Monument Mining Limited (TSX-V: MMY and FSE: D7Q1) “Monument” or

the “Company” today announced its annual financial results for the

year ended June 30, 2021. All amounts are in United States dollars

unless otherwise indicated (refer to www.sedar.com for full

financial results).

President and CEO Cathy Zhai commented: “During

this fiscal year, Monument has focused on consolidating the asset

portfolio by spinning off the Mengapur base metal project and

placing the Tuckanarra Gold Project into a joint venture. The

restructured gold focused portfolio provides potential catalysts

for re-rating the share price going forward into fiscal 2022 and

beyond for our shareholders.

“For the same reason, as of June 30, 2021, we

established a solid financial position with $38.62 million in cash

and cash equivalents on hand. The strengthened cash reserves allow

us to support and implement the corporate value creation

strategies, especially to fund the Selinsing gold treatment plant

expansion and exploration of Murchison. Monument is open to all

corporate development opportunities to optimize our future growth

and shareholders value moving forward”.

Ms. Zhai further commented: “With the continued

challenges from the global Covid-19 pandemic that caused more than

six weeks mine shut down during the year, Selinsing Gold

Mine produced positive cash flow in 2021 from mining

super-low grade ore, leachable sulphide ore and Peranggih

materials, which has brought our aggregated Selinsing Gold Mine

production to 325,509 ounces at an average cost of $535 per ounce

with gross revenue of $452.1 million, gross margin of $279.3

million and net cash from production of $275 million. Looking

forward, our management team will continue to work hard with the

“Can Do” attitude and the philosophy of “being a doer” in

delivering our commitment to our shareholders.”

Fiscal 2021 Highlights:

- Restructured assets to a gold

focused portfolio by spinning out Mengapur copper and iron

project;

- Two staged Selinsing gold plant

conversion with the flotation plant construction commenced and

fully funded;

- Murchison Project exploration

strategized to test potential gold discovery and upside;

- Tuckanarra Joint ventured with

Odyssey fast tracking exploration and development;

