Pelangio Intersects 49.5 Metres Grading 1.18 g/t Gold at Nkansu - Significant Intercepts in All Five Holes

08 May 2014 - 10:00PM

Marketwired Canada

Pelangio Exploration Inc. (TSX VENTURE:PX)(OTCQB:PGXPF) ("Pelangio" or the

"Company") announces results from a further five reverse circulation (RC) holes

completed at Nkansu during a continuing drill commissioning and exploration

program on its Manfo Project, Ghana.

Nkansu Gold Zones

-- 1.18 grams per tonne (g/t) gold over 49.50 metres in SGRC-322 from 54.80

metres down-hole.

-- 0.46 g/t over 51 metres in SGRC-323 from 89.30 metres down-hole.

-- 0.49 g/t over 30 metres in SGRC-324 from 51.80 metres down-hole.

-- 0.62 g/t over 36 metres in SGRC-325 from 24.80 metres down-hole

including 1.33 g/t over 10.50 metres from 44.30 metres down-hole.

-- 9.05 g/t over 1.50 metres from 123.80 metres down-hole, and 0.59 g/t

over 16.50 metres from 80.30 metres in SGRC-327.

"The results from the program on the south end of Nkansu indicate a continuous

shallow southwest plunging gold mineralized system which remains open to the

southwest and at depth," stated Warren Bates, Vice President Exploration. "A

second zone of mineralization has also been identified about 550 metres to the

north. All five drill holes returned significant intercepts. We are pleased that

the Grasshopper drill rig performance continues to improve, reaching depths of

up to 150 metres which is sufficient for evaluating mineralization with open pit

potential. As well, rig productivity increased significantly over the previous

program."

Geological Setting

The following table summarizes significant assay results reported herein,

including drill hole SGRC-322 which intersected 49.50 metres with a grade of

1.18 g/t gold:

----------------------------------------------------------------------------

Sample Hole

Section From To Length Gold Length

Prospect Target North BHID (m) (m) (m) (g/t) (m)

----------------------------------------------------------------------------

Nkansu South 46650 SGRC-322(i) 54.80 104.30 49.50 1.18 104.30

----------------------------------------------------------------------------

Nkansu South 46700 SGRC-323(i) 89.30 140.30 51.00 0.46 143.30

----------------------------------------------------------------------------

Nkansu South 46750 SGRC-324(i) 51.80 81.80 30.00 0.49 144.80

----------------------------------------------------------------------------

Nkansu North 47300 SGRC-325(ii) 24.80 60.80 36.00 0.62 152.30

----------------------------------------------------------------------------

including SGRC-325 44.30 54.80 10.50 1.33

----------------------------------------------------------------------------

Nkansu North 47300 SGRC-327(ii) 62.30 68.30 6.00 0.82 150.80

----------------------------------------------------------------------------

SGRC-327 80.30 96.80 16.50 0.59

----------------------------------------------------------------------------

SGRC-327 107.30 110.30 3.00 0.99

----------------------------------------------------------------------------

SGRC-327 123.80 125.30 1.50 9.05

----------------------------------------------------------------------------

Nkansu North 47300 SGRC-326(iii) 15.80

----------------------------------------------------------------------------

Total 711.30

----------------------------------------------------------------------------

(i) Intervals are sample lengths. True widths are estimated to be 70-90%

of the sample length. A cut-off grade of 0.2 g/t gold was used in

calculating intervals with allowance for up to five metres of internal

dilution.

(ii) Intervals are sample lengths. True widths will be defined with

additional drilling. A cut-off grade of 0.2 g/t gold was used in

calculating intervals with allowance for up to five metres of internal

dilution.

(iii) Hole abandoned and not sampled

Mineralization consists of quartz-sericite pyrite mineralization hosted in

biotitic granitoid.

Drill holes SGRC-322,-323 and -324 were drilled on sections 46650N, 46700N, and

46750N, respectively. These drill holes indicate better widths and grades being

seen as drilling moves to the east, indicating a continuous shallow southwest

plunging zone.

Drill holes SGRC-325, -326 and -327 were drilled 550 metres north on Section

47300N. Drill hole SGRC-326 (collared at the same location as SGRC-327) was

abandoned at 15.80 metres. Drill holes on section 47300N were drilled to test

coincident induced polarization and gold geochemical targets.

