Allied Energy, Inc. ("Company") (PINKSHEETS: AGGI) today announced

updates relating to its operations.

Drilling Update:

Cherokee County, Texas: During March 2012,

the Company commenced operations to re-enter the Ragsdale #1 well

located on the Ragsdale Estate lease, which totals approximately

186 acres in the East Texas Basin. The drilling plan calls for

re-entry into the original well bore to a depth of approximately

5,230', at which depth a deviated/slant hole will be drilled to an

approximate total measured depth of 10,160'. Based upon logs from

the original well and additional areal well control data, it is

expected that the Pettet D formation will be encountered, with an

anticipated pay-zone thickness of 10'-15', but there is no

assurance that this will occur. The well operator has advised that

total depth should be achieved and logging operations should begin

no later than the end of April.

One or more of the general partnerships sponsored by the Company

holds a 32% working interest in the Ragsdale #1 gas well. The

remaining working interest (68%), which currently is held by the

Company, may be used to satisfy certain obligations of the

Company.

Completion Update:

Leon County, Texas: The Company has

successfully completed the Champion Ranch 1-H oil well drilled in

Leon County, Texas. The well was drilled to a total depth of 12,015

feet, followed by the completion of a 17-stage fracking procedure.

A new pump jack was recently installed and commenced operation on

April 17, 2012.

One or more of the general partnerships sponsored by the Company

holds a majority of the working interest in the Champion Ranch 1-H

oil well. The Company owns a 25% working interest (4.75% net

revenue interest), inclusive of its interests in the general

partnerships.

Wood County, Texas: During November 2011,

the Rock Hill #1 well located on the Quitman Lake lease was drilled

to a total depth of 10,080 feet. During drilling operations,

several changes were made due to final placement of the bottom hole

location. The well was plugged back on two occasions in order to

relocate the bottom hole position. Analysis of the well log

indicated several potentially productive intervals that warranted

testing. Despite the difficulties encountered during drilling

operations, the well was approved for completion in several

intervals within the Rodessa and Travis Peak formations. Oil and

gas production from the well has been disappointing, averaging 4

bopd and 100mcf per day (flared). Based upon these production

numbers, the well is considered non-commercial. Our production

engineers believe that the poor production is due primarily to

complications resulting from a fault that was encountered during

drilling operations.

After further research and well evaluation, our consulting

engineers believe that it will be possible to avoid this fault

during the drilling of subsequent wells on nearby acreage, although

there can be no assurance that this will occur.

Working interest in the Rock Hill #1 prospect is held by one or

more general partnerships sponsored by the Company. The Company

holds a 24% working interest (18% net revenue interest), inclusive

of its interests in the general partnerships.

Production Update:

Leon County, Texas: In April 2011, the

Company, on behalf of certain of its sponsored partnerships,

managed the drilling and completion of the Wallrath #1H, a

horizontal oil well in Leon County, Texas. The well continues to

produce at commercial levels, and in March 2012, produced an

average of 130 barrels of oil per day. The Company holds a 13.38%

working interest (0.66% net revenue interest), inclusive of its

interests in the general partnerships.

Re-Entry Update:

Lavaca County, Texas: During December

2011, the Company purchased working interests in the #1 Konvicka

well located on the Yoakum East Property lease. The well,

originally drilled in August 2010, and testing at over 2,000 MCF

per day, did not sustain acceptable flow rates. In an attempt to

increase production, a fracking operation was scheduled and

completed in January 2012. According to recent reports from the

on-site engineers, due to unknown reasons, the fracking procedure

failed. The operator has completed swabbing operations and has

performed a casing evaluation. A report of the failed fracking

procedure is being finalized by the Company's engineer, and the

operator is currently evaluating the merits of performing a second

frack or a re-completion in an up-hole zone in an attempt to

improve the chances of producing a commercially viable well. It is

not currently known whether it will be possible to bring the well

into production, and, if so, what levels of production may be

expected. The Company holds a 44% working interest, (32.56% net

revenue interest), in the #1 Konvicka well.

Operating Update:

Grimes County, Texas: The Howard 1H and

the Howard 2H gas wells currently are being operated by Allied

Operating Texas, LLC, on behalf of partnerships sponsored by the

Company. The Company owns working interests of 16.4% and 13.38%,

and net revenue interests of .85% and 2.53%, respectively

(inclusive of its interests in the general partnerships), in the

Howard 1H and the Howard 2H wells.

The two wells had been "shut-in" since September 2011 for

approximately 3 1/2 months, by the owner of the pipeline through

which the production gas flows, for unacceptably high levels of CO2

detected in the production gas. In response to the pipeline owner's

action, an amine facility was installed and placed into service

resulting in a return to acceptable levels of CO2.

As of December 2011, the Howard IH and Howard 2H gas wells were

placed back into production. The production of hydrocarbons of the

two wells has returned to flows approximately similar to those

experienced immediately prior to the "shut-in" period and the

operator continues to monitor and fine-tune the amine plant in

order to maximize efficiency and production.

