Surge Copper Corp. (TSXV:

SURG) (OTCQX:

SRGXF) (Frankfurt:

G6D2) (“Surge” or the

“Company”) is pleased to announce that it has commenced a

Preliminary Economic Assessment (the “PEA”) on the Berg Project

located in central British Columbia. The Company has engaged

Ausenco Engineering Canada Inc. (“Ausenco”) to lead the PEA which

will utilize an updated mineral resource estimate to be completed

by Tetra Tech Canada Inc. The PEA is anticipated to be completed

during the second calendar quarter of 2023.

To view an interactive tour of the Berg site use

the following link or visit Surge’s website:

https://vrify.com/decks/12371-press-release-commencement-of-berg-pea

Highlights

- Project concept to outline

development opportunity of a simple, stand-alone open pit mine and

concentrator facility located in an easily accessible region of

British Columbia which has significant existing and ongoing

industrial development including multiple mines, a smelter, forest

products operations, a major pipeline, and a hydroelectricity

station

- Project anticipated to have a low

strip ratio, and benefit from near-surface, higher-grade supergene

enrichment zone material in early years

- Project design will tie into

existing infrastructure including the low-to-no-carbon-emissions BC

Hydro grid, and existing road networks which provide access to the

Berg Project

- PEA will leverage trade-off studies

completed in 2022 that identified multiple suitable tailings siting

options

- Updated resource modeling plus new

sample data anticipated to improve precious metals credits

- Design approach will focus on and

prioritize opportunities for energy efficiency and electrification

of energy-intensive activities, including use of conveyor systems,

in order to reduce carbon emissions footprint

Leif Nilsson, Chief Executive Officer,

commented: “The Berg Project represents a potentially globally

unique opportunity to develop a long-life project with high outputs

of metals critical for the energy transition including copper,

which is critical in nearly all electrification applications,

molybdenum, which is critical in large-scale geared wind turbines

and gas pipelines, and silver, which is a key component in solar

photovoltaic cells, located in a region with zero-carbon-emissions

grid hydroelectricity, and negligible water supply issues.

Significant effort has gone into conceptualizing Berg as an

emerging Canadian critical metals project, and we are excited to be

commencing this project study with our engineering consulting

partners at Ausenco.”

As a precursor to, and basis for the PEA, the

Company engaged Ausenco in early 2022 to complete a broad set of

trade-off studies focused on infrastructure opportunities and

alternatives present in the Berg-Huckleberry-Ootsa district,

spanning material movement technologies and logistics, electricity

supply options, and tailings facility siting options. In addition

to these trade-off studies, the PEA will be anchored by extensive

metallurgical testwork completed on material from the Berg deposit

by G&T Metallurgical Services Ltd. (now ALS Metallurgy). These

testwork programs focused on developing a flow sheet to produce

copper and molybdenum concentrates from both supergene and hypogene

composite samples and demonstrated that conventional flotation

processes can be used to produce marketable copper and molybdenum

concentrates.

In early 2021, the Company announced an updated

mineral resource estimate (“MRE”) for the Berg deposit based on

51,662 metres of drill core across 201 diamond drill holes

completed prior to 2012 (see March 17, 2021 press release). During

the 2021 exploration program, the Company re-established road

access to the Berg deposit, built an exploration camp, and

completed 2,855 metres of drilling across 9 diamond drill holes

(see March 8, 17, and 21, 2022 press releases). Historical drilling

in the database from prior to 1990, representing approximately 26%

of the total assay data used in the MRE, does not contain silver

assay data and the MRE applies a value of zero to these missing

values. After a detailed analysis of current drilling and silver

assays it is estimated that this estimation approach results in a

potential underestimation of actual silver grades in the deposit.

The Company is working on an improved geological model to better

constrain silver domains within the deposit to rectify this issue.

In addition, historical drilling at Berg was only sporadically

assayed for gold, and the current MRE does not contain any

estimates for gold content in the deposit. To rectify this issue,

the Company completed a systematic resampling program during the

2022 field season across approximately 5,200 historical drill core

samples and 3,000 pulp samples in storage to bolster this portion

of the database, and anticipates including this new data, in

addition to the 2021 drilling, in the updated resource estimate to

accompany the PEA.

About Ausenco

Ausenco is recognized for developing credible

and financeable studies and has significant design and execution

experience for copper projects globally and significant recent

experience on several projects in British Columbia including Skeena

Resources’ Eskay Creek Project (PEA, PFS, & FS), Copper

Mountain’s Life of Mine 65ktpd Expansion Study, Canagold Resources’

New Polaris Project (FS, in progress), Artemis Gold’s Blackwater

Project (FS), and Taseko’s Gibraltar Mine In Pit Crusher Relocation

(EPCM, in progress) and GDP3 Expansion (EPCM).

