UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| | |

| [X] | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2015

OR

| | |

| [ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ___________ to ___________

Commission file number 333-182113

ASTIKA HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| | | |

| Florida (State or other jurisdiction of incorporation or organization) | | 27-4601693 (I.R.S. Employer Identification Number) |

Level 1, 725 Rosebank Road

Avondale, Auckland, 1348, New Zealand

(Address of principal executive offices)

(64) 9 929 0502

(Issuer’s telephone number, including area code)

_________

(Former name, former address and former fiscal year, if changed since last report)

Check whether the issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [ ] No [X]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [ ] No [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| | |

| Large accelerated filer [ ] | Accelerated filer [ ] |

| Non-accelerated filer [ ] | Smaller reporting company [X] |

| (Do not check if a smaller reporting company) | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

State the number of shares outstanding of each of the issuer’s classes of common equity, as of the latest practicable date.

| | | |

| Class | | Outstanding at November 16, 2015 |

| | | |

| Common Stock, par value $.001 per share | | 11,077,750 shares |

2

ASTIKA HOLDINGS, INC.

TABLE OF CONTENTS

3

PART I - FINANCIAL INFORMATION

Item 1. Financial Statements

ASTIKA HOLDINGS, INC.

BALANCE SHEETS

| | | | | | | | | |

| | | March 31, 2015 | | December 31, 2014 |

| ASSETS | | (unaudited) | | |

| | | | | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | | | | |

| | Current Liabilities | | | | |

| | | Accounts payable and accrued expenses | | $ | 21,025 | | $ | 18,615 |

| | | Loan payable | | | 1,237 | | | 1,222 |

| | | Due to related parties | | | 21,469 | | | 21,469 |

| | Total Current Liabilities | | | 43,731 | | | 41,306 |

| | | | | | | |

| | Shareholders’ Equity | | | | | | |

| | | Preferred stock: 10,000,000 shares authorized; par value $0.001; none issued and outstanding | | | - | | | - |

| | | Common stock: 140,000,000 shares authorized; par value $0.001; 11,077,750 issued and outstanding as of March 31, 2015 and December 31, 2014 | | | 11,078 | | | 11,078 |

| | | Additional paid in capital | | | 112,782 | | | 112,782 |

| | | Accumulated deficit | | | (167,591) | | | (165,166) |

| | Total Shareholders’ Equity | | | (43,731) | | | (41,306) |

| | TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | | $ | - | | $ | - |

The accompanying notes are an integral part of these unaudited consolidated financial statements.

4

ASTIKA HOLDINGS, INC.

STATEMENTS OF OPERATIONS

(Unaudited)

| | | | | | | |

| | | Three months ended | | Three months ended |

| | | March 31, 2015 | | March 31, 2014 |

| | | | | |

| OPERATING EXPENSES | | | | |

| Selling, general & administrative | | $ | 2,410 | | $ | 4,019 |

| Amortization of intangible assets | | | - | | | 115 |

| Total Operating Expenses | | | 2,410 | | | 4,134 |

| | | | | | | |

| OPERATING LOSS | | | (2,410) | | | (4,134) |

| | | | | | | |

| Interest expense, net | | | (15) | | | (15) |

| | | | | | | |

| Net Loss before Income Taxes | | | (2,425) | | | (4,149) |

| Provision for Income Taxes | | | - | | | - |

| | | | | | | |

| NET LOSS | | $ | (2,425) | | $ | (4,149) |

| | | | | | | |

| Basic and Diluted Net Loss per Common Share | | $ | (0.00) | | $ | (0.00) |

| Weighted Average Number of Common Shares | | | 11,077,750 | | | 11,077,750 |

The accompanying notes are an integral part of these unaudited financial statements.

5

ASTIKA HOLDINGS, INC.

