Federal Reserve Board, FDIC Identify Deficiencies in Credit Suisse, BNP Paribas Resolution Plans

17 December 2022 - 9:33AM

Dow Jones News

By Denny Jacob

The Federal Reserve Board and the Federal Deposit Insurance

Corp. on Friday said they identified two deficiencies in a 2021

plan submitted by Credit Suisse Group AG pertaining to a resolution

planning cash flow forecasting capabilities and governance for its

U.S. operations.

The agencies said they are requesting the Swiss bank resubmit a

revised resolution plan for its U.S. operations by May 31 that

demonstrates the governance weaknesses have been addressed and that

its next plan, due by July 2024, demonstrates the cash flow

forecasting weaknesses have been remediated.

The agencies also said they identified a shortcoming in BNP

Paribas SA's 2021 plan related to its continuity in resolution of

the bank's securities repurchase agreement activity for its U.S.

operations.

The resolution plans must describe a financial company's

strategy for rapid and orderly resolution in bankruptcy in the

event of its material financial distress or failure, the agencies

said.

The agencies' joint review assessed resolution plans for 71

domestic and foreign banking organizations.

Write to Denny Jacob at denny.jacob@wsj.com

(END) Dow Jones Newswires

December 16, 2022 17:18 ET (22:18 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

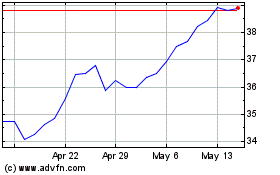

BNP Paribas (QX) (USOTC:BNPQY)

Historical Stock Chart

From Jan 2025 to Feb 2025

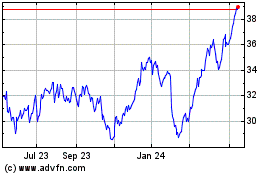

BNP Paribas (QX) (USOTC:BNPQY)

Historical Stock Chart

From Feb 2024 to Feb 2025

Real-Time news about BNP Paribas (QX) (OTCMarkets): 0 recent articles

More BNP Paribas (QX) News Articles