NetworkNewsWire Editorial Coverage: The cannabis market in the

U.S. and worldwide continues to grow, but that doesn’t mean

everyone is open to the idea of legal marijuana. The banking

industry is one example, as the Federal Deposit Insurance

Corporation (FDIC) has generally been unsupportive of backing

cannabis-related investments. Since marijuana hasn’t been legalized

at the federal level, most banks are hesitant to have any part of

the $6.7 billion marijuana industry. While many industry experts

expect this stance to change amid growing support for a bankable

marijuana industry, 70 percent of cannabis companies currently

operate without access to a corporate bank account. Industry

innovators are gearing up to fill this payments gap, however.

SinglePoint, Inc. (SING) (SING

Profile) recently announced an alternative payment

solution in partnership with First BitCoin Capital Corp.

(BITCF) to develop a bitcoin payment solution for the

marijuana industry. Other major players on the rising bitcoin

market include price-tracking Bitcoin Investment Trust

(GBTC) and a growing number of retailers, including

Overstock.com, Inc. (OSTK) and mobile gaming

company Zynga, Inc. (ZNGA), that are currently

accepting digital currencies.

A lack of bank support hasn’t deterred SinglePoint,

Inc. (SING) from aggressively expanding its market reach to the

29 states that have legalized medical marijuana. Demonstrative of

its insight into the opportunities afforded by mounting acceptance

and legalization of marijuana, SinglePoint recently announced its

partnership with First Bitcoin Capital (BITCF), a

leading provider of bitcoin technology, to create a viable payments

solution for unbanked cannabis businesses.

Using “blockchain

technology”, the solution will target high-risk payment

verticals and enable customers to use their credit or debit cards

at a medical/recreational cannabis dispensary – a capability that

will benefit customers as well as the swelling number of cannabis

suppliers and dispensaries across the nation.

"We are optimistic that our partnership with SinglePoint will

produce positive cash flow to our bottom line. Between the two of

our companies, we will have the ability to develop a best in class

solution and SinglePoint will be able to help in distribution. We

look forward to providing cutting edge products and services to all

states through the establishment of this new venture," Greg Rubin

of First Bitcoin Capital stated in the press release (http://nnw.fm/7XlMo).

This isn’t the first time SinglePoint has undertaken significant

integration. The company has successfully completed technology

integrations with Twilio, RedFynn and IATS, as well as ATT,

T-Mobile, Sprint and Verizon, enabling SinglePoint to provide its

text message marketing and text-based payment solutions. Leveraging

this experience, along with First Bitcoin Capital’s expertise, the

companies plan to develop payment technology that can be easily

implemented into any point-of-sale machine through a simple

download of the application.

SinglePoint, through its SingleSeed Payments subsidiary

(www.SingleSeed.com), already has its roots as a

payment solutions provider to the cannabis industry. SingleSeed

Payments delivers tools and support specifically crafted to help

cannabis businesses stay on top of key issues in the retail and

recreational markets in order to build their customer base and

develop effective strategies.

As SinglePoint continues to diversify its investment portfolio

(http://nnw.fm/Ds3d9) – which includes a stake

in Convectium, the manufacturer and distributor of an innovative

equipment and packaging solution in the cannabis industry, and

Discount Indoor Garden Supply (“DIGS”) – the company is proving its

foresight into the demand for new capabilities and technologies

such as digital currency and is also set to benefit from

anticipated investments in cannabis (http://nnw.fm/i3WwI).

The demand for bitcoin isn’t only on the retail side, however.

It is also gaining ground in the investment community.

Recently named to OTC Markets Group’s “OTCQX Best 50” for 2017,

Bitcoin Investment Trust (GBTC) enables investors

to gain exposure to bitcoin’s price movement through a traditional

investment vehicle, sidestepping the challenges of buying, storing

and safekeeping bitcoins. Bitcoin Investment Trust’s shares are the

first publicly quoted securities that are solely invested in and

deriving value from the price of bitcoin. Bitcoin Investment Trust

is sponsored by Grayscale, a digital currency group company, which

is also a sponsor of the Ethereum Classic Investment Trust.

Digital currencies are on track to transform finance, and the

potential application of this technology goes well beyond the

cannabis industry and the borders of the United States. In Japan,

for example, experts forecast bitcoin will soon be accepted in

260,000 stores. Though not on par with the pace overseas, more

U.S.-based retailers are participating in the growing phenomena of

“Internet money.”

Overstock.com (OSTK), in 2014, became the first

major U.S. retailer to accept bitcoin. A brief two years, later

Overstock began to issue stock over the Internet, becoming the

first publicly traded company to do so. According to a December

2016 article at Wired.com, Overstock distributed more than 126,000

shares via bitcoin blockchain. Controlled by a global network of

computers, this blockchain (an online ledger) isn’t controlled by

any government or single company, which adds to its allure. It

tracks all financial exchanges. In addition to money, it can track

stocks and bonds as well. Blockchain shares are driven through a

broker and other middlemen to satisfy regulatory requirements,

making them not much unlike a stock offering.

