White Gold Corp. (TSX.V: WGO, OTC – Nasdaq Intl: WHGOF,

FRA: 29W) (the "Company") is pleased to announce its fully

funded 2020 exploration program on its extensive 422,000+ hectare

land package, representing over 40% of the emerging White Gold

District in Yukon, Canada. The 2020 exploration program which is

budgeted at approximately $4.0 Million has been designed to further

test existing targets and recent high grade discoveries on the

Company’s White Gold, Hen, and JP Ross properties, as well as to

identify and advance other targets on its extensive regional land

package. Backed by partners Agnico Eagle Mines Limited (TSX: AEM,

NYSE: AEM) and Kinross Gold Corporation (TSX: K, NYSE: KGC), the

2020 exploration program is scheduled to commence in the coming

weeks.

A district scale map outlining the Company’s

planned 2020 exploration work areas and other images accompanying

this news release can be found at

http://whitegoldcorp.ca/investors/exploration-highlights/.

“2020 is expected to be another exciting

year for White Gold as we diamond drill test recent discoveries at

the Ryan’s Surprise and Titan targets, as well as advance other

high-priority targets across our expansive land package. Extensive

review and analysis performed in the off-season has also provided

new interpretations on several projects which we are excited to

test. We will also continue to develop a better understanding of

the geological and structural framework of our targets for follow

up drill testing when ready,” stated Terry Brace, Vice President of

Exploration.

Highlights Include:

- Ryan’s Surprise target (along

strike with the Golden Saddle Deposit): 1,500 m diamond drill

program to test for strike and down-dip extensions of

mineralization encountered with 2019 diamond drilling.

- Titan target: 1,500 m diamond drill

program to test the extents of high-grade mineralization

encountered in 2019 rotary air blast (RAB) drilling which included

72.81 g/t Au over 6.09 m from 10.67 m depth, within a 32 m zone of

mineralization.

- Approximately 25 RAB holes will be

drilled to test high-priority targets on the White Gold, Hen and JP

Ross properties.

- Mechanical trenching will be

carried out on multiple targets on the JP Ross property to collect

key structural data to aid in ongoing interpretations and future

drill planning.

- Extensive regional exploration work

on other properties will include geologic mapping and prospecting,

soil sampling, GT probe sampling, ultra high-resolution drone

imagery, and ground magnetics and VLF surveying on the Betty,

Nolan, Bonanza and Tea properties.

- A webinar to provide additional

information on the Company’s 2020 exploration plan will take place

on Thursday, May 28th, 2020, at 1 p.m. ET (10 a.m. PT).

Details below.

White Gold Property Program

The White Gold property hosts the Company’s

flagship Golden Saddle & Arc deposits which have a current

mineral resource of 1,039,600 gold ounces indicated at 2.26 g/t Au

and 508,700 gold ounces inferred at 1.48 g/t Au. Planned 2020

exploration work on the White Gold property includes 1,500 m of

diamond drilling at the Ryan’s Surprise (“Ryan’s”) target to test

for strike and down-dip extensions of mineralization encountered in

2019, as well as 8 RAB drill holes on high priority targets

elsewhere on the property.

The Ryan’s target is located approximately 2 km

west of the Golden Saddle deposit and is associated with a large

(> 500 m long) gold-in-soil anomaly with values ranging from

trace to 1,576 ppb Au. The area has been drill-tested by several

companies including Underworld Resources Inc. (2008), Kinross Gold

Corporation (2011) and the Company (2018-2019) for a combined total

of 15 diamond drill holes (3,152m) and 4 RC holes (682m) and

remains open in multiple directions.

