THIS DOCUMENT IS NOT INTENDED FOR DISSEMINATION OR DISTRIBUTION IN THE UNITED

STATES.

Questor Technology Inc. ("Questor" or the "Company") (TSX VENTURE:QST) announced

today its financial and operating results for the first quarter of 2013. The

Company reported a profit of $417,084 ($0.017per basic share) for the three

months ended March 31, 2013 compared to a profit of $487,438 ($0.020 per basic

share) for the same three-month period of the prior year.

The decrease in profit was due primarily to lower revenues arising out of

differences in the volume and mix of incinerator sales and utilization of the

fleet of rental incinerators in each quarter, offset in part by the stronger

margins achieved in the current quarter. Net foreign exchange gains recorded in

the first quarter of 2013 compared to foreign exchanges losses in the

comparative period of 2012, lower research and development expenditures and

lower income tax expense also contributed in reducing the impact of the lower

revenues on operating results.

FINANCIAL HIGHLIGHTS SUMMARY

(Stated in Canadian dollars except per share amounts)

Increase

For the three months ended March 31 2013 2012 (decrease)

----------------------------------------------------------------------------

Revenue 1,719,577 2,230,875 (511,298)

Gross profit(1) 890,441 1,053,700 (163,259)

EBITDA(1) 656,220 727,329 (71,109)

Profit and total comprehensive

income 417,084 487,438 (70,354)

Cost of sales as a percent of

revenue(1) 48.2% 52.8% (4.6%)

Cash generated from operations

before movements in non-cash

working capital(1) 662,405 774,985 (112,580)

March 31, December 31, Increase

As at 2013 2012 (decrease)

----------------------------------------------------------------------------

Total assets 10,439,573 9,798,449 641,124

Non-current liabilities 280,034 250,065 29,969

Shares outstanding(2)

Basic 25,007,370 24,869,255 138,115

Diluted 25,225,542 25,144,794 80,748

Earnings per share - Basic 0.017 0.020 (0.003)

Earnings per share - Diluted 0.017 0.019 (0.002)

----------------------------------------------------------------------------

(1) Non-IFRS financial measure. Please see discussion in the Non-IFRS

Financial Measures section of the Company's Management's Discussion and

Analysis for the three months ended March 31, 2013.

(2) Weighted average.

"Although our revenues are lower this quarter in comparison to the previous year

quarter, this is not a reflection of the expected performance for this year. We

have confirmed orders for incinerator sales of $4.0 million to date of which

only $1.2 million was recognized in first quarter 2013. We have taken

significant steps this first quarter of 2013, setting the stage for a very

active second quarter and balance of the year," said Audrey Mascarenhas,

President and Chief Executive Officer. "We completed the construction of units

that we had intended for our rental fleet, but are instead being sold to

customers to meet their timing requirements in Q2. We moved forward on several

joint venture arrangements for the construction of our units in Europe which

will prove to be a strategic location to also serve the Russian and Middle East

markets. Questor has appointed a Vice President Business Development which has

resulted in a series of productive meetings and discussions with both our US and

Canadian clients. We are supporting our clients in their quest for social

license to operate with our technology solution addressing community flaring

concerns that have attracted significant public attention."

"As the impact of the new emission standards in the United States becomes more

well understood, interest in our incineration technology has continued to grow.

In addition, regulation in Europe is becoming increasingly focused on emissions

and some countries have begun to disallow open flaring, thereby creating

opportunities for Questor.

As we move through 2013 we expect to see substantial growth in the sale and

rental of our units as the marketplace recognizes the operational, environmental

and economic benefits Questor's clean air solutions offer. Our focus will be on

increasing our operating capacity to meet this demand." concluded Ms.

Mascarenhas.

Shareholders are invited to attend the Company's Annual General Meeting to be

held on Tuesday, June 4, 2013 at 3:00 p.m. MDT in Questor's Boardroom at 1121

940 - 6th Avenue S.W., Calgary, Alberta. In addition to the formal business

items, management will be presenting an overview of Questor's results for the

financial year ended December 31, 2012 and first quarter ended March 31, 2013

and discussing the Company's strategic initiatives for 2013.

Questor's unaudited condensed financial statements and notes thereto and

management's discussion and analysis for the three months ended March 31, 2013

will be available shortly on the Company's website at www.questortech.com and

through SEDAR at www.sedar.com.

ABOUT QUESTOR TECHNOLOGY INC.

