ValOre Metals Corp. (“ValOre”;

TSX‐V: VO; OTCQB: KVLQF;

Frankfurt: KEQ0, “the Company”) today provided a corporate

and project update.

Thiago Diniz Appointed Vice President,

Exploration

Thiago Diniz,

P.Geo. has significant experience as an

exploration geologist in Brazil and Canada, including work on early

to advanced-stage Platinum Group Element (“PGE”), orogenic and

magmatic hydrothermal gold and gold-copper systems, sediment-hosted

zinc-lead, phosphate, and potash projects. His expertise in the

planning and management of large-scale programs, including data

review, mapping & sampling, exploratory & resource

delineation drill campaigns, and metallurgical testwork programs

have provided valuable input to ValOre’s Pedra Branca Project over

the last four years.

Mr. Diniz is a registered P.Geo in Ontario and

Saskatchewan, with a B.Sc. Geology (Federal University of Minas

Gerais), and a M.Sc. Economic Geology (Queens University).

Jim Paterson, Chairman & CEO, stated: “We

are very happy to announce Thiago’s appointment as V.P.

Exploration. He has been successfully managing ValOre’s Pedra

Branca PGE Project in Brazil for 4 years, excelling in the

planning, budgeting, and program execution, which resulted in

several discoveries, including Salvador, and a doubling of the

inferred resource at Pedra Branca. Importantly, Thiago has gained

the respect of ValOre’s in-country team and our board of directors

and has built an exceptional level of trust with the local

community of Capitao Mor and the Pedra Branca region.

On behalf of all ValOre team members, I would

like to wish Colin Smith great success as he moves on to serve as

the CEO of an exciting gold exploration company. We thank Colin for

his many years of excellent work at ValOre and the great

friendships formed along the way.”

Pedra Branca Project Update

ValOre continues to prioritize project

exploration and advancement efforts on the Pedra Branca PGE

deposits that exhibit the potential for the shortest development

timeline with the highest operating margin.

Key aspects of focus to achieve these goals,

include:

- grade and metallurgical

characteristics of PGE mineralization;

- depth and orientation of deposits

and related strip ratio of the optimized resource pits;

- proximity of deposits to one

another and to the proposed location of future on-site processing

facilities;

- Social Licence, local employment,

infrastructure and water availability.

The Curiu, Esbarro, Cedro, Cana Brava and

Salvador PGE deposits are now ValOre’s top priority areas of

focus.

- Curiu, Esbarro, Cedro and Cana

Brava host, in aggregate, a 2022 NI 43-101 inferred mineral

resource estimate of 1.031 million ounces (“Moz”) palladium +

platinum + gold (“2PGE+Au”) in 27.2 million tonnes (“Mt”)*;

- These four deposits are located

within a 3-kilometre (“km”) radius;

- Average resource strip ratio for

these 4 deposit areas is approximately 2.1:1 waste to ore*;

- Curiu and Esbarro collectively

average a resource strip ratio of approximately 0.7:1 waste to

ore*;

- Maximum vertical depth of the

mineralization drilled to form resource pits at these 4 deposits is

approximately 150 metres*;

- The recently discovered Salvador

target is located within 5km from those resource zone and

highlights significant potential for high grade PGE shallow

resources and improved economics in the surrounding area (CLICK

HERE for news release dated November 7, 2023 and HERE for news

release dated December 11, 2023 and references therein).

Planned 2024/2025 Tasks/Actions

include:

- Advanced metallurgical studies to

define processing flowsheets;

- Complete a marketability study for

Pedra Branca PGE-enriched concentrate;

- Complete additional exploration and

deposit definition drilling at Salvador target;

- Updated NI 43-101 Technical Report

disclosing a mineral resource estimate update, including

reclassification of certain zones into the “indicated category”

subject to an increased level of confidence in metallurgical

recoveries and drill hole spacing;

- Complete a preliminary economic

assessment (“PEA”) report, including CAPEX and OPEX

optimization;

- Commence permitting processes and

environmental impact assessment (“EIA”);

- Define timeline to production.

Exploration Upside:

- 3 additional resource zones,

Trapiá, Massapê and Santo Amaro, host, in aggregate, an inferred

mineral resource estimate of 1.167 Moz 2PGE+Au in 36.4 Mt*;

- The recently completed 2023 drill

program confirmed the potential for Pedra Branca resource

expansion, with PGE mineralization drilled in Galante, Troia, Nambi

and Ipueiras (CLICK HERE for news release dated September 21,

2023);

Significant additional discovery potential along

more than 80 km of Pedra Branca’s prospective, underexplored,

property-wide PGE trend.

