MiniLuxe Holding Corp. (TSXV: MNLX) today announced its financial

results for the 13 weeks ended July 2, 2023 (“Q2 2023”) and the 26

weeks ended July 2, 2023 (“H1 2023”). The fiscal year of MiniLuxe

is a 52-week reporting cycle ending on the Sunday closest to

December 31, which periodically necessitates a fiscal year of 53

weeks. FY2022 consisted of a 53-week period while all other fiscal

years referred to in this release consist of 52-week periods. All

quarters referred to in this release consist of 13-week periods.

Unless otherwise specified, all amounts are reported in U.S.

dollars.

MiniLuxe is pleased to announce continued

double-digit growth in year-over-year (“YOY”) revenue as the team

continues to drive the business towards cashflow positive

operations. Entering 2023, MiniLuxe built a strategy in its first

full post-Covid year to leverage its core studio business (fleet of

company-owned MiniLuxe locations) and its continued positive

contribution while identifying and testing opportunities for

diversification of revenue across new growth channels.

Strength in the core studio base

businessSimilar to previous periods, MiniLuxe continued

its trend of double-digit growth in Q2 2023 as total company

revenue increased 16% over Q2 2022 to $6.4M (all figures in US

dollars). The continued growth reflects well vs. pre-pandemic

(2019) comparatives as revenue increased 23% on a same-studio basis

vs. Q2 2019. Q2 2023 gross profit increased 9% over Q2 2022 to

$2.7M. As in past periods, the majority of this growth came

organically from the studio base business as did the gross profit.

The Company views gross profit dollar growth as a key indicator of

MiniLuxe’s positive trajectory towards long-term profitability. Key

drivers of revenue growth and gross profit growth in the core

studio base came from positive momentum on the demand side (new

customer and loyal customer growth) and supply side (talent

ecosystem growth to deliver service demand).

- New and loyal customer growth:

MiniLuxe continues to see robust growth in new customer count

across the studios with an average new customer rate of ~15%.

MiniLuxe’s loyal customer base remains robust and growing, with

~10,000 studio clients that average over 10 visits per year, a 7%

increase year-over-year. The top 30 percent of these loyal clients

visit MiniLuxe more than 20 times per year and have an average

annual spend of ~$2000.

- Growth in attracting talent: On the

supply side, MiniLuxe’s current and future success comes from the

continued growth, development, and scaling of the MiniLuxe Talent

Ecosystem. Beauty professionals who are part of MiniLuxe’s Talent

Ecosystem are part of a Career Path Program – from Apprentice,

Junior Designer, Studio Designer to Artistic and Expert Designer

Levels. Total beauty professionals across MiniLuxe’s Talent

Ecosystem ended Q2 2023 18% higher than year-end and 27% higher

than Q2 2022. The MiniLuxe studio fleet total staffed hours

grew at double-digit rates vs. Q2 2022 with a focus of staffing on

peak (high traffic) days, leading to similar growth rates in fleet

appointment hours.

Continued progress but greater

selectivity in other new growth channelsWhile new growth

channels demonstrated continued progress, results were more mixed

in terms of the ability to have near-term term impact on

profitability. Outside of the studio base of business for MiniLuxe,

new growth channels include its Anywhere off-premise services as

well as MiniLuxe product revenue through e-commerce and wholesale

channels. Given foreseeable macro-economic headwinds, the MiniLuxe

Board and Management hold the view of prioritizing quality of

revenue over quantity of revenue and are in the process of

realigning resources to more selectively pull-back and / or double

down in each of these growth channels.

MiniLuxe Anywhere Refocus: As previously shared,

MiniLuxe has been exploring strategies to introduce and offer

off-premise services to the self-care marketplace, referred to as

MiniLuxe Anywhere. Throughout the past eighteen months, the Company

has tested and explored multiple formats and opportunities, from

development of a platform for on-demand mobile services, to 1:1

home and office visits, to corporate/events services offerings.

While MiniLuxe Anywhere exhibited some good positive initial

results in its test markets, the Company has narrowed its focus to

“Store-in-Store” channel opportunities and selective events which

have been more profitable and scalable versus delivering in

individual homes and offices. Density of service delivery (i.e.,

where MiniLuxe has more locations and more talent) will be an

important factor on future decisions regarding priority

markets.

