Rio2 Limited (“Rio2” or “the Company”) (TSXV: RIO; OTCQX: RIOFF;

BVL: RIO) is providing an outline of its plans to complete the

financing for the construction of the Fenix Gold Project (“the

Project”) in Chile.

The plan includes appointing an independent

financial advisor, completing a Feasibility Study on the

development of the Fenix Gold Project, reviewing and restructuring

the precious metals purchase agreement with Wheaton Precious Metals

International Ltd and re-engaging with lenders for the senior

project debt facility of the Project construction financing.

APPOINTMENT OF INDEPENDENT FINANCIAL

ADVISOR

Rio2 has appointed Endeavour Financial

(“Endeavour”) to provide financial advisory services with respect

to the financing and construction of the Fenix Gold Mine.

Endeavour will work closely with Rio2 board and

management in developing the optimum financing solution for the

Fenix Gold Project given the Project's current status. Endeavour

will provide a full-service approach to the financial advisory,

which includes the review and restructuring of the existing

precious metals purchase agreement, technical guidance during the

completion of the Feasibility Study and dealing with lenders on the

debt component of the financing.

FENIX GOLD FEASIBILITY

STUDY

An updated Pre-Feasibility Study was prepared

for the Fenix Gold Project in August 2019 and amended and restated

on August 3, 2021.

Since that date, and over the course of H1 2022,

the Company completed detailed engineering and updated cost

estimates for the purpose of financing discussions with lenders for

the construction of the Project. Discussions with lenders were

halted on July 5, 2022, when the approval of the Project’s

Environmental Impact Assessment (“EIA”) was formally declined by

the Chilean Government. Given the Project's current status, the

Company has decided to incorporate the detailed engineering into a

new study and update operating and capital costs to reflect today’s

cost environment. The gold price will also be updated to a more

appropriate level, given the August 2019 study was based on a gold

price of $1,250. This new study will be completed to a Feasibility

level and is expected to be completed and published by the end of

Q2, 2023. The Feasibility Study will be a key document for

consideration by the Project’s potential lenders.

PRECIOUS METALS PURCHASE

AGREEMENT

On March 29, 2022, Rio2 announced that it had

received a deposit payment of US$25,000,000 from Wheaton Precious

Metals International Ltd. (“WPMI”) in connection with the

previously announced precious metals purchase agreement on Rio2’s

Fenix Gold Project in Chile (the “Gold Stream”).

Under the Gold Stream, WPMI will purchase 6.0%

of the gold production until 90,000 ounces of gold have been

delivered, thereafter dropping to 4.0% of the gold production until

140,000 ounces of gold have been delivered, after which the Gold

Stream will reduce to 3.5% of the gold production for the life of

mine from the Fenix Gold Project. In addition, WPMI will make

ongoing production payments for gold ounces delivered equal to 18%

of the spot gold price until the value of gold delivered to WPMI

less the production payments is equal to the total upfront

consideration payable by WPMI under the Gold Stream of US$50

million, at which point the production payment will increase to 22%

of the spot gold price. As part of the agreement, a second deposit

of US$25,000,000 was to be paid to Rio2 following the receipt of

the EIA approval for the Fenix Gold Project, and subject to the

satisfaction of certain other customary conditions.

As the approval of the EIA was declined by the

Chilean Government on July 5, 2022, the timing and completion dates

of the construction and eventual production of the Fenix Gold

Project are currently unknown. Given this uncertainty, Rio2, in

close consultation with Endeavour Financial, is planning to revise

and restructure the agreement with WPMI as soon as practicable.

DISCUSSIONS WITH LENDERS

Discussions with potential lenders were well

advanced prior to the negative EIA decision by the Chilean

Government on July 5, 2022.

Technical due diligence was almost completed by

independent experts acting on behalf of the lenders before July. On

receipt of the negative EIA decision, it was decided with the

lenders that the due diligence work be put on hold, with

reactivation expected once the planned Feasibility Study is

completed.

Despite the suspension of activities pertaining

to the construction of the Project, Rio2 is encouraged that lenders

are still showing interest in participating in financing the Fenix

Gold Mine construction.

STATUS OF ADMINISTRATIVE APPEAL

PROCESS

On August 31, 2022, Rio2’s local subsidiary

Fenix Gold Limitada (“Fenix Gold”), decided to exercise its right

to file an administrative appeal before the Ministries Committee.

The Ministries Committee is composed of the Ministries of

Environment (Chairman), Health, Economy, Agriculture, Energy and

Mining. The national director of the Environmental Assessment

Service (“SEA”) is the secretary of the Committee.

