false

0001770561

0001770561

2024-09-23

2024-09-23

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

|

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549 |

FORM 8-K

|

|

CURRENT

REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

|

Date

of report (date of earliest event reported): September 23, 2024

|

Coronado

Global Resources Inc.

(Exact name of registrant as specified in

its charter)

|

Delaware

(State

or other jurisdiction

of incorporation) |

000-56044

(Commission

File Number) |

83-1780608

(IRS Employer

Identification No.) |

Level

33, Central Plaza One, 345 Queen

Street

Brisbane,

Queensland, Australia

(Address of principal

executive offices) |

4000

(Zip Code) |

| Registrant’s

telephone number, including area code: (61)

7 3031 7777 |

| |

Not

Applicable

(Former name or former address, if changed

since last report)

|

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c))

Securities

registered pursuant to Section 12(b) of the Act:

|

| Title

of each class |

Trading

Symbol(s) |

Name

of each exchange on which

registered |

| None |

None |

None |

Indicate by check mark whether the registrant is

an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 7.01. |

Regulation FD Disclosure. |

Secured Notes Offering

On September 23, 2024 (September 23,

2024 in Australia), Coronado Global Resources Inc. (the “Company”) announced the commencement of an offering (the “Notes Offering”) by Coronado Finance Pty Ltd, a wholly-owned subsidiary of the Company (the “Issuer”),

of $400

million aggregate principal amount of senior secured notes due 2029 (the “Notes”) through a private placement to persons reasonably

believed to be qualified institutional buyers in the United States pursuant to Rule 144A under the Securities Act of 1933, as amended

(the “Securities Act”) and outside the United States pursuant to Regulation S under the Securities Act.

The Notes will be guaranteed on a senior secured

basis by the Company and certain of the Company’s subsidiaries (each, a “Note Guarantor”) that guarantee or is a borrower

under the Company’s ABL Facility (as defined below) or certain other debt and secured by (i) a first-priority lien on substantially

all of the assets of the Issuer and each Note Guarantor (other than accounts receivable and certain other rights to payment, inventory,

certain investment property, certain general intangibles and commercial tort claims, deposit accounts, securities accounts and other related

assets, chattel paper, letter of credit rights, certain insurance proceeds, intercompany indebtedness and certain other assets related

to the foregoing and proceeds and products of each of the foregoing (collectively, the “ABL Priority Collateral”)) and (ii) a

second-priority lien on the ABL Priority Collateral, which is junior to a first-priority lien for the benefit of the lenders and other

creditors under the Company’s asset-based revolving credit facility, dated as of May 8, 2023 (the “ABL Facility”),

in each case, subject to certain exceptions and permitted liens.

The Company intends to use the proceeds from the

Notes Offering (i) to redeem all of the Issuer’s outstanding 10.750% Senior Secured Notes due 2026 (the “Existing Notes”),

(ii) to pay related fees and expenses in connection with the Notes Offering and the Existing Notes Redemption (as defined below)

and (iii) for general corporate purposes.

This Current Report on Form 8-K does not

constitute an offer to sell or the solicitation of an offer to buy the Notes or any other securities nor shall there be any sale of securities

in any jurisdiction in which such offer, solicitation or sale would be unlawful. The Notes and the related guarantees have not been registered

under the Securities Act, or the securities laws of any state or other jurisdiction, and may not be offered or sold in the United States

without registration or an applicable exemption from the Securities Act and applicable state securities or blue sky laws and foreign securities

laws.

Existing Notes Redemption

On September 23, 2024, the Company further

announced that it had issued a conditional notice of redemption (the “Notice”) pursuant to the indenture governing the Existing

Notes. The Issuer intends to redeem, subject to the condition described below, $242,326,000 of the outstanding Existing Notes on October 3,

2024 (the “Redemption Date”) at a redemption price equal to 104.031% of the principal amount of the Existing Notes redeemed,

plus accrued and unpaid interest to, but excluding, the Redemption Date (the “Existing Notes Redemption”). The Existing Notes

Redemption is conditioned on the Issuer receiving funds from one or more debt financings, on terms and conditions acceptable to the Issuer

in its sole and absolute discretion, that, collectively, provide net proceeds sufficient to pay the redemption price in full and all fees

and expenses related to such debt financings and the Existing Notes Redemption (the “Financing Condition”). If the Financing

Condition is not satisfied on or prior to the Redemption Date, the Notice may be rescinded by the Issuer and will be of no effect.

This Current Report on Form 8-K does not

constitute an offer to purchase, a notice of redemption or a solicitation of an offer to purchase any of the Existing Notes.

The information contained in this Current Report

on Form 8-K is being furnished and shall not be deemed to be filed for the purposes of Section 18 of the Securities Exchange

Act of 1934 (the “Exchange Act”), or incorporated by reference into any filing under the Securities Act or the Exchange Act,

unless such subsequent filing specifically references this Current Report on Form 8-K.

