Securities Registration (ads, Immediate) (f-6ef)

18 November 2015 - 7:17AM

Edgar (US Regulatory)

As filed with the United States Securities and Exchange Commission on November 17, 2015

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-6

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933 FOR AMERICAN DEPOSITARY SHARES EVIDENCED BY

AMERICAN DEPOSITARY RECEIPTS

Alpha Bank A.E.

(Exact name of issuer of deposited securities as specified in its charter)

N/A

(Translation of issuer’s name into English)

Greece

(Jurisdiction of incorporation or organization of issuer)

DEUTSCHE BANK TRUST COMPANY AMERICAS

(Exact name of depositary as specified in its charter)

60 Wall Street

New York, New York 10005

(212) 250-9100

(Address, including zip code, and telephone number, including area code, of depositary’s principal executive offices)

Puglisi & Associates

850 Library Avenue, Suite 204

Newark, Delaware 29711

(302) 738-6680

(Address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Deutsche Bank Trust Company Americas

60 Wall Street

New York, New York 10005

(212) 250-9100

It is proposed that this filing become effective under Rule 466

| |

x

o

|

immediately upon filing

on (Date) at (Time)

|

If a separate registration statement has been filed to register the deposited shares, check the following box. o

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of

Securities to be Registered

|

Amount to be

Registered

|

Proposed Maximum

Aggregate Price Per Unit*

|

Proposed Maximum

Aggregate Offering Price**

|

Amount of

Registration Fee

|

|

American Depositary Shares evidenced by American Depositary Receipts, each American Depositary Share representing one-fourth of one common share of Alpha Bank A.E.

|

300,000,000

|

$0.05

|

$15,000,000

|

$1510.50

|

|

*

|

Each unit represents one American Depositary Share.

|

|

**

|

Estimated solely for the purpose of calculating the registration fee. Pursuant to Rule 457(k), such estimate is computed on the basis of the maximum aggregate fees or charges to be imposed in connection with the issuance of receipts evidencing American Depositary Shares.

|

This Registration Statement may be executed in any number of counterparts, each of which shall be deemed an original, and all of such counterparts together shall constitute one and the same instrument.

PART I

INFORMATION REQUIRED IN PROSPECTUS

PROSPECTUS

The Prospectus consists of the proposed form of American Depositary Receipt (“ADR” or “American Depositary Receipt”) included as Exhibit (a)(2) to this Registration Statement, which is incorporated herein by reference.

|

Item 1.

|

DESCRIPTION OF SECURITIES TO BE REGISTERED

|

|

Item Number and Caption

|

|

Location in Form of ADR Filed Herewith asProspectus

|

|

1. Name of Depositary and address of its principal executive office:

|

|

Following Article (11).

|

| |

|

|

|

2. Title of ADRs and identity of deposited securities:

|

|

Face of ADR, top center and introductory paragraph.

|

| |

|

|

|

Terms of Deposit:

|

|

|

| |

|

|

|

(a) Amount of deposited securities represented by one unit of ADRs:

|

|

Face of ADR, upper right corner and introductory paragraph.

|

| |

|

|

|

(b) Any procedure for voting the deposited

securities:

|

|

Articles (13), (14) and (18).

|

| |

|

|

|

(c) Procedure for collecting and distributing dividends:

|

|

Articles (2), (8), (12), (13), (15) and (21).

|

| |

|

|

|

(d) Procedures for transmitting notices, reports and proxy soliciting material:

|

|

Articles (13), (14), (16), (19), (20) and (21).

|

| |

|

|

|

(e) Sale or exercise of rights:

|

|

Articles (8), (12) and (14).

|

| |

|

|

|

(f) Deposit or sale of securities resulting from dividends, splits or plans of reorganization:

|

|

Articles (3), (4), (5), (8) and (15).

|

| |

|

|

|

(g) Amendment, extension or termination of the deposit agreement:

|

|

Articles (20) and (21) (no provision for extensions).

|

| |

|

|

|

(h) Rights of holders of ADRs to inspect the transfer books of the depositary and the list of holders of ADRs:

|

|

Article (16).

|

| |

|

|

|

(i) Restrictions on the right to transfer or withdraw the underlying securities:

|

|

Articles (2), (3), (4), (5), (6) and (8).

|

| |

|

|

|

(j) Any limitation on the depositary’s

liability:

|

|

Articles (5), (18) and (19).

|

| |

|

|

|

3. Fees and charges which may be imposed directly or indirectly on holders of ADRs:

|

|

Articles (5) and (8).

|

Item 2. AVAILABLE INFORMATION

| |

|

|

|

Item Number and Caption

|

|

Location in Form of ADR Filed Herewith asProspectus

|

|

(a) The Issuer is exempt from the requirement to register the deposited securities under Section 12(g) of the United States Securities Exchange Act of 1934, as amended (the “Exchange Act”), as it (1) is not required to file or furnish reports under Section 13(a) or Section 15(d) of the Exchange Act, (2) currently maintains a listing of the deposited securities on Athens Exchange S.A. (the “Athens Exchange”), which constitutes the Issuer’s primary trading market for those securities, and (3) has published in English on its Internet Web site (http://www.alpha.gr/page/default.asp?la=2&id=52) information that, since the first day of its most recently completed fiscal year (December 31, 2013), it (A) has made public or been required to make public pursuant to the laws of Greece, (B) has filed or been required to file with the Athens Exchange (the principal stock exchange in Greece on which the Issuer’s shares are traded) and that has been made public by the Athens Exchange and (C) has distributed or been required to distribute to its security holders. The Issuer intends to continue to publish, on an ongoing basis and for each subsequent fiscal year, the information specified in Rule 12g3-2(b)(1)(iii) in English on its Internet Web site.

|

|

Articles (11) and (16).

|

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

|

(a)(1)

|

Form of Amended and Restated Deposit Agreement, including the Form of American Depositary Receipt, among Alpha Bank A.E., as Issuer, Deutsche Bank Trust Company Americas, as Depositary, and all Holders of ADRs issued thereunder. Previously filed as Exhibit (a) to Registration Statement No. 333-160082.

|

|

(a)(2)

|

Form of American Depositary Receipt. – Filed herewith as Exhibit (a)(2).

|

|

(b)

|

Any other agreement to which the Depositary is a party relating to the issuance of the American Depositary Shares registered hereunder or the custody of the deposited securities represented thereby. – Not Applicable.

