Redstar Closes $3.3 Million Private Placement

29 May 2014 - 1:30AM

Access Wire

Vancouver, BC / ACCESSWIRE / May 28,

2014 / Redstar Gold Corp (TSX.V:RGC) ("Redstar" or the "Company")

announces it has closed its previously announced non-brokered

private placement of 55,133,333 units at a price of $0.06 per unit

for gross proceeds of $3.31 million. Proceeds from the placement

will be used to advance the Company's Unga gold project in Alaska

and for general working capital. A surface work program on Unga is

planned for this summer, to be followed by a drilling program later

this year, and into 2015.

The Company is pleased to report

that institutional participation in the private placement was very

strong, representing 89% of this capital raise. Investment firms

from the United States, Britain and Switzerland have become new

Redstar shareholders. Geologic Resource Partners LLC a leading

mining investment fund based in Boston acquired 28,333,333 units

representing approximately 15.7% of the Company's issued and

outstanding shares following the closing of the placement. Also

participating in the placement were three (3) highly respected

European fund managers. Redstar believes that the high quality of

this institutional investor group participating in this financing

is further testimony of the potential of Redstar's mineral

assets.

Additionally, Redstar's Chairman,

Jacques Vaillancourt through wholly owned Mount Everest Finance SA,

participated in the financing purchasing 2.5 million units and

separately purchased 1.9 million shares in the open market thereby

increasing his holdings by 4.4 million shares to 25.4 million

shares.

Each unit consists of one common

share and two transferable 1/2 common share purchase warrants

(Warrant A & Warrant B). Each whole (1) Warrant A can be

exercised into one (1) common share of Redstar at a price of $0.09

per share for a period of 12 months from the closing.

Each whole (1) Warrant B can be exercised into one (1) common share

of Redstar at a price of $0.12 per share for a period

of 30 months from the closing. If 18 months after closing Redstar

common shares trade at a 33.3% premium to the warrant exercise

price (i.e. $0.16) for 10 consecutive trading days then the Company

can force warrant holders to exercise their Warrant B into Redstar

shares. All securities issued under the

placement are subject to restrictions on resale to September 28,

2014.

The Company has paid finders' fees

in the amount of $64,080 to finders who

introduced subscribers to the placement, pursuant to the policies

of the TSX.V.

About Redstar

Redstar is a junior exploration company focused on gold

exploration in North America. The Company's main project is the

Unga Project in southwestern Alaska which contains high-grade

gold-silver vein systems. Redstar is the first company to

consolidate two strategic contiguous land positions at Unga

allowing for comprehensive district-scale exploration for the first

time. The Shumagin property contains the Shumagin vein with a

historic (non 43-101 compliant) resource estimate of 254,000 tonnes grading 27.4 g/t gold and 127

g/t silver (SRK Consulting, 2000)* based in shallow drilling

in the 1980's. The Shumagin property also contains the Apollo mine,

Alaska's first major underground gold mine, which produced

approximately 150,000 ounces of gold between 1890 and 1922 from

shallow oxide ore in high-grade gold veins. Mineralization along

both the Shumagin and Apollo veins remains open at depth and along

strike. Both veins lie along poorly-explored, district-scale

mineralized vein trends, each extending for 7-9km. The second

property, Unga-Popof, contains the extensions to the Shumagin and

Apollo veins as well as additional vein fields with high-grade

Au-Ag along the broader Apollo and Shumagin trends. In addition to

Apollo-Sitka, Shumigan and Unga-Popof there are several other

structures on the Property which have been sampled and indicate

good potential for high grade gold mineralization in veins.

Redstar also holds 50% of the Newman

Todd Project in Red Lake Ontario. Newman Todd is a high- grade gold

discovery in the mineralization along a 1.8Km corridor within the

Newman Todd Structure ("NTS"). The gold mineralization in the NTS

remains open along strike and at depth. Additionally, the Company

has 10 properties in Nevada which have been optioned out and upon

which Redstar has retained royalties and additional economic

rights.

*A qualified

person has not done sufficient work to classify the historical

estimate as current mineral resources, the Company is not treating

the historical estimate as current mineral resources and the

historical estimate should not be relied

upon.

On Behalf of the Board,

Redstar Gold

Corp.

"Ken

Booth"

Ken Booth

President and CEO

-----------------------------------------------------------------------

|TSX.V:RGC |CORPORATE INQUIRIES |

|WWW.REDSTARGOLD.COM |Redstar Gold Corp. |

|SUITE 615 |Tim Mikula, Business Development |

|800 WEST PENDER STREET|Tel: 604.488.0051 |

|VANCOUVER, BC | tmikula@redstargold.com|

|TEL: 604.488.0051 | |

-----------------------------------------------------------------------

Neither TSX Venture

Exchange nor its Regulation Services Provider (as that term is

defined in the policies of the TSX Venture Exchange) accepts

responsibility for the adequacy or accuracy of this release.

Forward-Looking Information This

release includes certain statements that may be deemed

"forward-looking statements". All statements in this release, other

than statements of historical facts, that address events or

developments that Redstar Gold Corporation (the "Company") expects

to occur, are forward-looking statements. Forward-looking

statements are statements that are not historical facts and are

generally, but not always, identified by the words "expects",

"plans", "anticipates", "believes", "intends", "estimates",

"projects", "potential" and similar expressions, or that events or

conditions "will", "would", "may", "could" or "should" occur.

Although the Company believes the expectations expressed in such

forward-looking statements are based on reasonable assumptions,

such statements are not guarantees of future performance and actual

results may differ materially from those in the forward-looking

statements. Factors that could cause the actual results to differ

materially from those in forward-looking statements include market

prices, exploitation and exploration successes, and continued

availability of capital and financing, and general economic, market

or business conditions. Investors are cautioned that any such

statements are not guarantees of future performance and actual

results or developments may differ materially from those projected

in the forward-looking statements. Forward-looking statements are

based on the beliefs, estimates and opinions of the Company's

management on the date the statements are made. Except as required

by applicable securities laws, the Company undertakes no obligation

to update these forward-looking statements in the event that

management's beliefs, estimates or opinions, or other factors,

should change.

SOURCE: Redstar Gold Corp

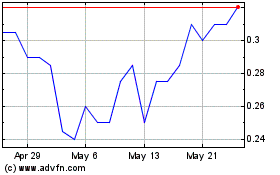

Relevant Gold (TSXV:RGC)

Historical Stock Chart

From Nov 2024 to Dec 2024

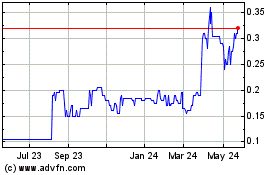

Relevant Gold (TSXV:RGC)

Historical Stock Chart

From Dec 2023 to Dec 2024