Quality Assurance/Quality Control

(“QA/QC”)

CLICK HERE for a summary of ValOre’s policies

and procedures related to QA/QC and grade interval reporting.

Qualified Person (“QP”)

The technical information in this news release

has been prepared in accordance with Canadian regulatory

requirements set out in NI 43-101 and reviewed and approved by

Thiago Diniz, P.Geo., ValOre’s QP and Vice President of

Exploration.

About ValOre Metals Corp.

ValOre Metals Corp.

(TSX‐V: VO) is a

Canadian company with a team aiming to deploy capital and knowledge

on projects which benefit from substantial prior investment by

previous owners, existence of high-value mineralization on a large

scale, and the possibility of adding tangible value through

exploration and innovation.

ValOre’s Pedra Branca Platinum Group Elements

Project comprises 52 exploration licenses covering a total area of

56,852 hectares (140,484 acres) in northeastern Brazil. At Pedra

Branca, 7 distinct PGE+Au deposit areas host, in aggregate, a 2022

NI 43-101 inferred resource of 2.198 Moz 2PGE+Au contained in 63.6

Mt grading 1.08 g/t 2PGE+Au. ValOre’s team believes the Pedra

Branca project has significant exploration discovery and resource

expansion potential. (CLICK HERE to download 2022 technical report*

and CLICK HERE for news release dated March 24, 2022).

*The 2022 Technical Report is entitled

“Independent Technical Report –Mineral Resource Update on the Pedra

Branca PGE Project, Ceará State, Brazil” was prepared as a National

Instrument 43-101 Technical Report on behalf of ValOre Metals Corp.

with an effective date of March 08, 2022. The 2022 Technical Report

by Independent qualified persons, Fábio Valério (P.Geo.) and

Porfirio Cabaleiro (P.Eng.), of GE21, commissioned to complete the

mineral resource estimate while Chris Kaye of Mine and Quarry

Engineering Services Inc. (MQes), was commissioned to review the

metallurgical information. The Mineral Resource estimates were

prepared in accordance with the CIM Standards, and the CIM

Guidelines, using geostatistical, plus economic and mining

parameters appropriate to the deposit. Mineral Resources, which are

not mineral reserves, do not have demonstrated economic viability,

and may be materially affected by environmental, permitting, legal,

marketing, and other relevant issues. Mineral Resources are based

upon a cut-off grade of 0.4 g/t PGE+Au, correlated to Pd_eq grade

of 0.35 g/t, and were limited by an economic pit built in Geovia

Whittle 4.3 software and following the geometric and economic

parameters as disclosed in the 2022 NI 43-101 Technical Report,

On behalf of the Board of Directors,

“Jim Paterson”

James R. Paterson, Chairman and CEO

ValOre Metals Corp.

For further information about ValOre Metals

Corp., or this news release, please visit our website at

www.valoremetals.com or contact Investor Relations at 604.653.9464,

or by email at contact@valoremetals.com.

ValOre Metals Corp. is a proud member of

Discovery Group. For more information please visit:

http://www.discoverygroup.ca/

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

This news release contains “forward-looking

statements” within the meaning of applicable securities laws.

Although ValOre believes that the expectations reflected in its

forward-looking statements are reasonable, such statements have

been based on factors and assumptions concerning future events that

may prove to be inaccurate. These factors and assumptions are based

upon currently available information to ValOre. Such statements are

subject to known and unknown risks, uncertainties and other factors

that could influence actual results or events and cause actual

results or events to differ materially from those stated,

anticipated or implied in the forward-looking statements. A number

of important factors including those set forth in other public

filings could cause actual outcomes and results to differ

materially from those expressed in these forward-looking

statements. Factors that could cause the actual results to differ

materially from those in forward-looking statements include the

future operations of ValOre and economic factors. Readers are

cautioned to not place undue reliance on forward-looking

statements. The statements in this press release are made as of the

date of this release and, except as required by applicable law,

ValOre does not undertake any obligation to publicly update or to

revise any of the included forward-looking statements, whether as a

result of new information, future events or otherwise. ValOre

undertakes no obligation to comment on analyses, expectations or

statements made by third parties in respect of ValOre, or its

financial or operating results or (as applicable), their

securities.

ValOre Metals (TSXV:VO)

Historical Stock Chart

From Nov 2024 to Dec 2024

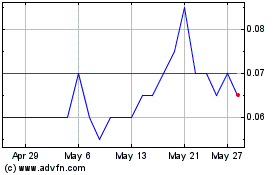

ValOre Metals (TSXV:VO)

Historical Stock Chart

From Dec 2023 to Dec 2024