STATEMENTS OF CASH FLOWS

(Unaudited)

| | | | | | | |

| | | Three months ended | | Three months ended |

| | | March 31, 2015 | | March 31, 2014 |

| | | | | |

| OPERATING ACTIVITIES | | | | |

| Net loss | | $ | (2,425) | | $ | (5,359) |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | | | | |

| Amortization | | | - | | | 114 |

| Depreciation | | | - | | | 187 |

| Interest expense | | | 15 | | | 14 |

| Changes in operating assets & liabilities: | | | | | | |

| Accounts payable - related parties | | | - | | | 9,182 |

| Accounts payable and accrued expenses | | | 2,410 | | | (4,138) |

| | | | | | | |

| NET CASH PROVIDED BY (USED IN) OPERATING ACTIVITIES | | | - | | | - |

| | | | | | | |

| NET INCREASE (DECREASE) IN CASH | | | - | | | - |

| CASH, BEGINNING OF PERIOD | | | - | | | - |

| CASH, END OF PERIOD | | $ | - | | $ | - |

| | | | | | | |

| Supplemental cash flow information and noncash financing activities: | | | | | | |

| Cash paid for: | | | | | | |

| Taxes paid | | $ | - | | $ | - |

| Interest paid | | $ | - | | $ | - |

The accompanying notes are an integral part of these unaudited financial statements.

6

ASTIKA HOLDINGS, INC.

NOTES TO UNAUDITED INTERIM FINANCIAL STATEMENTS

NOTE 1 - BASIS OF PRESENTATION

The accompanying unaudited interim financial statements have been prepared in accordance with the rules and regulations of the Securities and Exchange Commission for the presentation of interim financial information, but do not include all the information and footnotes required by generally accepted accounting principles for complete financial statements. The accompanying financial statements should be read in conjunction with the December 31, 2014 and 2013 financial statements file in our annual report on Form 10-K. In the opinion of management, all adjustments (consisting of normal recurring accruals) considered necessary for a fair presentation have been included. Operating results for the three-month period ended March 31, 2015 are not necessarily indicative of the results that may be expected for the year ended December 31, 2015.

NOTE 2- GOING CONCERN

The Company’s financial statements are prepared using accounting principles generally accepted in the United States of America applicable to a going concern which contemplates the realization of assets and liquidation of liabilities in the normal course of business. The Company has not yet established an ongoing source of revenue sufficient to cover its operating costs and allow it to continue as a going concern. The ability of the Company to continue as a going concern is dependent on the Company obtaining adequate capital to fund operating losses until it becomes profitable. If the Company is unable to obtain adequate capital, it could be forced to cease operations. These factors raise substantial doubt about the Company’s ability to continue as a going concern.

In order to continue as a going concern, the Company will need, among other things, additional capital resources. Management’s plans focus is on a variety of strategic acquisitions in service, agriculture and industrial companies to compliment and grow Astika Holdings, Inc.’s business. The Company is positioning to capture the next wave of growth companies from Asia. As the centerpieces for Astika Holdings in Asia, the focus is on rapid economic growth and increased foreign investment sector companies which management believes is poised for accelerated economic growth with national modernization. Astika’s planned focus is also on adding value through successful project development, efficient operations, and opportunistic acquisitions while maintaining a low risk profile through project diversification, astute financial management and operating in secure. to obtain such resources for the Company include (i) obtaining capital from management and significant stockholders sufficient to meet its minimal operating expenses; (ii) obtaining funding from outside sources through the sale of its debt and/or equity securities; and (iii) completing a merger with or acquisition of an existing operating company. However, management cannot provide any assurances that the Company will be successful in accomplishing any of its plans.

NOTE 3 - LOAN TRANSACTION

The Company purchased a recorded music compilation from EuGene Gant for a purchase price of $5,000 pursuant to a Bill of Sale and Assignment dated June 15, 2012, an Exclusive Songwriter Agreement dated June 15, 2012, and a Promissory Note that the Company concurrently executed and delivered to him on the same date. The Company made a payment to Mr. Gant in the amount of $1,000 on June 15, 2012 and $2,000 on October 1, 2012, and $1,000 on June 15, 2013, and the remaining $1,000 principal amount under Promissory Note bears interest at five percent (5%) per annum, and there is one remaining principal installment payment in the amount of $1,000 due. Accrued and unpaid interest on the Promissory Note is due in the amount of $15 for the period ended March 31, 2015and March 31, 2014, respectively. As of March 31, 2015 and December 31, 2014, total outstanding short-term debt is $1,237 and $1,222, respectively.