The basis of the administrative appeal is based

on the following key findings:

|

(a) |

The Fenix Gold

Project was presented for environmental assessment through an EIA,

which is the most stringent instrument contemplated by Chilean

Environmental Law. The EIA also included a successful public

consultation process and successful special consultation process

for indigenous communities, under the rules of the OIT No. 169

International Convention. The rejection of the EIA is not based on

legal incompatibilities that cannot be overcome, but on the need,

according to the authorities´ view, to provide additional

information to discard potential impacts to Chinchilla chinchilla,

Lama guanicoe and Vicugna vicugna; |

|

(b) |

Fenix Gold provided quality information in the EIA to

demonstrate there were no significant risks to the aforementioned

fauna species. This finding was incrementally strengthened and

supported during the process through additional monitoring

campaigns and data compilation, in direct response to the

authorities’ requests; |

|

(c) |

The monitoring campaigns and technical information produced by

Fenix Gold and its external advisors were prepared using the

methodologies and guidelines established by the authorities and

consistent with similar precedents in the area; |

|

(d) |

Certain requests or observations from the authorities,

incorrectly referred to by SEA as “not addressed” by Fenix Gold,

were made after the assessment process was closed, in which it is

not legally possible for the Company to present additional answers.

Making requests or observations after the EIA process is closed is

not consistent with the nature and rules of the environmental

impact assessment process. |

As a result of these key findings, Rio2 is of

the view that the rejection of the Project is not consistent with

the environmental assessment process that took place, and,

therefore, the Company believes there are strong legal and

technical grounds for seeking the review of the rejection of the

EIA before the Ministries Committee, which has the faculties to

reverse the decision made at the regional level.

It should be noted that the administrative

appeal is not a judicial process, and the decision of the

Ministries Committee may be subjective and not consider the

technical and legal arguments of the EIA decision being appealed.

Should Rio2 receive a negative decision from the appeal, the

Company will take the matter to a judicial level and vigorously

defend its legal rights to having the decision overturned.

In parallel with the administrative process,

Rio2 is conducting additional monitoring studies of the fauna in

the Project area to provide supporting information for the appeal

process. A list of additional voluntary commitments has been

developed to help address any remaining concerns that the

authorities may require to guarantee the sustainable execution of

the Project. The Company believes this additional work will provide

a positive contribution during the administrative appeal

process.

Timing for the administrative appeal has yet to

be formally communicated to Rio2 management.

FENIX GOLD PROJECT

The Fenix Gold Project is one of the largest

undeveloped gold oxide, heap leach projects in the Americas,

hosting a Measured and Indicated mineral resource (as such term is

defined in National Instrument 43-101 -Standards of Disclosure for

Mineral Projects, “NI 43-101”) of 5 Million ounces

of gold which the Company believes will make a positive

contribution to the Atacama Region and Chile. The Project is an

example of modern gold mining where a full complement of technical,

environmental, and social considerations has been consulted on and

designed in from the outset. The Project represents a significant

investment in the gold mining business in Chile by a junior mining

company of approximately US$210M of initial and sustaining capital

and will generate employment for at least 1,200 people during the

construction phase and 550 people during the 17 years operations

phase. The mine being contemplated at the Project will be a

run-of-mine heap leach operation; no crushing or tailings storage

facilities are required, thereby minimizing the overall impact and

footprint of the Project.

TECHNICAL INFORMATION

The scientific and technical content of this

news release has been reviewed, approved and verified by Enrique

Garay, MSc. P. Geo (AIG Member), a consultant to Rio2 Limited, who

is a QP under NI 43-101 has also reviewed, approved and verified

the scientific and technical content of this news release. For

additional information regarding the Project, including key

parameters, assumptions and risks associated with its development,

see the independent technical report entitled “Updated

Pre-Feasibility Study for the Fenix Gold Project, Atacama, III

Region, Chile” dated August 3, 2021, with an effective date of

August 15, 2019, a copy of which document is available under Rio2’s

SEDAR profile at www.sedar.com

ABOUT RIO2 LIMITED

Rio2 is a mining company with a focus on

development and mining operations with a team that has proven

technical skills as well as a successful capital markets track

record. Rio2 is focused on taking its Fenix Gold Project in Chile

to production in the shortest possible timeframe based on a staged

development strategy. Rio2 and its wholly owned subsidiary, Fenix

Gold Limitada, are companies with the highest environmental

standards and responsibility with the firm conviction that it is

possible to develop mining projects that respect the three axes

(Social, Environment, and Economics) of sustainable development. As

related companies, we reaffirm our commitment to apply

environmental standards beyond those that are mandated by

regulators, seeking to protect and preserve the environment of the

territories that we operate in.

ABOUT ENDEAVOUR FINANCIAL

Endeavour Financial, with offices in London, UK,

George Town, Cayman Islands and Vancouver, British Columbia, is one

of the top mining financial advisory firms, with a record of

success in the mining industry, specializing in arranging

multi-sourced funding solutions for development-stage companies.

