Current Report Filing (8-k)

23 July 2020 - 4:09AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

July 14, 2020

Date of Report

(Date of earliest event reported)

APPLife Digital Solutions, Inc.

(Exact name of registrant as specified in its charter)

|

Nevada

|

333-227878

|

82-4868628

|

|

(State or other jurisdiction of Incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

50 California St.

Suite 1500

San Francisco, CA 94111

Phone: (415) 439-5260

(Address and Telephone Number of Registrant’s Principal Executive Offices and Principal Place of Business)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act

Item 1.01 Entry into a Material Definitive Agreement.

On July 14, 2020, APPlife Digital Solutions, Inc. (the “Company”) entered into a $340,000 convertible promissory note (the “Note”) with a lender (the “Lender”). The outstanding principal balance of the Note shall bear interest at the rate of twelve percent (12%) per annum. If the Company has not paid the principal and interest due under Note to the Lender on or before the Maturity Date, upon the written demand of the Lender, the unpaid principal amount of all of this Note, together with all accrued and unpaid interest on the principal amount outstanding from time to time, shall be converted into that number of shares of Common Stock equal to the quotient obtained by dividing (i) the unpaid principal amount of the this Note, together with all accrued and unpaid interest on the principal amount outstanding from time to time, as of the end of the day immediately prior to the Conversion Date by $0.144. The Lender shall not be entitled to convert any amount that could case Lender to hold more that 9.99% of the Company’s common stock. Further, Lender agrees not to sell daily the Conversion Stock for a period of six (6) months from a conversion date (“Trading Restriction Period”) in an amount greater than thirty percent (30%) of the ten (10) day daily average trading volume of the Company’s common stock. Upon expiration of the Trading Restriction Period, the Lender shall have no restrictions relating to his Conversion Stock.

The foregoing information is a summary of the Note described above, is not complete, and is qualified in its entirety by reference to the full text of the Note, which is attached as Exhibit 10.1 to this Current Report on Form 8-K. Readers should review the Note for a complete understanding of the terms and conditions of the transaction described above.

Item 9.01 Financial Statements and Exhibits.

(d)Exhibits.

Exhibit NumberDescription_____________________________

10.1Convertible Promissory Note dated July 14, 2020

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: July 22, 2020

APPLIFE DIGITAL SOLUTIONS, INC.

/s/ Matthew Reid

Matthew Reid

Principal Executive Officer

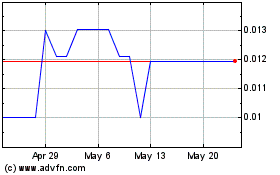

AppLife Digital Solutions (QB) (USOTC:ALDS)

Historical Stock Chart

From Jul 2024 to Jul 2024

AppLife Digital Solutions (QB) (USOTC:ALDS)

Historical Stock Chart

From Jul 2023 to Jul 2024