Beneficial Holdings Announces 2013 Unaudited Results; Reviews 2013

Activities; Sets Investor Call

MONTVALE, NJ--(Marketwired - Apr 3, 2014) - Beneficial Holdings

Inc. (OTC Pink: BFHJ) (PINKSHEETS: BFHJ) today announced

preliminary unaudited results for the year ended December 31, 2013,

updates to corporate developments and the date and time for an

investor conference call.

UNAUDITED FINANCIAL

RESULTS FOR THE TWELVE MONTHS AND FINAL QUARTER ENDED

DECEMBER 31, 2013

The Company has prepared unaudited financial statements for the

years ended December 31, 2013 and 2012. These financial statements

will be examined by the Company's independent public accountants

and posted on the Company's web site at

www.beneficial-holdings.net.

For the twelve months ended December 31, 2013 the Company

recorded revenues of $293,369 and a net loss for the twelve month

period of $1,738,226, equal to a loss of eight cents per share.

Approximately $1.3 million of such net loss (six cents per fully

diluted share) was attributed to the effects of recording

stock-based compensation in accordance with Generally Accepted

Accounting Principles. The weighted average number of fully-diluted

common shares for the twelve months ended December 31, 2013 was

22,180,917. All such amounts are unaudited. The Company recorded

$83,950 of revenue for the three months ended December 31, 2013.

The net loss for the period was $1,415,761, equal to a loss of six

cents per share (fully diluted). Approximately $1.3 million of such

net loss (six cents per fully diluted share) was attributed to the

effects of recording stock based compensation in accordance with

Generally Accepted Accounting Principles. The weighted average

number of fully-diluted common shares for the three months ended

December 31, 2013 was 22,285,543. All such amounts are

unaudited.

Revenues for the three- and twelve-month periods were generated

from the Company's asset management and development activities.

No member of management or their beneficiaries has engaged in

any sale or purchase of the Company's common shares or

equity-related securities during the twelve months ended December

31, 2013.

Operating results for the comparable periods in 2012 are not

relevant due to the previously-announced discontinuance of certain

operations and changes in accounting methods.

2013 ACTIVITY

SUMMARY Summing up 2013 activity, Gregory N. Senkevitch,

Beneficial's Chairman, President and CEO said: "Our Project

Solutions business provided all of the Company's revenues for 2013.

The Company recorded revenue from our co-development assignment at

1355 First Avenue and from our asset management engagements. Aside

from the effects of recording stock based compensation in

accordance with GAAP, the Company recorded a loss of two cents per

fully diluted share. Additionally, it should be noted the Company

has not recorded a credit for federal and state income taxes to

offset such losses on a GAAP basis."

Senkevitch added: "These initial activities of our Project

Solutions operation have uniquely positioned the Company to be

recognized as an innovative service provider within the 'built'

environment. Over the past year, our most significant project, 1355

First Avenue (www.charlesnyc.com) -- one of the few new

construction projects on Manhattan's highly desired Upper East Side

-- has garnered accolades for its design, sales activity and unique

market positioning. Our BFHJ Project Solutions management team is

proud to have originated this ground breaking development back in

2007 and is privileged to be playing a role in its delivery. The

Company's role in this project is small; however, it indicates the

business that Project Solutions is pursuing."

Commenting on 2013's acquisition activity, Senkevitch said:

"Restructuring the Green RG transaction to a licensing arrangement

recognizes the synergies that we can create within our existing

management team and its extended network of professional contacts.

During our due diligence process, we recognized that both

Beneficial's and Green RG's interests were better served by

obtaining access to Green RG's technology on a favorable pricing

basis and accessing proprietary situations where the technology

could be utilized to maximize our Company's profits. Over the next

several weeks we expect to conclude the Green Econometrics

acquisition (www.greenecon.net) and to further outline our plans to

staff up our Energy Solutions business and roll out its business

plan."

INVESTOR CALL

SET Senkevitch also announced the Company's second investor

call: "With the scope of the changes to the Company's capital

structure and business platform during 2013 and the expectation

that we will be able to announce one or more potential acquisitions

and management team additions over the next several weeks, a second

investor call is warranted. This call will provide an interactive

forum that will allow for the continued discussion of the Company's

strategy and communicate management's accomplishments and

expectations."

The investor call will start promptly at 11:00 AM EDT on

Wednesday, April 23, 2014. The toll free dial in number for United

States and Canada is (888) 481-2844. The international toll number

is (719) 325-2144 (not toll free). For either number please enter

pass code 6980950 when prompted. Allow at least 15 minutes prior to

the call for the registration process. Investor questions will be

answered as time allows.

"We are building a company that combines experienced,

principal-based talent with cutting edge technology and

capital-based solutions. Over the next several weeks we will

continue to outline additional service platforms and management

talent that will expand our basket of services for the 'built'

environment. We believe that this basket of services greatly

exceeds those provided by traditional real estate service

providers, will allow us to target unique value-added situations in

the 'built' environment and will enable us to achieve enhanced

revenue streams from multiple engagements with repeat clients and

customers. This is how we will 'Create Value from Market

Knowledge,'" Senkevitch concluded.

COMPANY BACKGROUND AND

HISTORY Beneficial Holdings, Inc., a Nevada Corporation, was

incorporated on December 20, 1990. The Company is currently engaged

in the real estate services and energy management sectors. The

Company's focus is on the 'built' environment: real estate and

infrastructure owned by public, institutional and private sector

entities. The Company seeks to work with select customers on a

long-term basis providing a multiplicity of services and solutions

affording the Company potential multiple revenue streams.