|

|

(c)

|

Every material contract relating to the deposited securities between the Depositary and the Company in effect at any time within the last three years. – Not Applicable.

|

|

(d)

|

Opinion of counsel to the Depositary as to the legality of the securities being registered. – Filed herewith as Exhibit (d).

|

|

(e)

|

Certification under Rule 466. – Filed herewith as Exhibit (e).

|

|

(f)

|

Powers of Attorney for certain officers and directors and the authorized representative of the Company. – Set forth on the signature pages hereto.

|

|

(a)

|

The Depositary hereby undertakes to make available at the principal office of the Depositary in the United States, for inspection by holders of the American Depositary Receipts, any reports and communications received from the issuer of the deposited securities which are both (1) received by the Depositary as the holder of the deposited securities; and (2) made generally available to the holders of the underlying securities by the issuer.

|

|

(b)

|

If the amounts of fees charged are not disclosed in the prospectus, the Depositary undertakes to prepare a separate document stating the amount of any fee charged and describing the service for which it is charged and to deliver promptly a copy of such fee schedule without charge to anyone upon request. The Depositary undertakes to notify each registered holder of an American Depositary Receipt 30 days before any change in the fee schedule.

|

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, as amended, Deutsche Bank Trust Company Americas, on behalf of the legal entity created by the Amended and Restated Deposit Agreement, by and among Alpha Bank A.E., Deutsche Bank Trust Company Americas, as depositary, and all Holders from time to time of American Depositary Shares evidenced by American Depositary Receipts issued thereunder, certifies that it has reasonable grounds to believe that all the requirements for filing on Form F-6 are met and has duly caused this Registration Statement on Form F-6 to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of New York, State of New York, on November 17, 2015.

| |

Legal entity created by the Deposit Agreement for the issuance of American Depositary Receipts evidencing American Depositary Shares, each representing one-fourth of one common share of Alpha Bank A.E.

|

|

| |

|

|

|

| |

Deutsche Bank Trust Company Americas, solely in its capacity as Depositary

|

|

| |

|

|

|

| |

By:

|

/s/ James Kelly

|

|

| |

|

Name: James Kelly |

|

| |

|

Title: Vice President |

|

| |

|

|

|

| |

By: |

/s/ Christopher Konopelko

|

|

| |

|

Name: Christopher Konopelko |

|

| |

|

Title: Director |

|

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, as amended, Alpha Bank A.E. certifies that it has reasonable grounds to believe that all the requirements for filing on Form F-6 are met and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Athens, Greece on November 17, 2015.

| |

Alpha Bank A.E.

|

|

| |

|

|

|

| |

By:

|

/s/ Demetrios P. Mantzounis |

|

| |

Name: |

Demetrios P. Mantzounis |

|

| |

Title: |

Managing Director - CEO |

|

Know all persons by these presents that each person whose signature appears below constitutes and appoints Demetrios P. Mantzounis and Vassilios E. Psaltis, jointly and severally, his or her true lawful attorneys-in-fact and agents with full and several power of substitution and resubstitution for and in his or her name, place and stead, in any and all capacities, to sign any and all amendments, including post-effective amendments and supplements to this Registration Statement and any registration statements pursuant to Rule 462(b) under the Securities Act of 1933, as amended, relating thereto, and to file the same, with all exhibits thereto and other documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorneys-in-fact and agents full power and authority to do and perform each and every act and thing requisite and necessary to be done in and about the premises, as fully to all intents and purposes as they or he or she might or could do in person, hereby ratifying and confirming all that said attorneys-in-fact and agents, or their substitute or substitutes, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, as amended, this Registration Statement has been signed by the following persons in the capacities indicated on November 17, 2015.

|

Signatures

|

|

Capacity

|

| |

|

|

|

/s/ Vasileios T. Rapanos

|

|

Chairman of the Board of Directors

|

| Vasileios T. Rapanos |

|

|

| |

|

|

| /s/ Minas G. Tanes |

|

Vice-Chairman of the Board of Directors

|

| Minas G. Tanes |

|

|

| |

|

|

| /s/ Demetrios P. Mantzounis |

|

Managing Director - CEO

|

|

Demetrios P. Mantzounis

|

|

|

| |

|

|

|

/s/ Spyros N. Filaretos

|

|

Executive Director

|

|

Spyros N. Filaretos

|

|

|

| |

|

|

|

/s/ Artemios Ch. Theodoridis

|

|

Executive Director

|

|

Artemios Ch. Theodoridis

|

|

|

| |

|

|

|

/s/ George C. Aronis

|

|

Executive Director

|

|

George C. Aronis

|

|

|

| |

|

|

|

/s/ Efthimios O. Vidalis

|

|

Director

|

|

Efthimios O. Vidalis

|

|

|

| |

|

|

|

/s/ Ioanna E. Papadopoulou

|

|

Director

|

|

Ioanna E. Papadopoulou

|

|

|

| |

|

|

|

/s/ Pavlos A. Apostolides

|

|

Director

|

|

Pavlos A. Apostolides

|

|

|

| |

|

|

/s/ Evangelos J. Kaloussis

|

|

Director

|

|

Evangelos J. Kaloussis

|

|

|

| |

|

|

|

/s/ Ioannis K. Lyras

|

|

Director |

|

Ioannis K. Lyras

|

|

|

| |

|

|

| |

|

Director |

|

Ibrahim S. Dabdoub

|

|

|

| |

|

|

| |

|

Director |

|

Shahzad Shahbaz

|

|

|

| |

|

|

|

/s/ Panagiota S. Iplixian

|

|

Director

|

|

Panagiota S. Iplixian

|

|

|

| |

|

|

|

/s/ Marica S. Ioannou-Frangakis

|

|

Director

|

|

Marica S. Ioannou-Frangakis

|

|

|

| |

|

|

|

/s/ Vassilios E. Psaltis

|

|

General Manager - CFO

|

|

Vassilios E. Psaltis

|

|

|

| |

|

|

|

/s/ Donald J. Puglisi

|

|

Authorized Representative in the United States

|

|

Donald J. Puglisi

|

|

|

|

Managing Director

|

|

|

|

Puglisi & Associates

|

|

|

INDEX TO EXHIBITS

|

Exhibit Number

|

|

(a)(2) Form of American Depositary Receipt

(d) Opinion of counsel to the Depositary

(e) Rule 466 Certification

|

| |

CUSIP Number: 02071M101

ISIN: US02071M1018

American Depositary Shares (Each

American Depositary Share

representing one-fourth (1/4) of one

(1) Fully Paid

Common Share)

|

EXHIBIT A

TO

DEPOSIT AGREEMENT

[FORM OF FACE OF RECEIPT]

AMERICAN DEPOSITARY RECEIPT

evidencing

AMERICAN DEPOSITARY SHARES

representing

COMMON VOTING SHARES

of

ALPHA BANK A.E.

