0001642365

true

S-1/A

0001642365

2023-01-01

2023-06-30

0001642365

2023-06-30

0001642365

2022-12-31

0001642365

2021-12-31

0001642365

2022-01-01

2022-06-30

0001642365

2022-01-01

2022-12-31

0001642365

2021-01-01

2021-12-31

0001642365

us-gaap:PreferredStockMember

2020-12-31

0001642365

us-gaap:CommonStockMember

2020-12-31

0001642365

us-gaap:AdditionalPaidInCapitalMember

2020-12-31

0001642365

us-gaap:RetainedEarningsMember

2020-12-31

0001642365

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2020-12-31

0001642365

2020-12-31

0001642365

us-gaap:PreferredStockMember

2021-12-31

0001642365

us-gaap:CommonStockMember

2021-12-31

0001642365

us-gaap:AdditionalPaidInCapitalMember

2021-12-31

0001642365

us-gaap:RetainedEarningsMember

2021-12-31

0001642365

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2021-12-31

0001642365

us-gaap:PreferredStockMember

2022-06-30

0001642365

us-gaap:CommonStockMember

2022-06-30

0001642365

us-gaap:AdditionalPaidInCapitalMember

2022-06-30

0001642365

us-gaap:RetainedEarningsMember

2022-06-30

0001642365

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-06-30

0001642365

2022-06-30

0001642365

us-gaap:PreferredStockMember

2022-12-31

0001642365

us-gaap:CommonStockMember

2022-12-31

0001642365

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001642365

us-gaap:RetainedEarningsMember

2022-12-31

0001642365

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-12-31

0001642365

us-gaap:PreferredStockMember

2021-01-01

2021-12-31

0001642365

us-gaap:CommonStockMember

2021-01-01

2021-12-31

0001642365

us-gaap:AdditionalPaidInCapitalMember

2021-01-01

2021-12-31

0001642365

us-gaap:RetainedEarningsMember

2021-01-01

2021-12-31

0001642365

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2021-01-01

2021-12-31

0001642365

us-gaap:PreferredStockMember

2022-01-01

2022-06-30

0001642365

us-gaap:CommonStockMember

2022-01-01

2022-06-30

0001642365

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-06-30

0001642365

us-gaap:RetainedEarningsMember

2022-01-01

2022-06-30

0001642365

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-01-01

2022-06-30

0001642365

us-gaap:PreferredStockMember

2022-07-01

2022-12-31

0001642365

us-gaap:CommonStockMember

2022-07-01

2022-12-31

0001642365

us-gaap:AdditionalPaidInCapitalMember

2022-07-01

2022-12-31

0001642365

us-gaap:RetainedEarningsMember

2022-07-01

2022-12-31

0001642365

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-07-01

2022-12-31

0001642365

2022-07-01

2022-12-31

0001642365

us-gaap:PreferredStockMember

2023-01-01

2023-06-30

0001642365

us-gaap:CommonStockMember

2023-01-01

2023-06-30

0001642365

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-06-30

0001642365

us-gaap:RetainedEarningsMember

2023-01-01

2023-06-30

0001642365

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-01-01

2023-06-30

0001642365

us-gaap:PreferredStockMember

2023-06-30

0001642365

us-gaap:CommonStockMember

2023-06-30

0001642365

us-gaap:AdditionalPaidInCapitalMember

2023-06-30

0001642365

us-gaap:RetainedEarningsMember

2023-06-30

0001642365

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-06-30

0001642365

altb:NationalHoldingsInvestmentsLtdMember

2022-06-16

2022-12-31

0001642365

us-gaap:SeriesAPreferredStockMember

2022-02-09

0001642365

us-gaap:SeriesAPreferredStockMember

2022-02-01

2022-02-09

0001642365

altb:NHILMember

2023-02-01

2023-02-20

0001642365

altb:NHILMember

2023-02-20

0001642365

altb:YDTCMember

altb:NationalHoldingsInvestmentsLtdMember

2022-10-04

0001642365

altb:NationalHoldingsInvestmentsLtdMember

2023-12-31

0001642365

altb:Mr.ZonghanWuMember

2023-06-30

0001642365

altb:MetaVerseInvestmentGroupMember

2022-02-01

2022-02-18

0001642365

2023-02-01

2023-02-20

0001642365

us-gaap:SeriesAPreferredStockMember

2022-12-31

0001642365

us-gaap:SeriesAPreferredStockMember

2021-12-31

0001642365

altb:CustodianVenturesMember

2021-11-01

2021-11-16

0001642365

altb:CustodianVenturesMember

2021-11-16

0001642365

altb:NationalHoldingsInvestmentsLtdMember

2022-12-31

0001642365

us-gaap:PreferredStockMember

2022-01-01

2022-12-31

0001642365

us-gaap:CommonStockMember

2022-01-01

2022-12-31

0001642365

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-12-31

0001642365

us-gaap:RetainedEarningsMember

2022-01-01

2022-12-31

0001642365

us-gaap:CommonStockMember

altb:NationalHoldingsInvestmentsLtdMember

2022-06-15

0001642365

us-gaap:RetainedEarningsMember

altb:NationalHoldingsInvestmentsLtdMember

2022-06-15

0001642365

us-gaap:AccumulatedOtherComprehensiveIncomeMember

altb:NationalHoldingsInvestmentsLtdMember

2022-06-15

0001642365

altb:TotalMember

altb:NationalHoldingsInvestmentsLtdMember

2022-06-15

0001642365

us-gaap:CommonStockMember

altb:NationalHoldingsInvestmentsLtdMember

2022-06-16

2022-12-31

0001642365

us-gaap:RetainedEarningsMember

altb:NationalHoldingsInvestmentsLtdMember

2022-06-16

2022-12-31

0001642365

us-gaap:AccumulatedOtherComprehensiveIncomeMember

altb:NationalHoldingsInvestmentsLtdMember

2022-06-16

2022-12-31

0001642365

altb:TotalMember

altb:NationalHoldingsInvestmentsLtdMember

2022-06-16

2022-12-31

0001642365

us-gaap:CommonStockMember

altb:NationalHoldingsInvestmentsLtdMember

2022-12-31

0001642365

us-gaap:RetainedEarningsMember

altb:NationalHoldingsInvestmentsLtdMember

2022-12-31

0001642365

us-gaap:AccumulatedOtherComprehensiveIncomeMember

altb:NationalHoldingsInvestmentsLtdMember

2022-12-31

0001642365

altb:TotalMember

altb:NationalHoldingsInvestmentsLtdMember

2022-12-31

0001642365

altb:NationalHoldingsInvestmentsLtdMember

2022-06-15

0001642365

altb:ElectronicEquipmentMember

srt:MinimumMember

altb:NationalHoldingsInvestmentsLtdMember

2022-12-31

0001642365

altb:ElectronicEquipmentMember

srt:MaximumMember

altb:NationalHoldingsInvestmentsLtdMember

2022-12-31

0001642365

us-gaap:CashAndCashEquivalentsMember

altb:NationalHoldingsInvestmentsLtdMember

2022-12-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

As

filed with the Securities and Exchange Commission on September 19, 2023

Registration No. ____________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment

1

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Alpine Auto Brokers Inc.

(Exact name of Registrant as specified in its charter)

| Nevada |

|

6770 |

|

38-3970138 |

| (State or other jurisdiction of |

|

(Primary Standard Industrial |

|

(I.R.S. Employer |

| incorporation or organization) |

|

Classification Code Number) |

|

Identification No.) |

46 Reeves Road, Pakuranga 2010, New Zealand

Tel: +61 405223877

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Copies to:

McMurdo Law Group, LLC

1185 Avenue of the Americas, 3rd Floor

New York, NY 10036

(917) 318-2865

Approximate date of commencement of proposed sale to the public: As soon as practicable after the registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| |

Large Accelerated Filer |

☐ |

Accelerated Filer |

☐ |

| |

Non-accelerated Filer |

☐ |

Smaller reporting company |

☒ |

| |

|

Smaller reporting company |

☐ |

If an smaller reporting company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

WE HEREBY AMEND THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL WE SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT, OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE SECURITIES AND EXCHANGE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(a), MAY DETERMINE.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state or other jurisdiction where offers or sales are not permitted.

SUBJECT

TO COMPLETION, DATED SEPTEMBER 19, 2023

Alpine Auto Brokers Inc.