DEVELOPMENT STAGE

ACTIVITIES Through year-end 2013, the Company was classified

as a development stage company with no significant revenues from

operations. Accordingly, all of the Company's operating results and

cash flows are related to development stage activities and

represent the cumulative from inception amounts from its

development stage activities reported pursuant to Financial

Accounting Standards Board ("FASB") Accounting Standards

Codification ("ASC") 915-10-05, Development Stage

Entities.

As a developmental stage company, the Company has limited access

to the capital markets; and the Company's ability to continue in

business is dependent upon obtaining sufficient financing or

attaining profitable operations. There can be no assurance that the

Company will be successful in obtaining additional funding or in

attaining profitable operations.

CAPITAL

STRUCTURE The Company had 898,992 common shares outstanding

as of December 31, 2013. Additionally, the Company has 2,000,000

Series "B" Convertible Preferred Stock outstanding. On December 12,

2013 the Company affected a 1:5,000 reverse split of its common

shares (with a provision that no shareholder will have less than

100 shares after the reverse split). As a result of this reverse

split, the Company's outstanding common shares decreased from

4,099,099,952 to 848,992.

The Series "B" Preferred Stock is at all times convertible into

no less than 51% of the aggregate amount of outstanding Common

Stock, inclusive of the Common Shares to be issued to the Series

"B" Preferred Stock, assuming all the Series "B" Preferred Stock is

converted (but not less than 2,000,000 shares).

After the 2013 reverse split, the Company issued 50,000 common

shares to its outside counsel for legal services. Additionally

options and warrants were issued to employees and consultants

allowing for the purchase of up to 4,175,000 common shares at a per

share price of 25 cents.

During 2013, the Company commenced an offering of its two-year

9% Series "A" Convertible Notes. The notes have a conversion price

of $1.43 per share and each $25,000 note includes a warrant to

purchase 17,500 shares at $2.00 per share. Through the date of this

news release, a total of $175,000 of the Series "A" Convertible

Notes has been placed.

In April 2012, the Company granted the Company's Chief Executive

Officer an option to acquire up to 10,000,000 shares of the

Company's for three cents per share.

At December 31, 2012, the Company entered into a line of credit

arrangement with an affiliate of its management. The credit

agreement, as amended, allows the Company to borrow up to $30,000

through December 31, 2015 when the credit agreement matures and is

due and payable. The credit agreement bears interest at a rate of

12% per annum, compounded monthly. Substantially all of the

Company's assets are pledged to secure borrowings under the credit

agreement, subject to subordination to the Series "A" Convertible

Notes.

In February of 2013, certain members of the Company's management

contributed real estate management contracts to the Company for

which they received no direct compensation.

At December 31, 2013, the Company was authorized to issue up to

200,000,000 shares of Common Stock at $0.00001 par value per share

and up to 2,000,000 shares of Series "B" Preferred Stock at

$0.00001 par value per share.

ABOUT BENEFICIAL

HOLDINGS, INC.

Beneficial Holdings, Inc. is a holding company seeking to

acquire and invest in operating service-oriented businesses in the

real estate, financial services and energy management sectors. For

more information on the Company please visit our web site at

www.beneficial-holdings.net.

FORWARD-LOOKING

STATEMENTS

This news release may contain forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934. As a general

matter, forward-looking statements reflect our current expectations

and projections relating to our financial condition, results of

operations, plans, objectives, future performance and business.

These statements may be identified by the use of forward-looking

terminology such as "may", "will", "expects", "plans", "estimates",

"anticipates", "projects", "intends", "believes", "outlook" and

similar expressions.

The forward-looking statements contained in this news release

are based upon our historical performance, current plans,

estimates, expectations and other factors we believe are

appropriate under the circumstances. The inclusion of this

forward-looking information is inherently subject to risks and

uncertainties, many of which cannot be predicted with accuracy and

some of which might not even be anticipated. Future events and

actual results, financial and otherwise, may differ materially from

the results discussed in the forward-looking statements. Statements

regarding the following subjects, among others, may be

forward-looking: our business and investment strategy; our

projected operating results; estimates relating to our ability to

make distributions to our stockholders in the future and economic

trends and economic recoveries.

All information in this release is as of April 3, 2014. The

Company does not undertake a duty to update forward-looking

statements, including its projected operating results. Readers are

cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date of this news release.

The Company may, in its discretion, provide information in future

public announcements regarding its outlook that may be of interest

to the investment community.

CONTACT: GREG McANDREWS & ASSOCIATES Gregory A. McAndrews

(310) 804-7037 greg@gregmcandrews.com

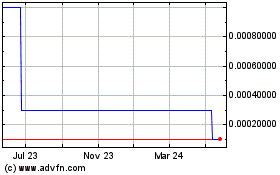

Beneficial (CE) (USOTC:BFHJ)

Historical Stock Chart

From Jan 2025 to Mar 2025

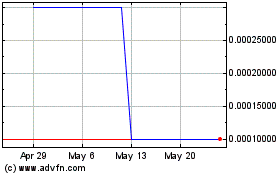

Beneficial (CE) (USOTC:BFHJ)

Historical Stock Chart

From Feb 2024 to Mar 2025