- Selinsing Gold Mine continued with

leachable sulphide ore production transitioning to new life of

mine

Fourth Quarter and Fiscal 2021

Production and Financial Highlights

|

|

Three months ended June 30, |

Year ended June 30, |

|

|

2021 |

2020 |

2021 |

2020 |

| Production |

|

|

|

|

| Ore mined (tonnes) |

72,074 |

42,331 |

427,528 |

263,074 |

| Waste removed (tonnes) |

687,255 |

463,228 |

3,639,490 |

2,887,441 |

| Ore processed (tonnes) |

94,940 |

68,961 |

579,569 |

675,708 |

| Average mill feed grade

(g/t) |

0.72 |

1.06 |

0.84 |

1.11 |

| Processing recovery rate

(%) |

64% |

67% |

61% |

71% |

| Gold production (1) (oz) |

1,838 |

2,311 |

10,282 |

17,360 |

| Gold sold (oz) |

3,473 |

3,282 |

12,850 |

19,401 |

| |

|

|

|

|

| Financial (in thousands of US

dollars) |

$ |

$ |

$ |

$ |

| Revenue |

6,085 |

5,404 |

23,236 |

29,971 |

| Gross margin from mining

operations |

1,270 |

2,652 |

8,103 |

12,944 |

| Net income before other

items |

(1,009) |

704 |

1,696 |

4,509 |

| Net loss |

(2,702) |

(1,273) |

(99,318) |

(275) |

| Cash flows generated from

operations |

2,208 |

657 |

1,654 |

6,273 |

| Working capital |

48,539 |

18,786 |

48,539 |

18,786 |

| |

|

|

|

|

| Loss per share before other

items – basic (US$/share) |

(0.00) |

0.00 |

0.01 |

0.01 |

| Loss per share – basic

(US$/share) |

(0.01) |

(0.00) |

(0.31) |

(0.00) |

|

|

|

|

|

|

|

|

Three months ended June 30, |

Year ended June 30, |

|

|

2021 |

2020 |

2021 |

2020 |

| |

|

|

|

|

| Other |

US$/oz |

US$/oz |

US$/oz |

US$/oz |

| Average realized gold price

per ounce sold (2) |

1,812 |

1,684 |

1,864 |

1,563 |

| |

|

|

|

|

| Cash cost per ounce (3) |

|

|

|

|

|

Mining |

496 |

233 |

397 |

223 |

|

Processing |

711 |

454 |

602 |

507 |

|

Royalties |

167 |

143 |

169 |

136 |

|

Operations, net of silver recovery |

12 |

8 |

10 |

12 |

| Total cash cost per

ounce |

1,386 |

838 |

1,178 |

878 |

| All-in sustaining costs per

ounce (4) |

|

|

|

|

|

By-product silver recovery |

1 |

1 |

1 |

1 |

|

Operation expenses |

119 |

179 |

46 |

40 |

|

Corporate expenses |

3 |

6 |

6 |

6 |

|

Accretion of asset retirement obligation |

9 |

12 |

10 |

9 |

|

Exploration and evaluation expenditures |

25 |

45 |

22 |

32 |

|

Sustaining capital expenditures |

104 |

174 |

162 |

171 |

|

Total all-in sustaining cost per ounce |

1,647 |

1,255 |

1,425 |

1,136 |

|

(1) |

Defined as good delivery gold bullion according to London Bullion

Market Association (“LBMA”), net of gold doŕe in transit and

refinery adjustment. |

| (2) |

Exclude gold prepaid delivery for

comparison purposes. |

| (3) |

Total cash cost includes

production costs such as mining, processing, tailing facility

maintenance and camp administration, royalties, and operating costs

such as storage, temporary mine production closure, community

development cost and property fees, net of by-product credits. Cash

cost excludes amortization, depletion, accretion expenses, capital

costs, exploration costs and corporate administration costs. |

| (4) |

All-in sustaining cost per ounce

includes total cash costs, operation expenses, and adds sustaining

capital expenditures, corporate administrative expenses for the

Selinsing Gold Mine including share-based compensation, exploration

and evaluation costs, and accretion of asset retirement

obligations. Certain other cash expenditures, including tax

payments and acquisition costs, are not included. |

| |

|

2021 Gold Production

Production Analysis

- Gold production

of 10,282oz, a 41% decrease as compared to 17,360oz of the previous

year. Gold production for the year ended June 30, 2021 was mainly

from transitional leachable sulphide ore from Selinsing Pit 4 &

Pit 5, oxide ore from Peranggih and old tailings materials. This

resulted in lower mill feed grades and lower recovery rates.

- 2021 mining

activities delivered 427,528 tonnes of ore from Selinsing (259,459

tonnes), Buffalo Reef (27,642 tonnes), Felda (13,022 tonnes) and

Peranggih (127,405 tonnes). Mining costs for Peranggih were

recorded against inventories for 127,405 tonnes during the year, of

which 118,688 tonnes were fed into the mill.

- Ore processed

decreased to 579,569 tonnes from 675,708 tonnes last year. The

decreased was due to the lack of availability of stockpiled ore.

Ore stockpile has significantly reduced mainly due to the adverse

impact of the shortage of explosive supplies in the first quarter

resulting in a lower mining rate. COVID-19 pandemic has not helped

in achieving the target. The Company has devoted its effort to

improve the stockpile balance.

- Total production

costs $15.13 million as compared to $17.03 million of last year.

Cash cost per ounce increased by 34% to $1,178/oz as compared to

$878/oz of last year. The increase was attributable to a 24%

decrease in the mill feed grade from 1.11g/t to 0.84g/t and a

decrease in recovery to 60.8% (2020: 70.9%) as a result of

processing significantly more leachable sulphide ore and other low

recovery ores.

Financial Analysis

- Gold sales

generated revenue of $23.24 million for the year as compared to

$29.97 million from last year. Gold sales revenue was derived from

the sale of 10,700oz (2020: 16,750oz) of gold at an average

realized gold price of $1,864 per ounce (2020: $1,563 per ounce)

and the delivery of 2,150oz (2020: 2,651oz) in fulfilling gold

prepaid obligations at an average London Fix PM gold price of

$1,525 per ounce (2020: $1,429 per ounce).

- Mining

operations before non-cash amortization and depreciation generated

a gross margin of $8.10 million, a decrease of 37% from $12.94

million from the previous year. The decrease in gross margin was

attributable to the decrease in gold sold offsite by a higher

average realized gold price.

- Cash and cash

equivalents balance as at June 30, 2021 was $38.62 million, an

increase of $28.50 million from the balance at June 30, 2020 of

$10.13 million. As at June 30, 2021, the Company had positive

working capital $48.54 million (June 30, 2020: $18.79 million). The

increase in working capital was mainly due to the increase in cash

and cash equivalents.

- Cashflow from

investing activities for the year was $26.87 million (2020: outflow

of $5.47 million), which was mainly from the sale of the Mengapur

project of $29.16 million and the sale of 80% interest in

Tuckanarra project of $2.66 million.