Upcoming Catalysts

The Company anticipates updating the market on

results from the following activities:

- Exploration drill results from

Phase One regional program on the Ootsa Property including Seel

Breccia Zone East, Blackjack, Blackjack East, and Placer North

- Exploration drill results from

Phase Two regional program on the Berg Property including Bergette,

Sibola, and Sylvia

- Exploration target updates from

regional surface reconnaissance program

- Berg PEA updates

Participation in Upcoming

Conference

The Company will be participating in the

upcoming joint Mines and Money and Resourcing Tomorrow conferences

in London, UK from November 29 to December 1. Additional

information can be found at minesandmoney.com/london.

Qualified

Persons

Dr. Shane Ebert P.Geo., President and VP

Exploration at the Company is the Qualified Person for the Ootsa

and Berg projects as defined by National Instrument 43-101 and has

approved the technical disclosure contained in this news

release.

Mark Wheeler, P.Eng., VP of Projects at the

Company as well as a Qualified Person as defined by National

Instrument 43-101, has supervised the preparation of the technical

information in this news release.

Additional Disclosure Related to Berg NI43-101 Resource

(previously released on March 17, 2021)

|

Table 1. Mineral Resource Estimate for the Berg

Deposit at 0.2% CuEq Cut-off with

Effective Date of March 9,

2021. |

|

|

|

|

Grade |

|

Contained Metal |

|

Material Type |

Resource Category |

Tonnes |

Cu |

Mo |

Ag |

CuEq |

|

Cu |

Mo |

Ag |

CuEq |

|

|

|

(Mt) |

(%) |

(%) |

(g/t) |

(%) |

|

(Mlbs) |

(Mlbs) |

(Moz) |

(Mlbs) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Supergene |

Measured |

86.9 |

0.41 |

0.03 |

2.46 |

0.50 |

|

789 |

52 |

6.9 |

960 |

|

|

Indicated |

88.5 |

0.29 |

0.02 |

2.67 |

0.37 |

|

572 |

43 |

7.6 |

724 |

|

|

Measured & Indicated |

175.4 |

0.35 |

0.02 |

2.57 |

0.44 |

|

1,362 |

95 |

14.5 |

1,685 |

|

|

Inferred |

7.2 |

0.23 |

0.01 |

4.26 |

0.29 |

|

37 |

2 |

1.0 |

47 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Hypogene |

Measured |

120.3 |

0.28 |

0.04 |

3.42 |

0.41 |

|

752 |

97 |

13.2 |

1,098 |

|

|

Indicated |

314.1 |

0.22 |

0.03 |

3.10 |

0.34 |

|

1,537 |

226 |

31.3 |

2,343 |

|

|

Measured & Indicated |

434.3 |

0.24 |

0.03 |

3.19 |

0.36 |

|

2,289 |

323 |

44.6 |

3,441 |

|

|

Inferred |

20.8 |

0.22 |

0.02 |

3.57 |

0.30 |

|

101 |

8 |

2.4 |

138 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Leachate |

Measured |

0.0 |

0.04 |

0.09 |

5.62 |

0.21 |

|

0 |

0 |

0.0 |

0 |

|

|

Indicated |

0.2 |

0.14 |

0.12 |

2.37 |

0.25 |

|

1 |

1 |

0.0 |

1 |

|

|

Measured & Indicated |

0.2 |

0.13 |

0.12 |

2.41 |

0.25 |

|

1 |

1 |

0.0 |

1 |

|

|

Inferred |

0.1 |

0.11 |

0.09 |

6.13 |

0.21 |

|

0 |

0 |

0.0 |

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

Measured |

207.2 |

0.34 |

0.03 |

3.0 |

0.45 |

|

1,541 |

149 |

20.1 |

2,058 |

|

|

Indicated |

402.8 |

0.24 |

0.03 |

3.0 |

0.35 |

|

2,110 |

270 |

39.0 |

3,069 |

|

|

Measured & Indicated |

610.0 |

0.27 |

0.03 |

3.0 |

0.38 |

|

3,651 |

419 |

59.1 |

5,126 |

|

|

Inferred |

28.1 |

0.22 |

0.02 |

3.8 |

0.30 |

|

138 |

11 |

3.4 |

185 |

|

Notes:1) Copper Equivalent (CuEq) calculated using metal

prices of $3.10/lb Cu, $10.00/lb Mo, and $20/oz Ag. Recoveries were

applied to correspond with estimated individual metal recoveries

based on limited metallurgical testwork for production of a copper

and molybdenum concentrate: supergene zone (Cu = 73%, Mo = 61%, and

Ag = 52%), hypogene zone (Cu = 81%, Mo = 71%, and Ag = 67%),

leachate zone (Cu = 0%, Mo = 61%, and Ag = 52%). Smelter loss was

not applied.2) A cut-off value of 0.2% CuEq was used as

the base case for reporting mineral resources that are subject to

open pit potential. The resource block model has been constrained

by a conceptual open pit shell, however, economic viability can

only be assessed through the completion of engineering studies

defining reserves including PFS and FS. The CIM Definition

Standards (May 10, 2014) were followed for classification of

Mineral Resources. It cannot be assumed that all or any part of

Inferred Mineral Resources will be upgraded to Indicated or

Measured as a result of continued exploration.3) Dry

bulk density has been estimated based on 2,996 in situ specific

gravity measurements collected between 2007 and 2011. Values were

applied by geology model domain (n = 18) representing the

