Rubicon Organics Inc. (TSXV: ROMJ) (OTCQX: ROMJF) (“Rubicon

Organics”, “Rubicon”, or the “Company”), a licensed producer

focused on cultivating and selling organic certified, premium

cannabis, today reported its financial results for the three months

ended March 31, 2024 (“Q1 2024”). All amounts are expressed in

Canadian dollars.

“Rubicon Organics holds the #1 premium position

in Canada and is poised for growth with the launch of our full

spectrum extract vapes line tapping into the highest growth segment

in Canada. With a focus on quality, we are confident that our vape

launch will not only drive revenue growth but also solidify our

position as a leader in the Canadian cannabis market.

“We anticipated a challenging Q1 due to typical

seasonality and the overhang of weak consumer sentiment from 2023.

I expect to recover from this temporary dip from our streak of

positive Adjusted EBITDA in Q2. In Q1, a changing product mix

reduced our gross margin, but this spring we've shifted focus to

higher-margin products, expecting improved results in Q2 and

beyond. Our Q1 working capital investment for product launches is

expected to come to fruition delivering further net revenue growth

starting in Q2. Additionally, our first-half results are influenced

by the ongoing one-time ERP implementation”, said Margaret Brodie,

CEO.

1 Adjusted EBITDA is a non-GAAP measure that is

calculated as earnings (losses) from operations before interest,

tax, depreciation and amortization, share-based compensation

expense, and fair value changes. Included in Adjusted EBITDA in the

three months ended March 31, 2024 is $0.3 million of one-time costs

incurred for the ERP implementation project. See Non-GAAP Financial

Measures for details on the Adjusted EBITDA calculation. 2 Hifyre

data for premium products covering flower, pre-rolled products,

concentrates, edibles, topicals, and vapes for the three months

ended March 31, 20243 Hifyre data for flower & pre-rolled

products covering three months ended March 31, 20244 Hifyre data

for premium flower & pre-rolled products covering three months

ended March 31, 20245 Hifyre data for topical products covering

three months ended March 31, 20246 Hifyre data for premium edible

products covering three months ended March 31, 2024

Janis Risbin, CFO, said “Despite the market

challenges, we've managed to maintain revenue levels in line with

Q1 2023, a testament to our resilience and adaptability. With the

expected re-financing of our debt later this year, we remain

focused on strengthening our already solid foundation and

continuing to invest opportunistically for growth in 2024 and

beyond.”

Q1 2024 and Subsequent

Highlights:For the three months ended March 31, 2024

- Net revenue of $8.9 million (1% increase from Q1 2023)

- Gross profit before fair value adjustments of $2.2 million (28%

decrease from Q1 2023)

- Adjusted EBITDA1 loss of $0.4 million compared to profit of

$1.7 million in Q1 2023

- Cash used by operating activities was $0.9 million compared to

cash provided by operating activities of $0.2 million in Q1

2023

- Number one premium licenced producer across all

categories7

- 2.0%8 national market share of flower and pre-rolls

- 7.1%3 national market share of premium flower and

pre-rolls

- 30.6%4 national market share of topical products

- 6.7%9 national market share of premium concentrates

- 22.8%10 national market share of premium edibles

- Launch of 1964 Supply Co.TM full spectrum extract (“FSE”)

vapes, initially available for Blue Dream and Comatose, with

purchase orders received from Alberta, BC and Ontario.