Rogers County, Oklahoma: The Company is

currently evaluating all the general partnerships for which the

Company acts as managing general partner in Rogers County, OK.

These general partnerships sponsored by the Company have

approximately 94 wells in production or under development from

which gas and/or oil are being produced from a variety of

formations.

The Company originally focused on this area in late 2006, with

the primary objective being to develop the coal bed methane

(natural gas) reserves that occur in multiple layers at relatively

shallow depths. Over the last five years, the Company has reduced

its drilling and development programs with respect to the leases in

the area, as the market price of natural gas has steadily declined

to historically low levels.

As a result of these low market prices, many of the wells in

Rogers County that might have been profitable producers at 2007

prices, are now unable to generate sufficient revenue to cover the

lease operating expenses.

The Company is presently conducting a review of production and

expense records to determine the financial condition of the

partnerships and the status of each of the partnerships' wells.

Based upon the findings of the review, we expect to make specific

recommendations either to 1) "shut-in" wells that might benefit by

a future rebound in the market prices of gas, 2) plug and abandon

wells deemed to be non-commercial, or 3) continue to operate wells

that are profitable or may be candidates for enhancement procedures

or re-engineering to improve production.

Corporate Update:

Appointment of CFO: In July 2011, the

Company entered into an agreement with Tatum LLC ("Tatum") to

engage the services of Gene Kamarasy, a partner of Tatum, as

interim Chief Financial Officer. Since that time, Mr. Kamarasy has

been in charge of the accounting, compliance and financial

functions, has moved aggressively towards the restructuring of the

accounting and finance departments of the Company, and is bringing

the Company current in its financial reporting requirements. Mr.

Kamarasy brings with him over 30 years of experience in the finance

and accounting industries and has extensive experience in the

restructuring of companies. Tatum is a national, professional

services firm supporting the offices of the CFO and CIO in many

companies within and outside the U.S.

About Allied Energy:

Allied Energy, Inc. is engaged in the oil and gas exploration

and development business, with operations located primarily in

Texas, Oklahoma and Ohio. The Company sponsors oil & gas

partnerships through which it raises funds for the drilling and

development of oil & gas wells. The Company serves as managing

general partner of the partnerships and often owns differing

partnership interests in the partnerships and/or differing direct

interests in the properties in which the partnerships

participate.

The Company's subsidiaries include Allied Operating, LLC and

Allied Operating, Texas, LLC, two operating companies that are used

to manage the drilling, development and operations of the oil &

gas drilling partnerships sponsored by the Company, as well as for

other non-affiliated oil and gas companies that are joint interest

owners in drilling activities owned primarily by partnerships

sponsored by the Company. The Company is also majority owner of

Allied Gas Transmission, Inc., which owns the pipeline system used

to transmit production from gas wells located in Rogers County,

Oklahoma to gas purchasers.

The Company's ultimate strategic focus is on the development of

oil and natural gas production and reserves. The Company believes

that its oil and natural gas development strategy will provide

growth to the Company in the future. For more information:

www.alliedenergy.com

Forward-Looking and Continuing

Statements:

Certain statements in this release and the attached corporate

profile that are not historical facts are "forward-looking

statements" within the meaning of the Private Securities Litigation

Reform Act of 1995. Such statements may be identified by the use of

words such as "anticipate," "believe," "expect," "future," "may,"

"will," "would," "should," "plan," "projected," "intend," and

similar expressions. Such forward-looking statements involve known

and unknown risks including but not limited to geological and

geophysical risks inherent to the oil and gas industry,

uncertainties and other factors that may cause the actual results,

price of oil and natural gas, state of the economy, industry

regulation, reliance upon expert recommendations and opinions,

performance or achievements of the Company to be materially

different from those expressed or implied by such forward-looking

statements. The Company's future operating results are dependent

upon many factors, including but not limited to the Company's

ability to: (i) obtain sufficient capital or strategic business

arrangements to fund its drilling plans; (ii) build the management

and human resources and infrastructure necessary to support the

growth of its business; (iii) competitive factors and developments

beyond the Company's control, including but not limited to the

strength of the overall economy; and (iv) other risk factors

inherent to the oil and gas industry.

Contact: Heather Age Allied Energy, Inc. 2427

Russellville Road Bowling Green, KY 42101 Phone: 866-256-5836 Fax:

800-251-9322 Website: http://www.alliedenergy.com Email:

info@alliedenergy.com

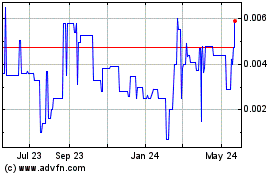

Allied Energy (PK) (USOTC:AGGI)

Historical Stock Chart

From Dec 2024 to Jan 2025

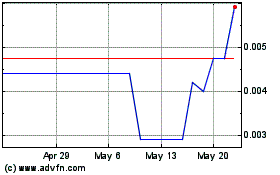

Allied Energy (PK) (USOTC:AGGI)

Historical Stock Chart

From Jan 2024 to Jan 2025