MiniLuxe Product Opportunities: Given

industry-wide changes in paid social media, MiniLuxe took a

conservative marketing spend approach to best generate marketing

efficiency and positive e-commerce DTC (direct-to-consumer) growth.

While the base of e-commerce remains modest, Q2 2023 e-commerce

orders grew 63% from Q2 2022 and new customer counts increased 64%

year-over-year with positive marketing-efficiency (i.e., positive

return on spend) give management confidence of product potential.

Hero SKUs – those products that have the highest sales velocity –

remain in the categories of self-care products for hand and

foot-care and seasonal polish colors.

Updates on

M&A and

Paintbox IntegrationM&A

remains an important part of MiniLuxe’s longer term growth plans.

The MiniLuxe management team continues to assess opportunities for

accretive growth via acquisitions. The current macro-economic

environment offers with it more reasonable multiples for targets

for service or product revenue acquisition candidates.

MiniLuxe’s planned growth initiatives for its

Paintbox brand, which was acquired in Fall 2022, continue with

further activities taken over the past several months. As a

reminder, Paintbox, based in New York City and founded in 2014, has

been re-defining the nail-care industry through its proprietary

nail art designs. The two principal areas of focus for Paintbox are

exploring “store-in-store” growth opportunities – which have

included a test of the format in MiniLuxe’s Boston South End

studio. The footprint of less than 200 square feet presents the

opportunity for a capital-light model to scale in the future – with

the largest opportunity being national channel partners.

- Asset-light store-in-store

opportunities: The Company also launched a test for a second

Paintbox “store-in-store” concept in collaboration with a New York

fashion house that explores a model where a MiniLuxe or Paintbox

outpost can serve as a traffic-generating amenity in exchange for

in-kind “rent” and various revenue share models.

- Ready-to-Wear Nail rollout:

MiniLuxe and Paintbox will also partner during New York Fashion

Week (NYFW) this September. Some of the iconic fashion brands that

the brands will partner with include 3.1 Phillip Lim and Tory

Burch, where Paintbox will launch and feature a new product

offering with “Ready-to-Wear Nail Art.” This latest Paintbox

innovation represents the brand’s reinvention of press-on nails -

curated in design and with some of the highest quality fit and

finish qualities in the industry. To provide some perspective,

press-on nails market sales exceeded wet polish sales industry wide

in 2023.

“While the macro-economic environment still

presents challenges, the core studio and its services remain

strong, and we need to continue to compound the cash contribution

from that base business while making the right bets on products,

partnerships and M&A. We’ve seen a greater number of inbound

opportunities that give us confidence on the strength of our brand

in the industry, but most exciting this quarter has been the strong

growth of both new customers and our most loyal customers,” said

Tony Tjan, Executive Chairman and Co-founder of MiniLuxe.

Go-forward focus With 3+

million services completed to date, a growing talent ecosystem of

empowered beauty professionals, and expanded offerings across our

product channels, MiniLuxe is well-positioned to continue building

its market presence and creating long-term shareholder value.

In closing, MiniLuxe’s Board and Executive Team

are focused on delivering a plan to achieve long-term cashflow

generative operations through execution of three key pillars:

(1) Continued compounding of studio economics,

particularly studio contribution, across the core base fleet

business, (2) Realignment of MiniLuxe’s infrastructure and cost

base to focus on key priorities and achieve material fixed cost

leverage in the near term, and (3) Identifying and executing on a

focused set of growth investments that have breakout growth

potential.

As previously mentioned and subsequent to the

end of Q2 2023, MiniLuxe completed an initial reconfiguration of

its overhead, which should yield fixed cost leverage benefits in H2

2023. In addition to these actions, MiniLuxe is in the process of

assessing and executing on further revenue and cost initiatives

with the goal of providing a faster path to cashflow positive

operations. The Company looks forward to sharing further updates

throughout the remainder of the year.

Q2

2023 Financial Highlights

($USD)

- Total revenue of $6.4M, a YoY

increase of 16%

- Gross profit of $2.7M, a 9%

increase from prior year

- Full Company Adjusted EBITDA1 of

($2.2M) compared to ($2.4M) for Q2 2022; decreased loss

attributable to lower SG&A and initial commencement of fixed

cost leverage

- Fleet Adjusted EBITDA1 in line with

prior year ($0.5M)

H1 2023 Financial Highlights

($USD)

- Total revenue of $11.6M, a YoY

increase of 17%

- Gross profit of $4.9M, a 12%

increase from prior year

- Full Company Adjusted EBITDA1 of

($4.8M) compared to ($4.7M) for H1 2022; slightly lower EBITDA than

prior year attributable to lag in SG&A related cost

adjustments

- Fleet Adjusted EBITDA1 in line with

prior year ($0.6M)

Other Items of Note

- During Q2 2023, the Company completed construction and

commenced operations in a new studio location in West Central

Florida, at the Water Street Development in downtown Tampa Bay, FL.

