THIS DOCUMENT IS NOT INTENDED FOR DISSEMINATION OR DISTRIBUTION IN THE UNITED

STATES.

Questor Technology Inc. ("Questor" or the "Company") (TSX VENTURE:QST) announced

today its financial and operating results for the year ended December 31, 2011.

The Company's audited annual financial statements have been prepared in

accordance with International Financial Reporting Standards ("IFRS"), including

restatement of prior year results for comparative purposes. 2011 earnings per

share was the third highest in the Company's history and nearly equivalent to

the second highest earnings per basic share of $0.051 which occurred in 2006.

The Company reported a profit of $1,190,404 ($0.048 per basic share) compared to

a profit of $445,060 ($0.018 per basic share) for the year ended December 31,

2010. 2011 earnings per share was the third highest in the Company's history and

nearly equivalent to the second highest earnings per basic share of $0.051 which

occurred in 2006.

This substantial increase in profit was primarily due to differences in the

sales and services mix in each year and the higher margins achieved in 2011.

Other non-recurring income arising in second quarter 2011 and comparatively

lower net foreign exchange losses further contributed to the positive profit

variance for the year ended December 31, 2011. Partially offsetting this

favourable result were higher administration expenses, income tax expense and

depreciation as well as losses on property and equipment disposals in 2011.

FINANCIAL HIGHLIGHTS SUMMARY

(Stated in Canadian dollars except per share amounts)

Increase

For the years ended December 31 2011 2010 (decrease)

----------------------------------------------------------------------------

Revenue 6,093,189 5,787,529 305,660

Gross profit(1) 2,883,387 2,001,900 881,487

EBITDA(1) 1,797,030 859,598 937,432

Profit and total comprehensive

income 1,190,404 445,060 745,344

Cost of sales as a percent of

revenue(1) 52.7% 65.4% (12.7)%

Cash generated from operations

before movements in non-cash

working capital(1) 1,793,638 904,113 889,525

Total assets 9,025,953 7,339,025 1,686,928

Non-current liabilities 156,034 58,592 97,442

Shares outstanding(2)

Basic 24,746,411 24,275,589 470,822

Diluted 24,796,499 24,387,275 409,224

Earnings per share - Basic and

diluted 0.048 0.018 0.030

----------------------------------------------------------------------------

1. Non-IFRS financial measure. Please see discussion in the Non-IFRS

Financial Measures section of the Company's Management's Discussion and

Analysis for the year ended December 31, 2011.

2. Weighted average.

"The Questor team delivered strong results in 2011 leading to a significant

increase to earnings per share relative to each of the last three years. The

Company generated the second highest annual revenue in the Company's history and

increased gross profit by 44 percent to achieve earnings of $0.048 per share,"

said Audrey Mascarenhas, President and Chief Executive Officer. "The market's

understanding of the economic value and operational benefits Questor's clean air

solutions offer is evolving as recognition of the Company's expertise and

products continue to grow. The superior performance of our incineration

equipment and its contributions to allaying public concerns regarding air

quality has been acknowledged as a best practice by certain of our customers.

During 2011 and into 2012, we experienced a substantial increase in demand for

our technology in the United States. Recent emissions legislation introduced in

the United States has created further opportunities for growth as Questor's

technology is capable of meeting the standards across a wide range of

applications, including shale gas development, natural gas sweetening and

dehydration, in situ oil sands combustion and steam assisted gravity drainage

("SAGD") operations.

We are well positioned to pursue growth opportunities in North America and

Europe in the coming year," concluded Ms. Mascarenhas.

2011 OPERATIONAL HIGHLIGHTS

Relative to the strategic priorities, the following selected events and

achievements exemplify Questor's progression in 2011:

-- Demonstrated the Company's technical expertise and competence in the

destruction of low heat content gases through the deployment of the

incineration equipment and related technology to shale gas and oil sands

developments and to amine, dehydration and other oil and gas processing

applications. As a result, certain customers have identified Questor's

technology as best practice and specify the use of the Company's

solutions in their tenders to third parties for field equipment.