7

The songwriter agreement expired on June 15, 2014 and the Company did not renew. On September 26, 2014 the company dissolved its subsidiary, Astika Music Entertainment, Inc., in response to the change in the nature of business operations.

NOTE 4 - RELATED PARTY TRANSACTIONS

The Company has entered into transactions with the related party, IQ Acquisition (NY), Ltd, owned by Mr. Richards, the CEO of the Company. IQ Acquisition (NY), Ltd, the major shareholder of the Company, has paid expenses on behalf of the Company in the amount of $21,469 as of March 31, 2015 and December 31, 2014. The advances are payable on demand and carry no interest.

NOTE 6 - SUBSEQUENT EVENT

On June 4, 2015, the Company contracted Artfield Investment RD, Inc. to provide consulting services for a fee of $45,000. Consultation fee shall be payable $22,500 in cash at the time of signing (6/4/2015), and the remaining fee of $22,500 to be paid in unrestricted shares. The shares haven't been issued as of the reporting date.

8

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis should be read in conjunction with our financial statements, including the notes thereto, appearing in this report and are hereby referenced. The following discussion contains forward-looking statements that reflect our plans, estimates and beliefs. Our actual results could differ materially from those discussed in the forward looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed below and elsewhere in this report. You should not place undue certainty on these forward-looking statements, which apply only as of the date of this report. We believe it is important to communicate our expectations. However, our management disclaims any obligation to update any forward-looking statements whether as a result of new information, future events or otherwise.

These forward-looking statements are based on our management’s current expectations and beliefs and involve numerous risks and uncertainties that could cause actual results to differ materially from expectations. You should not rely upon these forward-looking statements as predictions of future events because we cannot assure you that the events or circumstances reflected in these statements will be achieved or will occur. You can identify a forward-looking statement by the use of the forward-terminology, including words such as “may”, “will”, “believes”, “anticipates”, “estimates”, “expects”, “continues”, “should”, “seeks”, “intends”, “plans”, and/or words of similar import, or the negative of these words and phrases or other variations of these words and phrases or comparable terminology. These forward-looking statements relate to, among other things: our sales, results of operations and anticipated cash flows; capital expenditures; depreciation and amortization expenses; sales, general and administrative expenses; our ability to maintain and develop relationship with our existing and potential future customers; and, our ability to maintain a level of investment that is required to remain competitive. Many factors could cause our actual results to differ materially from those projected in these forward-looking statements, including, but not limited to: variability of our revenues and financial performance; risks associated with technological changes; the acceptance of our products in the marketplace by existing and potential customers; disruption of operations or increases in expenses due to our involvement with litigation or caused by civil or political unrest or other catastrophic events; general economic conditions, government mandates; and, the continued employment of our key personnel and other risks associated with competition.

Overview

Astika Holdings, Inc., a Florida corporation, is refocusing and preparing to relaunch the Company through a variety of strategic acquisitions in the textile, service, agricultural, and industrial sectors to complement and capture the next wave of growth companies from Asia and New Zealand. The initial planned target acquisitions from the Nantong Region in China are private companies which have been in business for over a decade with consistent track records of delivering revenue and earnings growth in the textile and service sectors. The Company also has plans for agricultural “Green Future” initiatives into the Industrial Hemp sector and New Zealand Dairy sector. The Holdings would become the primary operations and management believes that focusing our efforts on the acquisition of textile, service, agricultural, and industrial companies would represent the greatest potential for shareholder return. Rapid economic growth and increased foreign investment sector companies poised for accelerated growth with national modernization are the planned centerpieces for Astika Holdings in Asia and New Zealand.