Development

Selinsing Gold Mine

This year the Company commenced to develop the

Selinsing Sulphide Project into production through a two stages

de-risking process in order to reduce the initial upfront

investment required. Stage 1 is the construction of a flotation

plant aimed to produce saleable gold concentrates and stage 2 is

the construction of a BIOX ® leaching plant to treat third party

concentrates should a niche market be successfully established.

Selinsing Flotation construction will take

approximately 15 months to be completed for an estimated $20

million, including flotation plant optimization and engineering,

procurement, construction and commissioning, and securing off-take

agreements. Flotation test work was completed at the Selinsing

on-site lab to determine the optimum concentrate gold grade and

recovery for maximizing revenue. The positive results were

independently tested at Bureau Veritas Laboratory under Orway

Mineral Consultant’s (“OMC”) supervision.

OMC completed the process plant design in June

2021, and submitted the flotation process engineering design

including the process design criteria, major equipment summary,

flowsheet, mass balance and consumables estimates, as a

modification to the flotation conceptual engineering design that

reported in the Snowden feasibility study in February 2019. The new

set of design criteria would allow Selinsing to produce gold

concentrates as a final product for sale.

Further development work was carried out

including: an underground mining desktop study, Tailings Storage

Facility development, and mining cutback and test work for oxide

mining assessment at Peranggih in order to sustain Selinsing gold

production.

Murchison Gold Project

At Murchison development work took place to

re-assess early production opportunity. The mine plan was completed

by management and the independent review conducted by SRK, which

covered geotechnics, hydrology and environmental compliance in

addition to resource modelling, mining optimization and scheduling,

and metallurgical recoveries. The follow up work has been

recommended and considered by the Company. As a part of the value

creation strategies, the Company has taken direction to focus on

regional exploration to test potential for larger gold production

at Murchison pending on new gold discoveries. The geological study

has been conducted to further identify and optimize regional

exploration targets. Geological data has been further investigated

and integrated to the database. As a result, the phase one

exploration program was commenced subsequent to the end of the year

in July 2021.

Major Transactions

Tuckanarra Joint Venture (“JV”)

In October 2020 Monument entered into a JV

arrangement with Odyssey Gold Ltd. (“Odyssey”) to advance the

Tuckanarra Gold Project, and in December 2020 sold an 80% interest

in Tuckanarra to Odyssey for AUD$5 million subject to certain

conditions, leaving Monument with a 20% free carried interest and a

1% NSR royalty over Odyssey’s 80% interest in the property. Odyssey

will be solely responsible for funding the exploration and

evaluation activities at Tuckanarra until a decision to mine is

reached. The future processing of ore from tenements held by

Odyssey through the Burnakura plant remains an option should

commercial terms be reached.

Mengapur Copper-Iron Project Divestment

Monument closed a transaction with Fortress

Minerals in April 2021 to sell 100% interest in the Mengapur Copper

and Iron Project. The sale is part of the Company’s corporate

restructuring to focus on the development of the gold portfolios in

both Malaysia and Western Australia. Monument sold Mengapur Copper

and Iron Project for US$30,000,000 in cash, and will also receive a

1.25% gross revenue royalty on all products produced at the

Mengapur Project.

Exploration

Malaysia

A Reverse Circulation (RC) drilling program was

completed at Selinsing which consisted of 1,128m over 19 holes at

Pits 4, 5, and 6. A total of 1,335 including 225 QAQC samples were

assayed. The drill program aimed to identify and define

mineralization areas with average grades that can be immediately

mined economically in the current CIL plant. The main drilling

target was the shallow dipping structure extension close to the

east flank of the pits. The drilling program resulted with several

significant intercepts.

An RC drill program was undertaken at Peranggih

to upgrade the grade and ounces of mineralized material based on

previous close spaced drilling results. The first phase was

completed in April 2021 with 1,697m drilled over 34 holes. The

second phase drilling includes completing 420m over 9 holes and

additional drilling progressed at year end. Drill assays received

from the Selinsing Mine lab showed moderate to high grade

interceptions. RC drilling costs were recorded under Exploration

and Evaluation assets.

