Opus One Gold Corporation Flow-Through Private Placement of Up To $200,000

20 December 2022 - 10:30AM

Opus One Gold Corp. (OOR : TSXV)

(“

Opus One Gold” or the

“

Company”), is pleased to announce a non-brokered

private placement (the “

Offering”) for gross

proceeds of up to C$200,000 from the sale of flow-through units of

the Company (“

FT Units”). Each FT

Unit shall be issued at price per FT Unit of $0.02 and shall be

comprised of one flow-through common share of the Company (a

“

FT Share”) and one-half of one

non-flow-through common share purchase warrant (a

“

Warrant”), with each Warrant entitling the holder

to acquire one Share at an exercise price of $0.05 per Share for a

period of 24 months following the closing of the offering. Each FT

Share will be issued as a “flow-through share”, as such term is

defined in the Income Tax Act (Canada).

The Units will be offered by way of the

“accredited investor” exemption under National Instrument 45-106 –

Prospectus Exemptions in all the provinces of Canada. The FT Units,

Shares and Warrant Shares will be subject to a four-month hold

period in Canada following the closing of the offering.

In accordance with TSX Venture Exchange

policies, the Company is relying on a minimum price exception in

order to issue securities at less than $0.05 per listed security.

As such, the Company will not issue more than 100% of its issued

and outstanding Shares pursuant to the offering.

The gross proceeds from the issuance of the FT

Units will be used for Canadian exploration expenses and will

qualify as “flow-through mining expenditures”, as defined in

subsection 127(9) of the Income Tax Act (Canada) and under section

359.1 of the Taxation Act (Québec) (the “Qualifying

Expenditures”), which will be incurred on or before

December 31, 2023 and renounced to the subscribers with an

effective date no later than December 31, 2022 in an aggregate

amount not less than the gross proceeds raised from the issue of

the FT Units. In addition, with respect to Québec resident

subscribers of Québec FT Units and who are eligible individuals

under the Taxation Act (Québec), the Canadian exploration expenses

will also qualify for inclusion in the “exploration base relating

to certain Québec exploration expenses” within the meaning of

section 726.4.10 of the Taxation Act (Québec) and for inclusion in

the “exploration base relating to certain Québec surface mining

expenses or oil and gas exploration expenses” within the meaning of

section 726.4.17.2 of the Taxation Act (Québec).

In connection with the Offering, the Company may

pay finder’s fees and issue finder warrants to arm’s length

finders, consisting of: (i) cash finder's fees of up to 5 per cent

of the gross proceeds of the offering; and (ii) finder warrants in

an amount equal to up to 5 per cent of the number of FT Units

issued pursuant to the offering, exercisable at a price of $0.05

per common share for a period of two years following the closing

date.

Closing of the offering is scheduled to occur on

or about December 20, 2022 and is subject to the approval of the

TSX Venture Exchange and other customary closing conditions. There

can be no assurances that the offering will be completed on the

terms set out herein, or at all, or that the proceeds of the

offering will be sufficient for the uses of proceeds as set out

above.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of the release.

ABOUT OPUS ONE GOLD

CORPORATION

Opus One Gold Corporation is a mining

exploration company focused on discovering high quality gold and

base metals deposits within strategically located properties in

proven mining camps, close to existing mines in the Abitibi

Greenstone Belt, north-western Quebec and north-eastern Ontario -

one of the most prolific gold mining areas in the world. Opus One

holds assets in Val-d'Or and Matagami areas.

For more information, please

contact:

Louis Morin Chief Executive Officer &

Director Tel.: (514) 591-3988

Michael W. Kinley, CPA, CA President, Chief

Financial Officer & Director Tel: (902) 826-1579

info@OpusOneGold.com

Visit Opus One’s website: www.OpusOneGold.com

This press release contains forward-looking

statements and forward-looking information (collectively,

"forward-looking statements") within the meaning of applicable

Canadian securities legislation. All statements other than

statements of historical fact, including without limitation,

statements regarding the anticipated content, commencement and

exploration program results, the ability to complete future

financings, required permitting, exploration programs and drilling,

and the anticipated business plans and timing of future activities

of the Company, are forward-looking statements. Forward-looking

statements are typically identified by words such as: believe,

expect, anticipate, intend, estimate, postulate and similar

expressions, or are those, which, by their nature, refer to future

events. Although the Company believes that such statements are

reasonable, it can give no assurance that such expectations will

prove to be correct.

The Company cautions investors that any

forward-looking statements by the Company are not guarantees of

future results or performance, and that actual results may differ

materially from those in forward looking statements as a result of

various factors, including, but not limited to, the state of the

financial markets for the Company's equity securities, the state of

the commodity markets generally, variations in the nature, the

analytical results from surface trenching and sampling program,

including diamond drilling programs, the results of IP surveying,

the results of soil and till sampling program. the quality and

quantity of any mineral deposits that may be located, variations in

the market price of any mineral products the Company may produce or

plan to produce, the inability of the Company to obtain any

necessary permits, consents or authorizations required, including

TSX Venture acceptance, for its planned activities, the inability

of the Company to produce minerals from its properties successfully

or profitably, to continue its projected growth, to raise the

necessary capital or to be fully able to implement its business

strategies, , and other risks and uncertainties. All of the

Company's Canadian public disclosure filings may be accessed via

www.sedar.com and readers are urged to review these materials,

including the technical reports filed with respect to the Company's

mineral properties.

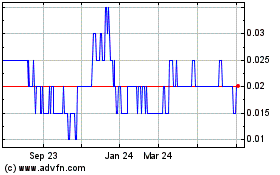

Opus One Gold (TSXV:OOR)

Historical Stock Chart

From Dec 2024 to Jan 2025

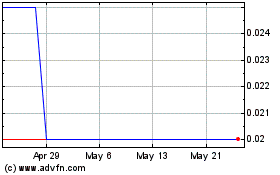

Opus One Gold (TSXV:OOR)

Historical Stock Chart

From Jan 2024 to Jan 2025