MiniLuxe Holding Corp. (TSXV: MNLX) today announced its financial

results for the 13 and 39 weeks ended September 29, 2024 (“Q3 2024”

and “YTD Q3 2024”, respectively). The fiscal year of MiniLuxe is a

52-week reporting cycle ending on the Sunday closest to December

31, which periodically necessitates a fiscal year of 53 weeks;

fiscal years referred to in this release consist of 52-week

periods. Unless otherwise specified, all amounts are reported in

U.S. dollars.

The third quarter marked continued progress

against key strategic priorities for the Company:

- Accelerating overall studio

contribution growth,

- Increasing fixed cost leverage and

SG&A efficiency

- Focusing growth through operating

and franchise partners and a narrower set of innovative

products

“Overall, Q3 represented a quarter of choices.

We made some tradeoff choices between growth in favor for more

profitability, but most important we made strides on our choice to

complement Company-owned Studios with selective partnerships, JVs

and franchisees. Notably the Company began the integration and

conversion process of Sugar Coat (majority-owned JV nail studio in

Atlanta) which has already become accretive to the business,” said

Tony Tjan, CEO and Co-Founder of MiniLuxe.

MiniLuxe’s third quarter demonstrated

year-over-year (“YoY”) revenue growth of +6% which included

intentional efforts to manage more controlled and slower growth of

its product channel. This strategy traded higher growth for more

profitable growth and as such the Company experienced its strongest

quarter in recent history for fixed cost leverage in the business.

Drivers of higher margin growth included:

- +5% YoY growth in MiniLuxe’s expanded waxing services which

provide higher gross margin dollar flow-through per service and

cross-selling opportunities

- Premium services overall increased +29% YoY across MiniLuxe’s

Core Studios

- Total Company gross profit was up +12% YoY

Operating burn for YTD Q3 2024 saw ~$3.8M

improvement over prior year when adjusting out for ERC received in

early 2023. From the cost side of the business, key highlights

include:

- Total Company SG&A (inclusive of corporate, studio-related,

and non-operating overhead) was down 28% YoY while non-operating

SG&A (as internally measured) was reduced materially by ~35%

versus the same period in 2023

- Significant efficiencies have also been gained at the unit

economic level through more effective management of indirect labor

and continued use of the Company’s technology platform

- In Q3 2024, ~98% of all service bookings were done through the

Company’s app or online. Further functionality being used includes

seamless / auto-check-in / check-out and testing has started for

AI-enabled marketing to help dynamically price services in peak and

trough periods

MiniLuxe’s positive trajectory on narrowing

losses included 56% improvement in Company-wide profitability on an

Adjusted EBITDA basis over YTD Q3 2023 along with $1.7 million in

Fleet Adjusted EBITDA generated during YTD Q3 2024, which is a $0.7

million improvement on a YoY basis. In conjunction with a reduced

cost base, this improvement has moved the Company to a further

narrowing loss rate. Focus for the balance of the business of the

year will be the holiday season which will include special MiniLuxe

product bundles, multi-service package offerings, and selectively

featured third-party products. Additionally, the Company is

evaluating a variety of capital investment interests that would

most likely come in the form of a new private placement. Pending

the attractiveness of terms of such offers of capital and approval

by the TSXv of such investment, the Company would consider taking

in a modest level of primary capital this calendar year.

“While we have more work to do and find ways

that we can do more faster and with less, overall, the Company has

demonstrated a quarter of growing high-demand offerings while being

more efficient with its cost base. At the same time, it has been

building a pipeline of commercial business development activities

on the services and product-side that we are looking forward to

sharing on during a future update,” said Tjan.