Kinross’ diamond drill hole WGRS11D0003 located

in the central part of Ryan’s returned 6.33 g/t Au over 6.56 m from

159.44 m downhole, and subsequent exploration drilling by the

Company has focused on this general area with holes drilled

primarily to the south. A revised geological interpretation in 2019

indicated that the mineralized zone may strike west-southwest and

dip steeply to the south-southeast, and the two diamond drill holes

drilled to the north to test this interpretation both intersected

mineralization. Hole WHTRS19D012 intersected 2.85 g/t Au over 4.14

m from 142.22 m downhole and 2.07 g/t over 21.0 m from 154.00 m

downhole, including 3.55 g/t Au over 8.42 m. This latter higher

grade zone appears to correlate with a mineralized zone in hole

WHTRYN18RC0002 which returned 5.02 g/t Au over 13.72 m from 121.92m

downhole, indicating a steep (70°) southerly dip. Hole WHTRS19D0012

also intersected a second mineralized zone higher up the hole in

the hanging wall which returned 2.66 g/t Au over 11.00 m from 93.0

m downhole. This hanging wall mineralization may represent a

subparallel zone which to date has only been tested by this single

hole. The close proximity of Ryan’s to existing mineral resources

at Golden Saddle and Arc makes it a strategic target for potential

future advancement of these projects.

Hen Property Program

The Titan target is located on the Hen property

approximately 25 km northeast of the Golden Saddle and Arc

deposits. The Hen property is situated within a prolific placer

mining camp where abundant coarse placer gold has been recovered

from creek gravels on North Henderson Creek immediately east of the

Titan.

The Titan target shows two distinct gold-in-soil

anomaly trends along the western (NNW trend) and southern (NE

trend) margins of a circular magnetic low with a diameter of

approximately 600 m. Six discrete magnetic high features measuring

from 100 m to 325 m long lie within the magnetic low. In 2019 soil

sampling in the southwestern part of the target area returned a

high of 113 g/t Au, which is the highest value ever recorded in the

Company’s 400,000+ soil sample database. Rock grab samples from

shallow pits in the same area contained fine-grained visible gold

and returned assays of 113 g/t Au, 497 g/t Au, and 605 g/t Au.

Ground geophysical surveys show that the mineralization is

associated with a resistivity low, chargeability high, and magnetic

high. In late 2019, the Company drilled 3 RAB holes totalling 221 m

to test this surface mineralization. Hole HENTTN19RAB-002

intersected a high-grade mineralized zone which returned 72.81 g/t

Au over 6.09 m from 10.67 m downhole including 136.36 g/t Au over

3.05 m within a broader zone of mineralization grading 14.80 g/t Au

over 32.00 m. The high-grade interval occurs at the top of the

broader zone and currently it is unclear if mineralization noted

below the high-grade interval is in-situ or potentially

cross-contaminated. However, the anomalous gold assays do

correspond with a resistivity low and high magnetic susceptibility

measurements to approximately 40 m depth, indicating that the

mineralization may be in place.

Based on available data, gold mineralization at

Titan is currently interpreted to occur along a discrete

high-grade, shallowly north-plunging zone along a

northwest-striking and northeast-dipping sheared contact between an

upper mafic to ultramafic unit and lower metasedimentary units.

Gold mineralization correlates with elevated Bi-Cu-Fe-P+/-U and is

associated with strong shearing, semi-massive to massive magnetite,

calc-silicate alteration, and fine-grained visible gold within the

mafic to ultramafic units.

The planned 2020 drill program consists of

1,500m of diamond drilling focused primarily along the NNW-striking

gold-in-soil anomaly which extends from the high-grade intercept in

hole HENTTN19RAB-002. Additionally, 7 RAB holes will be drilled to

test similar north-trending magnetic high features within the

magnetic low, as well as the separate northeast-striking

gold-in-soil anomaly along the southern margin of the magnetic low

feature.

JP Ross Property Program

The road accessible JP Ross property located

approximately 35 km north east of the Golden Saddle & Arc

deposits and contiguous to the Hen property where the Titan

discovery is located, and hosts multiple gold trends covering an

area measuring approximately 15 km x 15 km. A significant component

of the 2020 exploration work on the JP Ross property consists of

mechanical trenching on a number of existing targets highlighted by

2019 results from soil geochemistry, GT probe samples, VLF surveys,

RAB drilling, and geological and structural interpretations.

Specific trenching targets include Sabotage, Stagefright, North

Frenzy and Vertigo. The primary goal of this work is to collect key

structural data on mineralized veins, shear zones, faults, etc.

which will aid in ongoing detailed interpretations and planning of

future drilling. A total of 8 RAB holes are also planned to test

existing targets on the property with final hole locations based on

trenching results in conjunction with other exploration results.