Questor is an international environmental oilfield service company founded in

late 1994 and headquartered in Calgary, Alberta, Canada with a field office

located in Grande Prairie, Alberta. The Company is focused on clean air

technologies with activities in Canada, the United States, Europe and Asia.

Questor designs and manufactures high efficiency waste gas incinerators for sale

or for use on a rental basis and also provides combustion-related oilfield

services. The Company's proprietary incinerator technology destroys noxious or

toxic hydrocarbon gases which ensures regulatory compliance, environmental

protection, public confidence and reduced operating costs for customers. Questor

is recognized for its particular expertise in the combustion of sour gas (H2S).

While the Company's current customer base operates primarily in the oil and gas

industry, this technology is applicable to other industries such as landfills,

water and sewage treatment, tire recycling and agriculture.

Questor trades on the TSX Venture Exchange under the symbol "QST".

Certain information in this news release constitutes forward-looking statements.

When used in this news release, the words "may", "would", "could", "will",

"intend", "plan", "anticipate", "believe", "seek", "propose", "estimate",

"expect", and similar expressions, as they relate to the Company, are intended

to identify forward-looking statements. In particular, this news release

contains forward-looking statements with respect to, among other things,

business objectives, expected growth, results of operations, performance,

business projects and opportunities and financial results. These statements

involve known and unknown risks, uncertainties and other factors that may cause

actual results or events to differ materially from those anticipated in such

forward-looking statements. Such statements reflect the Company's current views

with respect to future events based on certain material factors and assumptions

and are subject to certain risks and uncertainties, including without

limitation, changes in market, competition, governmental or regulatory

developments, general economic conditions and other factors set out in the

Company's public disclosure documents. Many factors could cause the Company's

actual results, performance or achievements to vary from those described in this

news release, including without limitation those listed above. These factors

should not be construed as exhaustive. Should one or more of these risks or

uncertainties materialize, or should assumptions underlying forward-looking

statements prove incorrect, actual results may vary materially from those

described in this news release and such forward-looking statements included in,

or incorporated by reference in this news release, should not be unduly relied

upon. Such statements speak only as of the date of this news release. The

Company does not intend, and does not assume any obligation, to update these

forward-looking statements. The forward-looking statements contained in this

news release are expressly qualified by this cautionary statement.

----------------------------------------------------------------------------

QUESTOR TECHNOLOGY INC.

CONDENSED STATEMENTS OF FINANCIAL POSITION

Stated in Canadian dollars

Unaudited

March 31 December 31

As at 2013 2012

----------------------------------------------------------------------------

ASSETS

Current assets

Cash and cash equivalents $ 4,827,269 $ 4,405,624

Trade and other receivables 2,318,471 2,304,478

Inventories 1,136,229 670,959

Prepaid expenses and deposits 66,212 88,378

Current tax assets 48,182 25,158

----------------------------------------------------------------------------

Total current assets 8,396,363 7,494,597

----------------------------------------------------------------------------

Non-current assets

Property and equipment 2,035,192 2,295,529

Intangible assets 8,018 8,323

----------------------------------------------------------------------------

Total non-current assets 2,043,210 2,303,852

----------------------------------------------------------------------------

Total assets $ 10,439,573 $ 9,798,449

----------------------------------------------------------------------------

----------------------------------------------------------------------------

LIABILITIES AND EQUITY

Current liabilities

Trade payables, accrued liabilities and

provisions $ 919,535 $ 894,206

Deferred revenue and deposits 50,905 2,205

Current tax liabilities 273,153 171,907

----------------------------------------------------------------------------

Total current liabilities 1,243,593 1,068,318

----------------------------------------------------------------------------

Non-current liabilities

Deferred tax liabilities 104,375 97,319

Lease inducement 175,659 152,746

----------------------------------------------------------------------------

Total non-current liabilities 280,034 250,065

----------------------------------------------------------------------------

Total liabilities 1,523,627 1,318,383

----------------------------------------------------------------------------

Capital and reserves

Issued capital 5,521,001 5,521,001

Reserves 695,630 676,834

Retained earnings 2,699,315 2,282,231

----------------------------------------------------------------------------

Total equity 8,915,946 8,480,066

----------------------------------------------------------------------------

Total liabilities and equity $ 10,439,573 $ 9,798,449

----------------------------------------------------------------------------

----------------------------------------------------------------------------

See accompanying notes to the unaudited condensed financial statements.

----------------------------------------------------------------------------

QUESTOR TECHNOLOGY INC.