Q3 2024 Results

Selected Financial Measures

Results of Operations

The following table outlines the consolidated

statements of loss and comprehensive loss for the 13 and 39 weeks

ended September 29, 2024 and October 1, 2023:

Cash Flows

The following table presents cash and cash

equivalents as at September 29, 2024 and October 1, 2023:

Non-IFRS Measures and Reconciliation of

Non-IFRS Measures

This press release references certain non-IFRS

measures used by management. These measures are not recognized

under International Financial Reporting Standards (“IFRS”), do not

have a standardized meaning prescribed by IFRS, and are therefore

unlikely to be comparable to similar measures presented by other

companies. Rather, these measures are provided as additional

information to complement those IFRS measures by providing further

understanding of the Company’s results of operations from

management’s perspective. Accordingly, these measures should not be

considered in isolation nor as a substitute for analysis of the

Company’s financial information reported under IFRS. The non-IFRS

measures referred to in this press release are “Adjusted EBITDA”

and “Fleet Adjusted EBITDA”.

Adjusted EBITDA

Management believes Adjusted EBITDA most

accurately reflects the commercial reality of the Company's

operations on an ongoing basis by adding back non-cash expenses.

Additionally, the rent-related adjustments ensure that

studio-related expenses align with revenue generated over the

corresponding time periods.

Adjusted EBITDA is calculated by adding back

fixed asset depreciation, right-of-use asset amortization under

IFRS 16, asset disposal, and share-based compensation expense to

IFRS operating income, then deducting straight-line rent expenses

net of lease abatements. IFRS operating income is revenue less cost

of sales (gross profit), additionally adjusted for general and

administrative expenses, and depreciation and amortization

expense.

A reconciliation of IFRS operating income to

Adjusted EBITDA is included in Selected Consolidated Financial

Information.

The Company also uses Fleet Adjusted EBITDA to

evaluate the performance of its MiniLuxe Core Studio business (19

MiniLuxe-branded studios operating for 18+ months). This metric is

calculated in a similar manner, starting with Talent revenue and

adjusting for non-fleet Talent revenue and cost of sales, further

adjusted by fleet general and administrative expenses and finally

subtracting straight line rent expense (similar to amount used in

the full company Adjusted EBITDA, less amounts allocated to

locations outside of MiniLuxe’s core studio business, i.e.

Paintbox). The Company believes that this metric most closely

mirrors how management views the fleet portion of the business. A

reconciliation of Talent revenue to Fleet Adjusted EBITDA is

included in Selected Consolidated Financial Information.

The following table reconciles Adjusted EBITDA

to net loss for the periods indicated:

The following table reconciles Fleet Adjusted

EBITDA to net loss for the periods indicated:

About MiniLuxe

MiniLuxe, a Delaware corporation based in

Boston, Massachusetts. MiniLuxe is a lifestyle brand and talent

empowerment platform servicing the beauty and self-care industry.

The Company focuses on delivering high-quality nail care and

esthetic services and offers a suite of trusted proprietary

products that are used in the Company’s owned-and-operated studio

services. For over a decade, MiniLuxe has been elevating industry

standards through healthier, ultra-hygienic services, a modern

design esthetic, socially responsible labor practices, and

better-for-you, cleaner products. MiniLuxe’s aims to radically

transform a highly fragmented and under-regulated self-care and

nail care industry through its brand, standards, and technology

platform that collectively enable better talent and client

experiences. For its clients, MiniLuxe offers best-in-class

self-care services and better-for-you products, and for nail care

and beauty professionals, MiniLuxe seeks to become the employer of

choice. In addition to creating long-term durable economic returns

for our stakeholders, the brand seeks to positively impact and

empower one of the most diverse and largest hourly worker segments

through professional development and certification, economic

mobility, and company ownership opportunities (e.g., equity

participation and future franchise opportunities). Since its

inception, MiniLuxe has performed over 4 million services.

For further information

Christine MastrangeloInvestor Relations, MiniLuxe Holding

Corp.cmastrangelo@MiniLuxe.comMiniLuxe.com

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Forward-looking statements

This press release contains "forward-looking

information" and "forward-looking statements" (collectively,

"forward-looking information") concerning the Company and its

subsidiaries within the meaning of applicable securities laws.