Additional information on the specific targets and exploration work

will be released in due course.

The Regional Program

The 2020 regional exploration program will focus

on high priority targets that have been identified in 2019 and

prior seasons, and will include soil sampling, GT Probe sampling

and ground magnetic and VLF surveys. Additional exploration

activities will include geological mapping and prospecting, ultra

high-resolution drone imagery in select key areas and a thorough

digital compilation of all existing exploration data. The regional

exploration program will be conducted across multiple properties

and is anticipated to include exploration work on the following

properties:

Betty Property

The Betty property is located 65 km southeast of

the Golden Saddle and Arc deposits and covers the eastern extension

of the Coffee Creek Fault which hosts the Coffee gold deposit owned

by Newmont Corporation. Early exploration on the property from

2010-2013 was carried out by Ethos Gold Corp. and included 61

shallow RC holes totalling 7,132 m that mainly tested

intrusion-hosted gold ± silver and base metal mineralization in the

southeastern part of the property. More recent drilling conducted

by Centerra Gold Inc. in 2014 (16 RAB holes totalling 374.9 m) and

the Company in 2017–2018 (28 RAB holes totalling 1,827 m) has

focused on geochemical targets further north on the property. This

area is underlain by metamorphic rocks that are structurally

cross-cut by splays of the Coffee Creek Fault. Encouraging results

from the Company’s previous campaigns include 1.08 g/t Au over

50.29 m from 4.57 m in hole BETFRDRAB18-002 on the Berry Ford

target, with the zone remaining open in all directions.

Planned exploration on the Betty property in

2020 includes a detailed structural and magnetic lineament

interpretation utilizing magnetic and Lidar data which is expected

to guide ongoing future exploration. Infill soil sampling and

magnetic and VLF surveys will also be carried out in high priority

areas of the property, with a goal of identifying and refining

drill targets for the 2021 exploration season.

Nolan Property

The Nolan property is located 50 km west of

Dawson City and covers multiple placer gold-bearing creeks.

Numerous gold-in-soil anomalies occur in the northern (Cali, Nine,

Nine SW and Sixty South), central (Boucher) and southern (Mount

Hart) parts of the property.

The Cali target forms a 4 km long northeast

trending gold-in-soil anomaly with values ranging from trace up to

516 ppb Au which is associated with anomalous Sb-As±Ag-Pb. The

anomaly occurs along an interpreted northeast striking splay of the

Sixty Mile-Pika Fault which separates mafic gneisses in the

southeast from quartzites to the northwest. In 2017 the Company

drilled 22 short RAB holes totaling 1,386.82 m which tested the

target only to a maximum depth of 50 m.

In the Mount Hart area several significant

gold-in-soil anomalies have been identified, including Hart South

which forms a 2,000 m by 400 m trend with soil values ranging up to

539 ppb Au, and Hart East which measures 2,500 m by 900 m

with soil values ranging up to 399 ppb Au. A series of hornblende

diorite plugs intrude locally strongly potasically-altered gneiss

in the target area and the geochemical signature points to a

porphyry copper target.

Planned work in 2020 includes infill 25 m-spaced

soil sampling and ground magnetics and VLF surveying over the Mount

Hart target, as well as ground magnetics and VLF over the Cali,

Nine, Nine SW and Sixty South targets in the northern part of the

property.

Bonanza Property

The Bonanza property is located 10 km south of

Dawson City immediately east of Bonanza Creek, one of the richest

placer gold creeks in the world. The claims adjoin Klondike Gold

Corp.’s Eldorado property to the east and south. Exploration work

carried out on the Bonanza property to date includes geological

mapping, 50 m-spaced soil sampling (3,765 samples), GT probe

sampling (300 samples), 250 line km of airborne DIGHEM geophysical

surveying, and 5 RAB holes totaling 444.99m drilled by the Company

in 2018. A favourable geological contact between the Klondike

Schist to the north and the Snowcap Assemblage to the south extends

through the southern portion of the property, and the geophysical

surveys have outlined a pronounced north-trending magnetic low

lineament and corresponding DIGHEM resistivity low which extends

through the property and may represent a fault structure. Several

gold-in-soil anomalies have also been identified in the southern

and northwestern portions of the property.