120,000,000 Shares of Common Stock, $0.001 par value per share

This is a public offering of Alpine Auto Brokers Inc. (“ALTB,” or the “Company”). We are offering 120,000,000 Common Shares at $0.01 per share (the “Shares”), in a best effort, direct public offering, solely by our Chief Executive Officer, Yufeng Zhang, for the Company. There is no minimum proceeds threshold for the offering. The offering will terminate within 360 days from the date of this prospectus. The Company will retain all proceeds received from the shares sold on their account in this offering. The Company has not made any arrangements to place the proceeds in an escrow or trust account. Any proceeds received in this offering may be immediately used by the Company in its sole discretion. There are no minimum purchase requirements for each investor. All proceeds retained by the Company may not be sufficient to continue operations.

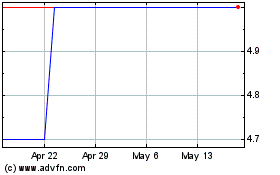

Our

Shares are not currently traded on any national securities exchange, but are quoted on OTC Pink market under the symbol “ALTB.”

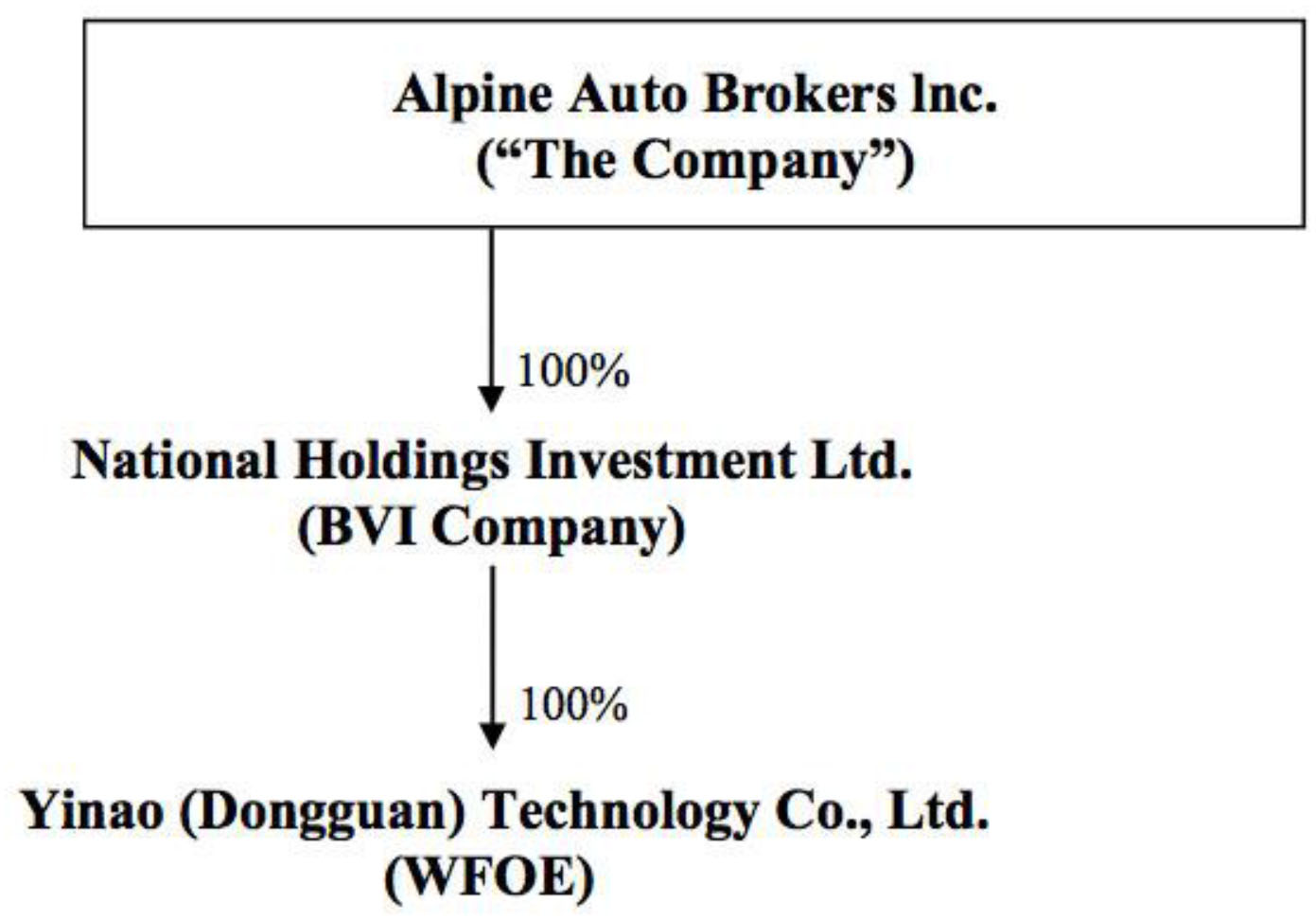

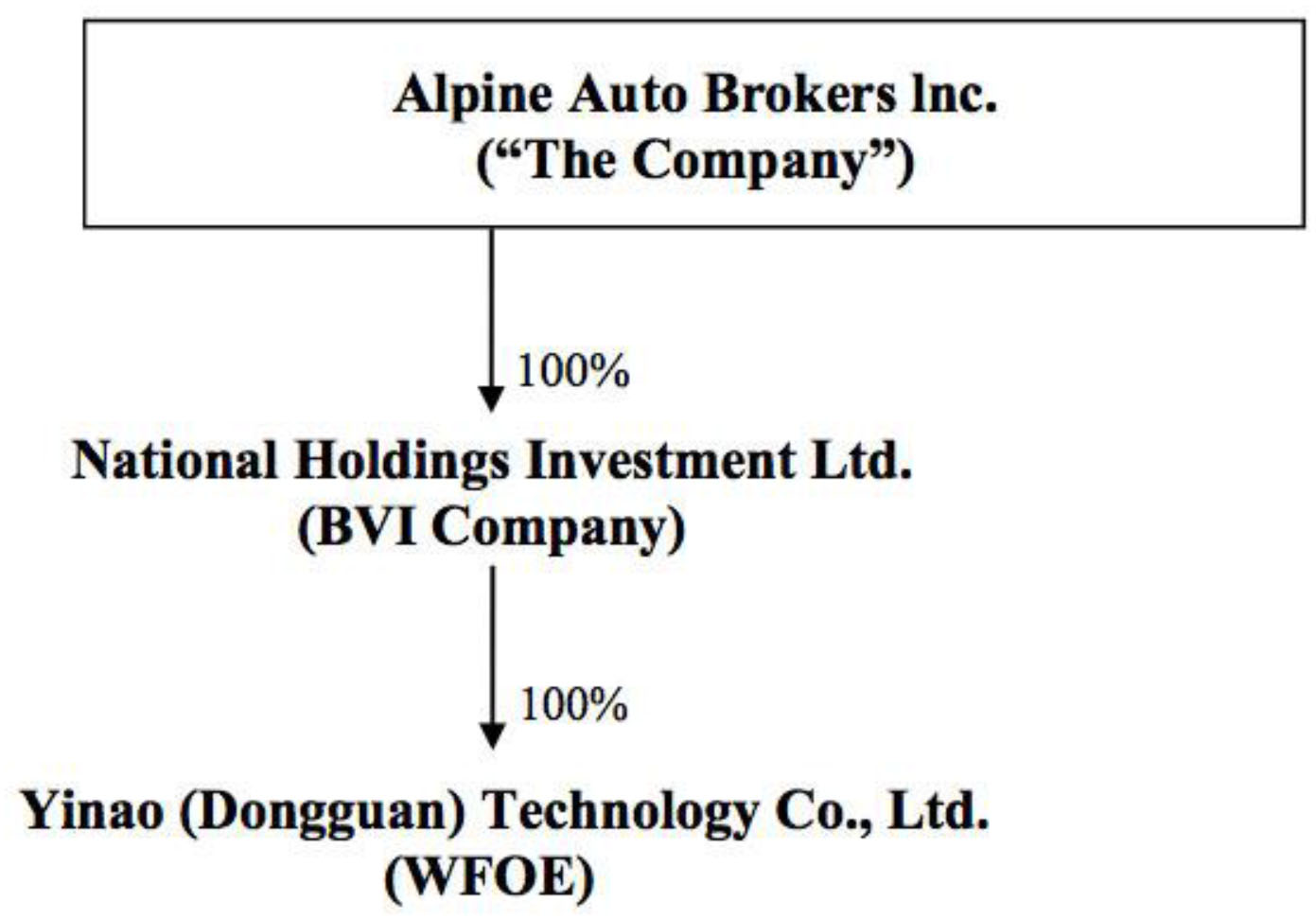

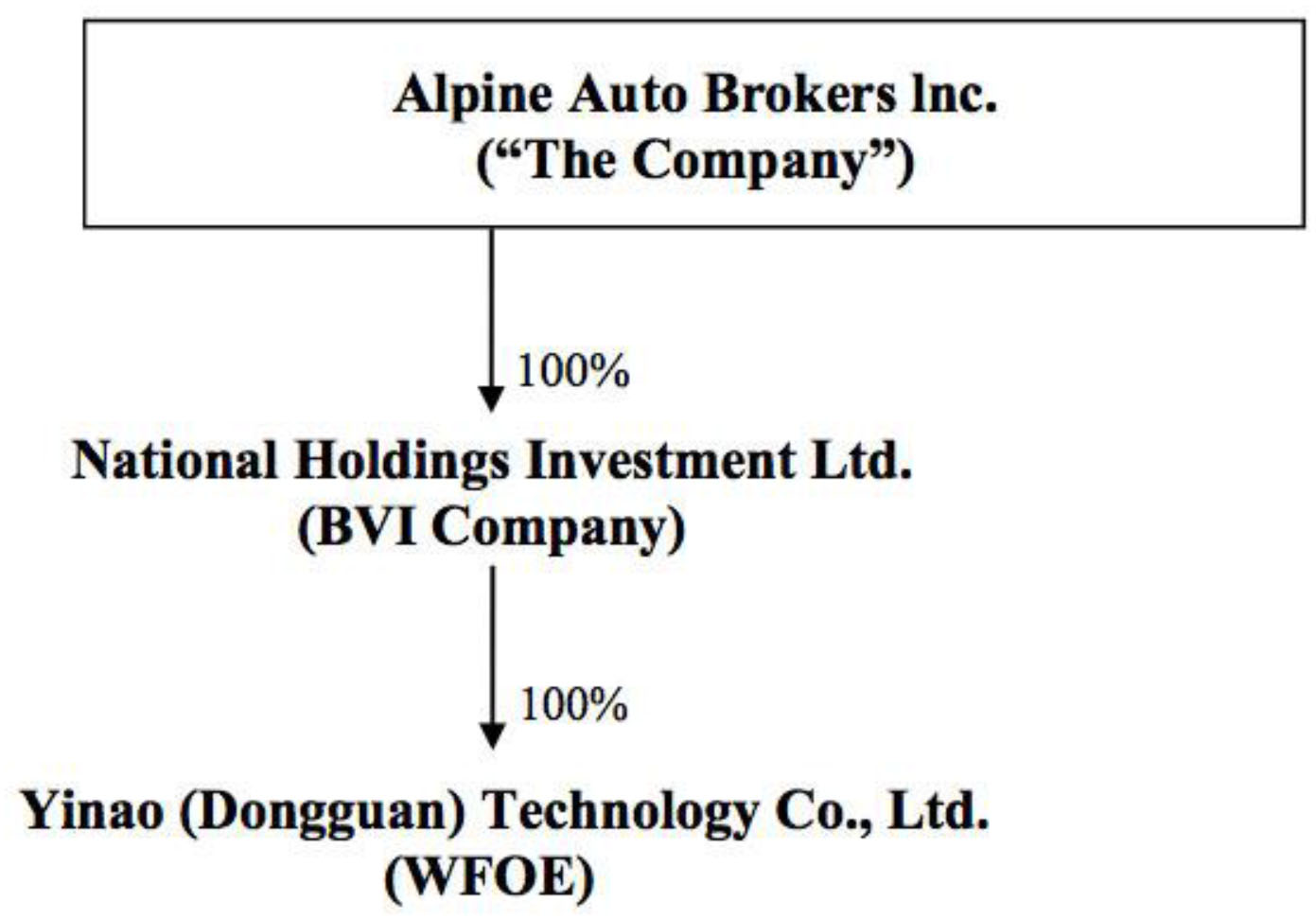

On February 20, 2023, the Company entered into a Definitive Share Exchange Agreement with National Holdings Investment Ltd., a British Virgin Islands corporation (“NHIL”), whereunder the Company acquired 100% ownership interest in NHIL for the issuance of 10,000,000 shares of the Company’s common stock. NHIL through its China based subsidiary, Yinao (Dongguan) Technology Co., Ltd., is mainly engaged in the planning and design service consulting business of new energy charging piles. The transaction closed effective February 24, 2023 and has been treated as a business combination, resulting in NHIL becoming a wholly-owned subsidiary of the Company. As such, the Company recognized the assets and liabilities of NHIL acquired in the reorganization, at their historical carrying amounts.

ALTB is not

a Chinese operating company. ALTB is a Nevada holding company that operates business through Yinao (Dongguan) Technology Co., Ltd. (“YDTC”).

The offering is being undertaken by ALTB, the Nevada corporation. Therefore, investors will be purchasing shares of common stock of ALTB,

the Nevada holding company, not a Chinese operating company. Any use of the terms “we” or “us” herein in regard

to the common stock offered hereby refers to ALTB, the Nevada holding company. Any use of the terms “we” or “us”

herein in regard to the operations refers to YDTC, the Chinese operating company.

The Company

exercises control over the operations of YDTC, as its wholly-owned subsidiary. On February 17, 2023, the China Securities Regulatory

Commission, or CSRC, issued the Trial Administrative Measures of Overseas Securities Offering and Listing by Domestic Companies, or the

Trial Measures, which became effective on March 31, 2023. Pursuant to the Trial Measures, domestic companies that seek to offer or list

securities overseas, both directly and indirectly, should fulfill the filing procedure and report relevant information to the CSRC. As

of the date of this prospectus, we have not received any inquiry, notice, warning or sanctions regarding our planned overseas listing

from the CSRC or any other PRC governmental authorities. As the Trial Measures were newly published and there is uncertainty with respect

to the filing requirements and the implementation, if we are required to submit to the CSRC and complete the filing procedures of our

overseas public offering and listing, we cannot be sure that we will be able to complete such filings in a timely manner. Any failure

or perceived failure by us to comply with such filing requirements under the Trial Measures may result in forced corrections, warnings