Founded in 1988, Endeavour Financial has a well-established

reputation of achieving success with over US$500 million in royalty

and stream finance, US$4 billion in debt finance and US$28 billion

in mergers and acquisitions. The Endeavour Financial team has

diverse experience in both natural resources and finance, including

investment bankers, geologists, mining engineers, cash flow

modelers and financiers.

Forward-Looking Statements

This news release contains forward-looking

statements and forward-looking information (collectively

“forward-looking information”) within the meaning of applicable

securities laws relating to Rio2’s planned development of the

Project and other aspects of Rio2’s anticipated future operations

and plans. In addition, without limiting the generality of the

foregoing, this news release contains forward-looking information

pertaining to the following: the development of financing solution

for the Fenix Gold Project given the Project's current status; the

preparation of a new study in respect of the feasibility of the

Fenix Gold Project; the potential revision and restructuring of the

Gold Stream; discussions with potential lenders who may participate

in the financing of the Fenix Gold Project; Rio2’s appeal of the

decision of the SEA to not approve Rio2’s EIA and the related

undertaking of additional studies of the fauna in the area of the

Fenix Gold Project; the potential development of a mine at the

Project and the expected capital investment required for such mine;

development and operating plans; certain anticipated economic

benefits of a mine at the Project to the local region and other

matters ancillary or incidental to the foregoing.

All statements included herein, other than

statements of historical fact, may be forward-looking information

and such information involves various risks and uncertainties.

Forward-looking information is often, but not always, identified by

the use of words such as “seek”, “anticipate”, “plan”, “continue”,

“estimate”, “expect”, “may”, “will”, “project”, “predict”,

“potential”, “targeting”, “intend”, “could”, “might”, “should”,

“believe”, and similar expressions. The forward-looking information

is based on certain key expectations and assumptions made by Rio2’s

management which may prove to be incorrect, including but not

limited to: expectations concerning the preparation and timing for

completion of the new study in respect of the Fenix Gold Project;

expectations concerning revision and restructuring of the Gold

Stream; expectations concerning the appeal of the decision of the

SEA to not approve Rio2’s EIA; expectations regarding the

availability of debt financing; expectations concerning prevailing

commodity prices, exchange rates, interest rates, applicable

royalty rates and tax laws; capital efficiencies; legislative and

regulatory environment of Chile; future production rates and

estimates of capital and operating costs; estimates of reserves and

resources; anticipated results of capital expenditures; the

sufficiency of capital expenditures in carrying out planned

activities; performance; the availability and cost of financing,

labor and services; and Rio2’s ability to access capital on

satisfactory terms.

Rio2 believes the expectations reflected in

these forward-looking statements are reasonable, but no assurance

can be given that these expectations will prove to be correct and

such forward-looking statements in this news release should not be

unduly relied upon. A description of assumptions used to develop

such forward-looking information and a description of risk factors

that may cause actual results to differ materially from

forward-looking information can be found in Rio2's disclosure

documents on the SEDAR website at www.sedar.com. These risks and

uncertainties include, but are not limited to: risks and

uncertainties relating to the completion of the financings as

described herein, and management’s ability to anticipate and manage

the factors and risks referred to herein. Forward-looking

statements included in this news release are made as of the date of

this news release and such information should not be relied upon as

representing its views as of any date after the date of this news

release. Rio2 has attempted to identify important factors that

could cause actual results, performance or achievements to vary

from those current expectations or estimates expressed or implied

by the forward-looking information. However, there may be other

factors that cause results, performance or achievements not to be

as expected or estimated and that could cause actual results,

performance or achievements to differ materially from current

expectations. Rio2 disclaims any intention or obligation to update

or revise any forward-looking statements, whether as a result of

new information, future events or otherwise, except as expressly

required by applicable securities legislation.

To learn more about Rio2 Limited, please visit:

www.rio2.com or Rio2's SEDAR profile at www.sedar.com.

ON BEHALF OF THE BOARD OF RIO2 LIMITED

Alex BlackExecutive ChairmanEmail:

alex.black@rio2.com Tel: +51 99279 4655

Kathryn JohnsonExecutive Vice President, CFO

& Corporate SecretaryEmail: kathryn.johnson@rio2.com Tel: +1

604 762 4720

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts the responsibility for the adequacy

or accuracy of this release.

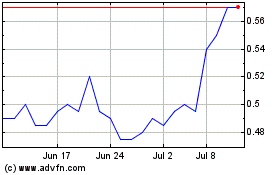

Rio2 (TSXV:RIO)

Historical Stock Chart

From Nov 2024 to Dec 2024

Rio2 (TSXV:RIO)

Historical Stock Chart

From Dec 2023 to Dec 2024