7 Hifyre data for premium products covering

flower, pre-rolled products, concentrates, edibles, topicals, and

vapes for the three months ended March 31, 20248 Hifyre data for

flower & pre-rolled products covering twelve months ending

March 31, 20249 Hifyre data for premium concentrates products

covering twelve months ending March 31, 202410 Hifyre data for

premium edible products covering twelve months ending March 31,

2024

2024 Results of Operations:

| |

Three months ended |

|

|

March 31, 2024$ |

March 31, 2023$ |

|

Net revenue |

8,890,417 |

|

8,799,940 |

|

| Production costs |

2,692,692 |

|

2,678,604 |

|

| Inventory expensed to cost of

sales |

3,737,334 |

|

2,934,894 |

|

|

Inventory written off or provided for |

266,039 |

|

157,424 |

|

|

Gross profit before fair value adjustments |

2,194,352 |

|

3,029,018 |

|

| Fair value adjustments to

cannabis plants, inventory sold, and other charges |

164,252 |

|

139,463 |

|

|

Gross profit |

2,358,604 |

|

3,168,481 |

|

|

As At: |

March 31,2024$ |

|

December 31, 2023$ |

|

Cash and cash equivalents |

8,121,134 |

|

9,784,190 |

| Working

capital † |

9,554,365 |

|

10,132,089 |

† Working capital as at March 31, 2024 includes $10.7 million

current portion of loans and borrowings. The Company is currently

in discussions with the debenture holder and other lenders to

extend the term of the existing agreement or to enter into a new

loan agreement in the second half of 2024.

2024 Outlook

Brand and Product

Development

Our strategy is founded on a strong premium

branded portfolio, highly regarded by both budtenders and consumers

alike. Guided by consumer research, we continually innovate our

products to anticipate market trends. Our commitment to quality and

excellence is evident throughout all areas of our business, seeking

to deliver products and services that consistently meet the highest

quality standards.

Launch into Vape Category

Rubicon is launching into the vape category with

our 1964 Supply CoTM brand. The introduction of vapes strategically

aligns with our market expansion strategy and offers substantial

growth prospects. The vape market has demonstrated robust growth

over recent years and trends in Canada and the US demonstrate

indicating the vape category's increasing prominence, rivaling or

surpassing traditional flower products.

Our launch into the vape category takes

advantage of additional biomass available from our contract grow

strategy launched in 2023 of our own genetics grown outside of the

Delta Facility. We have received initial purchase orders for our

Comatose and Blue Dream Full Spectrum Extract (“FSE”) resin vapes

in Ontario, BC, and Alberta which are all expected to be delivered

in May 2024 to the provincial distributors and available for

purchase in retail stores shortly thereafter.

In line with our approach to the live rosin

edibles we launched under the brand in 2023, we are focused on

delivering products that maintain a competitive edge through

superior quality, right price to value ratio leveraging our

established and reputable brands. We are confident that by

capitalizing on this opportunity, over time we can achieve

comparable financial success with our vape offerings as we have

with our flower business.

WildflowerTM’s Leadership

in Cannabis Wellness

WildflowerTM's prominence in the cannabis

wellness sector is characterized by its notable dominance in

topical products and the Company has recently expanded the brand to

other categories, including edibles, oils, and capsules designed to

address specific wellness needs such as sleep, pain relief, and

anxiety reduction. While we expect more competition to enter the

topical and wellness category, we are expanding the brand into

other categories and anticipate steady growth and momentum behind

the daily wellness consumer.

Launch of New Genetics

Rubicon plans to continue to launch new and

novel genetics into its Simply BareTM Organic and 1964 Supply CoTM

to continue leadership in the premium cannabis market. Launches in

2024 include BC Organic Zookies, BC Organic Power Mintz, and BC

Organic Fruit Loopz under the Simply Bare TM Organic brand, and

Blue Dream under the 1964 Supply CoTM brand.

Growth from Solid Business

Fundamentals

Consistent quality and systematic delivery to

our customers, including the provincial distributors and retailers,

and consumers to meet their needs is imperative to be successful in

the Canadian cannabis industry. In 2024 we are investing in an

Enterprise Resource Planning (“ERP”) system which is necessary for

our business to deliver more growth in future and allow less

reliance on key people within our internal systems. Anticipated

project costs for 2024 are estimated to reach $1 million, with $0.3

million incurred in the first three months of 2024. While a

resource intensive process, this ERP implementation readies our

business for growth in future.