and fines against us and could materially hinder our ability to offer or continue to offer our securities. In addition, changes in the

legal, political and economic policies of the Chinese government, the relations between China and the United States, or Chinese or U.S.

regulations may materially and adversely affect our business, financial condition and results of operations. Any such changes could significantly

limit or completely hinder our ability to offer or continue to offer our securities to investors and could cause the value of our securities

to significantly decline or become worthless.

YDTC is formed and operating the Peoples Republic of China (“Material PRC Company”) has been duly established and is validly existing as a limited liability company under the laws of the Peoples Republic of China (“PRC Laws”),and has received all authorizations required by the Peoples Republic of China (the “Governmental Authorizations”) for its establishment to the extent such Governmental Authorizations are required under applicable PRC Laws, and its business license is in full force and effect. The Material PRC Company has the capacity and authority to own assets, to conduct business, and to sue and be sued in its own name under PRC Laws. The articles of association, business license and other constitutional documents (if any) of the Material PRC Company complies with the requirements of applicable PRC Laws and are in full force and effect. The Material PRC Company has not taken any corporate action, nor has any legal proceedings commenced against it, for its liquidation, winding up, dissolution, or bankruptcy, for the appointment of a liquidation committee, team of receivers or similar officers in respect of its assets or for any adverse suspension, withdrawal, revocation or cancellation of its business license.

All of the

equity interests of the Material PRC Company are owned by NHIL, a BVI company, and we believe the Material PRC Company has obtained all

Governmental Authorizations for the ownership interest owned by NHIL. While we have not obtained an opinion from local counsel stating

so, we believe this to be true based on the experience of management. The equity interests of the Material PRC Company are owned by NHIL

free and clear of any pledge or other encumbrance under PRC Laws, and there are no outstanding rights, warrants or options to acquire,

or instruments convertible into or exchangeable for, any equity interest in the Material PRC Company under PRC Laws.

All of

our operations are conducted by our subsidiaries and through our wholly-foreign-owned entity (“WFOE”) based in China which

involves unique risks to investors. Our WFOE structure is used to provide investors with exposure to foreign investment in China-based

companies where Chinese law prohibits direct foreign investment in the operating companies. Investors may never hold equity interests

in the Chinese operating company. The senior management and the shareholders of the domestic company play a very important role in the

WFOE structure. Chinese regulatory authorities could disallow this structure, which would likely result in a material change in our operations

and/or a material change in the value of the securities we are registering for sale, including that it could cause the value of such

securities to significantly decline or become worthless.

The legal and operational risks associated with being based in or having the majority of the Company’s operations in China could result in a material change in the value of the securities we are registering for sale or could significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause the value of such securities to significantly decline or be worthless. Please see the Risk Factor titled “We are faced with risks and uncertainties as a foreign enterprise under PRC laws” on page 18.