Forward-looking information may relate to the future financial

outlook and anticipated events or results of the Company and may

include information regarding the Company's financial position,

business strategy, growth strategies, acquisition prospects and

plans, addressable markets, budgets, operations, financial results,

taxes, dividend policy, plans and objectives. Particularly,

information regarding the Company's expectations of future results,

performance, achievements, prospects or opportunities or the

markets in which the Company operates is forward-looking

information. In some cases, forward-looking information can be

identified by the use of forward-looking terminology such as

"plans", "targets", "expects", "budgets", "scheduled", "estimates",

"outlook", "forecasts", "projects", "prospects", "strategy",

"intends", "anticipates", "believes", or variations of such words

and phrases or statements that certain actions, events or results

"may", "could", "would", "might", or "will" occur. In addition, any

statements that refer to expectations, intentions, projections or

other characterizations of future events or circumstances contain

forward-looking information. Statements containing forward-looking

information are not historical facts but instead represent

management's expectations, estimates and projections regarding

future events or circumstances.

Many factors could cause the Company's actual

results, performance, or achievements to be materially different

from any future results, performance, or achievements that may be

expressed or implied by such forward-looking information,

including, without limitation, those listed in the "Risk Factors"

section of the Company's filing statement dated November 9, 2021.

Should one or more of these risks or uncertainties materialize, or

should assumptions underlying the forward-looking statements prove

incorrect, actual results, performance, or achievements could vary

materially from those expressed or implied by the forward-looking

statements contained in this press release.

Forward-looking information, by its nature, is

based on the Company's opinions, estimates and assumptions in light

of management's experience and perception of historical trends,

current conditions and expected future developments, as well as

other factors that the Company currently believes are appropriate

and reasonable in the circumstances. Those factors should not be

construed as exhaustive. Despite a careful process to prepare and

review forward-looking information, there can be no assurance that

the underlying opinions, estimates and assumptions will prove to be

correct. These factors should be considered carefully, and readers

should not place undue reliance on the forward-looking information.

Although the Company bases its forward-looking information on

assumptions that it believes were reasonable when made, which

include, but are not limited to, assumptions with respect to the

Company's future growth potential, results of operations, future

prospects and opportunities, execution of the Company's business

strategy, there being no material variations in the current tax and

regulatory environments, future levels of indebtedness and current

economic conditions remaining unchanged, the Company cautions

readers that forward-looking statements are not guarantees of

future performance and that our actual results of operations,

financial condition and liquidity, and the development of the

industry in which the Company operates may differ materially from

the forward-looking statements contained in this press release. In

addition, even if the Company's results of operations, financial

condition and liquidity, and the development of the industry in

which it operates are consistent with the forward-looking

information contained in this press release, those results or

developments may not be indicative of results or developments in

subsequent periods.

Although the Company has attempted to identify

important risk factors that could cause actual results to differ

materially from those contained in forward-looking information,

there may be other risk factors not presently known to the Company

or that the Company presently believes are not material that could

also cause actual results or future events to differ materially

from those expressed in such forward-looking information. There can

be no assurance that such information will prove to be accurate, as

actual results and future events could differ materially from those

anticipated in such information. Accordingly, readers should not

place undue reliance on forward-looking information, which speaks

only as of the date made (or as of the date they are otherwise

stated to be made). Any forward-looking statement that is made in

this press release speaks only as of the date of such

statement.

_____________________________________________

1 Straight-line rent expense for a given payment

period is calculated by dividing the sum of all payments over the

life of the lease (the figure used in the present value calculation

of the right-of-use asset) by the number of payment periods

(typically months). This number is then annualized by adding the

rent expenses calculated for the payment periods that comprise each

fiscal year. For leases signed mid-year, the total straight-line

rent expense calculation applies the new lease terms only to the

payment periods after the signing of the new lease.

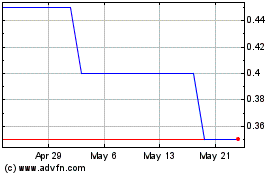

Miniluxe (TSXV:MNLX)

Historical Stock Chart

From Jan 2025 to Feb 2025

Miniluxe (TSXV:MNLX)

Historical Stock Chart

From Feb 2024 to Feb 2025