Mammoth Enters Option Agreement With Centerra Gold on Its Tenoriba Precious Metal Property, Mexico

21 December 2018 - 12:00AM

Mammoth Resources Corp. (TSX-V: MTH), (the

“Company”, or

“Mammoth”) is pleased to

announce the signing of an option agreement with Centerra Gold Inc.

(“Centerra”) to option Mammoth’s Tenoriba precious metal property

located in the prolific Sierra Madre precious metal belt in

southwestern Chihuahua State, Mexico. Centerra has the option to

earn up to a 70% interest in Tenoriba upon total project

expenditures of US$9.0 million over a seven-year period,

expenditure amounts which can be accelerated depending on

exploration success.

Thomas Atkins, President and CEO of

Mammoth commented on the signing of this agreement,

stating: “We’re exceptionally pleased to be partnering

with Centerra in the exploration-development of Tenoriba. The depth

of Centerra’s technical experience in these types of mineral

systems, their experience in project exploration and mine

development, combined with their financial strength and the

economies in costs and services a company of Centerra’s strength

and size can achieve have the potential to assist in advancing

Tenoriba beyond what Mammoth could achieve on its own. The option

agreement ensures robust exploration expenditures over a reasonable

time frame, amounts which can be accelerated depending on the level

of success, and which enables Mammoth shareholders to retain a 30

percent interest in the project upon Centerra having fulfilled its

total US$9.0 million expenditure obligation.

“We’re excited for the new year and the

advancement of exploration activities with Centerra, following up

on the successes of the 2018 and 2007 drill programs at Tenoriba

which together totalled 28 drill holes in various locations

along an approximate 4 kilometre strike length which remains open

to the east and west. Drilling intersected potentially economical

grades in the majority of these holes with many intersections

occurring over tens of metres.”

Details on the terms of the option agreement

include a committed minimum US$500,000 in project exploration

Expenditures (all exploration costs, property taxes, surface rights

and administrative fees) over the first twelve-month period from

the Effective Date of signing this option agreement and which over

the four-year term of the first option include total Expenditures

of US$5,000,000 upon which having completed such Expenditures,

Centerra will earn a 51% interest in the property. The schedule of

Expenditures are as follows:

- On or before the first anniversary

of the Effective Date, Expenditures in the aggregate are no less

than $500,000;

- On or before the second anniversary

of the Effective Date, Expenditures when aggregated are no less

than $1,500,000;

- On or before the third anniversary

of the Effective Date, Expenditures when aggregated are no less

than $3,000,000; and

- On or before the fourth anniversary

of the Effective Date, Expenditures when aggregated are no less

than 5,000,000;

Centerra having earned this initial 51% interest

has a second option entitlement to earn an additional 19% of the

ownership interests in the Tenoriba property by performing the

following within the three-year period following initiation of this

second option:

- Incurring additional Expenditures

on Tenoriba in the aggregate amount of US$4,000,000 and completing

a preliminary economic assessment level study on Tenoriba which

identifies a mineral resource which is compliant with National

Instrument 43-101; and

- Upon having completed the

additional Expenditures under the second option, make cash payments

of US$550,000 to Mammoth, or at Centerra’s option issue to Mammoth

Centerra common shares totalling US$550,000 (in the event that

common shares are issued, the five-day volume weight trading price

of a Centerra common share on the Toronto Stock Exchange

immediately prior the date of issuance will be used to determine

the number of shares to be issued, any Centerra common shares

issued subject to a hold period during which shares cannot be sold,

as required by the Ontario Securities Act).

In the event either party selects not to fund

its respective interest going forward such non-participating party

may be diluted to a 10 percent interest whereupon such interest

would revert to a two percent NSR, of which one percent can be

purchased for US$1.0 million and the non-diluted party has a right

of first refusal on the sale of the remaining one percent NSR

interest.

During the term of this option agreement, and

until Centerra’s interest drops below a 50 percent interest

(following its having earned the initial 51 percent interest),

Centerra will be the project operator. As project operator Centerra

will submit program activities and budgets to Mammoth for review

and input prior to approval. Centerra will be eligible to receive a

management fee equal to 5% of invoiced drilling and certain other

high cost Expenditure activities (any single activity that exceeds

$50,000) or otherwise receive a 10% management fee on all other

Expenditures.

Mammoth would like to take this opportunity to

correct a statement made in a press release dated December 6, 2018.

In this press release it was stated that Mammoth requested approval

to issue 2,414,000 common shares of Mammoth at a deemed issuance

price of $0.05/share to settle amounts owed two third party

creditors. The Company would like to correct this statement to read

that it has requested approval to issue 1,535,600 shares of the

Company at a deemed issuance price of $0.05/share to these

creditors. The issuance of these shares remain subject to TSX

Venture Exchange approval.

To find out more about Mammoth Resources and to

sign up to receive future press releases, please visit the

company's website

at: www.mammothresources.ca., or contact

Thomas Atkins, President and CEO at: 416 509-4326.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

Forward Looking Information: This news

release may contain or refer to forward-looking information.

Although the Company believes that the assumptions inherent in the

forward-looking statements are reasonable, forward-looking

statements are not guarantees of future performance and,

accordingly, undue reliance should not be placed on these

forward-looking statements due to the inherent uncertainty therein.

Please refer to the Company’s website at the following link:

http://www.mammothresources.ca/s/FAQ.asp to review the Company’s

complete forward looking statement.

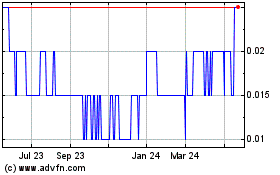

Mammoth Resources (TSXV:MTH)

Historical Stock Chart

From Mar 2025 to Apr 2025

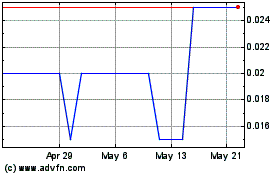

Mammoth Resources (TSXV:MTH)

Historical Stock Chart

From Apr 2024 to Apr 2025