Trading securities

may be prohibited under the Holding Foreign Companies Accountable Act (“HFCAA”), as amended by the Consolidated Appropriations

Act (“CAA”) of 2023. If the PCAOB determines that it cannot inspect or fully investigate the Company’s auditor for

two consecutive years, and that as a result an exchange may determine to delist your securities. On December 29, 2022, the CAA was signed

into law by President Biden. The CAA contained, among other things, an identical provision to the AHFCAA, which reduces the number of

consecutive non-inspection years required for triggering the prohibitions under the HFCA Act from three years to two. Since our current

registered public accounting firm, Shandong Haoxin Certified Accountants Co., Ltd., is located in the PRC and is currently subject to

the PCAOB inspections every two years, you may be deprived of the benefits of regular inspections which could result in limitation or

restriction to our access to the U.S. capital markets and trading of our securities on a national exchange or “over-the-counter”

markets may be prohibited under the HFCAA. On December 24, 2021, the China Securities Regulatory Commission, or the CSRC, issued Provisions

of the State Council on the Administration of Overseas Securities Offering and Listing by Domestic Companies (Draft for Comments) (the

“Administration Provisions”), and the Administrative Measures for the Filing of Overseas Securities Offering and Listing

by Domestic Companies (the “Measures”), which were open for public comments by January 23, 2022. The Administration Provisions

and Measures for overseas listings lay out specific requirements for filing documents and include unified regulation management, strengthening

regulatory coordination, and cross-border regulatory cooperation. Domestic companies seeking to list abroad must carry out relevant security

screening procedures if their businesses involve supervisions such as foreign investment security and cyber security reviews. Companies

endangering national security are among those off-limits for overseas listings. As the Administration Provisions and Measures have not

yet come into effect, we are currently unaffected by them. However, it is uncertain when the Administration Provision and the Measures

will take effect or if they will take effect as currently drafted.

Regulatory

Permission

As substantially

all of our operations are conducted by our PRC Subsidiaries in China, we are subject to the associated legal and operational risks, including

risks related to the legal, political and economic policies of the Chinese government, the relations between China and the United States,

or Chinese or United States regulations, which risks could result in a material change in our operations and/or cause the value of our

ordinary shares to significantly decline or become worthless, and affect our ability to offer or continue to offer securities to investors.

Recently, the PRC government initiated a series of regulatory actions and made a number of public statements on the regulation of business

operations in China with little advance notice, including cracking down on illegal activities in the securities market, enhancing supervision

over China-based companies listed overseas, and adopting new measures to extend the scope of cybersecurity reviews.

On July 6,

2021, the relevant PRC government authorities made public the Opinions on Strictly Cracking Down Illegal Securities Activities, which

provided that the administration and supervision of overseas-listed China-based companies will be strengthened, and the special provisions

of the State Council on overseas issuance and listing of shares by such companies will be revised, clarifying the responsibilities of

domestic industry competent authorities and regulatory authorities. However, the Opinions on Strictly Cracking Down Illegal Securities

Activities were only issued recently, leaving uncertainties regarding the interpretation and implementation of these opinions. It is

possible that any new rules or regulations may impose additional requirements on us. As of the date of this prospectus, neither we nor

our PRC Subsidiaries have been subject to any investigation, or received any notice, warning, or sanction from applicable government

authorities related to this offering. In addition, neither we nor our PRC Subsidiaries have been involved in any review, investigation,

enquiry, penalty, or other legal proceedings initiated by applicable governmental or regulatory authorities or third parties in relation

to this offering.

The Regulations

on Mergers and Acquisitions of Domestic Companies by Foreign Investors, or the M&A Rules, adopted by six PRC regulatory agencies

in 2006 and amended in 2009, requires an overseas special purpose vehicle formed for listing purposes through acquisitions of PRC domestic

companies and controlled by PRC companies or individuals to obtain the approval of the China Securities Regulatory Commission, or the

CSRC, prior to the listing and trading of such special purpose vehicle’s securities on an overseas stock exchange. We will not

be required to submit an application to the CSRC for the approval under the M&A Rules for an offering because (i) the CSRC currently

has not issued any definitive rule or interpretation concerning whether offerings like ours are subject to this regulation; and (ii)

we did not acquire any equity interests or assets of a “PRC domestic company” as such terms are defined under the M&A

Rules. However, there remains some uncertainty as to how the M&A Rules will be interpreted or implemented in the context of an overseas

offering and its opinions summarized above are subject to any new laws, rules and regulations or detailed implementations and interpretations

in any form relating to the M&A Rules.

On December

28, 2021, the Cyberspace Administration of China (the “CAC”) jointly with the relevant authorities formally published Measures

for Cybersecurity Review (2021) which took effect on February 15, 2022 and replace the former Measures for Cybersecurity Review (2020).

Measures for Cybersecurity Review (2021) stipulates that operators of critical information infrastructure purchasing network products

and services, and online platform operator (together with the operators of critical information infrastructure, the “Operators”)

carrying out data processing activities that affect or may affect national security, shall conduct a cybersecurity review, any online

platform operator who controls more than one million users’ personal information must go through a cybersecurity review by the

cybersecurity review office if it seeks to be listed in a foreign country. Given that: (i) we do not possess personal information on

more than one million users in our business operations; and (ii) data processed in our business does not have a bearing on national security

and thus may not be classified as core or important data by the authorities, this offering would not be required to apply for a cybersecurity

review under the Measures for Cybersecurity Review (2021). As a result of the nature of the Company’s operations and size, the

Company does not believe that the above is applicable to the Company. Additionally, The Company is of the belief that the expenses of

engaging PRC counsel would be unduly burdensome on the Company, and thus, the Company has not sought to engage PRC counsel to obtain

an additional opinion pertaining to the Company’s understanding of all required approvals and permission to operate our business.

According

to the Notice by the General Office of the State Council of Comprehensively Implementing the List-based Management of Administrative

Licensing Items (No. 2 [2022] of the General Office of the State Council) and its attachment, the List of Administrative Licensing Items

Set by Laws, Administrative Regulations, and Decisions of the State Council (2022 Edition), as of the date of this prospectus, our PRC

subsidiary has received from PRC authorities all requisite licenses, permissions or approvals needed to engage in the businesses currently

conducted in China. As of the date of this prospectus, neither we nor our PRC Subsidiary (i) are required to obtain permissions from

any PRC authorities to operate or issue our ordinary shares to foreign investors, (ii) are subject to permission requirements from the

CSRC, the CAC or any other entity that is required to approve our PRC Subsidiary’s operations, or (iii) have received or were denied

such permissions by any PRC authorities.

As of the

date of this prospectus, the only permission required for operations is the business license of the PRC subsidiary. The business license

in PRC is a permit issued by Market Supervision and Administration that allows the company to conduct specific business within the government’s

geographical jurisdiction. As of the date of this prospectus, our PRC subsidiary has received from PRC authorities all requisite licenses,

permissions or approvals needed to engage in the businesses currently conducted in China, and no permission or approval has been denied.

We believe

that we are not currently required to obtain approval from Chinese authorities, including the China Securities Regulatory Commission,

or CSRC, or Cybersecurity Administration Committee, or CAC, to list or become quoted on U.S. exchanges/quotation servicers or issue securities

to foreign investors, however, if we were required to obtain approval in the future and were denied permission from Chinese authorities

to list or become quoted on U.S. exchanges and/or quotation servicers, we will not be able to continue to be quoted or listed on U.S.

exchanges, which would materially affect the interests of the investors. It is uncertain when and whether the Company will be required

to obtain permission from the PRC government to list or become quoted on U.S. exchanges in the future, and even when such permission

is obtained, whether it will be denied or rescinded. Although the Company is currently not required to obtain permission from any of

the PRC central or local government to obtain such permission and has not received any denial to list or become quoted on the U.S. exchange,

our operations could be adversely affected, directly or indirectly, by existing or future laws and regulations relating to its business

or industry; if we inadvertently conclude that such approvals are not required when they are, or applicable laws, regulations, or interpretations

change and we are required to obtain approval in the future.

On December

24, 2021, the China Securities Regulatory Commission, or the CSRC, issued Provisions of the State Council on the Administration of Overseas

Securities Offering and Listing by Domestic Companies (Draft for Comments) (the “Administration Provisions”), and the Administrative

Measures for the Filing of Overseas Securities Offering and Listing by Domestic Companies (the “Measures”), which were open

for public comments by January 23, 2022. The Administration Provisions and Measures for overseas listings lay out specific requirements

for filing documents and include unified regulation management, strengthening regulatory coordination, and cross-border regulatory cooperation.