(Incorporated under the laws of Greece)

No. _____________

DEUTSCHE BANK TRUST COMPANY AMERICAS, as depositary (the “Depositary”), hereby certifies that [ ] is the owner of [ ] American Depositary Shares, representing deposited Common Voting Shares, including rights to receive such Common Voting Shares (“Shares”), of ALPHA BANK A.E., a corporation organized under the laws of Greece (the “Company”). At the date hereof, each American Depositary Share represents one-fourth of one Share deposited under the Deposit Agreement (hereinafter defined) at the Athens office of ALPHA BANK A.E. as Custodian (the “Custodian”). Capitalized terms used herein that are not defined herein shall have the meanings assigned to them in the Deposit Agreement.

|

1

|

The Deposit Agreement This American Depositary Receipt is one of the receipts (the “Receipts”) executed and delivered pursuant to the Amended and Restated Deposit Agreement dated as of June 24, 2009 (as amended from time to time, the “Deposit Agreement”) by and among the Company, the Depositary and all registered holders (“Holders”) from time to time of Receipts, each of whom by accepting a Receipt becomes a party thereto, bound by all applicable terms and provisions thereof and hereof. The Deposit Agreement sets forth the rights of Holders and the rights and duties of the Depositary in respect of the Shares deposited thereunder and any and all other securities, property and cash from time to time received in respect of such Shares and held thereunder (such Shares, securities, property and cash, collectively, the “Deposited Securities”). Copies of the Deposit Agreement and of the Company’s provisions of or governing Deposited Securities are on file at the Depositary’s Office, the office of the Custodian and at any other designated transfer office. The statements made on the face and the reverse of this Receipt are summaries of certain provisions of the Deposit Agreement and are qualified by and subject to the detailed provisions thereof. The Depositary makes no representation or warranty as to the validity or worth of the Deposited Securities.

|

|

2

|

Withdrawal of Deposited Securities Upon surrender of this Receipt and payment of the fee of the Depositary provided for in paragraph (8) of this Receipt at the Depositary’s Office or at such other offices as it may designate, subject to the Deposit Agreement and the provisions of or governing the Deposited Securities, the Holder hereof is entitled to the delivery without unreasonable delay at the office of the Custodian to such Holder or upon such Holder’s order of the Deposited Securities at the time represented by the American Depositary Shares evidenced by this Receipt. At the request, risk and expense of the Holder hereof, the Depositary may deliver such Deposited Securities at the Depositary’s Office or at such other place as may have been requested by the Holder. Delivery of Deposited Securities may be made by the delivery of certificates to the extent such Deposited Securities may be represented by certificates. Neither the Depositary nor the Custodian shall deliver Deposited Securities to any person except pursuant to this paragraph (2) or paragraphs (12), (15), (17), (19), (20) or (21). Notwithstanding any other provision of the Deposit Agreement or this Receipt, the Depositary may restrict the withdrawal of Deposited Securities only for the reasons set forth in General Instruction I.A.(1) of Form F-6 under the Securities Act of 1933.

|

|

3

|

Transfers, Split-ups and Combinations Subject to paragraph (4), this Receipt is transferable on the register maintained by the Depositary by the Holder hereof in person or by duly authorized attorney, upon surrender of this Receipt at any designated transfer office properly endorsed or accompanied by proper instruments of transfer and duly stamped as may be required by applicable law; provided that the Depositary may close the Receipt register at any time or from time to time when deemed expedient by it in connection with the performance of its duties under the Deposit Agreement or at the request of the Company. This Receipt may be split into other Receipts or may be combined with other Receipts into one Receipt, evidencing the same aggregate number of American Depositary Shares as those evidenced by the Receipt or Receipts surrendered.

|

|

4

|

Certain Limitations Prior to the execution and delivery, registration, registration of transfer, split-up or combination of any Receipt, the delivery of any distribution in respect thereof, or, subject to the last sentence of paragraph (2), the withdrawal of any Deposited Securities, the Depositary, the Company or the Custodian may require: (a) payment of (i) any stock transfer or other tax or other governmental charge with respect thereto, (ii) any stock transfer or registration fees in effect for the registration of transfers of Shares or other Deposited Securities upon any applicable register and (iii) any applicable charges as provided in paragraph (8) of this Receipt;

|

|

(b)

|

the production of proof satisfactory to it of the identity and genuineness of any signature and of such other information (including without limitation information as to citizenship, residence, exchange control approval, or legal or beneficial ownership of any securities) as it may deem necessary or proper or as the Company may require; and (c) compliance with such regulations, if any, as the Depositary may establish consistent with the Deposit Agreement. The delivery of Receipts against deposits of Shares may be suspended, deposits of Shares may be refused, or the registration of transfer of Receipts, their split-up or combination or, subject to the last sentence of paragraph (2), the withdrawal of Deposited Securities may be suspended, generally or in particular instances, when the Receipt register or any register for Shares or other Deposited Securities is closed or when any such action is deemed necessary or advisable by the Depositary or the Company. The Depositary may issue Receipts against rights to receive Shares from the Company, or any registrar, transfer agent, clearing agency or other entity recording Share ownership or transactions. The Depositary will not issue Receipts against other rights to receive Shares unless (x) such Receipts are fully collateralized (marked to market daily) with cash or U.S. government securities until such Shares are deposited, (y) the applicant for such Receipts represents in writing that it owns such Shares and will deliver them upon the Depositary’s request (no evidence of ownership is required or time of delivery specified) and (z) all such Receipts represent not more than 20% of Shares actually deposited. Such collateral, but not the earnings thereon, will be held for the benefit of the Holders. The Depositary may retain for its own account any compensation for the issuance of Receipts against such other rights to receive Shares, including without limitation earnings on the collateral securing such rights. The Depositary will execute and deliver Receipts only in accordance with Section 2.3 of the Deposit Agreement and paragraphs (3), (4), (12) and (15). The Depositary will not knowingly accept for deposit under the Deposit Agreement any Shares required to be registered under the Securities Act of 1933 and not so registered; the Depositary may refuse to accept for such deposit any Shares identified by the Company in order to facilitate the Company’s compliance with securities laws in the United States.

