CAVU Resources, Inc. Completes the Second Phase of Chisholm Lease Rework

15 March 2011 - 7:24AM

Marketwired

CAVU Resources, Inc. ("CAVU"), which trades as (PINKSHEETS: CAVR),

announced today the completion of its second phase of the Chisholm

Lease rework.

Garvin County, OK - Chisholm Lease Project

The Chisholm Lease Project is located in an area that stretches

from Paul's Valley to the Texas/Oklahoma state line and covers

approximately 290 square miles. The area contains over 90 wells

that were drilled between the late 1970's and early 2000's. Most of

these wells are currently shut-in and can be secured, reworked and

systematically put back into production starting with ones closest

CAVU's existing lease.

CAVU currently owns 190 acres with 9 existing wells, 4 of which

were reworked in 2009, 2010 and 2011. By using this approach, CAVU

could eventually work its way through the area consisting of more

than 3,000 acres and 90 additional shut-in wells, of which 30 are

known to be commercially viable wells that could be put back into

production at an estimated cost of approximately $188,000 per well.

CAVU has invested along with its partners approximately $1.8

million dollars in this existing project. Some of these wells also

have other potentially productive intervals that could be

perforated and co-produced utilizing horizontal drilling based on

similar projects could possibly increase cumulative production to

as much as 300 BOPD.

Chisholm Project

- Located about 1.5 hours south of Oklahoma City, OK

- In the historically prolific Washita River Valley

- Established oil and gas field

- Numerous historical wells completed in basal creek and oil

creek zones

- 87%+ success rate when drilling for oil in these zones

- Nine wells on the lease have multiple production zones

- The Layton at 2800'

- The McKinney at 2950'

- The Burns at 3025'

- The Second Bromide at 3050'

- The Tulip Creek at 3100'

- The McLish at 3200'

- The Upper Oil Creek sand at 3680'

- The Arbuckle at 3900'

- Most wells on the lease have produced from the Burns, Second

Bromide, McLish and Oil Creek

- Estimated cumulative production for a well completed in the

Basal Oil Creek sand is between 50,000 and 350,000 barrels of oil,

with total recoverable in all zone estimated to be 350,000 to

500,000 barrels of oil

CAVU has replaced the gathering system, wells, tanks, and

production equipment, with planned future leases and new wells to

be consolidated at CAVU's facilities. CAVU has already completed

the rework of 3 production wells and the rework and increased

volume permits on the current disposal well that can later be

converted to a producing well. The 3 existing wells had recent

servicing (cleaning out the well bores, acidizing the perforations

and in some cases perforating new potentially productive

reservoirs). It should be noted that of the 2 wells that have been

in production since 2009, one well tested at about 35 BOPD and

another at 10 BOPD with one well being acidized and new tubing

valves and pumps. Currently the company is completing another

producing well that has tested at 10 to 20 BOPD scheduled to be in

production in the next two weeks.

While service work is being done on these wells and new wells

are planned to be drilled, the CAVU land team plans to begin

working with people in the area who have shut-in wells on their

land. There are more than 50 of the known 90 viable wells that are

contiguous to this acreage position and within immediate range of

the CAVU gas gathering capabilities. Preliminary talks suggest that

a majority of these shut-in wells can be acquired at a huge

discount to their value so long as CAVU can get them into operation

within a few months. If CAVU were to be successful in

systematically working its way out towards wells beyond these

initial 50 wells, there are also about another 200 other wells in

the general area that are shut-in with most believed to be

commercially viable.

CAVU believes that within 12 months of acquisition of 30-50

shut-in wells that the commercially viable wells can be turned on,

which is estimated to result in additional production ranging

anywhere between 300-700 BOPD in production. Management is

utilizing conservative forecasts of 700 BOPD for production rates

after drilling the new wells and putting these 30-50 wells into

production.

Project Strengths

The positive aspects for developing shallow gas and oil

production in this area are:

- Location to strong and insulated gas markets with taps into

major pipelines, ample infrastructure and good availability of

service companies.

- Multiple pay zones at shallow depths with several zones that

blanket the area, making it feasible to complete a well nearly

every time one is drilled while keeping drilling risk low.

- Land is predominantly fee simple with pro-industry regulators

who encourage exploration.

CAVU plans to submit additional updates on production and its

other producing and speculative leases as well as yearend

financials and updated information statements by the end of

March.

About CAVU Resources, Inc.

During World War II, Navy fighter pilots would look up at the

sky and if it was a "CAVU" day then it meant ceiling and visibility

unlimited. The pilots believed they would have unobstructed flying

allowing them to see their targets quicker, identify the obstacles

they needed to overcome, giving them a greater chance of success.

The founders of CAVU Resources, Inc., chose the name CAVU because

they believe that the company will be the embodiment of its

name.

CAVU was formed with the goal of becoming a recognized regional

player in the independent oil and natural gas industry by growing

the company's oil and natural gas reserves. CAVU is a natural

resource company engaged in the acquisition, exploration and

development of oil and natural gas properties. The Company operates

in the upstream segment of the oil and gas industry with planned

activities including the drilling, completion and operation of oil

and gas wells in Oklahoma, Kansas, Colorado and Texas. The Company

also owns two pipelines in its area of operations, which will be

used for gathering its gas and oil and the gas and oil production

of other producers. The Company has acquired leases and is

currently exploring additional opportunities in oil, gas and helium

leases. The company has acquired significant oil and gas equipment

including rigs, trucks and completion equipment.

CAVU's 100% owned subsidiaries, CAVU Energy Services, LLC

provides contract drilling, fracture stimulation and directional

drilling services to oil, natural gas exploration and production

companies. EnviroTek Fuel Systems, Inc., provides natural gas

delivery and marketing thru its own pipelines, FILO quip Resources,

LLC a licensed Oil and Gas Operating Company manages the company's

properties and leases in Oklahoma, Colorado and Montana. CAVU plans

to expand operations not only in the traditional Oil and Gas

business, but also to invest in Geo-Thermal, Wind, taking advantage

of the changing environment and in the world's need for new, green

and innovative resources. More information is available at the

company's website at http://www.cavu-resources.com.

Cautionary note: This report contains

forward-looking statements, particularly those regarding cash flow,

capital expenditures and investment plans. Resource estimates,

unless specifically noted, are considered speculative. By their

nature, forward-looking statements involve risk and uncertainties

because they relate to events and depend on factors that will or

may occur in the future. Actual results may vary depending upon

exploration activities, industry production, commodity demand and

pricing, currency exchange rates, and, but not limited to, general

economic factors. Cautionary Note to U.S. investors: The U.S.

Securities and Exchange Commission specifically prohibits the use

of certain terms, such as "reserves'' unless such figures are based

upon actual production or formation tests and can be shown to be

economically and legally producible under existing economic and

operating conditions.

Contact: CAVU Resources, Inc.

info@cavu-resources.com (PINKSHEETS: CAVR) 5147 South

Harvard Ave, Suite 138 Tulsa, OK 74135 Tel: 505-722-7402 Fax:

918-782-0776

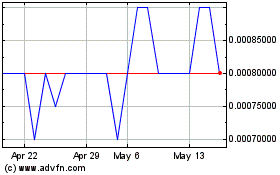

CAVU Resources (PK) (USOTC:CAVR)

Historical Stock Chart

From Jun 2024 to Jul 2024

CAVU Resources (PK) (USOTC:CAVR)

Historical Stock Chart

From Jul 2023 to Jul 2024