Monument Mining Limited (TSX-V: MMY and FSE: D7Q1) “Monument” or

the “Company” today announced its first quarter of fiscal 2022

production and financial results for the three months ended

September 30, 2021. All amounts are expressed in United States

dollars (“US$”) unless otherwise indicated (refer to www.sedar.com

for full financial results).

President and CEO Cathy Zhai commented, “2022

fiscal year is full of challenge and would be rewarding for

Monument when the Company stays focused on execution of the

corporate strategies. During the quarter, the Selinsing flotation

plant construction was kicked off with engineering design near

completion, long lead items procured, and the earthworks at site

reached 90% completion. The Phase 1 drilling at Murchison was

completed by overcoming the shortage of drill rigs. Peranggih

continued to provide additional mill feed that helped to sustain

the cash flow. The Delays in gold production is anticipated to be

caught up after the monsoon season in the third quarter.”

First Quarter Highlights:

- Phase one drilling program completed in Q1 at Murchison Project

with 91% assay results received to date;

- Phase 1&2 RC drilling program completed at Peranggih Gold

Prospect in Q1 with positive intercept results;

- Selinsing Flotation Plant Project progressing on time in Q1

with 31% completion to date;

- Long lead item contracts awarded to reputable suppliers for

Selinsing Flotation Plant Project;

- Selinsing Gold Mine production recovered gradually after the

mining ban lifted due to Covid 19 Pandemic;

- 1,423 ounces (“oz”) of gold sold for $2.38 million (Q1, FY

2021: 3,100oz for $5.92 million);

- Average quarterly gold price realized at $1,829/oz (Q1, FY2021:

$1,909/oz);

- Cash cost per ounce sold was $1,430/oz (Q1, FY2021:

$923/oz);

- Gross margin decreased by 88% to $0.35 million (Q1, FY2021:

$3.06 million);

- 1,043oz of gold produced (Q1, FY2021: 3,504oz);

- All-in sustaining cost (“AISC”) increased to $2,052/oz (Q1,

FY2021: $1,055/oz).

First Quarter Production and Financial

Highlights

|

|

|

Three months ended September 30, |

|

|

|

|

2021 |

|

2020 |

|

|

Production |

|

|

|

|

|

Ore mined (t*) |

|

|

74,972 |

|

81,576 |

|

|

Ore processed (t) |

|

|

156,611 |

|

166,432 |

|

|

Average mill feed grade (g/t*) |

|

|

0.54 |

|

0.98 |

|

|

Processing recovery rate (%) |

|

|

65.0 |

% |

63.6 |

% |

|

Gold recovery (oz) |

|

|

1,777 |

|

3,343 |

|

|

Gold production (1) (oz) |

|

|

1,043 |

|

3,504 |

|

|

Gold sold (oz) |

|

|

1,423 |

|

3,100 |

|

|

|

|

|

|

|

|

Financial (expressed in thousands of US$) |

|

|

$ |

|

$ |

|

|

Revenue |

|

|

2,383 |

|

5,919 |

|

|

Gross margin from mining operations |

|

|

348 |

|

3,059 |

|

|

Income (loss) before other items |

|

|

(755 |

) |

1,943 |

|

|

Net income (loss) |

|

|

(1,267 |

) |

138 |

|

|

Cash flows provided from operations |

|

|

23 |

|

747 |

|

|

Working capital |

|

|

44,532 |

|

18,482 |

|

|

Earnings (loss) per share - basic and diluted (US$/share) |

|

|

(0.00 |

) |

0.00 |

|

|

*grams/tonne (“g/t”); tonnes (“t”) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended September 30, |