weathering profiles and major lithological units; values ranged

from 2.38 t/m3 to 2.74 t/m3.4) There are no known legal,

political, unnatural environmental, or other risks that could

materially affect the potential development of the mineral

resources.5) All numbers are rounded. Overall numbers

may not be exact due to rounding. |

The Berg mineral resource estimate has been completed by Tetra

Tech in accordance with National Instrument 43-101 Standards of

Disclosure for Mineral Projects. The mineral resource estimate has

been prepared by Cameron Norton, P.Geo., Independent Qualified

Person as defined by National Instrument 43-101, and has an

effective date of March 9, 2021.

About Surge Copper Corp.

Surge Copper Corp. is a Canadian company that is

advancing an emerging critical metals district in a well-developed

region of British Columbia, Canada. The Company controls a large,

contiguous mineral claim package that hosts multiple advanced

porphyry deposits with pit-constrained NI 43-101 compliant

resources of copper, molybdenum, gold, and silver – metals which

are critical inputs to the low-carbon energy transition and

associated electrification technologies.

The Company owns a 100% interest in the Ootsa

Property, an advanced-stage exploration project containing the Seel

and Ox porphyry deposits located adjacent to the open pit

Huckleberry Copper Mine, owned by Imperial Metals. The Ootsa

Property contains pit-constrained NI 43-101 compliant resources of

copper, gold, molybdenum, and silver in the Measured, Indicated,

and Inferred categories.

The Company is also earning a 70% interest in

the Berg Property from Centerra Gold. Berg is a large,

advanced-stage exploration project located 28 km northwest of the

Ootsa deposits. Berg contains pit-constrained 43-101 compliant

resources of copper, molybdenum, and silver in the Measured,

Indicated, and Inferred categories. Combined, the adjacent Ootsa

and Berg properties give Surge a dominant land position in the

Ootsa-Huckleberry-Berg district and control over three advanced

porphyry deposits and multiple copper, gold, and silver exploration

targets.

On Behalf of the Board of

Directors

“Leif Nilsson”Chief Executive Officer

For further information, please contact:Riley

Trimble, Corporate Communications & DevelopmentTelephone: +1

604 416 2978Email: info@surgecopper.comTwitter:

@SurgeCopperLinkedIn: Surge Copper

Corphttps://www.surgecopper.com

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

This News Release contains forward-looking

statements, which relate to future events. In some cases, you can

identify forward-looking statements by terminology such as "will",

"may", "should", "expects", "plans", or "anticipates" or the

negative of these terms or other comparable terminology. All

statements included herein, other than statements of historical

fact, are forward-looking statements, including but not limited to

the Company’s plans regarding the Berg Property and the Ootsa

Property. These statements are only predictions and involve known

and unknown risks, uncertainties, and other factors that may cause

the Company’s actual results, level of activity, performance, or

achievements to be materially different from any future results,

levels of activity, performance, or achievements expressed or

implied by these forward-looking statements. Such uncertainties and

risks may include, among others, actual results of the Company's

exploration activities being different than those expected by

management, delays in obtaining or failure to obtain required

government or other regulatory approvals, the ability to obtain

adequate financing to conduct its planned exploration programs,

inability to procure labour, equipment, and supplies in sufficient

quantities and on a timely basis, equipment breakdown, impacts of

the current coronavirus pandemic, and bad weather. While these

forward-looking statements, and any assumptions upon which they are

based, are made in good faith and reflect the Company's current

judgment regarding the direction of its business, actual results

will almost always vary, sometimes materially, from any estimates,

predictions, projections, assumptions, or other future performance

suggestions herein. Except as required by applicable law, the

Company does not intend to update any forward-looking statements to

conform these statements to actual results.

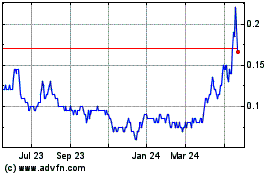

Surge Copper (TSXV:SURG)

Historical Stock Chart

From Dec 2024 to Jan 2025

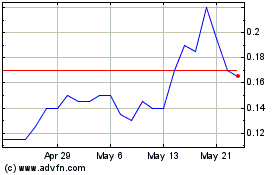

Surge Copper (TSXV:SURG)

Historical Stock Chart

From Jan 2024 to Jan 2025