Planned exploration work in 2020 includes infill

soil sampling at 25 m spacings on several of the existing

gold-in-soil anomalies, as well as ground magnetic and VLF surveys.

This work will provide greater resolution for ongoing structural

interpretations and target definition.

Tea Property

The Tea property is located 50 km south of the

Golden Saddle and Arc deposits and is strategically located 10 km

south of Newmont Corporation’s Coffee project and 10 km west of

Western Copper & Gold Corporation’s Casino project. The Tea

property covers 17 km of favourable geology underlain by

prospective rocks of the Klondike Schist and Snowcap Assemblage,

with potential for hosting orogenic gold mineralization. The Tea

property has seen very limited previous exploration, and planned

work for 2020 includes first-pass ridge and spur soil sampling

designed to identify favourable areas for future follow-up

exploration.

(1) All drill hole intercepts

reported herein are core widths. Currently there is insufficient

data to estimate true widths.

Corporate Update Webinar

White Gold Corp is inviting interested parties

to join David D'Onofrio – CEO, Shawn Ryan – Chief Technical Advisor

and Terry Brace – VP of Exploration, for a webinar to provide

further detail on its fully funded 2020 exploration program on its

White Gold District Projects, Yukon.

The White Gold Corp webinar will take place on

Thursday, May 28th, 2020, at 1 p.m. ET (10 a.m. PT). The Management

Team will be available to answer questions following the

presentation.

Live webinar registration :

https://webinars.6ix.com/6ix/White-Gold-Exploration-2020

Dial-in Number 1 (312) 248-9348

Dial-in ID Number 536652# Dial-in Passcode 8741#

About White Gold Corp.The

Company owns a portfolio of 21,159 quartz claims across 33

properties covering over 423,000 hectares representing over 40% of

the Yukon’s prolific White Gold District. The Company’s flagship

White Gold property hosts the Company’s Golden Saddle and Arc

deposits which have a mineral resource of 1,039,600 ounces

Indicated at 2.26 g/t gold and 508,700 ounces Inferred at 1.48 g/t

gold. Mineralization on the Golden Saddle and Arc is also known to

extend beyond the limits of the current resource estimate. The

Company’s recently acquired VG Deposit also hosts a historic

Inferred gold resource of 230,000 ounces at 1.65 g/t Au(2).

Regional exploration work has also produced several other new

discoveries and prospective targets on the Company’s claim packages

which border sizable gold discoveries including the Coffee project

owned by Newmont Corporation with Measured and Indicated Resources

of 2.17 Moz at 1.46 g/t Au, and Inferred Resources of 0.50 Moz at

1.32 g/t Au(3), and Western Copper and Gold Corporation’s Casino

project which has Proven and Probable reserves of 8.9 Moz Au and

4.5 Blb Cu(3). For more information visit www.whitegoldcorp.ca.

(2) See Comstock Metals Ltd. Technical report

titled “NI 43-101 TECHNICAL REPORT on the QV PROJECT”, dated August

19, 2014, available on SEDAR. (3) Noted

mineralization is as disclosed by the owner of each property

respectively and is not necessarily indicative of the

mineralization hosted on the Company’s property.

Qualified PersonTerry Brace,

P.Geo. and Vice President of Exploration for the Company is a

“qualified person” as defined under National Instrument 43-101 –

Standards of Disclosure of Mineral Projects and has reviewed and

approved the content of this news release.