Domestic companies seeking to list abroad must carry out relevant security screening procedures if their businesses involve supervisions

such as foreign investment security and cyber security reviews. Companies endangering national security are among those off-limits for

overseas listings. As the Administration Provisions and Measures have not yet come into effect, we are currently unaffected by them.

However, it is uncertain when the Administration Provision and the Measures will take effect or if they will take effect as currently

drafted.

On February

17, 2023, with the approval of the State Council, the CSRC released the Trial Administrative Measures of Overseas Securities Offering

and Listing by Domestic Companies (the “Trial Measures”) and five supporting guidelines, which will come into effect on March

31, 2023. According to the Trial Measures, among other requirements, (1) domestic companies that seek to offer or list securities overseas,

both directly and indirectly, should fulfill the filing procedures with the CSRC; if a domestic company fails to complete the filing

procedures, such domestic company may be subject to administrative penalties; and (2) where a domestic company seeks to indirectly offer

and list securities in an overseas market, the issuer shall designate a major domestic operating entity responsible for all filing procedures

with the CSRC, and such filings shall be submitted to the CSRC within three business days after the submission of the overseas offering

and listing application. On the same day, the CSRC also held a press conference for the release of the Trial Measures and issued the

Notice on Administration for the Filing of Overseas Offering and Listing by Domestic Companies, which clarifies that (1) on or prior

to the effective date of the Trial Measures, domestic companies that have already submitted valid applications for overseas offering

and listing but have not obtained approval from overseas regulatory authorities or stock exchanges may reasonably arrange the timing

for submitting their filing applications with the CSRC, and must complete the filing before the completion of their overseas offering

and listing; (2) a six-month transition period will be granted to domestic companies which, prior to the effective date of the Trial

Measures, have already obtained the approval from overseas regulatory authorities or stock exchanges, but have not completed the indirect

overseas listing; if domestic companies fail to complete the overseas listing within such six-month transition period, they shall file

with the CSRC according to the requirements; and (3) the CSRC will solicit opinions from relevant regulatory authorities and complete

the filing of the overseas listing of companies with contractual arrangements which duly meet the compliance requirements, and support

the development and growth of these companies.

With respect

to the domestic company, non-compliance with the Trial Measures or an overseas listing completed in breach of it may result in a warning

or a fine ranging from RMB 1 million to RMB10 million. Furthermore, the directly responsible executives and other directly responsible

personnel of the domestic company may be warned, or fined between RMB 500,000 and RMB 5 million and the controlling shareholder, actual

controllers, and other legally appointed persons of the domestic company may be warned, or fined between RMB 1 million and RMB 10 million.

If, during the filing process, the domestic company conceals important factors or the content is materially false, and securities are

not issued, they are subject to a fine of RMB1 million to RMB10 million. With respect to the directly responsible executives and other

directly responsible personnel of the domestic company, they are subject to a warning and fine between RMB 500,000 and RMB 5 million,

and with respect to the controlling shareholder, actual controllers, and other legally appointed persons of the domestic company, they

are subject to a warning and fine between RMB 1 million and RMB 10 million.

As of the

date of this prospectus, the Trial Measures have come into effect. After March 31, 2023, any failure or perceived failure by the domestic

company or PRC subsidiaries to comply with the above confidentiality and archives administration requirements under the Trial Measures

and other PRC laws and regulations may result in that the relevant entities would be held legally liable by competent authorities, and

referred to the judicial organization to be investigated for criminal liability if suspected of committing a crime.

According

to a translated copy of the current and effective regulations promulgated by the China Securities Regulatory Commission, that is, the

“Trial Administrative Measures of Overseas Securities Offering and Listing by Domestic Companies” Article 2 states, “Direct

overseas offering and listing by domestic companies refers to such overseas offering and listing by joint-stock company incorporated

domestically. Indirect overseas offering and listing by domestic companies refers to such overseas offering and listing by a company

in the name of an overseas incorporated entity, whereas the company’s major business operations are located domestically and such

offering and listing is based on the underlying equity, assets, earnings or other similar rights of a domestic company”. Accordingly,

as the Company believes it is not a joint-stock company incorporated domestically, this offering is not a direct overseas offering and

listing by a domestic company. Article 16 states, “Subsequent securities offerings of an issuer in the same overseas market where

it has previously offered and listed securities shall be filed with the CSRC within 3 working days after the offering is completed. The

Company is a Nevada Corporation formed on January 10, 1991. As a public company with securities quoted on the OTC Pink Sheets, On February 20,

2023, the Company entered into an agreement with National Holdings Investment Ltd., a British Virgin Islands corporation (“NHIL”),

whereunder the Company acquired 100% ownership interest in NHIL. NHIL through its China based subsidiaries, Yinao (Dongguan) Technology

Co., Ltd., is mainly engaged in the planning and design service consulting business of new energy charging piles. The transaction closed

effective February 24, 2023 and has been treated as a business combination. Therefore, this offering is classified as “Subsequent

securities offerings of an issuer in the same overseas market where it has previously offered and listed securities”. The Company

does not believe that it is required to seek authorizations from Chinese authorities now, as the offering is not completed. The company

has taken no actions in regards to the CSRC approval and does not intend to do so, and the company does not believe that this offering

is contingent upon receipt of approval from the CSRC now.

According

to a translated copy of the current and effective regulations promulgated by the China Securities Regulatory Commission, that is, the

“Regulations on Strengthening the Confidentiality and Archives Management Work Related to the Overseas Issuance and Listing of Securities”

Article 3 states, “A domestic company that plans to, either directly or through its overseas listed entity, publicly disclose or

provide to relevant entities or individuals including securities companies, securities service providers, and overseas regulators, documents

and materials that contain state secrets or government work secrets, shall first obtain approval from competent authorities according

to law, and file with the secrecy administrative department at the same level. Where there is ambiguity or dispute over the identification

of a state secret, a request shall be submitted to the competent secrecy administrative department for determination; where there is

ambiguity or dispute over the identification of a government work secret, a request shall be submitted to the competent government authority

for determination.” Further, Article 4 states that, “A domestic company that plans to, either directly or through its overseas

listed entity, publicly disclose or provide to relevant entities or individuals including securities companies, securities service providers,

and overseas regulators, other documents and materials that, if divulged, will jeopardize national security or public interest, shall

strictly fulfill relevant procedures stipulated by applicable national regulations.” Accordingly, as the Company does not believe

its operations fall into the above legal provisions, the Company does not believe that it is required to seek authorizations from Chinese

authorities.

Article 15

states, “any overseas offering and listing made by an issuer that meets both the following conditions will be determined as indirect:

(1) 50% or more of the issuer’s operating revenue, total profit, total assets or net assets as documented in its audited consolidated

financial statements for the most recent accounting year is accounted for by domestic companies; and (2) the main parts of the issuer’s

business activities are conducted in the Chinese Mainland, or its main places of business are located in the Chinese Mainland, or the

senior managers in charge of its business operation and management are mostly Chinese citizens or domiciled in the Chinese Mainland.

The determination as to whether or not an overseas offering and listing by domestic companies is indirect, shall be made on a substance

over form basis.” Article 34 states, “For the purpose of this Measures, domestic companies herein refer to companies incorporated

within the Chinese Mainland, including domestic join-stock companies whose securities are directly offered and listed overseas and the

domestic operating entities of companies whose securities are indirectly offered and listed overseas. Accordingly, the Company believes

this offering is an indirect overseas offering by a domestic company.

However,

Article 16 states, “Subsequent securities offerings of an issuer in the same overseas market where it has previously offered and

listed securities shall be filed with the CSRC within 3 working days after the offering is completed. The Company is a Nevada Corporation

formed on January 10, 1991. As a public company with securities quoted on the OTC Pink Sheets, On February 20, 2023, the Company

entered into an agreement with National Holdings Investment Ltd., a British Virgin Islands corporation (“NHIL”), whereunder

the Company acquired 100% ownership interest in NHIL. NHIL through its China based subsidiaries, Yinao (Dongguan) Technology Co., Ltd.,

is mainly engaged in the planning and design service consulting business of new energy charging piles. The transaction closed effective

February 24, 2023 and has been treated as a business combination. Therefore, this offering is classified as “Subsequent securities

offerings of an issuer in the same overseas market where it has previously offered and listed securities”. The Company does not

believe that it is required to seek pre-authorizations from Chinese authorities now, as the offering is not completed. The Company has

taken no actions in regard to the CSRC approval and does not intend to do so prior to completion of this offering. The company does not

believe that this offering is contingent upon receipt of approval from the CSRC now.