|

|

|

|

2021 |

|

2020 |

|

|

|

|

|

|

|

|

Other |

|

|

US$/oz |

|

US$/oz |

|

|

Average realized gold price per ounce sold(2) |

|

|

1,829 |

|

1,909 |

|

|

|

|

|

|

|

|

Cash cost per ounce (3) |

|

|

|

|

|

Mining |

|

|

522 |

|

274 |

|

|

Processing |

|

|

720 |

|

481 |

|

|

Royalties |

|

|

168 |

|

163 |

|

|

Operations, net of silver recovery |

|

|

20 |

|

5 |

|

|

Total cash cost per ounce |

|

|

1,430 |

|

923 |

|

|

All-in sustaining costs per ounce (4) |

|

|

|

|

|

By-product silver recovery |

|

|

1 |

|

1 |

|

|

Operation expenses |

|

|

34 |

|

9 |

|

|

Corporate expenses |

|

|

4 |

|

9 |

|

|

Accretion of asset retirement obligation |

|

|

22 |

|

11 |

|

|

Exploration and evaluation expenditures |

|

|

11 |

|

10 |

|

|

Sustaining capital expenditures |

|

|

551 |

|

92 |

|

|

Total all-in sustaining costs per ounce |

|

|

2,052 |

|

1,055 |

|

|

(1) |

|

Defined as good delivery gold bullion according to London Bullion

Market Association (“LBMA”), net of gold doŕe in transit and

refinery adjustment. |

|

(2) |

|

Monument realized 1,829US$/oz for the three months ended September

30, 2021 which excludes gold prepaid delivered of 723oz for

comparison purposes. |

|

(3) |

|

Total cash cost per ounce includes production costs such as mining,

processing, tailing facility maintenance and camp administration,

royalties and operating costs such as storage, temporary mine

production closure, community development cost and property fees,

net of by-product credits. Cash cost excludes amortization,

depletion, accretion expenses, idle production costs, capital

costs, exploration costs and corporate administration costs.

Readers should refer to section 15 “Non-GAAP Performance

Measures”. |

|

(4) |

|

All-in sustaining cost per ounce includes total cash costs and adds

sustaining capital expenditures, corporate administrative expenses

for the Selinsing Gold Mine including share-based compensation,

exploration and evaluation costs, and accretion of asset retirement

obligations. Certain other cash expenditures, including tax

payments and acquisition costs, are not included. Readers should

refer to section 15 “Non-GAAP Performance Measures”. |

|

|

|

|

Q1 2022 Production Analysis

- Q1 2022 gold

production was 1,043oz, a 70% decrease as compared to 3,504oz for

Q1 2021. The decrease mainly resulted from a large quantity of

super low-grade ore being fed into the mill although gold recovery

was slightly higher.

- Q1 2022 ore

processed decreased to 156,611t from 166,432t for Q1 2021. The

decreased mill feed was mainly due to less leachable sulphide ore

and old tailings being fed into plant.

- Average mill

feed grade was 0.54g/t Au as compared to 0.98g/t Au of Q1 2021. Q1

2022 processing recovery rate increased to 65.0% from 63.6% for Q1

2021. The slight increase in processing recovery rate was mainly

due to significant increase in Peranggih oxide materials being

processed.

- Q1 2022 cash

cost per ounce increased by 55% to $1,430/oz from $923/oz for Q1

2021. This increase was primarily due to a significant reduction in

the mill feed grade from 0.98g/t Au to 0.54g/t Au and significantly

more low-grade leachable sulphide ore and low-grade Peranggih

materials being processed.

- Ore stockpile

has reduced mainly due to adverse impact from the delay in blast

permit issuance, rainfall in the first quarter and shortage of

explosive supplies resulting in a lower mining rate that has yet to

return to normal. The covid-19 pandemic has not helped in achieving

the target. The Company has devoted its effort to improve the

stockpile balance.

Q1 2022 Financial Analysis

- Q1 2022 gold

sales generated revenue was $2.38 million as compared to

$5.92million from Q1 2021. Gold sales revenue was derived from the

sale of 1,423oz (Q1 2021: 3,100oz) of gold at an average realized

gold price of $1,829 per ounce (Q1 2021: $1,909 per ounce) and the

delivery of 723 oz (Q1 2021: 723 oz at $1,625 per ounce gold

equivalent) in fulfilling gold prepaid obligations.

- Q1 2022 total

production costs decreased by 29% to $2.04 million as compared to

$2.86 million from Q1 2021. Cash cost per ounce increased by 55% to

$1,430/oz as compared to $923/oz of the same period last year. The

increase was attributable to a 45% decrease in the mill feed grade

from 0.98g/t to 0.54g/t but an increase in recovery to 65.0% (Q1

2021: 63.6%) as a result of processing significantly more leachable

sulphide ore and other low grade ores.

