CaixaBank Targets Higher Profitability With 2019-21 Strategy

27 November 2018 - 6:09PM

Dow Jones News

By Pietro Lombardi and Nathan Allen

CaixaBank SA (CABK.MC) raised its profitability target Tuesday

as it presented its 2019-21 strategic plan ahead of its investor

day.

The Spanish bank targets a return on tangible equity--a key

measure of profitability--of above 12% by the end of 2021. This

compares with a previous target of between 9% and 11% for 2018.

It confirmed it expects to pay a cash dividend of at least 50%

of consolidated net profit.

The lender also sees it core tier 1 capital, a key measure of

capital strength, at 12% by the end of 2021.

CaixaBank's fully loaded CET1 ratio was stable at 11.4% at the

end of September, the bank said in its third-quarter results, while

its RoTE stood at 9.4%.

During the 2019-2021 period CaixaBank expects core revenue to

grow at a compound annual rate of around 5%, outpacing expected

compound growth of 3% in recurring expenses.

Net interest income is seen growing at a compound annual rate of

5% in the period, compared with around 4% for fee and commission

income and between 9% and 10% for insurance income.

Write to Pietro Lombardi at pietro.lombardi@dowjones.com and

Nathan Allen at nathan.allen@dowjones.com

(END) Dow Jones Newswires

November 27, 2018 01:54 ET (06:54 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

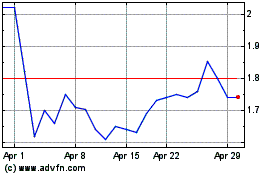

Caixabank (PK) (USOTC:CAIXY)

Historical Stock Chart

From Oct 2024 to Nov 2024

Caixabank (PK) (USOTC:CAIXY)

Historical Stock Chart

From Nov 2023 to Nov 2024

Real-Time news about Caixabank (PK) (OTCMarkets): 0 recent articles

More Caixabank (PC) News Articles