The Company

will settle amounts owed under the WFOE structure by transferring dividends, or distributions between the holding company and its subsidiaries,

or to investors, which have not yet occurred. We intend to rely primarily on dividends paid by the WFOE for our cash needs, including

the funds necessary to pay dividends and other cash distributions, if any, to our shareholders, to service any debt we may incur and

to pay our operating expenses. The Company has made no such distributions to date nor has it received any distributions from the WFOE

to date, and the Company has no current cash management policies in place. The Company will look to implement one in the near future.

The PRC government also imposes controls on the conversion of RMB into foreign currencies and the remittance of currencies out

of the PRC. Therefore, our WFOE may experience difficulties in completing the administrative procedures necessary to pay distributions

from its profits, if any. Furthermore, if our WFOE incurs debt on its own in the future, the instruments governing the debt may restrict

their ability to pay distributions or make other payments. If the Company or our subsidiaries are unable to receive all of the revenues

from our operations, we may be unable to pay dividends on our Shares.

Cash dividends,

if any, on the Company’s Shares will be paid in U.S. dollars. If the Company is considered a PRC tax resident enterprise for tax

purposes, any dividends paid to our overseas shareholders may be regarded as China-sourced income and as a result may be subject to PRC

withholding tax at a rate of up to 10.0%.

There are

no legal, arbitral or governmental proceedings, regulatory investigations or other governmental decisions, rulings, orders, or actions

before any Governmental Agencies in progress or pending in the PRC to which the Company or the Material PRC Company is a party or to

which any assets of the Material PRC Company is a subject.

All dividends declared and payable upon the equity interests in the WFOE may be converted into foreign currency and freely transferred out of the PRC free of any deductions in the PRC, provided that (i) the declaration and payment of such dividends complies with applicable PRC Laws and the constitutional documents of the WFOE, and (ii) the remittance of such dividends out of the PRC complies with the procedures required by the relevant PRC Laws relating to foreign exchange administration.

We face uncertainties

with respect to indirect transfers of equity interests in PRC resident enterprises by their non-PRC holding companies.

Adverse changes in economic and political policies of the PRC government could have a material and adverse effect on overall economic growth in China, which could materially and adversely affect our business. General macroeconomic conditions may materially and adversely affect our business, prospects, results of operations and financial position. The PRC government’s control over foreign currency conversion may adversely affect our business and results of operations and our ability to remit dividends. PRC regulation of loans to and direct investments in PRC entities by offshore holding companies may delay or prevent us from using the proceeds of this offering to make loans or additional capital contributions to our operating subsidiary in China, which could materially and adversely affect our liquidity and our ability to fund and expand business.

There will

be no offer, issuance or sale of the Common Shares made, directly or indirectly, within the PRC. Therefore, a prior approval from the

CSRC is not required for the Offering. However, there are substantial uncertainties regarding the interpretation and application of the

M&A Rules, other PRC Laws and future PRC laws and regulations, and there can be no assurance that any Governmental Agency will not

take a view that is contrary to or otherwise different from our opinions stated herein. Subject to any applicable administrative procedures

required by PRC Laws, and provided that all required Governmental Authorizations have been duly obtained, the due application of the

net proceeds to be received by the Company from the issue Common Shares as disclosed in the Prospectus under the caption “Use of

Proceeds” does not and immediately after the Offering will not contravene any applicable PRC Laws, the articles of association

or the business licenses of the Material PRC Company.

There

is no tax or duty payable by or on behalf of the Material PRC Company under applicable PRC Laws in connection with the creation, allotment

and issuance Common Shares, provided that each person taking the aforementioned actions is not subject to PRC tax by reason of citizenship,

permanent establishment, residence or otherwise subject to PRC tax imposed on or measured by net income or net profits.

There are no reporting obligations to any Governmental Agency under PRC Laws on those holders of Common Shares who are not deemed to be PRC residents as defined under applicable PRC Laws, to the extent that no reporting obligation is triggered by the purchase or holding of Common Shares under the PRC anti-monopoly laws, rules and regulations.

We currently intend to retain all available funds and future earnings, if any, for the operation and expansion of our business and do not anticipate declaring or paying any dividends in the foreseeable future. Any future determination related to our dividend policy will be made at the discretion of our board of directors after considering our financial condition, results of operations, capital requirements, contractual requirements, business prospects and other factors the board of directors deem relevant, and subject to the restrictions contained in any future financing instruments.

On December 16, 2021, Public Company Accounting Oversight Board (PCAOB) issued a report on its determinations that PCAOB is unable to inspect or investigate completely PCAOB-registered public accounting firms headquartered in mainland China and in Hong Kong, a Special Administrative Region of the People’s Republic of China (PRC), because of positions taken by PRC authorities in those jurisdictions. The PCAOB made these determinations pursuant to PCAOB Rule 6100, which provides a framework for how the PCAOB fulfils its responsibilities under the Holding Foreign Companies Accountable Act (HFCAA). The report further listed in its Appendix A and Appendix B, Registered Public Accounting Firms Subject to the Mainland China Determination and Registered Public Accounting Firms Subject to the Hong Kong Determination, respectively. The audit report included in this registration statement for the year ended December 31, 2022, was issued by Shandong Haoxin Certified Accountants Co., Ltd. (“HAOXIN”), an audit firm headquartered in PRC, a jurisdiction that the PCAOB has determined that the PCAOB may be unable to conduct inspections or investigate auditors, despite a recent treaty allowing the PCAOB to review the audit papers of firms in the PRC. Our auditors HAOXIN is among those listed by the PCAOB Mainland China Determination, a determination announced by the PCAOB on December 16, 2021 that the PCAOB is unable to inspect or investigate completely registered public accounting firms headquartered in PRC, because of a position taken by one or more authorities in PRC. As a result, we and investors in our common stock may be deprived of the benefits of such full PCAOB inspections, which could cause investors in our stock to lose confidence in our reported financial information and the quality of our financial statements.

In

addition, under the HFCAA, as amended by the CAA, the Company’s securities may be prohibited from trading on the U.S. stock exchanges

or in the over-the-counter trading market in the U.S. if the Company’s auditor is not inspected by the PCAOB for two consecutive

years, and this ultimately could result in the Company’s common stock being delisted. Furthermore, on July 19, 2021, the U.S. Senate

passed the Accelerating Holding Foreign Companies Accountable Act (“AHFCAA”), which amends the HFCAA and requires the SEC

to prohibit an issuer’s securities from trading on any U.S. stock exchanges or in the over-the-counter trading market in the U.S.

if its auditor is not subject to PCAOB inspections for two consecutive years. In the future, if we do not engage an auditor that is subject

to regular inspection by the PCAOB, our common stocks may be delisted. See “Risk Factors – Risks related to doing business

in China – The audit report included in this Amendment is prepared by an auditor who is not inspected by the Public Company Accounting

Oversight Board and as such, the Company’s investors are deprived of the benefits of such inspection. The Company could be delisted

if it is unable to timely meet the PCAOB inspection requirements established by the Holding Foreign Companies Accountable Act.”

U.S

shareholders may face difficulties in effecting service of process against the Company and officers and director, as one is based in

New Zealand and the other is based in China. Even with proper service of process, the enforcement of judgments obtained in U.S. courts

or foreign courts based on the civil liability provisions of the U.S. federal securities laws would be extremely difficult. Furthermore,

there would be added costs and issues with bringing an original action in foreign courts to enforce liabilities based on the U.S. federal

securities laws against the Company.

Cash

dividends, if any, on our Shares will be paid in U.S. dollars. If we are considered a PRC tax resident enterprise for tax purposes, any

dividends we pay to our overseas shareholders may be regarded as China-sourced income and as a result may be subject to PRC withholding

tax at a rate of up to 10.0%.

The registered capital of the Material PRC Company has been duly paid in accordance with applicable PRC Laws and their respective articles of association, to the extent that such registered capital is required to be paid prior to the date hereof.

All of our business operations are conducted in China. Accordingly, our business, financial condition, results of operations and prospects are affected significantly by economic, political and legal developments in China. Although the PRC economy has been transitioning from a planned economy to a more market-oriented economy since the late 1970s, the PRC government continues to exercise significant control over China’s economic growth through direct allocation of resources, monetary and tax policies, and a host of other government policies such as those that encourage or restrict investment in certain industries by foreign investors, control the exchange between the Renminbi and foreign currencies, and regulate the growth of the general or specific market. While the Chinese economy has experienced significant growth in the past 30 years, growth has been uneven, both geographically and among various sectors of the economy. As the PRC economy has become increasingly linked with the global economy, China is affected in various respects by downturns and recessions of major economies around the world. The various economic and policy measures enacted by the PRC government to forestall economic downturns or bolster China’s economic growth could materially affect our business. Any adverse change in the economic conditions in China, in policies of the PRC government or in laws and regulations in China could have a material adverse effect on the overall economic growth of China and market demand for our outsourcing services. Such developments could adversely affect our businesses, lead to reduction in demand for our services and adversely affect our competitive position.