-- Advanced the Company's United States market penetration in both the sale

of incinerators and use of incineration equipment on a rental basis.

Revenue from United States sources increased from $669,556 in 2010 to

$3,738,220 in 2011.

-- Increased incinerator rental revenue by 58.1 percent year over year by

deploying incineration equipment to the United States and Germany in

addition to the traditional Western Canada market and by securing

longer-term rental arrangements for approximately 75 percent of the

rental incinerator fleet over the course of the year. To exploit the

growing demand for non-permanent applications arising from the oil and

gas industry's focus on shale gas opportunities, the Company invested

$1.4 million in rental incinerator fleet modifications and additions.

-- Awarded its first sales order to supply incineration equipment for a

project located in Russia and delivered that equipment in first quarter

2012. The Russian market holds strong potential for Questor as the

country focuses on opportunities to reduce gas flaring.

-- Continued to advance the development and commercialization of a process

to recover waste heat from incineration and convert the heat to power.

The Company experimented with a variety of designs at its test facility

in Grande Prairie, Alberta. The first such application was installed in

third quarter 2011 and has been the basis for the development of

customized designs for demonstration projects with other potential

customers.

-- Built market awareness and recognition for Questor's expertise in

matters relating to air quality as demonstrated by invitations to

present at several events worldwide including:

-- The 11th China International Petroleum and Petrochemical Technology

and Equipment Exhibition (CIPPE 2011) held March 22 - 24, 2011 in

Beijing, China on the topic of "Clearing the Air! Effective,

Efficient, Safe and Sustainable";

-- 2011 North America Gas and Oil Expo and Conference held June 9, 2011

in Calgary, Alberta, Canada, on the topic "Emission Reduction:

Effective, Efficient, Safe and Sustainable";

-- Regional Forum on Flaring Reduction and Gas Utilization held June

17, 2011 in Baku, Azerbaijan, an event organized by the World Bank

led Global Gas Flaring Reduction (GGFR) partnership and SOCAR,

Azerbaijan's national oil company;

-- Global Methane Initiative All-Partnership Meeting in Krakow, Poland

on October 13, 2011 on the topic of "Heat to Power";

-- Global Clean Energy Congress in Calgary, Alberta, Canada on November

2, 2011 on the topic of "Solutions Powered by Clean Combustion"; and

-- Canadian Unconventional Resources Conference in Calgary, Alberta,

Canada on November 15, 2011 on the topic of "Community Engagement"

in relation to its importance to the success of unconventional

reserves development.

-- The Company was selected for Alberta Venture's 2011 Fast Growth 50 list,

an annual ranking honouring fifty of the fastest growing companies in

Alberta. This was the third year in succession that Questor was

selected.

-- Questor's President and Chief Executive Officer, Audrey Mascarenhas, was

the recipient of the Ernst & Young Entrepreneur Of The Year 2011

Prairies Award for the Cleantech and Environmental Services category.

She was also selected by the national judging panel to receive a special

citation in honour of Values-Based Innovation.

SUBSEQUENT TO DECEMBER 31, 2011

At December 31, 2011, the Company had confirmed incinerator sales orders of $1.0

million. Since the beginning of 2012, confirmed incinerator sales orders for an

additional $1.1 million have been received. Of the $2.1 million of associated

revenue to be recorded in relation to these orders, $1.7 million will be

recognized in first quarter 2012 and $0.4 million in second quarter 2012.

The Company is pleased to announce that it is establishing a marketing

arrangement with Global Industrial Dynamics B.V. ("GI Dynamics") to jointly

market Questor's incineration equipment in Europe, Russia, China and Australia.

GI Dynamics is a technology and service provider focused on industrial projects

in gas processing, waste handling and renewable technologies. The company is

headquartered in The Netherlands with representation offices in China and

Australia. The Managing Director of GI Dynamics will be making a presentation

regarding Questor's clean air technologies at the Gas Processors Association

(GPA) Europe Annual Conference 2012 in Berlin, Germany on May 24, 2012.

