ArcelorMittal publishes revised analyst model per new segmental reporting

27 March 2024 - 8:30PM

27 March 2024, 10:30 CET

As announced with ArcelorMittal’s (‘the Company’) fourth quarter

2023 financial results, the Company has amended its presentation of

reportable segments and EBITDA.

The changes, applied from January 1, 2024, are as follows:

- EBITDA is defined as operating

result plus depreciation, impairment items and exceptional items

and result from associates, joint ventures and other investments

(excluding impairments and exceptional items if any);

- The NAFTA segment has been renamed

"North America", a core growth region for the Company;

- ‘India and JVs’ is now reported

separately as a segment, reflecting the share of net income of AMNS

India, VAMA and AMNS Calvert as well as the other associates, joint

ventures and other investments. India is a high growth vector of

the Company, with our assets well-positioned to grow with the

domestic market;

- A new ‘Sustainable Solutions’

segment is composed of a number of high-growth, niche, capital

light businesses, playing an important role in supporting climate

action (including renewables, special projects and construction

business). Previously reported within the Europe segment, this is a

growth vector of the Company and represents businesses employing

over 12,000 people at more than 260 commercial and production sites

across 60+ countries;

- Following the sale of the Company’s

operations in Kazakhstan, the remaining parts of the former ‘ACIS’

segment have been assigned to ‘Others’; there are no changes to the

‘Brazil’ and ‘Mining’ segments.

The following periods: FY 2021, FY 2022 and FY 2023 and all four

quarters of 2023 - have been recast in the Company’s published

analyst model which can be viewed

here: https://corporate.arcelormittal.com/investors/results

In addition, the Company has included key reconciliations of net

income/ (loss) to EBITDA and adjusted net income and adjusted EPS

as well as provided historic key performance indicators for its

three key JVs: AMNS India, AMNS Calvert and VAMA.

Forward-Looking Statements This document may

contain forward-looking information and statements about

ArcelorMittal and its subsidiaries. These statements include

financial projections and estimates and their underlying

assumptions, statements regarding plans, objectives and

expectations with respect to future operations, products and

services, and statements regarding future performance.

Forward-looking statements may be identified by the words

“believe”, “expect”, “anticipate”, “target” or similar expressions.

Although ArcelorMittal’s management believes that the expectations

reflected in such forward-looking statements are reasonable,

investors and holders of ArcelorMittal’s securities are cautioned

that forward-looking information and statements are subject to

numerous risks and uncertainties, many of which are difficult to

predict and generally beyond the control of ArcelorMittal, that

could cause actual results and developments to differ materially

and adversely from those expressed in, or implied or projected by,

the forward-looking information and statements. These risks and

uncertainties include those discussed or identified in the filings

with the Luxembourg Stock Market Authority for the Financial

Markets (Commission de Surveillance du Secteur Financier) and the

United States Securities and Exchange Commission (the “SEC”) made

or to be made by ArcelorMittal, including ArcelorMittal’s latest

Annual Report on Form 20-F on file with the SEC. ArcelorMittal

undertakes no obligation to publicly update its forward-looking

statements, whether as a result of new information, future events,

or otherwise.

Non-GAAP/Alternative Performance MeasuresThis

document includes supplemental financial measures that are or may

be non-GAAP financial/alternative performance measures, as defined

in the rules of the SEC or the guidelines of the European

Securities and Market Authority (ESMA). They may exclude or include

amounts that are included or excluded, as applicable, in the

calculation of the most directly comparable financial measures

calculated in accordance with IFRS. Accordingly, they should be

considered in conjunction with ArcelorMittal's consolidated

financial statements prepared in accordance with IFRS, including in

its annual report on Form 20-F, its interim financial reports and

earnings releases. Comparable IFRS measures and reconciliations of

non-GAAP/alternative performance measures thereto are presented in

such documents, as well as in the document “Reconciliation of

Non-GAAP Financial Measures to IFRS Measures” available on the

Company's website (under "Investors -- Results"). ArcelorMittal

presents EBITDA and EBITDA/tonne and free cash flow (FCF) which are

non-GAAP financial/alternative performance measures, as additional

measures to enhance the understanding of its operating performance.

ArcelorMittal believes such indicators are relevant to provide

management and investors with additional information. The

definition of EBITDA has been revised to split out the impairment

charges and exceptional items of the Kazakhstan disposal because

the Company believes this presentation provides more clarity with

respect to the impacts of this disposal. ArcelorMittal also

presents net debt as an additional measure to enhance the

understanding of its financial position, changes to its capital

structure and its credit assessment. ArcelorMittal also presents

adjusted net income(loss) and adjusted basic earnings per share as

it believes these are useful measures for the underlying business

performance excluding impairment items and exceptional items. The

definition of adjusted net income has been revised as for EBITDA to

split out the impairment charges and exceptional items of the

Kazakhstan disposal for clarity and also to clarify that impairment

charges and exceptional items of associates, joint ventures and

other investments are excluded from this alternative performance

measure. In the model, the definition of EBITDA has also been

revised to include income from share of associates, JVs and other

investments (excluding impairments and exceptional items if any, of

associates, JVs and other investments). Non-GAAP

financial/alternative performance measures should be read in

conjunction with, and not as an alternative to, ArcelorMittal's

financial information prepared in accordance with IFRS.

ENDS

About ArcelorMittal

ArcelorMittal is one of the world’s leading integrated steel and

mining companies with a presence in 60 countries and primary

steelmaking operations in 15 countries. It is the largest steel

producer in Europe, among the largest in the Americas, and has a

growing presence in Asia through its joint venture AM/NS India.

ArcelorMittal sells its products to a diverse range of customers

including the automotive, engineering, construction and machinery

industries, and in 2023 generated revenues of $68.3 billion,

produced 58.1 million metric tonnes of crude steel and 42.0 million

tonnes of iron ore.

Our purpose is to produce smarter steels for people and planet.

Steels made using innovative processes which use less energy, emit

significantly less carbon and reduce costs. Steels that are

cleaner, stronger and reusable. Steels for the renewable energy

infrastructure that will support societies as they transform

through this century. With steel at our core, our inventive people

and an entrepreneurial culture at heart, we will support the world

in making that change.

ArcelorMittal is listed on the stock exchanges of New York (MT),

Amsterdam (MT), Paris (MT), Luxembourg (MT) and on the Spanish

stock exchanges of Barcelona, Bilbao, Madrid and Valencia

(MTS).

http://corporate.arcelormittal.com/

| |

|

| Contact

information ArcelorMittal Investor Relations |

|

| |

|

| General |

+44 20 7543

1128 |

| Retail |

+44 20 3214

2893 |

| SRI |

+44 20 3214

2801 |

|

Bonds/CreditE-mail |

+33 171 921

026investor.relations@arcelormittal.com |

|

|

|

|

|

|

| Contact

information ArcelorMittal Corporate Communications |

|

| Paul

WeighTel:E-mail: |

+44 20

3214 2419press@arcelormittal.com |

|

|

|

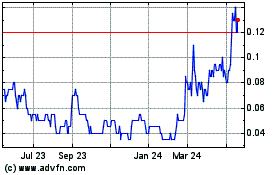

Metallis Resources (TSXV:MTS)

Historical Stock Chart

From Nov 2024 to Dec 2024

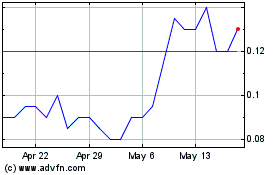

Metallis Resources (TSXV:MTS)

Historical Stock Chart

From Dec 2023 to Dec 2024