CONDENSED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

Stated in Canadian dollars except per share data

Unaudited

For the three months ended March 31 2013 2012

----------------------------------------------------------------------------

Revenue $ 1,719,577 $ 2,230,875

Cost of sales (829,136) (1,177,175)

----------------------------------------------------------------------------

Gross profit 890,441 1,053,700

Administration expenses (353,550) (353,444)

Net foreign exchange gains (losses) 44,997 (34,413)

Depreciation of property and equipment (10,740) (10,322)

Amortization of intangible assets (305) (305)

Write-off of property and equipment - (2,768)

Other income 4,675 4,705

----------------------------------------------------------------------------

Profit before tax 575,518 657,153

Income tax expense (158,434) (169,715)

----------------------------------------------------------------------------

Profit and total comprehensive income $ 417,084 $ 487,438

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Earnings per share

Basic $ 0.017 $ 0.020

Diluted $ 0.017 $ 0.019

----------------------------------------------------------------------------

----------------------------------------------------------------------------

QUESTOR TECHNOLOGY INC.

CONDENSED STATEMENTS OF CHANGES IN EQUITY

Stated in Canadian dollars

Unaudited

Issued Retained

capital Reserves earnings Total equity

----------------------------------------------------------------------------

Balance at January 1,

2013 $ 5,521,001 $ 676,834 $ 2,282,231 $ 8,480,066

Profit and total

comprehensive income - - 417,084 417,084

Recognition of share-

based payments - 18,796 - 18,796

Issue of ordinary

shares under

employee share

option plan - - - -

----------------------------------------------------------------------------

Balance at March 31,

2013 $ 5,521,001 $ 695,630 $ 2,699,315 $ 8,915,946

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Balance at January 1,

2012 $ 5,458,215 $ 622,226 $ 1,241,875 $ 7,322,316

Profit and total

comprehensive income - - 487,438 487,438

Recognition of share-

based payments - 9,281 - 9,281

Issue of ordinary

shares under

employee share

option plan - - - -

----------------------------------------------------------------------------

Balance at March 31,

2012 $ 5,458,215 $ 631,507 $ 1,729,313 $ 7,819,035

----------------------------------------------------------------------------

----------------------------------------------------------------------------

----------------------------------------------------------------------------

QUESTOR TECHNOLOGY INC.

CONDENSED STATEMENTS OF CASH FLOWS

Stated in Canadian dollars

Unaudited

For the three months ended March 31 2013 2012

----------------------------------------------------------------------------

Cash flows from operating activities

Profit and total comprehensive income $ 417,084 $ 487,438

Adjustments for:

Income tax expense 158,434 169,715

Write-off of property and equipment - 2,768

Depreciation of property and equipment 80,397 69,871

Amortization of intangible assets 305 305

Net unrealized foreign exchange (gains) losses (12,611) 35,607

Expense recognized in respect of equity-settled

share-based payments 18,796 9,281

----------------------------------------------------------------------------

662,405 774,985

Movements in non-cash working capital (156,651) 1,414,553

----------------------------------------------------------------------------

Cash generated from operations 505,754 2,189,538

Income taxes paid - (280,061)

----------------------------------------------------------------------------

Net cash generated from operating activities 505,754 1,909,477

----------------------------------------------------------------------------

Cash flows used in investing activities

Payments for property and equipment (90,355) (152,502)

----------------------------------------------------------------------------

Net cash used in investing activities (90,355) (152,502)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Cash flows from financing activities - -

----------------------------------------------------------------------------

Net increase in cash 415,399 1,756,975

Cash at beginning of the period 4,405,624 2,166,301

Effects of exchange rate changes on the balance of

cash held in foreign currencies 6,246 (31,522)

----------------------------------------------------------------------------

Cash at end of the period $ 4,827,269 $ 3,891,754

----------------------------------------------------------------------------

----------------------------------------------------------------------------

FOR FURTHER INFORMATION PLEASE CONTACT:

Questor Technology Inc.

Audrey Mascarenhas

President and Chief Executive Officer

(403) 571-1530

(403) 571-1539 (FAX)

amascarenhas@questortech.com

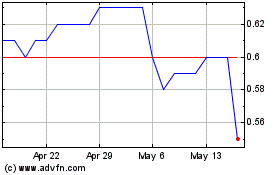

Questor Technology (TSXV:QST)

Historical Stock Chart

From Dec 2024 to Jan 2025

Questor Technology (TSXV:QST)

Historical Stock Chart

From Jan 2024 to Jan 2025