Bitminer.CC LTD, a Wholly-Owned Subsidiary of First Bitcoin Capital Corp., (OTCMarkets: BITCF) Enters Into MOU, Signs Non-dis...

17 April 2014 - 5:00PM

Access Wire

VANCOUVER, B.C / ACCESSWIRE / April, 17, 2014 / Bitminer.cc LTD,

a wholly-owned subsidiary of First Bitcoin Capital Corp., is

pleased to announce that it has entered into a memorandum of

understanding to acquire the assets of Bitcoin mining company

Alydian.

Due to a previously signed non-disclosure agreement and relevant

SEC regulations, the companies can not disclose the terms of the

MOU at this time.

Alydian, a portfolio company of venture-backed Bitcoin business

incubator CoinLab, Inc., was launched in 2012 to deliver

enterprise-scale turnkey Bitcoin mining services for qualified

customers.

Located in several U.S. data centers, Alydian’s Bitcoin hardware

is capable of mining Bitcoins at approximately 215 terahashes per

second. The company’s Bitcoin mining rigs were designed to solve

complex mathematical algorithms in order to mine the virtual

currency.

Alydian is ranked as one of the top three Bitcoin miners on

BTCGuild.com, one of the world’s largest Bitcoin mining pools where

multiple mining companies combine their computer processing

resources to generate bitcoins.

First Bitcoin Capital Corp. said the move signifies a vital step

in its plan to expand its mining operations.

“Since First Bitcoin Capital Corp. is the first

vertically-integrated publically traded Bitcoin consolidator, we

believe that being involved in mining and manufacturing of Bitcoin

mining hardware will give us an advantage in this fast-growing

crypto-currency arena”- management commented.

The company said its hardware integrates a custom-designed

application-specific integrated circuit, or ASIC, a microchip that

is designed to perform the hashing algorithms necessary to verify

transactions on the Bitcoin network and mine coin. Eventually, the

company plans to develop its own bitcoin mining technology.

“We plan on initiating a mass production of chips using 20nm

process technology, which will allow us to make very complex and

highly-integrated system on chips.”

Mining Bitcoin and other digital currency requires the operation

of expensive and powerful computing equipment, which uses

substantial amounts of electricity to perform complex algorithms.

The mining process gets increasingly difficult as more Bitcoins are

mined, driving the demand for computing power even higher.

Industry experts say that while prospecting may not be an ideal

investment for the average individual, it can lead to massive

potential earnings for large bitcoin mining companies that are able

to scale operations and save costs on cooling and power, while

making their computers more efficient and cost effective.

At least two of the top mining companies have generated profits

solely from mining. Stockholm-based KnCMiner’s computers mined

21,000 Bitcoins, according to the company’s co-founder. The chief

executive officer of Cloud Hashing, which allows individuals to buy

computing capacity and share in profits, said the company mines

about $230,000 to $260,000 worth of Bitcoins per day.

About the company:

Bitminer.cc LTD was formed specifically to acquire and manage

Bitcoin mining assets on behalf of the company. Bitminer.cc LTD

plans to join the BTCGuild.com mining pool.

First Bitcoin Capital Corp. is a developing Canadian-based

mining company currently holding concessions of Gold in Venezuela

and is preparing to enter the crypto-currency industry. It is the

first publicly traded, vertically-integrated consolidation company

of the Bitcoin and crypto-currency marketplace.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS: This press

release includes various "forward-looking statements" within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended,

which represent the Company's expectations or beliefs concerning

future events. Statements containing expressions such as

"believes," "anticipates," "intends," or "expects," used in the

Company's press releases and in Disclosure Statements and Reports

filed with the Over the Counter Markets through the OTC Disclosure

and News Service are intended to identify forward-looking

statements. All forward-looking statements involve risks and

uncertainties. Although the Company believes its expectations are

based upon reasonable assumptions within the bounds of its

knowledge of its business and operations, there can be no

assurances that actual results will not differ materially from

expected results. The Company cautions that these and similar

statements included in this report are further qualified by

important factors that could cause actual results to differ

materially from those in the forward-looking statements. Readers

are cautioned not to place undue reliance on forward-looking

statements, which speak only as of the date thereof.

Contacts:

info@bitcoincapitalcorp.com

bitcoincapitalcorp.com

Source: First Bitcoin Capital Corp.

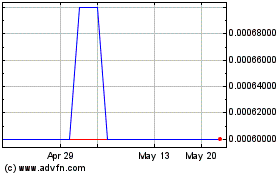

First Bitcoin Capital (PK) (USOTC:BITCF)

Historical Stock Chart

From Oct 2024 to Nov 2024

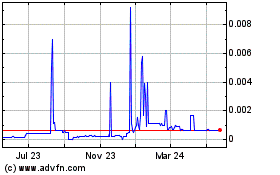

First Bitcoin Capital (PK) (USOTC:BITCF)

Historical Stock Chart

From Nov 2023 to Nov 2024