Bourque Industries, Inc. Announces $7.5M Equity Investment From Ironridge Technology Co.

10 June 2013 - 10:00PM

OTC Markets

Follow on investment clears path for

growth

Tucson, AZ June 10, 2013 ? Bourque

Industries, Inc. (Pink Sheets: BORK),

which is developing carbon metal alloys and related

product applications using a patented process called Kryron, announced today that it has entered

into a $7.5

million stock purchase agreement with Ironridge Technology

Co., an institutional investor that specializes in direct equity

investments in the technology sector. The Company plans to use the

proceeds from this investment to fund operational growth, make

additional strategic leadership additions, focus sales and

marketing channels, and work on resolving outstanding

liabilities.

Under the terms of the agreement, Bourque Industries

will issue Ironridge restricted convertible preferred stock as

funds are drawn down monthly. These are convertible into restricted

common stock at a fixed price of $0.04 per

share. Ironridge will

be unable to convert the preferred shares into common stock for at

least 6 months after each issuance. The preferred shares will earn

dividends of 8% per year for 18 years, subject to

adjustment.

The first Closing occurred

June 5, 2013 in which the Company

received $55,000.

Each subsequent Closing will take place on the first day of each

calendar month thereafter or sooner, at the Company's option if

certain conditions set forth in the Stock Purchase Agreement are

met. A

more detailed description of the private placement is contained in

the Company?s Supplemental Information Filing with OTC Markets on

June 7, 2013, seen here:

http://www.otcmarkets.com/financialReportViewer?symbol=BORK&id=106097.

The securities offered in this private placement have not been

registered under the Securities Act of 1933 and may not be offered

or sold in the United States absent registration with the U.S.

Securities and Exchange Commission or an applicable exemption from

such registration requirements.

?We are extremely impressed with the disruptive potential of the

Kryon technology, and are grateful for the opportunity to help

facilitate the Company?s vision to better protect American

military, security and law enforcement personnel,? commented John

C. Kirkland,

Managing Director of Ironridge Global Partners.

"We are very pleased to make this follow-on commitment to Bourque

Industries, following our first $778,000 investment in

2012. We have a great

deal of trust and experience with Matt at the helm of multiple

public companies. He

and his teams have executed well against their stated plans, and

always fully performed as promised."

Matthew Schissler,

Chairman commented. "Let

this be a clear message to all of our partners, past, current and

future that the Bourque Industries ship is turning.? We have the necessary respected

financial partner and firepower in Ironridge Global to complete on

what we set out to do. Having secured this funding is a

major milestone for Bourque Industries, one that I personally take

with tremendous gratitude towards their willingness to continue to

partner with our organization.?

About Bourque Industries

Bourque Industries, Inc. is an advanced materials science company

that develops and produces metal alloys and related

product applications using our revolutionary metal-alloying

process, Kryron.

Kryronized alloys have shown global potential for paradigm-shifting

applications across a wide range of industries, including ballistic

armor, electrical, aviation, automotive, mining, medical devices,

agriculture and heavy equipment, consumer electronics, and

more. Our fundamental

goal is to establish broad market

penetration across a wide range of industries. Please visit

www.bourqueindustries.com.

CONTACT:

info@bourqueindustries.com

About Ironridge Technology

Co.

Ironridge Technology Co. is a division of Ironridge

Global IV, Ltd. that specializes in direct equity investments in

technology companies.

Ironridge Global Partners, LLC is an institutional investor, making

direct equity investments in small-cap and micro-cap public

companies. Ironridge Global has completed over 50 transactions

since 2011, ranging from under a quarter million to more than $15

million each, for Nasdaq, NYSE MKT, OTC Bulletin Board and Pink

Sheets companies. Ironridge Global Partner?s principals have

handled several hundred billion dollars in public company financing

transactions over more than two decades. Ironridge Global?s

extensive industry experience includes life sciences, energy,

natural resources, consumer products, media and technology. To

learn more about Ironridge Global Partners, please visit

http://www.ironridgeglobal.com.

Safe Harbor Statement:

This release includes

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933 and Section 27E of the Securities Act of

1934. Statements contained in this release that are not historical

facts may be deemed to be forward-looking statements. Investors are

cautioned that forward-looking statements are inherently uncertain.

Actual performance and results may differ materially from that

projected or suggested herein due to certain risks and

uncertainties including, without limitation, ability to obtain

financing and regulatory and shareholder approvals for anticipated

actions. Such statements are based on management's current

expectations and are subject to certain factors, risks and

uncertainties that may cause actual results, events and performance

to differ materially from those referred to or implied by such

statements. In addition, actual or future results may differ

materially from those anticipated depending on a variety of

factors, including continued maintenance of favorable license

arrangements, success of market research identifying new product

opportunities, successful introduction of new products, continued

product innovation, sales and earnings growth, ability to attract

and retain key personnel, and general economic conditions affecting

consumer spending. Readers are cautioned not to place undue

reliance on these forward-looking statements, which speak only as

of the date hereof. BORK does not intend to update any of the

forward-looking statements after the date of this release to

conform these statements to actual results or to changes in its

expectations, except as may be required by

law.

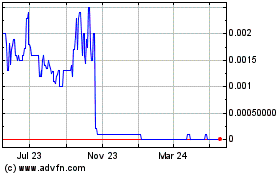

Bourque Industries (CE) (USOTC:BORK)

Historical Stock Chart

From Dec 2024 to Jan 2025

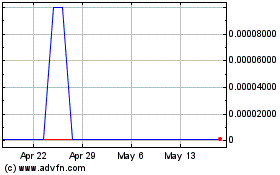

Bourque Industries (CE) (USOTC:BORK)

Historical Stock Chart

From Jan 2024 to Jan 2025