|

|

5

|

Liability of Holder for Taxes If any tax or other governmental charge shall become payable by or on behalf of the Custodian or the Depositary with respect to this Receipt or any Deposited Securities represented by the American Depositary Shares evidenced by this Receipt, such tax or other governmental charge shall be payable by the Holder hereof, who shall pay the amount thereof to the Depositary. The Depositary may refuse to effect any registration of transfer of this Receipt or any split-up or combination hereof or any withdrawal of such Deposited Securities until such payment is made, and may withhold or deduct from any distributions on such Deposited Securities, or may sell for the account of the Holder hereof any part or all of such Deposited Securities (after attempting by reasonable means to notify the Holder hereof prior to such sale), and may apply such cash or the proceeds of any such sale in payment of such tax or other governmental charge, the Holder hereof remaining liable for any deficiency.

|

|

6

|

Warranties by Depositor Every person depositing Shares under the Deposit Agreement shall be deemed thereby to represent and warrant that such Shares and each certificate therefor are validly issued and outstanding, fully paid, nonassessable and free of pre-emptive rights, that the person making such deposit is duly authorized so to do and that such Shares are not “restricted securities” as such term is defined in Rule 144 of the Securities Act of 1933. Such representations and warranties shall survive the deposit of Shares and issuance of Receipts.

|

|

7

|

Disclosure of Interests To the extent that provisions of or governing any Deposited Securities may require the disclosure of beneficial or other ownership of Deposited Securities, other Shares and other securities to the Company and may provide for blocking transfer and voting or other rights to enforce such disclosure or limit such ownership, the Depositary has agreed to use its reasonable efforts to comply with Company instructions as to Receipts in respect of any such enforcement or limitation and Holders and all persons taking and holding Receipts thereby agree to comply with all such disclosure requirements and ownership limitations and to cooperate with the Depositary in the Depositary’s compliance with such Company instructions.

|

|

8

|

Charges of Depositary The Depositary shall charge the following fees for the services performed under the terms of the Deposit Agreement; provided, however, that no fees shall be payable upon distribution of cash dividends so long as the charging of such fee is prohibited by the exchange, if any, upon which the American Depositary Shares are listed:

|

|

|

(i) to any person to whom American Depositary Shares are issued or to any person to whom a distribution is made in respect of American Depositary Share distributions pursuant to stock dividends or other free distributions of stock, bonus distributions, stock splits or other distributions (except where converted to cash), a fee not in excess of U.S.$5.00 per 100 American Depositary Shares (or fraction thereof) so issued under the terms of the Deposit Agreement to be determined by the Depositary;

|

|

|

(ii) to any person surrendering American Depositary Shares for cancellation and withdrawal of Deposited Securities including, inter alia, cash distributions made pursuant to a cancellation or withdrawal, a fee not in excess of U.S.$5.00 per 100 American Depositary Shares (or fraction thereof) so surrendered;

|

|

|

(iii) to any Holder of American Depositary Shares, a fee not in excess of U.S.$2.00 per 100 American Depositary Shares held for the distribution of cash proceeds, including cash dividends or sale of rights and other entitlements, not made pursuant to a cancellation or withdrawal;

|

|

|

(iv) to any Holder of American Depositary Shares, a fee not in excess of U.S.$5.00 per 100 American Depositary Shares (or portion thereof) issued upon the exercise of rights;

|

|

|

(v) to any Holder of American Depositary Shares, an annual fee not in excess of U.S.$2.00 per 100 American Depositary Shares for the operation and maintenance costs associated with the administration of such American Depositary Shares, provided, however, that if the Depositary imposes a fee under this clause (v), then the total of fees assessed under this clause (v), combined with the total of fees assessed under clause (iii) above, shall not exceed U.S.$2.00 per 100 ADS in any calendar year; and

|

|

|

(vi) for the expenses incurred by the Depositary, the Custodian or their respective agents in connection with inspections of the relevant share register maintained by the local registrar and/or performing due diligence on the central securities depository for Greece: an annual fee of U.S.$1.00 per 100 American Depositary Shares (such fee to be assessed against Holders of record as at the date or dates set by the Depositary as it sees fit and collected at the sole discretion of the Depositary by billing such Holders for such fee or by deducting such fee from one or more cash dividends or other cash distributions).

|

|

|

In addition, Holders, persons depositing Shares for deposit and persons surrendering American Depositary Shares for cancellation and withdrawal of Deposited Securities will be required to pay the following charges:

|

|

|

(i) taxes (including applicable interest and penalties) and other governmental charges;

|

|

|

(ii) such registration fees as may from time to time be in effect for the registration of Shares or other Deposited Securities with the foreign registrar and applicable to transfers of Shares or other Deposited Securities to or from the name of the Custodian, the Depositary or any nominees upon the making of deposits and withdrawals, respectively;

|

|

|

(iii) such cable, telex , facsimile and electronic transmission and delivery expenses as are expressly provided in the Deposit Agreement to be at the expense of the person depositing or withdrawing Shares or Holders of American Depositary Shares;

|

|

|

(iv) the expenses and charges incurred by the Depositary in the conversion of foreign currency;

|

|

|

(v) such fees and expenses as are incurred by the Depositary in connection with compliance with exchange control regulations and other regulatory requirements applicable to Shares, Deposited Securities, American Depositary Shares and American Depositary Receipts;

|

|

|

(vi) the fees and expenses incurred by the Depositary in connection with the delivery of Deposited Securities, including any fees of a central depository for securities in the local market, where applicable; and

|

|

|

(vii) any additional fees, charges, costs or expenses that may be reasonably incurred by the Depositary from time to time.

|

|

|

Any other charges and expenses of the Depositary under this Deposit Agreement will be paid by the Company upon agreement between the Depositary and the Company. All fees and charges may, at any time and from time to time, be changed by agreement between the Depositary and Company but, in the case of fees and charges payable by Holders, only in the manner contemplated by paragraph (20) of this Receipt.