- Gross margin for

Q1 2022 was $0.35 million before operation expenses and non-cash

amortization and accretion. That represented an 89% decrease as

compared to $3.06 million from Q1 2021. The decrease in gross

margin was attributable to significant lower-grade of ore fed, much

lower volume of gold sold, and increased cash costs.

- Net loss for Q1

2022 was $1.26 million, or ($0.00) per share as compared to net

income of $0.14 million or $0.00 per share from Q1 2021. The net

loss was mainly caused by lower operating margins.

- Cash and cash

equivalents balance as at September 30, 2021 was $35.57 million, a

decrease of $3.05 million from the balance at June 30, 2021 of

$38.62 million. As at September 30, 2021, the Company had positive

working capital of $44.53 million as compared to that at June 30,

2021 of $48.54 million.

Development

Selinsing Gold Mine

At Selinsing the engineering, procurement,

construction and project management (EPCM) progress has reached 31%

completion for the flotation plant construction and mine

development. 80% of the flotation design work was completed during

the first quarter. Civil and structural drawings were completed

subsequent to the quarter, and mechanical and piping drawings will

be issued for construction by November 2021. All major contracts

for long lead items were awarded to suppliers and 90% of the major

equipment has been procured at the end of the quarter. Procurement

for construction contractors are short listed and tender documents

have been distributed.

Flotation construction includes earthworks,

civil engineering, structural engineering, mechanical and

electrical installation and other associated plant upgrades.

Earthworks were initiated in April 2021 and are 90% completed to

date. Civil foundation work is scheduled to start in January 2022

and expected to be completed by the end of April 2022.

The flotation pilot plant has been assembled and

is successfully running at SGMM research and development

laboratory. The pilot plant features a ball mill and classifier,

rougher/scavenger flotation cells and three stages of cleaner

flotation to replicate the flowsheet of the full-scale flotation

plant. The pilot plant will be used for operator training, reagent

trials, and for the preparation of concentrate samples for

potential customers.

The Tailing Storage Facility (“TSF”) is under

expansion to accommodate the new mine life. The construction to

raise the current TSF to 540m RL continued during the quarter and

is expected to be completed by March 1, 2022

Murchison Gold Project

Murchison Project development is put on hold.

The existing processing plant is under care and maintenance and in

good condition. It is ready for start-up production with

installation of the refurbished plant.

Exploration Progress

Malaysia

At Peranggih the reverse circulation (“RC”)

drilling campaign covering areas of Peranggih Central and South for

3,317m over 68 RC holes was initiated last fiscal year and was

completed during the first quarter of fiscal 2022. It was done in

two phases: Phase 1 was 34 drill holes for 1,697m and Phase 2 was

34 holes for 1,620m. All assay results for the 3,901 samples were

received for analysis up to date, including assay results for 1,681

samples during the quarter ended September 30, 2021. The RC

drilling is down 70m deep with space of 20m by 20m following

steeply dipping high-grade mineralized structure. Overall, 70% of

the designed holes hit gold mineralization above an oxide cut-off

(>0.35 g/t Au Au) at relatively shallow depth, 50m below the

surface. The results defined wider lower grade mineralization over

an 830m long by 60m wide zone.

Western Australia

Fiscal year 2022 started with regional

exploration at Murchison Gold Project. A 2-year exploration program

and associated periodical rolling budget has been implemented to

potentially add significant amount of additional resources to the

current resource base. The aim is to establish Murchison as the

company’s cornerstone gold project should the Murchison Project be

potentially developed into a gold producing mine.

The Phase 1 drill program commenced on July 4th

2021 and was completed on August 21st 2021 at Burnakura. A total of

3,465m for 46 RC holes was finished for the Munro Bore Extension as

well as the FLC2 and FLC3 prospects and a total of 10,484m for 349

aircore (“AC”) holes was completed with a focus on high quality

structural targets including the Junction exploration target. A

combined total of over 6,000 RC and AC samples were sent to ALS

Geochemistry, Perth for analysis, of which 91% have been received

up to November 2021, subsequent to the first quarter. The results

will be announced as soon as the data is fully received and has

been interpreted.