The grand opening of the studio occurred on May 11, 2023, as

MiniLuxe celebrated its 21st studio location opening, the first

since the pandemic.

- During H1 2023, the Company signed a lease to open a new studio

in Dedham, Massachusetts at the Legacy Place Development. The

lessor has not yet made the studio available for use.

Q2 and

H1 2023

Results

Selected Financial Measures

MiniLuxe notes a change in accounting policy to

more accurately reflect revenue generated from talent and product

revenue streams to more align with how management analyzes the

Company. The change has been retrospectively applied and does not

have any effect on revenue recognition principles utilized or total

overall revenue recognized.

| |

Thirteen weeks ended |

YoY Change |

|

|

July 2, |

June 26, |

$ Change |

% Change |

|

|

|

2023 |

|

|

2022 |

|

|

|

|

Talent |

|

6,237,148 |

|

|

5,433,252 |

|

|

803,896 |

|

|

15 |

% |

|

Product |

|

148,130 |

|

|

52,865 |

|

|

95,265 |

|

|

180 |

% |

|

Total Revenue |

|

6,385,278 |

|

|

5,486,117 |

|

|

899,161 |

|

|

16 |

% |

| Gross Profit ($) |

|

2,705,756 |

|

|

2,489,408 |

|

|

216,348 |

|

|

9 |

% |

| Gross Margin (%) |

|

42 |

% |

|

45 |

% |

|

|

| |

|

|

|

|

| |

Twenty-six weeks ended |

YoY Change |

| |

July 2, |

June 26, |

$ Change |

% Change |

| |

|

2023 |

|

|

2022 |

|

|

|

|

Talent |

|

11,333,473 |

|

|

9,775,230 |

|

|

1,558,243 |

|

|

16 |

% |

|

Product |

|

269,778 |

|

|

117,788 |

|

|

151,990 |

|

|

129 |

% |

|

Total Revenue |

|

11,603,251 |

|

|

9,893,018 |

|

|

1,710,233 |

|

|

17 |

% |

| Gross Profit ($) |

|

4,915,173 |

|

|

4,398,657 |

|

|

516,516 |

|

|

12 |

% |

| Gross Margin (%) |

|

42 |

% |

|

44 |

% |

|

|

| |

|

|

|

|

| |

|

|

|

|

| Non-IFRS Metrics |

Thirteen weeks ended |

Twenty-six weeks ended |

| |

July 2, |

June 26, |

July 2, |

June 26, |

| In thousands |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| Adjusted EBITDA |

($ |

2,172 |

) |

($ |

2,449 |

) |

($ |

4,803 |

) |

($ |

4,732 |

) |

| Fleet Adjusted EBITDA |

$ |

468 |

|

$ |

510 |

|

$ |

585 |

|

$ |

575 |

|

Results of Operations

The following table outlines the consolidated

statements of loss and comprehensive loss for the fiscal quarters

ended July 2, 2023, and June 26, 2022:

| |

Thirteen weeks ended |

|

Twenty-six weeks ended |

| |

July 2, |

June 26, |

|

July 2, |

June 26, |

| |

|

2023 |

|

|

2022 |

|

|

|

2023 |

|

|

2022 |

|

|

Revenue |

$ |

6,385,278 |

|

$ |

5,486,117 |

|

|

$ |

11,603,251 |

|

$ |

9,893,018 |

|

|

Cost of sales |

|

3,679,522 |

|

|

2,996,709 |

|

|

|

6,688,078 |

|

|

5,494,361 |

|

|

Gross profit |

|

2,705,756 |

|

|

2,489,408 |

|

|

|

4,915,173 |

|

|

4,398,657 |

|

| General and administrative

expense |

|

4,395,229 |

|

|

4,373,114 |

|

|

|

8,776,434 |

|

|

8,019,734 |

|

| Depreciation and amortization

expense |

|

872,100 |

|

|

727,659 |

|

|

|

1,701,884 |

|

|

1,491,027 |

|

|

Operating loss |

|

(2,561,573 |

) |

|

(2,611,365 |

) |

|

|

(5,563,145 |

) |

|

(5,112,104 |

) |

|

Finance costs |

|

(340,231 |

) |

|

(336,802 |

) |

|

|

(677,242 |

) |

|

(685,707 |

) |

|

Other income |

|

6,680 |

|

|

3,248 |

|

|

|

3,166,240 |

|

|

167,470 |

|

|

Unrealized loss |

|

(51,170 |

) |

|

- |

|

|

|

(51,170 |

) |

|

- |

|

|

Income (loss) before taxes |

|

(2,946,294 |

) |

|

(2,944,919 |

) |

|

|

(3,125,317 |

) |

|

(5,630,341 |

) |

| Income tax expenses |

|

(23,501 |

) |

|

(17,492 |

) |

|

|

(35,711 |

) |

|

(42,011 |

) |

| Net and comprehensive

income (loss) |

$ |

(2,969,795 |

) |

$ |

(2,962,411 |

) |

|

$ |

(3,161,028 |

) |

$ |

(5,672,352 |

) |

| |

|

|

|

|

|

|

Earnings per share |

|

|

|

|

|

|

Subordinate voting shares (basic) |

|

(0.02 |

) |

|

(0.02 |

) |

|

|

(0.02 |

) |

|

(0.04 |

) |

|

Proportionate voting shares (basic) |

|

(20.19 |

) |

|

(20.29 |

) |

|

|

(21.49 |

) |

|

(38.84 |

) |

|

Subordinate voting shares (diluted) |

|

(0.02 |

) |

|

(0.02 |

) |

|

|

(0.02 |

) |

|

(0.04 |

) |

|

Proportionate voting shares (diluted) |

|

(20.19 |

) |

|

(20.29 |

) |

|

|

(21.49 |

) |

|

(38.84 |

) |

Cash Flows

The following table presents cash and cash

equivalents as at July 2, 2023 and June 26, 2022:

| |

Twenty-six weeks ended |

|

|

July 2, |

June 26, |

|

|

|

2023 |

|

|

2022 |

|

| Cash, cash equivalents and

restricted cash, beginning of period |

$ |

8,343,375 |

|

$ |

19,120,111 |

|

|

Net cash provided by (used in): |

|

|

|

Operating activities |

|

(1,291,397 |

) |

|

(4,405,761 |

) |

|

Investing activities |

|

(1,254,475 |

) |

|

(423,451 |

) |

|

Financing activities |

|

(943,599 |

) |

|

(772,608 |

) |

|

Net decrease in cash and cash equivalents |

|

(3,489,471 |

) |

|

(5,601,820 |

) |

| Cash, cash equivalents and

restricted cash, end of period |

$ |

4,853,904 |

|

$ |

13,518,291 |

|

Non-IFRS Measures and Reconciliation of

Non-IFRS Measures

This press release references certain non-IFRS

measures used by management. These measures are not recognized

under International Financial Reporting Standards (“IFRS”), do not

have a standardized meaning prescribed by IFRS, and are therefore

unlikely to be comparable to similar measures presented by other

companies. Rather, these measures are provided as additional

information to complement those IFRS measures by providing further

understanding of the Company’s results of operations from

management’s perspective. Accordingly, these measures should not be

considered in isolation nor as a substitute for analysis of the

Company’s financial information reported under IFRS. The non-IFRS

measures referred to in this press release are “Adjusted EBITDA”

and “Fleet Adjusted EBITDA”.

Adjusted EBITDA

Adjusted EBITDA is used by management as a

supplemental measure to review and assess operating performance.

Management believes Adjusted EBITDA most accurately reflects the

commercial reality of the Company's operations on an ongoing basis

by adding back non-cash expenses. Additionally, the rent-related

adjustments ensure that studio-related expenses align with revenue

generated over the corresponding time periods.

Adjusted EBITDA is calculated by adding back

fixed asset depreciation, right-of-use asset depreciation under

IFRS 16, asset disposal, and share-based compensation expense to

IFRS operating income, then deducting straight-line rent expenses1

net of lease abatements. IFRS operating income is revenue less cost

of sales (gross profit), additionally adjusted for general and

administrative expenses, and depreciation and amortization

expense.