Zynga (ZNGA) was also among the first to jump

into digital currency. The mobile gaming provider, which was

recently upgraded to an Overweight rating at Morgan Stanley, in

January 2014 took note of rising popularity of bitcoin and, via

Reddit, announced it would begin testing the currency as payment

for in-game purchases. At the time, bitcoin was priced around

$1,200. Today, one bitcoin is the equivalent to more than

$2,715.

From consumer products at Overstock.com to high-risk verticals

such as cannabis, digital currency continues to pick up momentum

worldwide. With a nod to the need for payment solutions in the

marijuana industry, SinglePoint is on track to become the preferred

payment solution in the marijuana industry, which is predicted to

grow to $24 billion by the year 2026, based on New Frontier

projections.

For more information on SinglePoint please visit: Singlepoint

(SING) or www.SinglePoint.com

About NetworkNewsWire

NetworkNewsWire (NNW) is an information service that provides to

users (1) access to our news aggregation and syndication servers,

(2) enhanced press release services, and (3) a full array of social

communication solutions. As a multifaceted financial news and

content distribution company with an extensive team of contributing

journalists and writers, NNW is uniquely positioned to best serve

private and public companies that desire to reach a wide audience

of investors, consumers, journalists and the general public. NNW

has an ever-growing distribution network of more than 5,000 key

syndication outlets across the country. By cutting through the

overload of information in today's market, NNW brings its clients

unparalleled visibility, recognition and brand awareness. NNW is

where news, content and information converge.

NetworkNewsWire (NNW)

New York, New York

www.NetworkNewsWire.com

212.418.1217 Office

Editor@NetworkNewsWire.com

Please see full terms of use and disclaimers on the

NetworkNewsWire website applicable to all content provided by NNW,

wherever published or re-published: http://NNW.fm/Disclaimer

DISCLAIMER: NetworkNewsWire (NNW) is the source of the Article

and content set forth above. References to any issuer other than

the profiled issuer are intended solely to identify industry

participants and do not constitute an endorsement of any issuer and

do not constitute a comparison to the profiled issuer. The

commentary, views and opinions expressed in this release by NNW are

solely those of NNW. Readers of this Article and content agree that

they cannot and will not seek to hold liable NNW for any investment

decisions by their readers or subscribers. NNW are a news

dissemination and financial marketing solutions provider and are

NOT registered broker-dealers/analysts/investment advisers, hold no

investment licenses and may NOT sell, offer to sell or offer to buy

any security.

The Article and content related to the profiled company

represent the personal and subjective views of the Author, and are

subject to change at any time without notice. The information

provided in the Article and the content has been obtained from

sources which the Author believes to be reliable. However, the

Author has not independently verified or otherwise investigated all

such information. None of the Author, NNW, or any of their

respective affiliates, guarantee the accuracy or completeness of

any such information. This Article and content are not, and should

not be regarded as investment advice or as a recommendation

regarding any particular security or course of action; readers are

strongly urged to speak with their own investment advisor and

review all of the profiled issuer's filings made with the

Securities and Exchange Commission before making any investment

decisions and should understand the risks associated with an

investment in the profiled issuer's securities, including, but not

limited to, the complete loss of your investment.

NNW HOLDS NO SHARES OF ANY COMPANY NAMED IN THIS RELEASE.

This release contains "forward-looking statements" within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E the Securities Exchange Act of 1934, as amended and

such forward-looking statements are made pursuant to the safe

harbor provisions of the Private Securities Litigation Reform Act

of 1995. "Forward-looking statements" describe future expectations,

plans, results, or strategies and are generally preceded by words

such as "may", "future", "plan" or "planned", "will" or "should",

"expected," "anticipates", "draft", "eventually" or "projected".

You are cautioned that such statements are subject to a multitude

of risks and uncertainties that could cause future circumstances,

events, or results to differ materially from those projected in the

forward-looking statements, including the risks that actual results

may differ materially from those projected in the forward-looking

statements as a result of various factors, and other risks

identified in a company's annual report on Form 10-K or 10-KSB and

other filings made by such company with the Securities and Exchange

Commission. You should consider these factors in evaluating the

forward-looking statements included herein, and not place undue

reliance on such statements. The forward-looking statements in this

release are made as of the date hereof and NNW undertake no

obligation to update such statements.

Source:

NetworkNewsWire

Contact:

NetworkNewsWire (NNW)

New York, New York

www.NetworkNewsWire.com

212.418.1217 Office

Editor@NetworkNewsWire.com

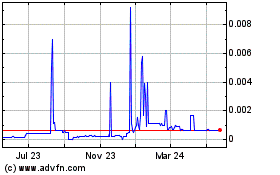

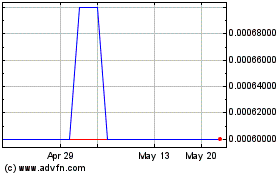

First Bitcoin Capital (PK) (USOTC:BITCF)

Historical Stock Chart

From Oct 2024 to Nov 2024

First Bitcoin Capital (PK) (USOTC:BITCF)

Historical Stock Chart

From Nov 2023 to Nov 2024