The

PRC legal system is based on written statutes. Prior court decisions may be cited for reference but have limited precedential value.

Since the late 1970s, the PRC government has been building a comprehensive system of laws and regulations governing economic matters

in general. The overall effect has been to significantly enhance the protections afforded to various forms of foreign investments in

China. We conduct our business primarily through our WFOE, the WFOE is established in China. These companies are generally subject to

laws and regulations applicable to foreign investment in China. However, since these laws and regulations are relatively new and the

PRC legal system continues to rapidly evolve, the interpretations of many laws, regulations and rules are not always uniform and enforcement

of these laws, regulations and rules involves uncertainties, which may limit legal protections available to us. In addition, some regulatory

requirements issued by certain PRC government authorities may not be consistently applied by other government authorities (including

local government authorities), thus making strict compliance with all regulatory requirements impractical, or in some circumstances impossible.

For example, we may have to resort to administrative and court proceedings to enforce the legal protection that we enjoy either by law

or contract.

An

investment in our securities is highly speculative, involves a high degree of risk and should be considered only by persons who can

afford the loss of their entire investments. See “Risk Factors” beginning on page 15 of this prospectus.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

Prospectus dated , 2023

TABLE OF CONTENTS

You should rely only on information contained in this prospectus. We have not authorized anyone to provide you with additional information or information different from that contained in this prospectus. Neither the delivery of this prospectus nor the sale of our securities means that the information contained in this prospectus is correct after the date of this prospectus. This prospectus is not an offer to sell or the solicitation of an offer to buy our securities in any circumstances under which the offer or solicitation is unlawful or in any state or other jurisdiction where the offer is not permitted.

For investors outside the United States: We have not taken any action that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the securities covered hereby and the distribution of this prospectus outside of the United States.

The information in this prospectus is accurate only as of the date on the front cover of this prospectus. Our business, financial condition, results of operations and prospects may have changed since those dates.

No person is authorized in connection with this prospectus to give any information or to make any representations about us, the securities offered hereby or any matter discussed in this prospectus, other than the information and representations contained in this prospectus. If any other information or representation is given or made, such information or representation may not be relied upon as having been authorized by us.

We have not done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than the United States. You are required to inform yourself about, and to observe any restrictions relating to, this offering and the distribution of this prospectus.

Until

October 30, 2023, all dealers that effect transactions in these securities, whether or not participating in this offering, may be

required to deliver a prospectus.

Prospectus Summary

This summary highlights information that we present more fully elsewhere in this prospectus. This summary does not contain all of the information that you might wish to consider before buying Common Shares in this offering. You should read the entire prospectus carefully, including “Risk Factors” and the financial statements and accompanying notes.

Corporate Overview

Alpine Auto Brokers (the “Company”) was organized as Alpine Auto Brokers, LLC in the state of Utah in December 2010. The Company sold automobiles and provided dealer services, for a fee.

The Company was incorporated as Alpine Auto Brokers, Inc. on May 12, 2011, in the State of Nevada for the purpose of locating and purchasing used vehicles at auctions, from private individuals, from other dealers and selling these vehicles specifically to consumers in Salt Lake City, Utah. On January 1, 2014, the Company acquired 100 percent of the membership interests of Alpine Auto Brokers, LLC, a Utah Limited Liability Company formed on December 10, 2010. The Company operated through its wholly owned subsidiary Alpine Auto Brokers, LLC.

The acquisition was accounted for as a reverse recapitalization in which the operating entity’s historical financial statements become those of the “accounting acquirer” in which historical operating results are presented from inception.

The Company had been dormant since October 27, 2016.

On August 18, 2021, the Eight Judicial District Court in Clark County, Nevada Case No: A-20-816619-B appointed Custodian Ventures, managed by David Lazar as the Company’s Receiver.

On January 28, 2022, the Company, amended its articles of incorporation change its name back to Alpine Auto Brokers Inc. The change was made because the Company failed to complete its prior name change with FINRA.

On February 9, 2022, as a result of a private transactions, 10,000,000 shares of Series A Preferred Stock, $0.001 par value per share (the “Shares”) of the “Company”, were transferred from Custodian Ventures, LLC to MetaVerse Investment Group (the “Purchaser”). As a result, the Purchaser became the holder of 90% of the voting rights of the issued and outstanding share capital of the Company on a fully-diluted basis of the Company, and became the controlling shareholder. The consideration paid for the Shares was $420,000, with $20,000 being held back pending certain public filings of the Company. The source of the cash consideration for the Shares was personal funds of the Purchaser. In connection with the transaction, David Lazar released the Company from all debts owed to him and/or Custodian Ventures, LLC.

On February 9, 2022, the existing director and officer resigned immediately. Accordingly, David Lazar, serving as a director and an officer, ceased to be the Company’s Chief Executive Officer, Chief Financial Officer, President, Treasurer, Secretary and a Director. At the effective date of the transfer, Zibin Xiao consented to act as the new Chief Executive Officer, President, and member of the Board of Directors. Also on February 9, 2022, Zonghan Wu consented to act as the new CFO, Treasurer, Secretary, and Chairman of the Board of Directors of the Company.

On June 27, 2022, Zibin Xiao resigned as the Chief Executive Officer, President, and member of the Board of Directors. Also on June 27, 2022, Yufeng Zhang consented to act as the new Chief Executive Officer, President, and member of the Board of Directors.

On February 20, 2023, the Company entered into a Definitive Share Exchange Agreement with National Holdings Investment Ltd., a British Virgin Islands corporation (“NHIL”), whereunder the Company acquired 100% ownership interest in NHIL for the issuance of 10,000,000 shares of the Company’s common stock. NHIL through its China based subsidiaries, Yinao (Dongguan) Technology Co., Ltd., is mainly engaged in the planning and design service consulting business of new energy charging piles. The transaction closed effective February 24, 2023 and has been treated as a business combination, resulting in NHIL becoming a wholly-owned subsidiary of the Company. As such, the Company recognized the assets and liabilities of NHIL acquired in the reorganization, at their historical carrying amounts.

As

a result of the above transaction, the Company’s corporate structure which is set forth as follows:

Yinao (Dongguan) Technology Co., Ltd (YDTC) was organized in 2022 to engage in the business of constructing and operating charging stations for electric vehicles (“EV”). Our ambition is to build YDTC into a central participant in this growing industry.

In this, our first year of operation, we are focusing our efforts on building a group of consulting clients who are themselves distributors of charging stations. We are undertaking this top-down approach to the industry in part because we lack sufficient financial resources to compete directly with the major participant in the industry. But of equal importance is the opportunity for market impact that we will gain by positioning ourselves as leaders in the charging station industry. As those to whom we provide our services and guidance spread throughout the EV world, they will advertise our brand as their authoritative source for technological and commercial knowledge about the charging station industry, and so our brand will gain value among the relevant participants in the EV world. Our goal is that, when we have secured the financing necessary to compete in the charging station community, we will already be known and identified with quality and know-how related to charging stations.

Our main business at this time, therefore, is to provide consulting services relating to the planning and design of new energy charging piles to customer in Guangdong Province of the PRC. Our customers are enterprises that are either initiating their participation in this industry in general or expanding their operations to Guangdong. In either case, a customer who engages YDTC, will receive, among other things:

|

● |

a survey report on the distribution of new energy charging piles that have been built and are under construction in the district of Guangzhou City in which the customer intends to distribute its stations;, |

|

● |

a business plan based upon an analysis of the existing distribution of charging piles in the target market; |

|

● |

a site selection plan identifying prospective locations where charging piles can be built; |

|

● |

a plan of the electric equipment design plus the type of charging piles to be used; |

|

● |

a plan of the construction and the construction method; as well as |

|

● |

the design and sample drawings of the foundation for the piles, |

1. Corporate History and Structure

On January 10, 2022, Yinao (Dongguan) Technology Co., Ltd (YDTC) was incorporated pursuant to the PRC law.

On June 16,

2022, Jiayue Yang established a holding company, National Holdings Investment Ltd (NHIL), under the laws of the British Virgin Islands

(BVI).

On October 04, 2022, NHIL acquired 100% ownership interest in YDTC. YDTC becomes a wholly foreign owned enterprise pursuant to the PRC law.