|

|

9

|

Title to Receipts Title to this Receipt (and to the Deposited Securities represented by the American Depositary Shares evidenced hereby), when properly endorsed or accompanied by proper instruments of transfer, is transferable by delivery with the same effect as in the case of a negotiable instrument; provided that the Depositary, notwithstanding any notice to the contrary, may treat the person in whose name this Receipt is registered on the register maintained by the Depositary as the absolute owner hereof for the purpose of determining the person entitled to any distribution or notice and for all other purposes.

|

|

10

|

Validity of Receipt This Receipt shall not be entitled to any benefits under the Deposit Agreement or be valid or obligatory for any purpose unless executed by the Depositary by the manual or facsimile signature of a duly authorized officer of the Depositary.

|

|

11

|

Available Information The Company publishes and agrees to continue publishing the information in English required to maintain the exemption from registration under Rule 12g3-2(b) under the Securities Exchange Act of 1934 on its Internet Web site (http://www.alpha.gr/page/default.asp?la=2&id=52) or through an electronic information delivery system generally available to the public in its primary trading market. Should the Company become subject to the periodic reporting or other informational requirements under the Securities Exchange Act of 1934, it will be required in accordance therewith to file reports and other information with the Commission. The Depositary does not assume any duty to determine if the Company is complying with the current requirements of Rule 12g3-2(b) under the Securities Exchange Act of 1934 or to take any action if the Company is not complying with those requirements.

|

|

Dated:

DEUTSCHE BANK TRUST COMPANY AMERICAS,

as Depositary

By: _______________________________

Name:

Title:

By: _______________________________

Name:

Title:

|

|

The address of the Depositary’s Office is 60 Wall Street, New York, New York 10005, USA, Attention: ADR Department.

[FORM OF REVERSE OF RECEIPT]

SUMMARY OF CERTAIN ADDITIONAL PROVISIONS

OF THE DEPOSIT AGREEMENT

|

12

|

Distributions Upon Deposited Securities Whenever the Depositary or the Custodian shall receive any cash dividend or other cash distribution upon any Deposited Securities, the Depositary shall, subject to the Deposit Agreement, distribute the amount thus received, by checks drawn on a bank in the United States, to the Holders on the record date set by the Depositary therefor of Receipts evidencing American Depositary Shares representing such Deposited Securities, in proportion to the number of American Depositary Shares representing such Deposited Securities held by each of them respectively; provided that the Depositary shall make appropriate adjustments in the amounts so distributed in respect of (a) any of the Deposited Securities being not entitled, by reason of its date of issuance or otherwise, to receive all or any portion of such distribution or (b) any amounts (i) required to be withheld by the Company, the Custodian or the Depositary on account of taxes or (ii) charged by the Depositary in connection with the conversion of foreign currency into U.S. dollars. Cash distributions and cash proceeds from sales of non-cash distributions in foreign currency will be converted by sale or such other manner as the Depositary may determine into U.S. dollars (net of the Depositary’s charges and expenses in effecting such conversion) before distribution to Holders. If in the judgment of the Depositary amounts received in foreign currency may not be converted on a reasonable basis into U.S. dollars transferable to the United States, or may not be so convertible for all of the Holders entitled thereto, the Depositary may in its discretion make such conversion and distribution in U.S. dollars to the extent reasonable and permissible to the Holders entitled thereto and may distribute the balance in foreign currency to the Holders entitled thereto or hold such balance or all such foreign currency for the Holders entitled thereto (without liability for interest thereon). If any distribution upon any Deposited Securities consists of a dividend in, or free distribution of, Shares, the Depositary may or shall if the Company shall so request, subject to the Deposit Agreement, distribute to the Holders on a record date set by the Depositary therefor of Receipts evidencing American Depositary Shares representing such Deposited Securities, in proportion to the number of American Depositary Shares representing such Deposited Securities held by each of them respectively, additional Receipts for an aggregate number of Depositary Shares representing the number of Shares received as such dividend or free distribution. In lieu of delivering Receipts for fractional American Depositary Shares in the case of any such distribution, the Depositary shall sell the number of Shares represented by the aggregate of such fractions and distribute the net proceeds to the Holders entitled thereto as in the case of a distribution received in cash. If additional Receipts are not so distributed, each American Depositary Share shall thenceforth also represent its proportionate interest in the additional Shares so distributed upon such Deposited Securities. If the Company shall offer or cause to be offered to the holders of any Deposited Securities any rights to subscribe for additional Shares or any rights of any nature, the Depositary shall have discretion as to whether and how such rights are to be made available to the Holders; provided that the Depositary will, if requested by the Company, either (y) make such rights available to Holders by means of warrants or otherwise, if lawful and feasible, or (z) if making such rights available is not lawful or not feasible, or if such rights or warrants are not exercised and appear to be about to lapse, sell such rights or warrants at public or private sale, at such place or places and upon such terms as the Depositary may deem proper, and allocate the proceeds of such sales for account of the Holders otherwise entitled thereto upon an averaged or other practicable basis without regard to any distinctions among such Holders because of exchange restrictions, or the date of delivery of any Receipt or Receipts, or otherwise, and distribute the net proceeds so allocated to the Holders entitled thereto as in the case of a distribution received in cash. The Depositary will distribute to Holders on the record date set by it therefor any distribution on Deposited Securities other than cash, Shares or rights in any manner that the Depositary deems equitable and practicable; provided if in the opinion of the Depositary any distribution other than cash, Shares or rights upon any Deposited Securities cannot be made proportionately among the Holders entitled thereto, or if for any other reason the Depositary deems such distribution not to be feasible, the Depositary may adopt such method as it may deem equitable for the purpose of effecting such distribution, including the sale (at public or private sale) of the securities or property thus received, or any part thereof, and the net proceeds of any such sale will be distributed by the Depositary to the Holders entitled thereto as in the case of a distribution received in cash. The Depositary need not distribute securities, Receipts or rights unless the Company furnishes certain evidence or opinions in respect of United States securities laws (which the Company has no obligation to do).