An initial longitudinal section for the southern portion of Nkansu, as well as

plan views and cross sections illustrating the Nkansu drill holes and

intersections discussed above are available at

http://www.pelangio.com/Projects/Ghana/Manfo/Exploration-Results/Nkansu.aspx

Quality Assurance/Quality Control and Qualified Person

Reverse circulation holes were sampled with a conventional three-inch reverse

circulation hammer within casing to casing depth. Casing depth is variable and

is generally below the oxide/sulphide interface. Below casing depth, reverse

circulation holes are sampled with a three-inch centre return reverse

circulation hammer. All drilling performed with RC set-up was completed without

water injection. Contractors working for Pelangio conducted all logging and

sampling. Company security is provided at the drill site.

Sample intervals for RC drilling were 1.5 metres, with samples being split from

a cyclone exhaust and weighed. A sample in return was split from the primary

sample with a riffle splitter to obtain a 2.5 kilogram sample for assay. A

sample of chips was extracted from the primary sample with a sieve and water and

put in a chip tray with the interval marked on the chip tray. RC chips were

logged using hand lens and microscope. The remainder of the sample is stored on

site in plastic sample bags in a secure location at the Pelangio compound in

Tepa, Ghana. The 2.5 kilogram sample for assay is placed into sealed bags and

securely stored at the site before being shipped to the ALS Chemex laboratory in

Kumasi, Ghana. The sample was dried and crushed by ALS Chemex and a 150 gram

pulp was prepared from the coarse crushed material. ALS Chemex conducted routine

gold analysis using a 50 gram charge and fire assaying with atomic absorption

finish. Quality control procedures included the systematic insertion of blanks,

duplicates and sample standards into the sample stream at the rate of one per

every 20 samples. In addition, ALS Chemex inserted one preparation blank and a

certified reference sample in every 20 samples, and ran one duplicate analysis

every 20 samples.

The exploration program at the Manfo Property is overseen by Warren Bates, P.

Geo. (APGO #0211), a Qualified Person as defined by the Canadian Securities

Administrators' National Instrument 43-101. Mr. Bates has verified and approved

the data disclosed in this release, including the sampling, analytical and test

data underlying the information.

About Pelangio Exploration Inc.

Pelangio successfully acquires and explores camp-sized land packages in

world-class gold belts, while using innovative corporate restructuring to

maximize shareholder value. The Company primarily operates in Ghana, West

Africa, an English-speaking, common law jurisdiction that is consistently ranked

amongst the most favourable mining jurisdictions in Africa. The Company is

exploring three 100%-owned camp-sized properties: the 100 km2 Manfo Property,

the site of seven recent near-surface gold discoveries, which currently hosts a

mineral resource of 195,000 ounces of gold in the Indicated category (3,973,000

tonnes at 1.52 g/t Au) and 298,000 ounces of gold in the Inferred category

(9,666,000 tonnes at 0.96 g/t Au), estimated in conformity with generally

accepted Canadian Institute of Mining, Metallurgy and Petroleum ("CIM")

Estimation of Mineral Resource and Reserves Best Practices Guidelines and

reported in accordance with NI 43-101; the 264 km2 Obuasi Property, located four

kilometres on strike and adjacent to AngloGold Ashanti's prolific, high-grade

Obuasi Mine, which has produced over 30 million ounces of gold since 1897; and

the early-stage 159 km2 Akroma Property. For additional information, please

visit our website at www.pelangio.com or follow us on Twitter @PelangioEx.

Cautionary Note Regarding Mineral Resource Estimates

Investors should not assume that any of the indicated or inferred resource

disclosed herein will ever be upgraded to a higher category of mineral resource

or to mineral reserves and that any or all of the indicated or inferred mineral

resource exist or is or will be economically or legally feasible to mine. In

addition, investors should not assume that any of the references herein to

adjacent properties (based on public information) is necessarily indicative of

the mineralization on the Manfo property or that further exploration on the

Manfo property will prove to be successful.

The disclosure herein uses mineral resource classification terms that comply

with reporting standards in Canada and the disclosure of mineral resource

estimates are made in accordance with National Instrument 43-101 - Standards of

Disclosure for Mineral Projects. NI 43-101 is a rule developed by the Canadian

Securities Administrators that establishes standards for all public disclosure

an issuer makes of scientific and technical information concerning mineral

projects that are considered material to the issuer.