Ms. Mascarenhas presented at the ACAMP (Alberta Centre for Advanced MNT

Products) Cleantech Technology Seminar 2012 in Calgary, Alberta on March 8, 2012

on the topic of "Clearing the Air! Safely, Economically and Efficiently". She

also made a presentation at the CERBA (Canada Eurasia Russian Business

Association) International Conference on Canada-Eurasia-Russia Cooperation on

Energy Efficiency and Sustainable Development of the Regions in Vancouver,

British Columbia on March 14, 2012 on the topic of "Innovative Technologies in

Energy Efficiency and Environment Protection". Copies of these presentations are

available on the Company's website. On May 9, 2012, Ms. Mascarenhas will present

on the topic of "New Technological and Regulatory Approaches to Addressing

Environmental Challenges around Northern Development in Alberta" at the Country

Special Canada Forum on the Far North: Economic Opportunities, Environmental

Challenges and Scientific Exploration held in conjunction with the IFAT ENTSORGA

Trade Show and Conference in Munich, Germany. A copy of this presentation will

be posted to the Company's website in due course.

The Company also announced today that effective April 25, 2011, subject to

regulatory approval, the grant of share options to select officers, employees

and contractors entitling the purchase of up to 900,000 common shares at $0.28

per share, exercisable for a period of five years and vesting in accordance with

the provisions of the Company's share option plan.

Shareholders are invited to attend the Company's Annual General Meeting to be

held on Tuesday, June 5, 2012 at 3:00 p.m. MDT in the Cardium Room of the

Calgary Petroleum Club, located at 319 - 5th Avenue S.W., Calgary, Alberta. In

addition to the formal business items, management will be presenting an overview

of Questor's results for the financial year ended December 31, 2011 and first

quarter ended March 31, 2012 and discussing the Company's strategic initiatives

for 2012.

Questor's audited financial statements and notes thereto and management's

discussion and analysis for the year ended December 31, 2011 will be available

shortly on the Company's website at www.questortech.com and through SEDAR at

www.sedar.com.

ABOUT QUESTOR TECHNOLOGY INC.

Questor is an international environmental oilfield service company founded in

late 1994 and headquartered in Calgary, Alberta, Canada with a field office

located in Grande Prairie, Alberta, Canada. The Company is focused on clean air

technologies with activities in Canada, the United States, Europe and Asia.

Questor designs and manufactures high efficiency waste gas incinerators for sale

or for use on a rental basis and also provides combustion-related oilfield

services. The Company's proprietary incinerator technology destroys noxious or

toxic hydrocarbon gases which ensures regulatory compliance, environmental

protection, public confidence and reduced operating costs for customers. Questor

is recognized for its particular expertise in the combustion of sour gas (H2S).

While the Company's current customer base is primarily in the oil and gas

industry, this technology is applicable to other industries such as landfills,

water and sewage treatment, tire recycling and agriculture.

Questor trades on the TSX Venture Exchange under the symbol "QST".

Certain information in this news release constitutes forward-looking statements.