|

|

13

|

Record Dates Whenever any distribution is being made upon any Deposited Securities or any meeting of holders of Shares or other Deposited Securities is being held or whenever the Depositary shall find it necessary or convenient in connection with the giving of any notice, solicitation of any consent or any other matter, the Depositary will, after consultation with the Company, if practicable, fix a record date for the determination of the Holders who shall be entitled to receive such distribution or the net proceeds of the sale thereof, to give instructions for the exercise of voting rights at any such meeting, to receive such notice or solicitation or act in respect of such other matter, subject to the provisions of the Deposit Agreement.

|

|

14

|

Voting of Deposited Securities As soon as practicable after receipt of notice of any meeting or solicitation of consents or proxies of holders of Shares or other Deposited Securities, the Depositary shall mail to Holders a notice containing (a) such information as is contained in such notice and in the solicitation materials, if any, (b) a statement that each Holder at the close of business on a specified record date will be entitled, subject to the provisions of or governing Deposited Securities, to instruct the Depositary as to the exercise of the voting rights, if any, pertaining to the Deposited Securities represented by the American Depositary Shares evidenced by such Holders’ Receipts and (c) a statement as to the manner in which such instructions may be given, including an express indication that instructions may be given (or be deemed given in accordance with the last sentence of this paragraph if no instruction is received) to the Depositary to give a discretionary proxy to a person designated by the Company. Upon the written request of a Holder on such record date, received on or before the date established by the Depositary for such purpose, the Depositary shall endeavor insofar as practicable and permitted under the provisions of or governing Deposited Securities to vote or cause to be voted (or to grant a discretionary proxy to a person designated by the Company to vote) the Deposited Securities represented by the American Depositary Shares evidenced by such Holder’s Receipts in accordance with any instructions set forth in such request. The Depositary will not itself exercise any voting discretion over any Deposited Securities. If no instructions are received by the Depositary from any Holder with respect to any of the Deposited Securities represented by the American Depositary Shares evidenced by such Holder’s Receipts on or before the date established by the Depositary for such purpose, the Depositary will deem such Holder to have instructed the Depositary to give a discretionary proxy to a person designated by the Company with respect to such Deposited Securities and the Depositary will give a discretionary proxy to a person designated by the Company to vote such Deposited Securities, provided that no such instruction shall be deemed given and no such discretionary proxy shall be given with respect to any matter as to which the Company informs the Depositary (and the Company agrees to so inform promptly in writing) that (x) the Company does not wish such proxy given, (y) substantial opposition exists or (z) materially affects the rights of holders of Shares.

|

|

15

|

Changes Affecting Deposited Securities Upon any change in par value, split-up, consolidation, cancellation or any other reclassification of Deposited Securities, or upon any recapitalization, reorganization, merger or consolidation or sale of assets affecting the Company or to which it is a party, any securities that shall be received by the Depositary in exchange for, or in conversion, replacement or otherwise in respect of, Deposited Securities shall be treated as Deposited Securities under the Deposit Agreement; and, the Depositary may with the Company’s approval, and shall if the Company shall so request, execute and deliver additional Receipts in respect of such securities as in the case of a dividend of Shares or call for the surrender of outstanding Receipts to be exchanged for new Receipts, reflecting such securities, and to the extent that such additional or new Receipts are not delivered this Receipt shall thenceforth evidence American Depositary Shares representing the right to receive the Deposited Securities including the securities so received.

|

|

16

|

Reports; Inspection of Register The Depositary will make available for inspection by Holders at the Depositary’s Office, at the office of the Custodian and at any other designated transfer offices any reports and communications received from the Company which are both (a) received by the Depositary, the Custodian or the nominee of either as the holder of the Deposited Securities and (b) made generally available to the holders of Deposited Securities by the Company. The Depositary will also mail or make available to Holders copies of such reports when furnished by the Company as provided in the Deposit Agreement. The Depositary will keep, at its transfer office in the Borough of Manhattan, The City of New York, a register for the registration of Receipts and their transfer that at all reasonable times will be open for inspection by the Holders and the Company; provided that such inspection shall not be for the purpose of communicating with Holders in the interest of a business or object other than the business of the Company or a matter related to the Deposit Agreement or the Receipts.

|

|

17

|

Withholding In connection with any distribution to Holders, the Company will remit to the appropriate governmental authority or agency all amounts (if any) required to be withheld by the Company and owing to such authority or agency by the Company; and the Depositary and the Custodian will remit to the appropriate governmental authority or agency all amounts (if any) required to be withheld by the Company and owing to such authority or agency by the Depositary or the Custodian. If the Depositary determines that any distribution in property other than cash (including Shares or rights) on Deposited Securities is subject to any tax that the Depositary or the Custodian is obligated to withhold, the Depositary may dispose of all or a portion of such property in such amounts and in such manner as the Depositary deems necessary and practicable to pay such taxes, by public or private sale, and the Depositary shall distribute the net proceeds of any such sale or the balance of any such property after deduction of such taxes to the Holders entitled thereto.