The Company also uses Fleet Adjusted EBITDA to

evaluate its fleet performance. This metric is calculated in a

similar manner, starting with Talent revenue and adjusting for

non-fleet Talent revenue and cost of sales, further adjusted by

fleet SG&A and finally subtracting the same straight line rent

expense used in the full company Adjusted EBITDA (as the fleet

holds all real estate leases). The Company believes that this

metric most closely mirrors how management views the fleet portion

of the business.

The following table reconciles Adjusted EBITDA

to net loss for the periods indicated:

| |

Thirteen weeks ended |

|

Twenty-six weeks ended |

|

|

July 2, |

June 26, |

|

July 2, |

June 26, |

|

in thousands of U.S. dollars |

|

2023 |

|

|

2022 |

|

|

|

2023 |

|

|

2022 |

|

|

Operating Loss |

$ |

(2,562 |

) |

$ |

(2,611 |

) |

|

$ |

(5,563 |

) |

$ |

(5,112 |

) |

|

Right-of-Use Asset Amortization Expense |

|

349 |

|

|

448 |

|

|

|

689 |

|

|

600 |

|

|

Fixed Asset Depreciation Expense |

|

523 |

|

|

280 |

|

|

|

1,013 |

|

|

892 |

|

|

Disposals |

|

89 |

|

|

|

|

89 |

|

|

|

Stock Compensation Expense |

|

85 |

|

|

10 |

|

|

|

201 |

|

|

28 |

|

|

Straight Line Rent |

|

(656 |

) |

|

(576 |

) |

|

|

(1,232 |

) |

|

(1,140 |

) |

|

Full Company Adjusted EBITDA |

$ |

(2,172 |

) |

$ |

(2,449 |

) |

|

$ |

(4,803 |

) |

$ |

(4,732 |

) |

The following table reconciles Fleet Adjusted

EBITDA to net loss for the periods indicated:

| |

Thirteen weeks ended |

|

Twenty-six weeks ended |

|

|

July 2, |

June 26, |

|

July 2, |

June 26, |

|

in thousands of U.S. dollars |

|

2023 |

|

|

2022 |

|

|

|

2023 |

|

|

2022 |

|

|

Talent Revenue |

$ |

6,237 |

|

$ |

5,433 |

|

|

$ |

11,333 |

|

$ |

9,775 |

|

|

Less: Non-Fleet Revenue |

|

(305 |

) |

|

(56 |

) |

|

|

(526 |

) |

|

(79 |

) |

|

Talent Cost of Sales |

|

(3,583 |

) |

|

(2,977 |

) |

|

|

(6,549 |

) |

|

(5,447 |

) |

|

Less: Non-Fleet Cost of Sales |

|

262 |

|

|

49 |

|

|

|

408 |

|

|

104 |

|

|

Fleet SG&A |

|

(1,571 |

) |

|

(1,363 |

) |

|

|

(2,960 |

) |

|

(2,638 |

) |

|

Fleet Straight Line Rent |

|

(572 |

) |

|

(576 |

) |

|

|

(1,121 |

) |

|

(1,140 |

) |

|

Fleet Adjusted EBITDA |

$ |

468 |

|

$ |

510 |

|

|

$ |

585 |

|

$ |

575 |

|

About

MiniLuxe

MiniLuxe, a Delaware corporation based in

Boston, Massachusetts is a digital-first, socially responsible

lifestyle brand and talent empowerment platform and marketplace

[let’s consider] for the nail and waxing industry. For over a

decade, MiniLuxe has been setting industry standards for health,

hygiene, high quality services, and fair labor practices in its

efforts to transform the nail care and waxing industry. Underlying

MiniLuxe’s mission and purpose is to become one of the largest

inclusionary educators and employers of diverse self-care

professionals across our omni-channel ecosystem and talent

empowerment platform.

Today, MiniLuxe derives its revenue streams from

nail care and waxing services across an omni-channel ecosystem of

on premises with company-owned studios and partnerships and

off-premises on-demand services. The company also develops and

sells a proprietary retail and e-commerce line of clean nail care

and waxing products that are also used in MiniLuxe services.

MiniLuxe is driven by a fully integrated digital platform that

manages all client bookings, preferences, and payments and provides

designers with the ability to manage scheduling and client

preferences, track their performance and compensation, and access

training content. Since its inception, MiniLuxe has performed

nearly 3 million services. www.miniluxe.com

For further information

Anthony TjanExecutive Chairman, MiniLuxe Holding

Corp.atjan@miniluxe.com

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Forward-looking statements

This press release contains "forward-looking

information" and "forward-looking statements" (collectively,

"forward-looking information") concerning the Company and its

subsidiaries within the meaning of applicable securities laws.