When used in this news release, the words "may", "would", "could", "will",

"intend", "plan", "anticipate", "believe", "seek", "propose", "estimate",

"expect", and similar expressions, as they relate to the Company, are intended

to identify forward-looking statements. In particular, this news release

contains forward-looking statements with respect to, among other things,

business objectives, expected growth, results of operations, performance,

business projects and opportunities and financial results. These statements

involve known and unknown risks, uncertainties and other factors that may cause

actual results or events to differ materially from those anticipated in such

forward-looking statements. Such statements reflect the Company's current views

with respect to future events based on certain material factors and assumptions

and are subject to certain risks and uncertainties, including without

limitation, changes in market, competition, governmental or regulatory

developments, general economic conditions and other factors set out in the

Company's public disclosure documents. Many factors could cause the Company's

actual results, performance or achievements to vary from those described in this

news release, including without limitation those listed above. These factors

should not be construed as exhaustive. Should one or more of these risks or

uncertainties materialize, or should assumptions underlying forward-looking

statements prove incorrect, actual results may vary materially from those

described in this news release and such forward-looking statements included in,

or incorporated by reference in this news release, should not be unduly relied

upon. Such statements speak only as of the date of this news release. The

Company does not intend, and does not assume any obligation, to update these

forward-looking statements. The forward-looking statements contained in this

news release are expressly qualified by this cautionary statement.

----------------------------------------------------------------------------

QUESTOR TECHNOLOGY INC.

STATEMENTS OF FINANCIAL POSITION

Stated in Canadian dollars

December 31 December 31 January 1

As at 2011 2010 2010

----------------------------------------------------------------------------

ASSETS

Current assets

Cash $ 2,166,301 $ 3,995,669 $ 3,080,997

Short-term investment 1,007,896 - -

Trade and other receivables 2,852,578 1,873,636 864,260

Inventories 766,028 313,567 433,145

Prepaid expenses and deposits 96,296 107,467 103,428

Current tax assets 73,341 362 306,850

----------------------------------------------------------------------------

Total current assets 6,962,440 6,290,701 4,788,680

----------------------------------------------------------------------------

Non-current assets

Property and equipment 2,053,972 1,037,565 1,188,814

Intangible assets 9,541 10,759 15,682

Deferred tax assets - - 33,377

----------------------------------------------------------------------------

Total non-current assets 2,063,513 1,048,324 1,237,873

----------------------------------------------------------------------------

Total assets $ 9,025,953 $ 7,339,025 $ 6,026,553

----------------------------------------------------------------------------

----------------------------------------------------------------------------

LIABILITIES AND EQUITY

Current liabilities

Trade payables, accrued

liabilities and provisions $ 1,070,989 $ 852,821 $ 348,150

Current portion of borrowings - - 15,232

Deferred revenue and deposits 280,042 146,485 198,641

Current tax liabilities 196,572 230,746 19,034

----------------------------------------------------------------------------

Total current liabilities 1,547,603 1,230,052 581,057

----------------------------------------------------------------------------

Non-current liabilities

Deferred tax liabilities 94,935 58,592 -

Lease inducement 61,099 - -

----------------------------------------------------------------------------

Total non-current liabilities 156,034 58,592 -

----------------------------------------------------------------------------

Total liabilities 1,703,637 1,288,644 581,057

----------------------------------------------------------------------------

Capital and reserves

Issued capital 5,458,215 5,404,966 5,265,736

Reserves 622,226 593,944 573,349

Retained earnings (deficit) 1,241,875 51,471 (393,589)

----------------------------------------------------------------------------

Total equity 7,322,316 6,050,381 5,445,496

----------------------------------------------------------------------------

Total liabilities and equity $ 9,025,953 $ 7,339,025 $ 6,026,553

----------------------------------------------------------------------------

----------------------------------------------------------------------------

----------------------------------------------------------------------------

QUESTOR TECHNOLOGY INC.

STATEMENTS OF COMPREHENSIVE INCOME

Stated in Canadian dollars except per share data

For the years ended December 31 2011 2010

----------------------------------------------------------------------------

Revenue $ 6,093,189 $ 5,787,529

Cost of sales (3,209,802) (3,785,629)

----------------------------------------------------------------------------

Gross profit 2,883,387 2,001,900

Administration expenses (1,548,813) (1,322,834)

Write-off of property and equipment (39,437) -

Depreciation of property and equipment (31,342) (11,641)

Amortization of intangible assets (1,218) (4,923)

Net foreign exchange losses (18,392) (50,551)

Finance costs - (1,012)

Other income 324,593 55,036

----------------------------------------------------------------------------

Profit before tax 1,568,778 665,975

Income tax expense (378,374) (220,915)

----------------------------------------------------------------------------

Profit and total comprehensive income $ 1,190,404 $ 445,060

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Earnings per share

Basic $ 0.048 $ 0.018

Diluted $ 0.048 $ 0.018

----------------------------------------------------------------------------

----------------------------------------------------------------------------

QUESTOR TECHNOLOGY INC.