On February 20,

2023, the Company entered into a Definitive Share Exchange Agreement with National Holdings Investment Ltd., a British Virgin Islands

corporation (“NHIL”), whereunder the Company acquired 100% ownership interest in NHIL for the issuance of 10,000,000 shares

of the Company’s common stock to Jiayue Yang. NHIL through its China based subsidiaries, Yinao (Dongguan) Technology Co., Ltd.,

is mainly engaged in the planning and design service consulting business of new energy charging piles. The transaction closed effective

February 24, 2023 and has been treated as a business combination, resulting in NHIL becoming a wholly-owned subsidiary of the Company.

Between June

16, 2022 and October 4, 2022, NHIL was a private company owned by Jiayue Yang, with no assets and no relationship to the Company. Upon

acquiring YDTC and before February 20, 2023, NHIL was wholly-owned by Jiayue Yang and held YDTC as a wholly-owned subsidiary.

2. Competitive Strengths

The following are the competitive strengths of Yinao (Dongguan) Technology Co., Ltd:

Top-down approach: The company’s strategy of targeting consulting clients who are themselves distributors of charging stations is a smart move, as it allows the company to establish itself as a leader in the industry while building its financial resources to compete directly with major participants. This approach will help the company gain valuable insights into the industry while building its brand reputation.

Technological and commercial knowledge: YDTC’s focus on providing its clients with technological and commercial knowledge about the charging station industry positions the company as a credible and authoritative source of information in the EV world. This knowledge base will be useful when the company is ready to enter the market as a direct competitor.

Brand reputation: By positioning itself as a leader in the charging station industry through its consulting services, YDTC is laying the foundation for a strong brand reputation. As clients spread the word about the quality of its services, the company’s brand value will increase, making it easier to compete with major players in the industry.

Growing industry: The electric vehicle market is expected to grow rapidly in the coming years, and the need for charging stations will increase accordingly. As a company focused solely on charging stations, YDTC is well-positioned to take advantage of this growth and establish itself as a significant player in the industry.

Strategic location: Dongguan is a key manufacturing hub in China, and the company’s location there gives it access to a large pool of skilled workers, suppliers, and potential customers. This strategic location could give YDTC an edge over competitors located in less advantageous areas.

3. The Charging Station Industry in China

In recent

decades, China’s rapid economic growth has enabled more and more consumers to buy their own cars. The result has been the creation

of the largest automotive market in the world—but also serious urban air pollution, high greenhouse gas emissions, and growing

dependence on oil imports. To counteract those troubling trends, the Chinese government has imposed policies to encourage the adoption

of plug-in electric vehicles (Evs). Since buying an EV costs more than buying a conventional internal combustion engine vehicle, in 2009

the government began to provide generous subsidies for EV purchases. As a result, China became the world’s largest market for EV’s,

accounting for approximately 50% of global sales. In 2020 1.1 million Evs were produced and sold in China. The central government’s

“New Energy Vehicle Industry Development Plan (2021 – 2035) predicted that sales of new energy vehicles would account for

20% of car sales in China in 2025. In fact, during 2022, EV sales represented 22% of new car sales.

As the number of EV purchases grew, paying for the subsidies became extremely costly for the government. As a result, beginning in 2020, China’s government began to phase out the subsidies and instead rely on a mandate imposed on car manufacturers. The mandate requires that a certain percent of all vehicles sold by a manufacturer each year must be battery-powered. To avoid financial penalties, every year manufacturers must earn a stipulated number of points, which are awarded for each EV produced based on a complex formula that takes into account range, energy efficiency, performance, and more. The requirements get tougher over time, with a goal of having Evs make up 40% of all car sales in China by 2030.

The mandate on vehicle manufacturers to produce Evs is supplemented by a number of Chinese government policies:

|

● |

Tax exemptions. The Chinese government exempts electric vehicles from consumption and sales taxes, which can save purchasers tens of thousands of RMB (equivalent to thousands of dollars). It also waives 50% of vehicle registration fees for electric vehicles. |

|

● |

Procurement. The Chinese government also uses its procurement power to promote electric vehicles. A May 2016 order required that half of new vehicles purchased by China’s central government be new energy vehicles within five years. |

|

● |

New auto factory requirements. Chinese regulations strongly discourage the construction of factories for manufacturing internal combustion engine vehicles only. Subject to exceptions that are difficult to satisfy, any new vehicle factory is required to include capacity for the construction of electric vehicles. |

Since Evs

will be useless without charging stations, the Chinese central government has promoted the development of EV charging infrastructure

as a matter of national policy. As the central government has withdrawn subsidies for purchase of Evs, it has redirected a significant

portion of those funds to support the development of EV infrastructure, primarily charging stations. In November 2020, the General

Office of the State Council promulgated its “Development Plan of the New Energy Vehicle Industry (2021 – 2035), in which

it mandated financial support for the construction of charging stations and proposed preferential policies with respect to allocation

of space in parking lots to charging stations. China State Grid and China Southern Grid, China’s two state-owned electric utilities,

both have programs to promote the development of electric vehicle charging infrastructure.

Guangdong Province has also been aggressive in support of Evs and EV infrastructure. During 2022 the number of Evs sold in Guangdong Province doubled compared to sales in 2021, and now one-eighth of the Evs manufactured in the PRC are manufactured in Guangdong Province. To support this push toward Evs, Guangdong Province now has more charging stations than any other province in China – and three times as many charging facilities as are located in the entire United States. The Province subsidizes certain purchases of Evs, and encourages insurance companies to provide preferential premiums for Evs. The government of Guangdong Province gives every indication that it will continue to support the expansion of the charging station network indefinitely, with an ultimate goal of maximizing the conversion of vehicular traffic to electric.

4. Competition

The Company is operating in the growing market of new energy charging piles, which is becoming increasingly competitive due to the growing demand for electric vehicles and the government’s push towards cleaner energy. The competition the Company is facing can be broadly categorized into the following:

1. Established players: The new energy charging pile market is already populated with a number of established players such as State Grid, Southern Power Grid, and other major energy companies. These companies have a strong brand presence, financial resources, and expertise in the energy sector. They also have established relationships with customers and are likely to be strong competitors for the Company.

2. New entrants: The market for new energy charging piles is attracting a growing number of new entrants, ranging from start-ups to established companies diversifying into the market. These competitors are also likely to be aggressive in pursuing market share and have the potential to disrupt the market.

3. Technological changes: The charging technology for electric vehicles is constantly evolving, and competitors are investing heavily in developing new charging technologies such as wireless charging, fast charging, and ultra-fast charging. These technological changes could lead to new entrants and disrupt existing market players.

4. Regulatory environment: The regulatory environment for the new energy charging pile market is evolving rapidly, and competitors are likely to be affected by changes in regulations and policies related to the development of the new energy industry. These changes could favor some players and disadvantage others.

In summary, the Company is operating in a highly competitive market, facing competition from established players, new entrants, technological changes, and regulatory environment changes. The Company are developing a strong value proposition and endeavoring to build a competitive advantage to succeed in the market.

5. Marketing

The Company is developing a brand identity that reflects the Company’s values and mission. This includes developing a unique logo, website, and marketing materials that are visually appealing and clearly communicate the Company’s value proposition. The Company also plans to further strengthen our marketing efforts and improve our brand awareness through the following actions:

1. Leverage social media: Social media platforms such as WeChat, Weibo, and LinkedIn can be used to build awareness of our brand, share Company news and updates, and engage with potential customers. The Company can also consider partnering with influencers in the electric vehicle or sustainability space to reach a wider audience.

2. Attend industry events: The Company will attend industry events such as trade shows, conferences, and seminars to network with potential customers and partners. These events can also provide valuable insights into industry trends and customer needs.

3. Foster partnerships: The Company is seeking out partnerships with property developers, government agencies, and other companies in the new energy space. By partnering with these organizations, YDTC can expand its reach and access new customer segments.

4.

Overall, by developing a brand identity, leveraging social media, attending industry events, and fostering partnerships, The Company

can build awareness of its brand and generate leads in the highly competitive market.

6. PRC Laws and Regulations Affecting Our Business

There are several PRC laws and regulations that could affect the Company’s business, including:

Regulations on new energy vehicles: The Chinese government has implemented a number of regulations and policies aimed at promoting the

development and adoption of new energy vehicles, including electric vehicles. These policies could create opportunities for the Company

as demand for electric vehicle charging infrastructure increases.

It is important for YDTC to stay up-to-date with any changes or developments in these and other relevant laws and regulations in order to ensure compliance and mitigate any potential risks or challenges to its business operations.

7. Risks Related to Our Business

YDTC will face intense competition. It will not achieve market share and customers if it fails to compete effectively.