Ant Financial's Latest Fundraising Led by China Investment Corp.

08 April 2016 - 4:30PM

Dow Jones News

China's sovereign-wealth fund, China Investment Corp., is among

the investors leading the latest fundraising round by Alibaba Group

Holding Ltd.'s financial-services affiliate Ant Financial Services

Group, which will value the company at around $60 billion,

according to people familiar with the situation.

Ant Financial, China's most valuable Internet finance company,

is raising funds from new and existing investors after receiving

strong demand for its shares, according to people familiar with the

situation. The Wall Street Journal reported in March that Ant

Financial was planning to raise up to 20 billion yuan ($3.1

billion) at a valuation of more than $50 billion. The funds being

raised now will exceed that amount, the people said.

China Investment Corp. and China Construction Bank Corp. are

lead investors for the latest round, which includes several of

China's biggest insurance companies and a handful of other small

investors, people familiar with the situation said. The funding

round is expected to close by the end of the month, the people

said.

The fresh fundraising will give the operator of popular Chinese

online payments platform Alipay more financial muscle as it buys

stakes in businesses ranging from a Chinese lottery company to

China's Postal Savings Bank.

It also sets the stage for Ant Financial's future initial public

offering—the most anticipated Chinese share offering on the

horizon. The company doesn't have a timeline for an initial public

offering yet, Ant Financial's vice president Cyril Han told an

audience at a conference in Hong Kong this week. Bankers have said

previously that they expected an IPO for Ant Financial as early as

2017, potentially on a local Chinese stock exchange.

Ant Financial runs the Alipay Internet payments platform,

China's largest, which used to be part of Alibaba. The group's

chairman Jack Ma controversially separated the payment unit from

the e-commerce company and brought it under his control, drawing

criticism from major shareholder Yahoo Inc. Alibaba said the

separation was driven by Chinese government rules that could limit

the ability of Alipay to provide certain payment services if it

wasn't a domestic company.

Ant Financial, with more than 400 million annual active users,

operates a number of products closely linked with Alibaba's

e-commerce and online marketplace businesses, including Alipay,

online money-market fund Yu'e Bao and MYbank.

Goldman Sachs Group Inc., J.P. Morgan Chase & Co. and China

International Capital Corp. Ltd. are advising Ant Financial on the

current fundraising, according to people familiar with the

situation.

Ant Financial raised more than 12 billion yuan ($1.9 billion)

last year in its first round of fundraising, attracting a dozen

outside investors led by China's national social security fund.

China's four biggest insurance companies—China Pacific Insurance

Group, People's Insurance Company of China, China Life Insurance

Co. and New China Life Insurance Co. Ltd.—each took stakes,

according to Ant Financial shareholding records. Those disclosures

also confirmed that private-equity firm Primavera Capital, led by

former Goldman Sachs partner Fred Hu, is a shareholder.

Other investors include national postal service China Post

Group, Chinese policy lender China Development Bank and state-owned

Shanghai Financial Development Investment Fund.

Write to Kane Wu at Kane.Wu@wsj.com and Rick Carew at

rick.carew@wsj.com

(END) Dow Jones Newswires

April 08, 2016 02:15 ET (06:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

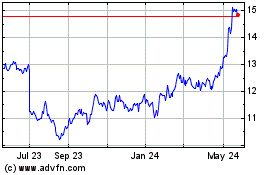

China Construction Bank (PK) (USOTC:CICHY)

Historical Stock Chart

From Dec 2024 to Jan 2025

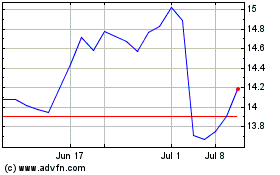

China Construction Bank (PK) (USOTC:CICHY)

Historical Stock Chart

From Jan 2024 to Jan 2025