Financial

We believe that our commitment to cannabis quality, strategic

brand positioning, diverse product portfolio, and committed team

will position us as one of the premier cannabis companies in

Canada. We anticipate year over year growth in net revenue,

supported by modest increases in our cost base, excluding the

impact of the ERP implementation occurring mostly in the first

half, thereby enhancing our operating leverage. While we expect

growth in 2024, we also anticipate that much of the growth will

come from our branded products that are produced using external

capacity and thereby deliver lower gross margin than our current

mix. Furthermore, we expect continued fierce competition in the

distressed Canadian cannabis industry with price compression across

all categories. Notwithstanding these pressures, we expect to

deliver continued operating positive cash flow in the year ahead

and plan to refinance our debt to a longer-term mortgage facility

in the second half of 2024.

Conference Call

The Company will be hosting a conference call to

discuss Q1 2024 results on Thursday, May 16, 2024. Conference call

details are as follows:

|

Time: |

7:00 AM PT / 10:00 AM ET |

|

Conference ID: |

30069 |

|

Local dial-in: |

+1 (289) 514 5100 |

|

Toll Free N. America: |

+1 (800) 717 1738 |

|

Webcast: |

https://onlinexperiences.com/Launch/QReg/ShowUUID=A8F14C29-EF4E-4A50-B4E1-292C04F7E127 |

ABOUT RUBICON ORGANICS INC.

Rubicon Organics Inc. is the global brand leader

in premium organic cannabis products. The Company is vertically

integrated through its wholly owned subsidiary Rubicon Holdings

Corp, a licensed producer. Rubicon Organics is focused on achieving

industry leading profitability through its premium cannabis flower,

product innovation and brand portfolio management, including three

flagship brands: its super-premium brand Simply Bare™ Organic, its

premium brand 1964 Supply Co™, and its cannabis wellness brand

Wildflower™ in addition to the Company’s mainstream brand Homestead

Cannabis Supply™.

The Company ensures the quality of its supply

chain by cultivating, processing, branding and selling organic

certified, sustainably produced, super-premium cannabis products

from its state-of-the-art glass roofed facility located in Delta,

BC, Canada.

CONTACT INFORMATION

Margaret BrodieCEOPhone: +1 (437) 929-1964Email:

ir@rubiconorganics.com

The TSX Venture Exchange or its Regulation Services Provider (as

that term is defined in the policies of the TSX Venture Exchange)

does not accept responsibility for the adequacy or accuracy of this

press release.

Non-GAAP Financial Measures

This press release contains certain financial

performance measures that are not recognized or defined under IFRS

(“Non-GAAP Measures”) including, but not limited to, “Adjusted

EBITDA”. As a result, this data may not be comparable to data

presented by other companies.

The Company believes that these Non-GAAP

Measures are useful indicators of operating performance and are

specifically used by management to assess the financial and

operational performance of the Company as well as its liquidity.

Accordingly, they should not be considered in isolation nor as a

substitute for analysis of our financial information reported under

IFRS. For more information, please refer to the “Selected Financial

Information” section in the MD&A for the year ended December

31, 2023, which is available on SEDAR+ at www.sedarplus.ca.

Adjusted EBITDA

Below is the Company’s quantitative

reconciliation of Adjusted EBITDA calculated as earnings (losses)

from operations before interest, tax, depreciation and

amortization, share-based compensation expense, and fair value

changes. The following table presents the Company’s reconciliation

of Adjusted EBITDA to the most comparable IFRS financial measure

for the three months ended March 31, 2024, March 31, 2023, and

December 31, 2023.

| |

Three months ended |

| |

March 31,2024 |

March 31, 2023 |

December 31,2023 |

|

|

$ |

$ |

$ |

|

Profit (loss) from operations |

(1,738,486 |

) |

|

(304,497 |

) |

|

889,166 |

|

|

| IFRS fair value accounting

related to cannabis plants and inventory |

(164,252 |

) |

|

(139,463 |

) |

|

(829,800 |

) |

|

| Depreciation and

amortization |

776,680 |

|

|

744,783 |

|

|

793,006 |

|

|

|

Share-based compensation expense |

702,846 |

|

|

(132,158 |

) |

|

440,491 |

|

|

|

Adjusted EBITDA ‡ |

(423,212 |

) |

|

168,665 |

|

|

1,292,863 |

|

|

‡ Included in Adjusted EBITDA in the three months ended March

31, 2024 is $0.3 million of one-time costs incurred for the ERP

implementation project.

