssey owning

additional high-grade gold projects will open up more opportunities

to advance the Murchison Gold Project.

Exploration Progress

Malaysia

At Selinsing the exploration activities during

the quarter were related to grade control drilling at Peranggih and

geological assessment at Selinsing pits 4, 5 and 6.

At Peranggih grade control drilling continued to

detail the geological and assay data through close space drilling

(5mx5m) at 10m maximum target depth. This method was proved to be

effective in defining near-surface mineralisation, as demonstrated

by a previous campaign conducted at Peranggih Central, thus

continuing to aid the exploration at Peranggih and the nearby area.

In addition, the area covered with GC drilling could be mined

immediately, following the current practice in Peranggih

Central.

An exploration drill program at Pits 5 and 6 was

under review, as well as additional drill holes proposed to

investigate the Pit 4 mineralisation's southern extension. This

program is scheduled to be conducted in Q2 2021, with the main

objective to delineate resource extensions that could be mined as

immediate feed to the current CIL plant.

Western Australia

Exploration was focused on the generation of

regional targets for the Murchison Project as well as the

commencement of detailed deposit reviews that will be included in

the updated life of mine plan The regional targets were generated

from all available datasets including drilling, geophysics,

geochemistry, geological as well as previously defined exploration

targets.

In preparation for updated life of mine

planning, available data is being reviewed in detail for the

individual deposits so that risks can be identified, and work plans

can be designed to help mitigate these risks. Various aspects,

including collar surveys, specific gravity, weathering surfaces as

well as models including geological, structural and mineralization

were assessed. The historical and GIS Compilation database

refinement work and upgrades continued to realize improved

efficiencies.

Burnakura: A total of 30 regional exploration

targets were identified at the Burnakura Project. High potential

exploration targets that were identified includes greenfield style

targets with no known first pass sampling with potential strike

lengths of over 3km, and brownfields style targets along strike and

adjacent to known deposits such as New Alliance and the NOA group

of deposits. There are at least six deposits from Burnakura that

are included in the life of mine plan and five of these contain

Resources that have been classified as Indicated or Inferred

Resources under NI43-101 standards.

Gabanintha:

A total of 30 regional exploration targets were

identified at the Gabanintha Project. High potential targets along

strike to the north and south of Tumblegum South were identified as

well as along strike to the south of the Kavanagh pit and north of

the Golden Hope trend. There is a general lack of first pass

sampling data for the Gabanintha project which creates opportunity

to discover substantial new deposits. The portions of the resource

inventory that are included in the life of mine plan were reviewed

which is composed predominantly of mineralization around the

existing pit areas including Yagahong, Canterbury and Terrells.

Tuckanarra:

A total of 18 regional exploration targets were

identified at the Tuckanarra Project. The targets are focused on

underexplored magnetic BIF units along strike direction, from known

gold occurrences.

About Monument

Monument Mining Limited (TSX-V: MMY, FSE: D7Q1)

is an established Canadian gold producer that owns and operates the

Selinsing Gold Mine in Malaysia. Its experienced management team is

committed to growth and is advancing several exploration and

development projects including the Mengapur Copper-Iron Project, in

Pahang State of Malaysia, and the Murchison Gold Projects

comprising Burnakura, Gabanintha and Tuckanarra in the Murchison

area of Western Australia. The Company employs approximately 205

people in both regions and is committed to the highest standards of

environmental management, social responsibility, and health and

safety for its employees and neighboring communities.

Cathy Zhai, President and CEOMonument Mining

LimitedSuite 1580 -1100 Melville Street Vancouver, BC V6E 4A6

FOR FURTHER INFORMATION visit the company web

site at www.monumentmining.com or contact:

Richard Cushing, MMY Vancouver T:

+1-604-638-1661 x102 rcushing@monumentmining.com

"Neither TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release."

Forward-Looking Statement

This news release includes statements containing

forward-looking information about Monument, its business and future

plans (“forward-looking statements”). Forward-looking statements

are statements that involve expectations, plans, objectives or

future events that are not historical facts and include the

Company’s plans with respect to its mineral projects and the timing

and results of proposed programs and events referred to in this

news release. Generally, forward-looking information can be

identified by the use of forward-looking terminology such as

"plans", "expects" or "does not expect", "is expected", "budget",

"scheduled", "estimates", "forecasts", "intends", "anticipates" or

"does not anticipate", or "believes", or variations of such words

and phrases or state that certain actions, events or results "may",

"could", "would", "might" or "will be taken", "occur" or "be

achieved". The forward-looking statements in this news release are

subject to various risks, uncertainties and other factors that

could cause actual results or achievements to differ materially

from those expressed or implied by the forward-looking statements.

These risks and certain other factors include, without limitation:

risks related to general business, economic, competitive,

geopolitical and social uncertainties; uncertainties regarding the

results of current exploration activities; uncertainties in the

progress and timing of development activities; foreign operations

risks; other risks inherent in the mining industry and other risks

described in the management discussion and analysis of the Company

and the technical reports on the Company’s projects, all of which

are available under the profile of the Company on SEDAR at

www.sedar.com. Material factors and assumptions used to develop

forward-looking statements in this news release include:

expectations regarding the estimated cash cost per ounce of gold

production and the estimated cash flows which may be generated from

the operations, general economic factors and other factors that may

be beyond the control of Monument; assumptions and expectations

regarding the results of exploration on the Company’s projects;

assumptions regarding the future price of gold of other minerals;

the timing and amount of estimated future production; the expected

timing and results of development and exploration activities; costs

of future activities; capital and operating expenditures; success

of exploration activities; mining or processing issues; exchange

rates; and all of the factors and assumptions described in the

management discussion and analysis of the Company and the technical

reports on the Company’s projects, all of which are available under

the profile of the Company on SEDAR at www.sedar.com. Although the

Company has attempted to identify important factors that could

cause actual results to differ materially from those contained in

forward-looking statements, there may be other factors that cause

results not to be as anticipated, estimated or intended. There can

be no assurance that such statements will prove to be accurate, as

actual results and future events could differ materially from those

anticipated in such statements. Accordingly, readers should not

place undue reliance on forward-looking statements. The Company

does not undertake to update any forward-looking statements, except

in accordance with applicable securities laws.

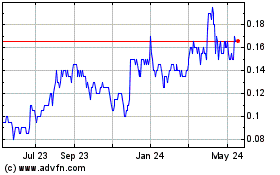

Monument Mining (TSXV:MMY)

Historical Stock Chart

From Nov 2024 to Dec 2024

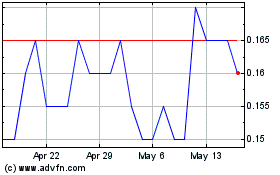

Monument Mining (TSXV:MMY)

Historical Stock Chart

From Dec 2023 to Dec 2024