Forward-looking information may relate to the future financial

outlook and anticipated events or results of the Company and may

include information regarding the Company's financial position,

business strategy, growth strategies, acquisition prospects and

plans, addressable markets, budgets, operations, financial results,

taxes, dividend policy, plans and objectives. Particularly,

information regarding the Company's expectations of future results,

performance, achievements, prospects or opportunities or the

markets in which the Company operates is forward-looking

information. In some cases, forward-looking information can be

identified by the use of forward-looking terminology such as

"plans", "targets", "expects", "budgets", "scheduled", "estimates",

"outlook", "forecasts", "projects", "prospects", "strategy",

"intends", "anticipates", "believes", or variations of such words

and phrases or statements that certain actions, events or results

"may", "could", "would", "might", or "will" occur. In addition, any

statements that refer to expectations, intentions, projections or

other characterizations of future events or circumstances contain

forward-looking information. Statements containing forward-looking

information are not historical facts but instead represent

management's expectations, estimates and projections regarding

future events or circumstances.

Many factors could cause the Company's actual

results, performance, or achievements to be materially different

from any future results, performance, or achievements that may be

expressed or implied by such forward-looking information,

including, without limitation, those listed in the "Risk Factors"

section of the Company's filing statement dated November 9, 2021.

Should one or more of these risks or uncertainties materialize, or

should assumptions underlying the forward-looking statements prove

incorrect, actual results, performance, or achievements could vary

materially from those expressed or implied by the forward-looking

statements contained in this press release.

Forward-looking information, by its nature, is

based on the Company's opinions, estimates and assumptions in light

of management's experience and perception of historical trends,

current conditions and expected future developments, as well as

other factors that the Company currently believes are appropriate

and reasonable in the circumstances. Those factors should not be

construed as exhaustive. Despite a careful process to prepare and

review forward-looking information, there can be no assurance that

the underlying opinions, estimates and assumptions will prove to be

correct. These factors should be considered carefully, and readers

should not place undue reliance on the forward-looking information.

Although the Company bases its forward-looking information on

assumptions that it believes were reasonable when made, which

include, but are not limited to, assumptions with respect to the

Company's future growth potential, results of operations, future

prospects and opportunities, execution of the Company's business

strategy, there being no material variations in the current tax and

regulatory environments, future levels of indebtedness and current

economic conditions remaining unchanged, the Company cautions

readers that forward-looking statements are not guarantees of

future performance and that our actual results of operations,

financial condition and liquidity, and the development of the

industry in which the Company operates may differ materially from

the forward-looking statements contained in this press release. In

addition, even if the Company's results of operations, financial

condition and liquidity, and the development of the industry in

which it operates are consistent with the forward-looking

information contained in this press release, those results or

developments may not be indicative of results or developments in

subsequent periods.

Although the Company has attempted to identify

important risk factors that could cause actual results to differ

materially from those contained in forward-looking information,

there may be other risk factors not presently known to the Company

or that the Company presently believes are not material that could

also cause actual results or future events to differ materially

from those expressed in such forward-looking information. There can

be no assurance that such information will prove to be accurate, as

actual results and future events could differ materially from those

anticipated in such information. Accordingly, readers should not

place undue reliance on forward-looking information, which speaks

only as of the date made (or as of the date they are otherwise

stated to be made). Any forward-looking statement that is made in

this press release speaks only as of the date of such

statement.

1Straight-line rent expense for a given payment period is

calculated by dividing the sum of all payments over the life of the

lease (the figure used in the present value calculation of the

right-of-use asset) by the number of payment periods (typically

months). This number is then annualized by adding the rent expenses

calculated for the payment periods that comprise each fiscal year.

For leases signed mid-year, the total straight-line rent expense

calculation applies the new lease terms only to the payment periods

after the signing of the new lease.

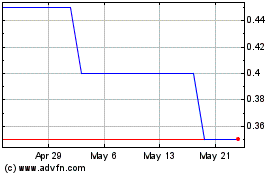

Miniluxe (TSXV:MNLX)

Historical Stock Chart

From Feb 2025 to Mar 2025

Miniluxe (TSXV:MNLX)

Historical Stock Chart

From Mar 2024 to Mar 2025