9

Plan of Operation

Astika Holdings’ planed focus is on a variety of strategic acquisitions in the textile, service, agriculture and industrial sectors to compliment and capture the next wave of growth companies from Asia and New Zealand. Astika plans on adding value through successful project development, efficient operations, and opportunistic acquisitions while maintaining a low risk profile through project diversification, astute financial management and operating in secure jurisdictions. Management believes there will be rapid economic growth and an increase in foreign investment sector companies poised for accelerated growth with national modernization are planned centerpieces for Astika Holdings in Asia. The planned initial acquisitions from the Nantong Region, private companies, have all been in business for over a decade and have consistent track records of delivering revenue and earnings growth. Additionally, Astika qualifies as an "emerging growth company" as defined in the Jumpstart Our Business Startups Act, which became law in April 2012.

Astika's ongoing strategy through opportunistic high growth sector planned acquisitions include the dredging sector in the Nantong region of China and the Company's agriculture 'Green Future' planned initiatives into the Industrial Hemp sector. As global demand for hemp is increasing, the Company's existing relationships with China coupled with New Zealand infrastructure for seed production and food processing along with New Zealand's temperate climate and ideal soils offers Astika a position to capture the added value and economic benefits that this opportunity presents.

Astika's entrance into the Industrial Hemp sector is in conjunction with Astika's commitment to acquisitions and development of agriculture in Asia and New Zealand with the New Zealand Dairy Sector. There are large rural areas and dairy farmers eager to work with Mark Richards, the President of Astika, to potentially acquire and grow their operating dairy farms. The food service sector is intended to benefit the future of Astika's shareholders along with the Asian, New Zealand and World Markets.

Results of Operations for the Three Months Period Ended March 31, 2015 Compared to the Three Period Ended March 31, 2014

Revenues. The Company’s revenues were $0 for the three months period ended March 31, 2015 and 2014.

Selling, General and Administrative Expenses. Selling, general and administrative expenses for the three months period ended March 31, 2015 were $2,410 as compared to $4,134 for the three months period ended March 31, 2014. General and administrative expenses decreased since the Company incurred additional costs in the first quarter of 2014 related to public reporting and the preparation of the Company's public offering. Professional fees decreased due to the legal fees involved with the original public offering in the first quarter of 2014.

Liquidity and Capital Resources

We measure our liquidity in a number of ways, including the following:

| | | | | | | | |

| | As of March 31, 2015 | | | As of December 31, 2014 |

| | | | | |

| Cash | | $ | - | | | $ | - |

| Working Capital | | | (43,731) | | | | (41,306) |

| Debt (current) | | | 43,731 | | | | 41,306 |

10

From January 13, 2011 (inception) through March 31, 2015, we raised a total of $123,500 from the issuance of common stock and the conversion of Series A Convertible Preferred Stock into shares of common stock. We have not raised any additional capital since the completion of our public offering in Fall 2012.

The Company has not yet established an ongoing source of revenue sufficient to cover its operating costs and allow it to continue as a going concern. The ability of the Company to continue as a going concern is dependent on the Company obtaining adequate capital to fund operating losses until it becomes profitable. If the Company is unable to obtain adequate capital, it could be forced to cease operations. These factors raise substantial doubt about the Company’s ability to continue as a going concern.

In order to continue as a going concern, the Company will need, among other things, additional capital resources. Management’s plans focus is on a variety of strategic acquisitions in service, agriculture and industrial companies to compliment and grow Astika Holdings, Inc.’s business. The Company is positioning to capture the next wave of growth companies from Asia. As the centerpieces for Astika Holdings in Asia, the focus is on rapid economic growth and increased foreign investment sector companies which management believes is poised for accelerated economic growth with national modernization. Astika’s planned focus is also on adding value through successful project development, efficient operations, and opportunistic acquisitions while maintaining a low risk profile through project diversification, astute financial management and operating in secure. to obtain such resources for the Company include (i) obtaining capital from management and significant stockholders sufficient to meet its minimal operating expenses; (ii) obtaining funding from outside sources through the sale of its debt and/or equity securities; and (iii) completing a merger with or acquisition of an existing operating company. However, management cannot provide any assurances that the Company will be successful in accomplishing any of its plans.