|

|

18

|

Liability of the Company and the Depositary Neither the Depositary, its agents nor the Company shall incur any liability if, by reason of any present or future law, the provisions of or governing any Deposited Security, act of God, war or other circumstance beyond its control, the Depositary, its agents or the Company shall be prevented or forbidden from, or subjected to any civil or criminal penalty on account of, or delayed in, doing or performing any act or thing which by the terms of the Deposit Agreement it is provided shall be done or performed. Each of the Company, the Depositary and its agents assumes no obligation and shall be subject to no liability under the Deposit Agreement or this Receipt to Holders or other persons, except to perform such obligations as are specifically set forth and undertaken by it to perform in the Deposit Agreement without gross negligence or bad faith. Neither the Depositary, its agents nor the Company will be (a) under any obligation to appear in, prosecute or defend any action, suit or other proceeding in respect of any Deposited Securities or this Receipt that in its opinion may involve it in expense or liability, unless indemnity satisfactory to it against all expense and liability be furnished as often as may be required or (b) liable for any action or inaction by it in reliance upon the advice of or information from legal counsel, accountants, any person presenting Shares for deposit, any Holder, or any other person believed by it to be competent to give such advice or information. The Depositary, its agents and the Company may rely and shall be protected in acting upon any written notice, request, direction or other document believed by them to be genuine and to have been signed or presented by the proper party or parties. The Depositary and its agents will not be responsible for any failure to carry out any instructions to vote any of the Deposited Securities, for the manner in which any such vote is cast or for the effect of any such vote. The Depositary shall not incur any liability for any failure to determine that any distribution or action may be lawful or reasonably practicable, for the content of any information submitted to it by the Company for distribution to the Holders or for any inaccuracy of any translation thereof, for any investment risk associated with acquiring an interest in the Deposited Securities, for the validity or worth of the Deposited Securities or for any tax consequences that may result from the ownership of the American Depositary Shares, Shares or Deposited Securities, for the credit-worthiness of any third party, for allowing any rights to lapse upon the terms of this Deposit Agreement or for the failure or timeliness of any notice from the Company. None of the Depositary, its agents or the Company shall be liable for any action or non action by it in reliance upon the opinion, advice of or information from legal counsel, accountants, any person representing Shares for deposit, any Holder or any other person believed by it in good faith to be competent to give such advice or information. The Depositary and its agents shall not be liable for any acts or omissions made by a successor depositary whether in connection with a previous act or omission of the Depositary or in connection with any matter arising wholly after the removal or resignation of the Depositary, provided that in connection with the issue out of which such potential liability arises the Depositary performed it obligations without gross negligence or bad faith while it acted as Depositary. The Depositary and its agents may own and deal in any class of securities of the Company and its affiliates and in Receipts. The Company has agreed to indemnify the Depositary, the Custodian, and each of their respective directors, officers, employees, agents and affiliates, and any Receipt registrar, co-transfer agent, co-registrar or other agent of the Depositary appointed under the Deposit Agreement (the “indemnified persons”) against any loss, liability, tax, costs, claims, judgments, proceedings, actions, demands and any charges or expense (including reasonable fees and expenses of counsel, and in each case, value added tax and any similar tax charged or otherwise imposed in respect thereof) that may arise (a) out of acts performed or omitted in connection with the Deposit Agreement and the Receipts, (i) by any indemnified person, except to the extent that any such loss, liability or expense is due to the negligence or bad faith of such indemnified person, or (ii) by the Company or any of its agents, or (b) out of or in connection with any offer or sale of Receipts, American Depositary Shares, Shares or any other Deposited Securities or any registration statement under the Securities Act of 1933 in respect thereof, except to the extent such loss, liability or expense arises out of information (or omissions from such information) relating to such indemnified person, furnished in writing to the Company by such indemnified person expressly for use in a registration statement under the Securities Act of 1933. Each indemnified person shall indemnify, defend and save harmless the Company against any loss, liability or expense incurred by the Company in connection with the Deposit Agreement and the Receipts due to the negligence or bad faith of such indemnified person. Notwithstanding the above, in no event shall the Depositary, the Custodian, the Company or any of their respective directors, officers, employees, agents or affiliates be liable for any special, punitive or consequential damages. Any indemnified person shall notify the Company of the commencement of any indemnifiable action or claim promptly after such indemnified person becomes aware of such commencement (provided that the failure to make such notification shall not affect such indemnified person’s rights to indemnification except to the extent the Company is materially prejudiced by such failure) and shall consult in good faith with the Company as to the conduct of the defense of such action or claim that may give rise to an indemnity hereunder, which defense shall be reasonable under the circumstances. No indemnified person shall compromise or settle any action or claim that may give rise to an indemnity hereunder without the consent of the Company, which consent shall not be unreasonably withheld.

|

|

19

|

Resignation and Removal of Depositary; the Custodian The Depositary may at any time resign as Depositary under the Deposit Agreement by written notice of its election so to do delivered to the Company or be removed by the Company by written notice of such removal delivered to the Depositary, such resignation or removal to take effect upon the appointment of and acceptance by a successor depositary as provided in the Deposit Agreement. The Depositary may, upon written request or written approval of the Company, at any time appoint substitute or additional Custodians and the term “Custodian” refers to each Custodian or all Custodians as the context requires.

|

|

20

|

Amendment of Deposit Agreement and Receipts The Receipts and the Deposit Agreement may be amended by agreement between the Company and the Depositary. Any amendment that shall impose or increase any fees or charges or that shall otherwise prejudice any substantial existing right of Holders, shall not, however, become effective as to outstanding Receipts until the expiration of 30 days after notice of such amendment shall have been given to the Holders. Every Holder at the expiration of such 30 days shall be deemed by holding such Receipt to consent and agree to such amendment and to be bound by the Deposit Agreement or the Receipt as amended thereby. In no event shall any amendment impair the right of the Holder hereof to surrender this Receipt and receive therefor the Deposited Securities represented hereby, except in order to comply with mandatory provisions of applicable law.

|

|

21

|

Termination of Deposit Agreement The Depositary will at any time at the direction of the Company terminate the Deposit Agreement by mailing notice of such termination to the Holders at least 30 days prior to the date fixed in such notice for such termination. The Depositary may terminate the Deposit Agreement, upon the notice set forth in the preceding sentence, at any time after 90 days after the Depositary shall have resigned, provided that no successor depositary shall within such 90 days have been appointed and accepted its appointment within such 90 days. After the date so fixed for termination, the Depositary will perform no further acts under the Deposit Agreement, except to advise Holders of such termination, receive and hold distributions on Deposited Securities (or sell property or rights or convert Deposited Securities into cash) and deliver Deposited Securities being withdrawn. As soon as practicable after the expiration of six months from the date so fixed for termination, the Depositary shall sell the Deposited Securities and shall thereafter (as long as it may lawfully do so) hold in a segregated account the net proceeds of any such sale, together with any other cash then held by it under the Deposit Agreement, without liability for interest, in trust for the pro rata benefit of the Holders of Receipts not theretofore surrendered.

|

22 Compliance with Greek Notification Requirements

Greek law provides that any individual or entity (including a Holder of American Depositary Shares), acting alone or in concert with others, that acquires or disposes of the voting rights of the Company, and as a result of such acquisition or disposal holds greater than or equal to one-twentieth, one-tenth, three-twentieths, one-fifth, one-fourth, one-third, one-half or two-thirds of the voting rights of the Company, or whose holdings fall below any such level, or in the case of a holder of more than 10% of the voting rights of the Company whose holding increases or decreases by 3% or more of the voting rights of the Company, must notify the Company and the Hellenic Capital Markets Commission (“HCMC”). The notification must be in writing, made within three trading days of exceeding or falling below any of the levels describe above and state the number of Shares held by the Holder, the number of other equity securities giving access to the voting rights of the Company and the percentage and total number of voting rights attached thereto. Any Holder who fails to comply with the notification requirements to the HCMC may be subject to administrative sanctions and fines by the competent Greek authorities.