STATEMENTS OF CHANGES IN EQUITY

Stated in Canadian dollars

Retained

Issued (deficit)

capital Reserves earnings Total equity

----------------------------------------------------------------------------

Balance at January 1,

2010 $ 5,265,736 $ 573,349 $ (393,589) $ 5,445,496

Profit and total

comprehensive income - - 445,060 445,060

Recognition of share-

based payments - 89,825 - 89,825

Issue of ordinary

shares under employee

share option plan 139,230 (69,230) - 70,000

----------------------------------------------------------------------------

Balance at December 31,

2010 5,404,966 593,944 51,471 6,050,381

----------------------------------------------------------------------------

Profit and total

comprehensive income - - 1,190,404 1,190,404

Recognition of share-

based payments - 54,531 - 54,531

Issue of ordinary

shares under employee

share option plan 53,249 (26,249) - 27,000

----------------------------------------------------------------------------

Balance at December 31,

2011 $ 5,458,215 $ 622,226 $ 1,241,875 $ 7,322,316

----------------------------------------------------------------------------

----------------------------------------------------------------------------

----------------------------------------------------------------------------

QUESTOR TECHNOLOGY INC.

STATEMENTS OF CASH FLOWS

Stated in Canadian dollars

For the years ended December 31 2011 2010

----------------------------------------------------------------------------

Cash flows (used in) from operating activities

Profit and total comprehensive income for the

year $ 1,190,404 $ 445,060

Adjustments for:

Income tax expense 378,374 220,915

Finance costs - 1,012

Write-off of property and equipment 39,437 -

Depreciation of property and equipment 227,034 187,688

Amortization of intangible assets 1,218 4,923

Net unrealized foreign exchange gains (102,361) (61,316)

Expense recognized in respect of equity-

settled share-based payments 54,531 89,825

Write-downs of inventories to net realizable

value 5,001 16,006

----------------------------------------------------------------------------

1,793,638 904,113

Movements in non-cash working capital (2,076,211) (342,263)

----------------------------------------------------------------------------

Cash (used in) generated from operations (282,573) 561,850

Income taxes (paid) refunded (278,710) 264,331

----------------------------------------------------------------------------

Net cash (used in) generated from operating

activities (561,283) 826,181

----------------------------------------------------------------------------

Cash flows (used in) from investing activities

Payments for property and equipment (1,411,014) (36,439)

Proceeds from disposal of property and

equipment 3,200 -

Interest paid - (1,012)

----------------------------------------------------------------------------

Net cash used in investing activities (1,407,814) (37,451)

----------------------------------------------------------------------------

Cash flows from financing activities

Repayment of borrowings - (15,232)

Proceeds from issue of ordinary shares under

employee share option plan 27,000 70,000

----------------------------------------------------------------------------

Net cash from financing activities 27,000 54,768

----------------------------------------------------------------------------

Net (decrease) increase in cash (1,942,097) 843,498

Cash at beginning of the year 3,995,669 3,080,997

Effects of exchange rate changes on the

balance of cash held in foreign currencies 112,729 71,174

----------------------------------------------------------------------------

Cash at end of the year $ 2,166,301 $ 3,995,669

----------------------------------------------------------------------------

----------------------------------------------------------------------------

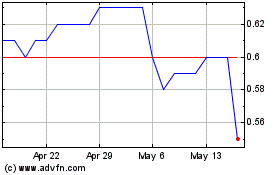

Questor Technology (TSXV:QST)

Historical Stock Chart

From Apr 2024 to May 2024

Questor Technology (TSXV:QST)

Historical Stock Chart

From May 2023 to May 2024