All resource estimates contained herein are based on the definitions adopted by

CIM and recognized under NI 43-101. These standards differ significantly from

the mineral reserve disclosure requirements of the U.S. Securities and Exchange

Commission set out in Industry Guide 7. Consequently, resource information

contained in this press release is not comparable to similar information that

would generally be disclosed by U.S. companies in accordance with the rules of

the SEC. The SEC's Industry Guide 7 does not recognize mineral resources and US.

companies are generally not permitted to disclose mineral resources in documents

they file with the SEC. Investors are specifically cautioned not to assume that

any part or all of the mineral resources disclosed above will ever be converted

into SEC defined mineral reserves. Further, "inferred mineral resources" have a

great amount of uncertainty as to their existence and as to whether they can be

mined legally or economically. In accordance with Canadian rules estimates of

inferred mineral resources generally cannot form the basis of an economic

analysis.

Forward Looking Statements

Certain statements herein may contain forward-looking statements and

forward-looking information within the meaning of applicable securities laws.

Forward-looking statements or information appear in a number of places and can

be identified by the use of words such as "plans", "expects" or "does not

expect", "is expected", "budget", "scheduled", "estimates", "forecasts",

"intends", "anticipates" or "does not anticipate" or "believes" or variations of

such words and phrases or statements that certain actions, events or results

"may", "could", "would", "might" or "will" be taken, occur or be achieved.

Forward-looking statements and information include statements regarding the

mineral resource estimate, the timing of exploration programs and filing of

technical reports and the Company's exploration plans and exploration results

with respect to the Manfo Property. With respect to forward-looking statements

and information contained herein, we have made numerous assumptions, including

assumptions about gold price, cut-off grades, metallurgical recoveries,

operating and other costs and technical assumptions used in the estimate.

Such forward-looking statements and information are subject to risks,

uncertainties and other factors which may cause the Company's actual results,

performance or achievements, or industry results, to be materially different

from any future results, performance or achievements expressed or implied by

such forward-looking statement or information. Such risks include discrepancies

between actual and estimated mineral resources, subjectivity of estimating

mineral resources and the reliance on available data and assumptions and

judgments used in the interpretation of such data, speculative and uncertain

nature of gold exploration, exploration costs, capital requirements and the

ability to obtain financing, volatility of global and local economic climate,

share price volatility, estimate gold price volatility, changes in equity

markets, political developments in Ghana, increases in costs, exchange rate

fluctuations and other risks involved in the gold exploration industry. See the

Company's annual information form and annual and quarterly financial statements

and management's discussion and analysis for additional information on risks and

uncertainties relating to the forward-looking statement and information. There

can be no assurance that a forward-looking statement or information referenced

herein will prove to be accurate, as actual results and future events could

differ materially from those anticipated in such statements or information.

Also, many of the factors are beyond the control of the Company. Accordingly,

readers should not assume that any of the indicated or inferred resource will

ever be upgraded to a higher category or to mineral reserves and any or all

exist or is economically or legally feasible to mine or place undue reliance on

forward-looking statements or information. We undertake no obligation to reissue

or update any forward-looking statements or information except as required by

law. All forward-looking statements and information herein are qualified by this

cautionary statement.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term

is defined in the policies of the TSX Venture Exchange) accepts responsibility

for the adequacy or accuracy of this release.

FOR FURTHER INFORMATION PLEASE CONTACT:

Ingrid Hibbard

President and CEO

905-875-3828 or Toll-free: 1-877-746-1632

Warren Bates

Senior Vice President Exploration

905-875-3828 or Toll-free: 1-877-746-1632

info@pelangio.com

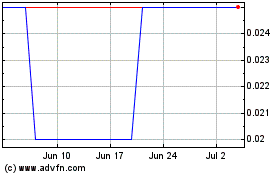

Pelangio Exploration (TSXV:PX)

Historical Stock Chart

From Oct 2024 to Nov 2024

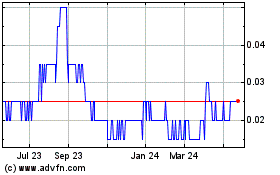

Pelangio Exploration (TSXV:PX)

Historical Stock Chart

From Nov 2023 to Nov 2024