In addition, as the Company is a Greek credit institution, any individual or entity (including a Holder of American Depositary Shares) that intends to (i) acquire a direct or indirect interest greater than or equal to 5% of the issued share capital or the voting rights of the Company, (ii) acquire or dispose of the voting rights of the Company, and as a result of such acquisition or disposal would hold greater than or equal to one-twentieth, one-tenth, three-twentieths, one-fifth, one-fourth, one-third, one-half or two-thirds of the voting rights of the Company, or whose holdings fall below any such level, or (iii) acquire control or cease to have control over the Company, must submit a written notification to the Bank of Greece prior to any such acquisition or disposal. Such notification must contain the percentage of the share capital or voting rights of the Company proposed to be acquired and, in the case of a legal entity, the identity of the private individuals that directly or indirectly control the Holder. Upon receiving the notification, the Bank of Greece is required to approve or reject any such acquisition or disposal within three months. Failure to comply with the notification requirements to the Bank of Greece will result in the automatic suspension of the voting rights attached to the Shares exceeding the thresholds mentioned above held by such Holder. In addition, any Holder who fails to comply with the notification requirements to the Bank of Greece may be subject to administrative sanctions and fines by the competent Greek authorities. Holders shall be responsible for consulting with their Greek counsel in order to ascertain and comply with any Greek notification requirements applicable to their respective holdings.

Ziegler, Ziegler & Associates LLP

Counselors at Law

570 Lexington Avenue, Suite 2405

New York, New York 10022

(212) 319-7600

Telecopier (212) 319-7605

November 17, 2015

Deutsche Bank Trust Company Americas, as Depositary

60 Wall Street

New York, New York 10005

American Depositary Shares

evidenced by American Depositary Receipts

for deposited common shares

Alpha Bank A.E.

Dear Sirs:

Referring to the Registration Statement on Form F-6 relating to the above-entitled American Depositary Shares ("ADSs") evidenced by American Depositary Receipts ("ADRs") each ADS representing one-fourth of one common share of Alpha Bank A.E. (the "Company"), a corporation incorporated under the laws of Greece. Capitalized terms used herein that are not herein defined shall have the meanings assigned to them in the Deposit Agreement (the "Deposit Agreement") appearing, or incorporated by reference, in Exhibit (a)(1) to the Registration Statement.

In rendering the opinions set forth herein, we have assumed that (i) the Deposit Agreement will have been duly authorized, executed and delivered by the Company and will constitute a valid and legally binding obligation of the Company enforceable against it in accordance with its terms, (ii) the relevant Deposited Securities will have been duly deposited with a Custodian under and in accordance with all applicable laws and regulations, (iii) that the choice of New York law contained in the Deposit Agreement is legal and valid under the laws of Greece and (iv) that insofar as any obligation under the Deposit Agreement is to be performed in, or by a party organized under the laws of, any jurisdiction outside of the United States of America, its performance will not be illegal or ineffective in any jurisdiction by virtue of the law of that jurisdiction.

Based upon and subject to the foregoing, assuming that, at the time of their issuance, the Registration Statement will have been declared effective by the Securities and Exchange Commission, we are of the opinion that the American Depositary Shares covered by the Registration Statement, when issued in accordance with the terms of the Deposit Agreement and the Registration Statement, will be legally issued and will entitle the registered holders thereof to the rights specified in the Deposit Agreement and those ADRs.

The foregoing opinion is limited to the laws of the State of New York, and we are expressing no opinion as to the effect of the laws of any other jurisdiction.

Nothing contained herein or in any document referred to herein is intended by this firm to be used, and the addressee hereof cannot use anything contained herein or in any document referred to herein, as “tax advice” (within the meaning given to such term by the U.S. Internal Revenue Service (“IRS”) in IRS Circular 230 and any related interpretative advice issued by the IRS in respect of IRS Circular 230 prior to the date hereof, and hereinafter used within such meaning and interpretative advice). Without admitting that anything contained herein or in any document referred to herein constitutes “tax advice” for any purpose, notice is hereby given that, to the extent anything contained herein or in any document referred to herein constitutes, or is or may be interpreted by any court, by the IRS or by any other administrative body to constitute, “tax advice,” such “tax advice” is not intended or written to be used, and cannot be used, for the purpose of (i) avoiding penalties under the U.S. Internal Revenue Code, or (ii) promoting, marketing or recommending to any party any transaction or matter addressed herein.

We hereby consent to the use of this opinion as Exhibit d of the above mentioned Registration Statement. In giving such consent, we do not admit thereby that we are within the category of persons whose consent is required under Section 7 of the Securities Act of 1933, as amended.

| |

Very truly yours,

/s/Ziegler, Ziegler & Associates LLP

|

Certification under Rule 466

The depositary, Deutsche Bank Trust Company Americas, represents and certifies the following:

(1) That it previously had filed a registration statement on Form F-6 (Alpha Bank A.E. 333-160082) that the Commission declared effective, with terms of deposit identical to the terms of deposit of this registration statement.

(2) That its ability to designate the date and time of effectiveness under Rule 466 has not been suspended.

| |

By: |

DEUTSCHE BANK TRUST COMPANY

AMERICAS, Depositary

|

| |

|

|

|

| |

|

|

|

| |

By:

|

/s/ Michael Curran |

|

| |

Name: |

|

|

| |

Title: |

Vice President

|

|

| |

|

|

|

| |

|

|

|

| |

By:

|

/s/ Christopher Konopelko |

|

| |

Name: |

|

|

| |

Title: |

Director

|

|

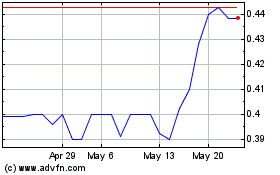

Alpha Services (PK) (USOTC:ALBKY)

Historical Stock Chart

From May 2024 to Jun 2024

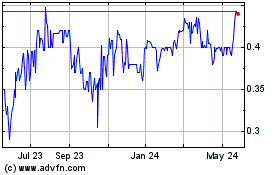

Alpha Services (PK) (USOTC:ALBKY)

Historical Stock Chart

From Jun 2023 to Jun 2024