Western Australia

In fiscal 2021, Monument announced the results

of the drilling program carried out from February to May 2020,

which confirmed the continuity of gold mineralization within

identified structures and favorable lithology from existing mineral

resources. The Company decided to begin regional exploration

potential assessment and commenced work on a 2-year exploration

strategy designed to test beneath cover for potential

mineralization that is aimed to lead to the discovery of shallow

stand alone or satellite gold deposits, aiming to add significant

additional resources to the current resource base. The strategy

will involve testing down dip of high-grade mineralization

underneath existing pits as well as test some of the high priority

regional targets through Greenfield exploration of the land package

at Burnakura and Gabanintha. Field work permitting activities have

continued with ground preparation activities during the fourth

quarter, and the first stage of drilling started, subsequent to the

end of the year.

About Monument

Monument Mining Limited (TSX-V: MMY, FSE:D7Q1)

is an established Canadian gold producer that owns and operates the

Selinsing Gold Mine in Malaysia. Its experienced management team is

committed to growth and is also advancing the Murchison Gold

Projects comprising Burnakura, Gabanintha and Tuckanarra JV (20%

interest) in the Murchison area of Western Australia. The Company

employs approximately 200 people in both regions and is committed

to the highest standards of environmental management, social

responsibility, and health and safety for its employees and

neighboring communities.

Cathy Zhai, President and CEOMonument Mining

LimitedSuite 1580 -1100 Melville StreetVancouver, BC V6E 4A6

FOR FURTHER INFORMATION visit the company web

site at www.monumentmining.com or contact:

| Richard

Cushing, MMY Vancouver |

T:

+1-604-638-1661 x102 |

rcushing@monumentmining.com |

"Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release."

Forward-Looking Statement

This news release includes statements containing

forward-looking information about Monument, its business and future

plans (“forward-looking statements”). Forward-looking statements

are statements that involve expectations, plans, objectives or

future events that are not historical facts and include the

Company’s plans with respect to its mineral projects and the timing

and results of proposed programs and events referred to in this

news release. Generally, forward-looking information can be

identified by the use of forward-looking terminology such as

"plans", "expects" or "does not expect", "is expected", "budget",

"scheduled", "estimates", "forecasts", "intends", "anticipates" or

"does not anticipate", or "believes", or variations of such words

and phrases or state that certain actions, events or results "may",

"could", "would", "might" or "will be taken", "occur" or "be

achieved". The forward-looking statements in this news release are

subject to various risks, uncertainties and other factors that

could cause actual results or achievements to differ materially

from those expressed or implied by the forward-looking statements.

These risks and certain other factors include, without limitation:

risks related to general business, economic, competitive,

geopolitical and social uncertainties; uncertainties regarding the

results of current exploration activities; uncertainties in the

progress and timing of development activities; foreign operations

risks, including risks related to changes in mining license rights,

tax rates and government royalty requirements; other risks inherent

in the mining industry and other risks described in the management

discussion and analysis of the Company and the technical reports on

the Company’s projects, all of which are available under the

profile of the Company on SEDAR at www.sedar.com. Material factors

and assumptions used to develop forward-looking statements in this

news release include: expectations regarding the estimated cash

cost per ounce of gold production and the estimated cash flows

which may be generated from the operations, general economic

factors and other factors that may be beyond the control of

Monument; assumptions and expectations regarding the results of

exploration on the Company’s projects; assumptions regarding the

future price of gold of other minerals; the timing and amount of

estimated future production; the expected timing and results of

development and exploration activities; costs of future activities;

capital and operating expenditures; success of exploration

activities; mining or processing issues; exchange rates; expected

mining rights, tax rates, and government royalty requirements in

the jurisdictions in which the Company operates; and all of the

factors and assumptions described in the management discussion and

analysis of the Company and the technical reports on the Company’s

projects, all of which are available under the profile of the

Company on SEDAR at www.sedar.com. Although the Company has

attempted to identify important factors that could cause actual

results to differ materially from those contained in

forward-looking statements, there may be other factors that cause

results not to be as anticipated, estimated or intended. There can

be no assurance that such statements will prove to be accurate, as

actual results and future events could differ materially from those

anticipated in such statements. Accordingly, readers should not

place undue reliance on forward-looking statements. The Company

does not undertake to update any forward-looking statements, except

in accordance with applicable securities laws.

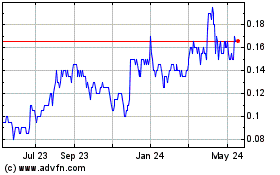

Monument Mining (TSXV:MMY)

Historical Stock Chart

From Nov 2024 to Dec 2024

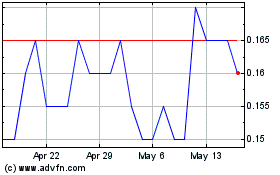

Monument Mining (TSXV:MMY)

Historical Stock Chart

From Dec 2023 to Dec 2024