About Monument

Monument Mining Limited (TSX-V: MMY, FSE:D7Q1)

is an established Canadian gold producer that owns and operates the

Selinsing Gold Mine in Malaysia. Its experienced management team is

committed to growth and is also advancing the Murchison Gold

Projects comprising Burnakura, Gabanintha and Tuckanarra JV (20%

interest) in the Murchison area of Western Australia. The Company

employs approximately 200 people in both regions and is committed

to the highest standards of environmental management, social

responsibility, and health and safety for its employees and

neighboring communities.

Cathy Zhai, President and CEOMonument Mining

LimitedSuite 1580 -1100 Melville

Street Vancouver, BC V6E

4A6

FOR FURTHER INFORMATION visit the company web

site at www.monumentmining.com or contact:

Richard Cushing, MMY Vancouver T:

+1-604-638-1661 x102 rcushing@monumentmining.com

"Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release."

Forward-Looking Statement

This news release includes statements containing

forward-looking information about Monument, its business and future

plans ("forward-looking statements"). Forward-looking statements

are statements that involve expectations, plans, objectives or

future events that are not historical facts and include the

Company's plans with respect to its mineral projects and the timing

and results of proposed programs and events referred to in this

news release. Generally, forward-looking information can be

identified by the use of forward-looking terminology such as

"plans", "expects" or "does not expect", "is expected", "budget",

"scheduled", "estimates", "forecasts", "intends", "anticipates" or

"does not anticipate", or "believes", or variations of such words

and phrases or state that certain actions, events or results "may",

"could", "would", "might" or "will be taken", "occur" or "be

achieved". The forward-looking statements in this news release are

subject to various risks, uncertainties and other factors that

could cause actual results or achievements to differ materially

from those expressed or implied by the forward-looking statements.

These risks and certain other factors include, without limitation:

risks related to general business, economic, competitive,

geopolitical and social uncertainties; uncertainties regarding the

results of current exploration activities; uncertainties in the

progress and timing of development activities; foreign operations

risks; other risks inherent in the mining industry and other risks

described in the management discussion and analysis of the Company

and the technical reports on the Company's projects, all of which

are available under the profile of the Company on SEDAR at

www.sedar.com. Material factors and assumptions used to develop

forward-looking statements in this news release include:

expectations regarding the estimated cash cost per ounce of gold

production and the estimated cash flows which may be generated from

the operations, general economic factors and other factors that may

be beyond the control of Monument; assumptions and expectations

regarding the results of exploration on the Company's projects;

assumptions regarding the future price of gold of other minerals;

the timing and amount of estimated future production; the expected

timing and results of development and exploration activities; costs

of future activities; capital and operating expenditures; success

of exploration activities; mining or processing issues; exchange

rates; and all of the factors and assumptions described in the

management discussion and analysis of the Company and the technical

reports on the Company's projects, all of which are available under

the profile of the Company on SEDAR at www.sedar.com. Although the

Company has attempted to identify important factors that could

cause actual results to differ materially from those contained in

forward-looking statements, there may be other factors that cause

results not to be as anticipated, estimated or intended. There can

be no assurance that such statements will prove to be accurate, as

actual results and future events could differ materially from those

anticipated in such statements. Accordingly, readers should not

place undue reliance on forward-looking statements. The Company

does not undertake to update any forward-looking statements, except

in accordance with applicable securities laws.

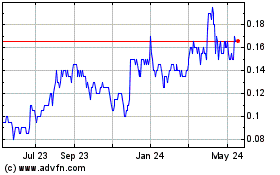

Monument Mining (TSXV:MMY)

Historical Stock Chart

From Nov 2024 to Dec 2024

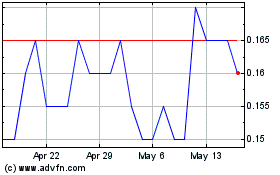

Monument Mining (TSXV:MMY)

Historical Stock Chart

From Dec 2023 to Dec 2024