Greece's Piraeus Looks to KKR to Manage Problem Loans

03 August 2016 - 12:30AM

Dow Jones News

ATHENS—Greece's largest lender based on assets, Piraeus Bank,

said Tuesday it is looking into striking a deal with U.S. based

private equity group KKR & Co. to manage €600 million ($670.1

million) of its problem loans.

Piraeus Bank's deputy chief executive, George Poulopoulos, who

is also acting chief executive officer of the Greek lender, told

The Wall Street Journal, that Piraeus Bank "is examining" the

possibility of teaming up with KKR to restructure these loans. An

announcement may be made soon after the summer, Mr. Poulopoulos

said.

"It would involve the restructuring of corporate loans—debt that

belongs to large potentially viable companies," said Mr.

Poulopoulos.

"This won't solve the entire problem of course, but it is part

of the solution. There are a lot of further steps we want to take

in the management of NPLs and that is what we are doing," he

added.

Greek banks have been slow in tackling the €110 billion of bad

loans weighing on their books as a result of the country's crisis

that has reduced the size of its economy by more than a quarter to

some €180 billion.

Lenders have been reluctant to sell non-performing loans

directly to private equity groups with Greek bank executives

arguing that many of the large corporate loans simply need to be

restructured and should not be sold off at a loss to third

parties.

Better management of non-performing loans is seen as being a

crucial step in the country's return to growth as it will free up

funds to finance healthier companies.

Problems caused by bad loans was also a key point of discussion

in a meeting between Greece's president Prokopis Pavlopoulos and

Bank of Greece Governor Yannis Stournaras on Tuesday, according to

a central bank official.

Piraeus Bank will be the third Greek lender to hook up with KKR

in recent months, in the event of this deal being signed.

In May, KKR signed an agreement with Eurobank and Alpha Bank,

Greece's third and fourth largest lenders respectively, to manage

up to €1.2 billion of their underperforming assets via KKR's

platform, known as Pillarstone. KKR has already rolled out a

similar system in Italy for three lenders by using this same

platform.

In Athens, Greece's second largest lender, National Bank, is now

expected to follow suit, according to Yannis Sinapis, an analyst at

Athens-based brokerage Euroxx Securities.

Mr. Sinapis said that Piraeus Bank will benefit from KKR's

sophisticated collection methods and knowledge but added that the

deal only involves a small part of the Greek bank's domestic

troubled assets, which stood at €24.7 billion at the end of the

first quarter of the year.

In a bid to help banks clean up their balance sheets, Greece's

creditors—the International Monetary Fund and eurozone nations—have

been pushing for management changes at lenders by introducing

tougher economic governance rules.

This involved Greece's parliament late last year passing a

complex and comprehensive set of rules aimed at reducing

politicized appointments in the sector. These new laws are seen as

removing up to a third of the country's board members, according to

bank officials.

Amid the shake up, Piraeus Bank Chairman Michalis Sallas stood

down from his position last month, after running the bank for 25

years, marking the departure of one of the banking sector's most

prominent figures.

Write to Stelios Bouras at stelios.bouras@wsj.com

(END) Dow Jones Newswires

August 02, 2016 10:15 ET (14:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

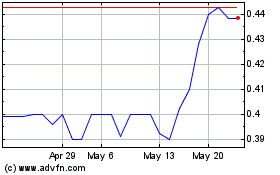

Alpha Services (PK) (USOTC:ALBKY)

Historical Stock Chart

From Nov 2024 to Dec 2024

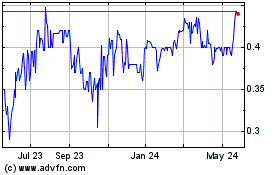

Alpha Services (PK) (USOTC:ALBKY)

Historical Stock Chart

From Dec 2023 to Dec 2024