Impact of Inflation

We believe that the rate of inflation has had negligible effect on our operations. We believe we can absorb most, if not all, increased non-controlled operating costs by increasing sales prices, whenever deemed necessary and by operating our Company in the most efficient manner possible.

Net Cash Used in Operating Activities

We experienced $0 cash flow from operating activities during the three months period ended March 31, 2015 and 2014.

Net Cash Used in Investing Activities

The cash used in investing activities during the three months period ended March 31, 2015 and 2014 was $0.

Net Cash Provided by Financing Activities

Cash provided by financing activities during the three months period ended March 31, 2015 and 2014 was $0.

11

Availability of Additional Funds

Based on our working capital deficit as of March 31, 2015 and zero revenues, we expect to need additional equity and/or debt financing to continue our operations during the next 12 months. We expect that our current cash on hand will not fund our operations through March 2016. See “Description of Business”.

Critical Accounting Policies and Estimates

Our financial statements and accompanying notes have been prepared in accordance with United States generally accepted accounting principles applied on a consistent basis. The preparation of financial statements in conformity with United States generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting periods. Actual results could differ from these estimates. Our significant estimates and assumptions include amortization, the fair value of our stock, and the valuation allowance relating to the Company’s deferred tax assets.

We qualify as an “emerging growth company”, as defined in the Jumpstart Our Business Startups Act, which became law in April, 2012. Under the JOBS Act, “emerging growth companies”, can delay adopting new or revised accounting standards until such time as those standards apply to private companies. We have elected not to avail ourselves of this exemption from new or revised accounting standards and, therefore, will be subject to the same new or revised accounting standards as other public companies that are not emerging growth companies.

Material Commitments

There was no material commitments during the three months period ended March 31, 2015.

Purchase of Furniture and Equipment

We purchased no equipment during the three months period ended March 31, 2015.

Recent Accounting Pronouncements

We have adopted all recently issued accounting pronouncements. The adoption of the accounting pronouncements, including those not yet effective, is not anticipated to have a material effect on our financial position or results of operations.

Off Balance Sheet Arrangements

As of March 31, 2015, we had no off balance sheet arrangements.

Item 3. Quantitative and Qualitative Disclosures about Market Risk

Disclosure under this section is not required for a smaller reporting company.

12

Item 4. Controls and Procedures

We maintain disclosure controls and procedures that are designed to ensure that the information required to be disclosed in the reports that we file under the Securities Exchange Act of 1934 (the "Exchange Act") is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission’s rules and forms, and that such information is accumulated and communicated to our management, including our President and Treasurer, as appropriate, to allow timely decisions regarding required disclosures. In designing and evaluating the disclosure controls and procedures, management recognized that any controls and procedures, no matter how well designed and operated, can only provide reasonable assurance of achieving the desired control objectives, and in reaching a reasonable level of assurance, management necessarily was required to apply its judgment in evaluating the cost-benefit relationship of possible controls and procedures.

As required by SEC Rule 13a-15(b), we carried out an evaluation, under the supervision and with the participation of our management, including our President and Treasurer, of the effectiveness of the design and operation of our disclosure controls and procedures as of the end of our fourth fiscal quarter covered by this report. Based on the foregoing, our President and Treasurer concluded that our disclosure controls and procedures were not effective at the reasonable assurance level. It should be noted that the design of any system of controls is based in part upon certain assumptions about the likelihood of future events, and there can be no assurance that any design will succeed in achieving its stated goals under all potential future conditions, regardless of how remote.

Management's Remediation Initiatives

In an effort to remediate the identified material weaknesses and other deficiencies and enhance our internal controls, we plan to initiate the following series of measures once we have the financial resources to do so:

·

We will create a position to segregate duties consistent with control objectives and will increase our personnel resources and technical accounting expertise within the accounting function when funds are available to us. And, we plan to appoint one or more outside directors to an audit committee resulting in a fully functioning audit committee, which will undertake the oversight in the establishment and monitoring of required internal controls and procedures, such as reviewing and approving estimates and assumptions made by management when funds are available to us.