Contact Information:David

D’Onofrio Chief Executive Officer White Gold Corp. (647) 930-1880

ir@whitegoldcorp.ca

Cautionary Note Regarding Forward

Looking InformationThis news release contains

"forward-looking information" and "forward-looking statements"

(collectively, "forward-looking statements") within the meaning of

the applicable Canadian securities legislation. All statements,

other than statements of historical fact, are forward-looking

statements and are based on expectations, estimates and projections

as at the date of this news release. Any statement that involves

discussions with respect to predictions, expectations, beliefs,

plans, projections, objectives, assumptions, future events or

performance (often but not always using phrases such as "expects",

or "does not expect", "is expected", "anticipates" or "does not

anticipate", "plans", “proposed”, "budget", "scheduled",

"forecasts", "estimates", "believes" or "intends" or variations of

such words and phrases or stating that certain actions, events or

results "may" or "could", "would", "might" or "will" be taken to

occur or be achieved) are not statements of historical fact and may

be forward-looking statements. In this news release,

forward-looking statements relate, among other things, the

Company’s objectives, goals and exploration activities conducted

and proposed to be conducted at the Company’s properties; future

growth potential of the Company, including whether any proposed

exploration programs at any of the Company’s properties will be

successful; exploration results; and future exploration plans and

costs and financing availability.

These forward-looking statements are based on

reasonable assumptions and estimates of management of the Company

at the time such statements were made. Actual future results may

differ materially as forward-looking statements involve known and

unknown risks, uncertainties and other factors which may cause the

actual results, performance or achievements of the Company to

materially differ from any future results, performance or

achievements expressed or implied by such forward-looking

statements. Such factors, among other things, include: risks

related to the novel coronavirus disease on the Company; expected

benefits to the Company relating to exploration conducted and

proposed to be conducted at the Company’s properties;; failure to

identify any additional mineral resources or significant

mineralization; the preliminary nature of metallurgical test

results; uncertainties relating to the availability and costs of

financing needed in the future, including to fund any exploration

programs on the Company’s properties; business integration risks;

fluctuations in general macroeconomic conditions; fluctuations in

securities markets; fluctuations in spot and forward prices of

gold, silver, base metals or certain other commodities;

fluctuations in currency markets (such as the Canadian dollar to

United States dollar exchange rate); change in national and local

government, legislation, taxation, controls, regulations and

political or economic developments; risks and hazards associated

with the business of mineral exploration, development and mining

(including environmental hazards, industrial accidents, unusual or

unexpected formations pressures, cave-ins and flooding); inability

to obtain adequate insurance to cover risks and hazards; the

presence of laws and regulations that may impose restrictions on

mining and mineral exploration; employee relations; relationships

with and claims by local communities and indigenous populations;

availability of increasing costs associated with mining inputs and

labour; the speculative nature of mineral exploration and

development (including the risks of obtaining necessary licenses,

permits and approvals from government authorities); the

unlikelihood that properties that are explored are ultimately

developed into producing mines; geological factors; actual results

of current and future exploration; changes in project parameters as

plans continue to be evaluated; soil sampling results being

preliminary in nature and are not conclusive evidence of the

likelihood of a mineral deposit; title to properties; and those

factors described in the most recently filed management’s

discussion and analysis of the Company. Although the

forward-looking statements contained in this news release are based

upon what management of the Company believes, or believed at the

time, to be reasonable assumptions, the Company cannot assure

shareholders that actual results will be consistent with such

forward-looking statements, as there may be other factors that

cause results not to be as anticipated, estimated or intended.

Accordingly, readers should not place undue reliance on

forward-looking statements and information. There can be no

assurance that forward-looking information, or the material factors

or assumptions used to develop such forward-looking information,

will prove to be accurate. The Company does not undertake to

release publicly any revisions for updating any voluntary

forward-looking statements, except as required by applicable

securities law.

Neither the TSX Venture Exchange (the

“Exchange”) nor its Regulation Services Provider (as that term is

defined in the policies of the Exchange) accepts responsibility for

the adequacy or accuracy of this news release.

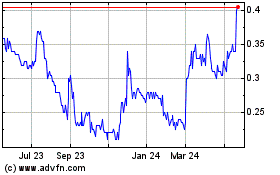

White Gold (TSXV:WGO)

Historical Stock Chart

From Dec 2024 to Jan 2025

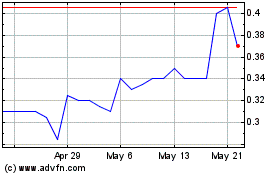

White Gold (TSXV:WGO)

Historical Stock Chart

From Jan 2024 to Jan 2025