Aventine Renewable Energy Holdings, Inc. Enters Into a Significant Restructuring Transaction With Members of Its Lender Group

21 August 2012 - 7:40AM

Aventine Renewable Energy Holdings, Inc. (OTCBB:AVRW), today

announced that it has entered into a Restructuring Agreement with

100% of its term loan lenders. Under the terms of this agreement

the Company would convert the majority of its outstanding term loan

debt into newly issued common equity of the Company, representing,

on a fully diluted basis, approximately 92.5% of the issued and

outstanding common stock after the issuance (subject to downward

adjustment and/or dilution as described in the agreement).

The Company's Board of Directors unanimously approved entering

into the agreement and holders of approximately 60% of its common

stock have also approved the agreement. If completed, the

Company expects the restructuring to reduce the Company's existing

debt by approximately $135 million and significantly lower the

Company's annual cash interest expense. As part of the

transactions, the term loan lenders have also agreed, subject to

receipt of internal credit approvals, to provide $30 million in the

form of additional indebtedness to further improve the Company's

liquidity.

With the commitment of all the requisite stakeholders the

transactions are expected to be consummated without any court

approvals. If completed, the Company expects that

unsecured creditors would not be affected by the restructuring and

trade creditors would continue to receive payments in the ordinary

course. The transactions are targeted to close by the

end of the 3rd quarter of 2012.

Completion of the transactions contemplated by the Restructuring

Agreement is subject to certain customary conditions and approvals

as well as the finalization of definitive documentation.

"The Company would like to thank its lenders and significant

stakeholders for supporting its business and operations. These

are difficult times for the industry and the consummation of these

transactions is expected to result in a much stronger balance sheet

for the Company," said John Castle, Aventine's Chief Executive

Officer.

The securities of the Company to be issued and/or offered and

sold to the term loan lenders in reliance on Section 4(a)(2) and/or

Rule 506 of Regulation D of the Securities Act of 1933, as amended

(the "Securities Act"), have not been registered under the

Securities Act and may not be offered or sold in the United States

absent registration or an applicable exemption from the

registration requirements. This press release does not

constitute an offer to sell or a solicitation of an offer to buy

any securities nor shall there be any sale of these securities in

any state or jurisdiction in which such an offer, solicitation or

sale would be unlawful prior to registration or qualification under

the securities laws of any such jurisdiction.

About Aventine Renewable Energy

Aventine is a leading producer of ethanol. Through our

production facilities, we market and distribute ethanol to many of

the leading energy companies in the U.S. In addition to producing

ethanol, our facilities also produce several by-products, such as

distillers grain, corn gluten meal and feed, corn germ and grain

distillers dried yeast, which generate revenue and allow us to help

offset a significant portion of our corn costs.

Forward Looking Statements

Certain information included in this press release may be deemed

to be "forward looking statements" within the meaning of Section

27A of the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934. In some cases, you can identify these

statements by forward-looking words such as "may," "might," "will,"

"should," "expect," "plan," "anticipate," "believe," "estimate,"

"predict," "potential" or "continue," and the negatives of these

terms and other comparable terminology. These forward-looking

statements, which are subject to known and unknown risks,

uncertainties and assumptions about us, include the anticipated

benefits of the Restructuring Agreement and the related

transactions, expected timing of the completion of the transactions

contemplated by the Restructuring Agreement and other aspects of

the proposed restructuring, and may include projections of our

future financial performance based on our growth strategies and

anticipated trends in our business. These statements are only

predictions based on our current expectations and projections about

future events. There are important factors that could cause our

actual results, level of activity, performance or achievements to

differ materially from the results, level of activity, performance

or achievements expressed or implied by the forward-looking

statements.

Some of the factors that may cause Aventine's actual results,

developments and business decisions to differ materially from those

contemplated by such forward looking statements include our ability

to reach agreement with our stakeholders on, and successfully

complete negotiations with respect to, definitive documents

effectuating the transactions contemplated by the Restructuring

Agreement and to satisfy all the conditions precedent to the

consummation of all the transactions contemplated by the

Restructuring Agreement in a timely manner, or at all, our ability

to obtain and maintain normal terms with vendors and service

providers, our ability to estimate allowed general unsecured

claims, unliquidated and contingent claims and future distributions

of securities and allocations of securities among various

categories of claim holders, our ability to maintain contracts that

are critical to our operations, our ability to attract and retain

customers, our ability to fund and execute our business plan and

any ethanol plant expansion or completion projects, our ability to

receive or renew permits to construct or commence operations of our

proposed capacity additions in a timely manner, or at all, laws,

tariffs, trade or other controls or enforcement practices

applicable to our operations, changes in weather and general

economic conditions, overcapacity within the ethanol, biodiesel and

petroleum refining industries, availability and costs of products

and raw materials, particularly corn, coal and natural gas and the

subsequent impact on margins, our ability to raise additional

capital and secure additional financing, our ability to service our

debt or comply with our debt covenants, our ability to attract,

motivate and retain key employees, liability resulting from actual

or potential future litigation or the outcome of any litigation

with respect to our auction rate securities or otherwise, and plant

shutdowns or disruptions. We disclaim any obligation or undertaking

to disseminate any updates or revisions to any forward looking

statements contained in this release or to reflect any change in

our expectations after the date of this release or any change in

events, conditions or circumstances on which any statement is based

except as required by law.

CONTACT: Aventine Renewable Energy Holdings, Inc.

Calvin Stewart

Chief Financial Officer

Ph: 214-451-6766

Fax: 214-451-6799

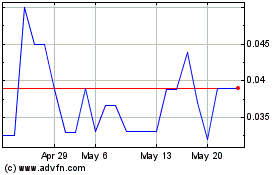

Avenir Wellness Solutions (QB) (USOTC:AVRW)

Historical Stock Chart

From Jan 2025 to Feb 2025

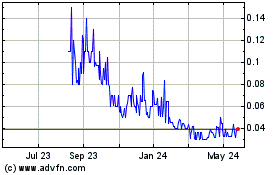

Avenir Wellness Solutions (QB) (USOTC:AVRW)

Historical Stock Chart

From Feb 2024 to Feb 2025