·

Management believes that the appointment of outside directors to a fully functioning audit committee, would remedy the lack of a functioning audit committee.

Changes in Internal Control Over Financial Reporting

There were no changes in our internal controls over financial reporting that occurred during the period covered by this report, which were identified in connection with management’s evaluation required by paragraph (d) of Rules 13a-15 and 15d-15 under the Exchange Act, that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

/s/ Mark W. Richards

Mark W. Richards

CEO, President and Treasurer

13

PART II - OTHER INFORMATION

Item 1. Legal Proceedings

None.

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds.

None.

Item 3. Defaults Upon Senior Securities

None.

Item 4. Mine Safety Disclosures

Not applicable.

Item 5. Other Information

None.

Item 6. Exhibits

(a) Exhibits

| | | |

| Exhibit No. | | Description |

| | | |

| Exhibit 31.1 | | 302 Certification - Mark W. Richards |

| | | |

| Exhibit 32.1 | | 906 Certification - Mark W. Richards |

(b) Reports of Form 8-K

None

14

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

ASTIKA HOLDINGS, INC.

DATE: November 16, 2015

By: /s/ Mark W. Richards

Mark W. Richards

Chairman, President, Chief Executive Officer

and Treasurer (Principal Accounting Officer

and Authorized Officer)

15

Astika Holdings, Inc.

Index to Exhibits

| | | |

| Exhibit No. | | Description |

| | | |

| Exhibit 31.1 | | 302 Certification - Mark W. Richards |

| | | |

| Exhibit 32.1 | | 906 Certification - Mark W. Richards |

16

Exhibit 31.1

CERTIFICATION

I, Mark W. Richards, certify that:

1. I have reviewed this Quarterly Report on Form 10-Q of Astika Holdings, Inc.;

2. Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report;

3. Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in the report;

4. The registrant’s other certifying officer(s) and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the registrant and have:

(a) Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant, is made known to us by others within those entities, particularly during the period in which this report is being prepared;

(b) Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles;

(c) Evaluated the effectiveness of the registrant’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and

(d) Disclosed in this report any change in the registrant’s internal control over financial reporting that occurred during the registrant’s most recent fiscal quarter (the registrant’s fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting; and

5. The registrant’s other certifying officer(s) and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the registrant’s auditors and the audit committee of the registrant’s board of directors (or persons performing the equivalent functions):

(a) All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant’s ability to record, process, summarize and report financial information; and

(b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s internal control over financial reporting.

Date: November 16, 2015

/s/ Mark W. Richards

Mark W. Richards

Chief Executive Officer

(Principal Executive Officer)

Exhibit 32.1

CERTIFICATION PURSUANT TO 18 U.S.C. 1350 AS ADOPTED

PURSUANT TO SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002

The undersigned hereby certify, pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, that, to their knowledge, the Quarterly Report on Form 10-Q for the period ended March 31, 2015 of Astika Holdings, Inc. (the “Company”) fully complies with the requirements of Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, and the information contained in such periodic report fairly presents, in all material respects, the financial condition and results of operations of the Company as of, and for, the periods presented in such report.

Very truly yours,

/s/ Mark W. Richards

Mark W. Richards

Chief Executive Officer

/s/ Mark W. Richards

Mark W. Richards

Chief Financial Officer

Dated: November 16, 2015

A signed original of this written statement required by Section 906 of the Sarbanes-Oxley Act of 2002 has been provided to Astika Holdings, Inc. and will be furnished to the Securities and Exchange Commission or its staff upon request.

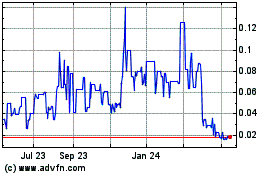

Astika (PK) (USOTC:ASKH)

Historical Stock Chart

From Dec 2024 to Jan 2025

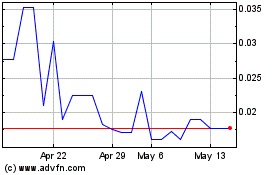

Astika (PK) (USOTC:ASKH)

Historical Stock Chart

From Jan 2024 to Jan 2025