Cautionary Statement Regarding Forward Looking

Information

This press release contains forward-looking

information within the meaning of applicable securities laws. All

statements that are not historical facts, including without

limitation, statements regarding future estimates, plans, programs,

forecasts, projections, objectives, assumptions, expectations or

beliefs of future performance, statements regarding Rubicon

Organics' goal of achieving industry leading profitability are

"forward-looking statements". Forward-looking information can be

identified by the use of words such as “will” or variations of such

word or statements that certain actions, events or results "will"

be taken, occur or be achieved.

Such forward-looking statements involve known

and unknown risks, uncertainties and other factors that may cause

actual results, events or developments to be materially different

from any future results, events or developments expressed or

implied by such forward looking statements. The forward-looking

information in this press release is based upon certain assumptions

that management considers reasonable in the circumstances,

including the impact on revenue of new products and brands entering

the market, and the timing of achieve Adjusted EBITDA1

profitability and cashflow positive. Risks and uncertainties

associated with the forward looking information in this press

release include, among others, dependence on obtaining and

maintaining regulatory approvals, including acquiring and renewing

federal, provincial, local or other licenses and any inability to

obtain all necessary governmental approvals licenses and permits

for construction at its facilities in a timely manner; regulatory

or political change such as changes in applicable laws and

regulations, including bureaucratic delays or inefficiencies or any

other reasons; any other factors or developments which may hinder

market growth; Rubicon Organics' limited operating history and lack

of historical profits; reliance on management; and the effect of

capital market conditions and other factors on capital

availability; competition, including from more established or

better financed competitors; and the need to secure and maintain

corporate alliances and partnerships, including with customers and

suppliers; and those factors identified under the heading "Risk

Factors" in Rubicon Organic’s annual information form dated March

27, 204 filed with Canadian provincial securities regulatory

authorities.

These factors should be considered carefully,

and readers are cautioned not to place undue reliance on such

forward-looking statements. Although Rubicon Organics has attempted

to identify important risk factors that could cause actual actions,

events or results to differ materially from those described in

forward-looking statements, there may be other risk factors that

cause actions, events or results to differ from those anticipated,

estimated or intended. There can be no assurance that

forward-looking statements will prove to be accurate, as actual

results and future events could differ materially from those

anticipated in forward-looking statements. Rubicon Organics assumes

no obligation to update any forward-looking statement, even if new

information becomes available as a result of future events, new

information or for any other reason except as required by law.

We have made numerous assumptions about the

forward-looking statements and information contained herein,

including among other things, assumptions about: optimizing yield,

achieving revenue growth, increasing gross profit, operating

cashflow and Adjusted EBITDA1 profitability. Even though the

management of Rubicon Organics believes that the assumptions made,

and the expectations represented by such statements or information

are reasonable, there can be no assurance that the forward-looking

information will prove to be accurate, as actual results and future

events could differ materially from those anticipated in

forward-looking statements. Investors are cautioned against undue

reliance on forward-looking statements or information.

Forward-looking statements and information are designed to help

readers understand management's current views of our near and

longer term prospects and may not be appropriate for other

purposes. Rubicon Organics assumes no obligation to update any

forward-looking statement, even if new information becomes

available as a result of future events, changes in assumptions, new

information or for any other reason except as required by law.

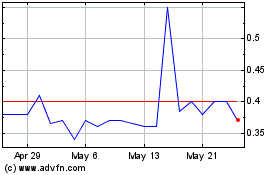

Rubicon Organics (TSXV:ROMJ)

Historical Stock Chart

From Oct 2024 to Nov 2024

Rubicon Organics (TSXV:ROMJ)

Historical Stock Chart

From Nov 2023 to Nov 2024