Forward-Looking Statements

This Current Report on Form 8-K contains

certain “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of

the Exchange Act, concerning our business, operations, financial performance and condition, the coal, steel and other industries, as well

as our plans, objectives and expectations for our business, operations, financial performance and condition. Forward-looking statements

may be identified by words such as “may,” “could,” “believes,” “estimates,” “expects,”

“intends,” “plans,” “anticipate,” “forecast,” “outlook,” “target,”

“likely,” “considers” and other similar words. Any forward-looking statements involve known and unknown risks,

uncertainties, assumptions and other important factors that could cause actual results, performance, events or outcomes to differ materially

from the results, performance, events or outcomes expressed or anticipated in these statements, many of which are beyond our control.

Such forward-looking statements are based on an assessment of present economic and operating conditions on a number of best estimate assumptions

regarding future events and actions. These factors are difficult to accurately predict and may be beyond our control. Factors that could

affect our results, our announced plans, or an investment in our securities include, but are not limited to: the prices we receive for

our coal; uncertainty in global economic conditions, including the extent, duration and impact of ongoing civil unrest and wars, as well

as risks related to government actions with respect to trade agreements, treaties or policies; a decrease in the availability or increase

in costs of key supplies, capital equipment or commodities, such as diesel fuel, steel, explosives and tires, as the result of inflationary

pressures or otherwise; the extensive forms of taxation that our mining operations are subject to, and future tax regulations and developments.

For example, the amendments to the coal royalty regime implemented in 2022 by the Queensland State Government in Australia introducing

higher tiers to the coal royalty rates applicable to our Australian Operations; concerns about the environmental impacts of coal combustion

and greenhouse gas, or GHG emissions, relating to mining activities, including possible impacts on global climate issues, which could

result in increased regulation of coal combustion and requirements to reduce GHG emissions in many jurisdictions, including federal and

state government initiatives to control GHG emissions could increase costs associated with coal production and consumption, such as costs

for additional controls to reduce carbon dioxide emissions or costs to purchase emissions reduction credits to comply with future emissions

trading programs, which could significantly impact our financial condition and results of operations, affect demand for our products or

our securities and reduce access to capital and insurance; severe financial hardship, bankruptcy, temporary or permanent shut downs or

operational challenges of one or more of our major customers, including customers in the steel industry, key suppliers/contractors, which

among other adverse effects, could lead to reduced demand for our coal, increased difficulty collecting receivables and customers and/or

suppliers asserting force majeure or other reasons for nonperforming their contractual obligations to us; our ability to generate sufficient

cash to service our indebtedness and other obligations; our indebtedness and ability to comply with the covenants and other undertakings

under the agreements governing such indebtedness; our ability to collect payments from our customers depending on their creditworthiness,

contractual performance or otherwise; the demand for steel products, which impacts the demand for our metallurgical coal; risks inherent

to mining operations could impact the amount of coal produced, cause delay or suspend coal deliveries, or increase the cost of operating

our business; the loss of, or significant reduction in, purchases by our largest customers; risks unique to international mining and trading

operations, including tariffs and other barriers to trade; unfavorable economic and financial market conditions; our ability to continue

acquiring and developing coal reserves that are economically recoverable; uncertainties in estimating our economically recoverable coal

reserves; transportation for our coal becoming unavailable or uneconomic for our customers; the risk that we may be required to pay for

unused capacity pursuant to the terms of our take-or-pay arrangements with rail and port operators; our ability to retain key personnel

and attract qualified personnel; any failure to maintain satisfactory labor relations; our ability to obtain, renew or maintain permits

and consents necessary for our operations; potential costs or liability under applicable environmental laws and regulations, including

with respect to any exposure to hazardous substances caused by our operations, as well as any environmental contamination our properties

may have or our operations may cause; extensive regulation of our mining operations and future regulations and developments; our ability

to provide appropriate financial assurances for our obligations under applicable laws and regulations; assumptions underlying our asset

retirement obligations for reclamation and mine closures; any cyber-attacks or other security breaches that disrupt our operations or

result in the dissemination of proprietary or confidential information about us, our customers or other third parties; the risk that we

may not recover our investments in our mining, exploration and other assets, which may require us to recognize impairment charges related

to those assets; risks related to divestitures and acquisitions; the risk that diversity in interpretation and application of accounting

principles in the mining industry may impact our reported financial results and our ability to successfully repurchase and/or redeem the

Existing Notes.

For additional factors affecting the business

of the Company, refer to Part I – Item 1A. Risk Factors of our Annual Report on Form 10-K for the year ended December 31,

2023 filed with the Securities and Exchange Commission (the “SEC”) and the Australian Securities Exchange (“ASX”)

on February 20, 2024, as modified by Part II, Item 1A. of our Quarterly Report on Form 10-Q for the period ended June 30,

2024, filed with the SEC and ASX on August 5, 2024, and other filings filed with the SEC.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Coronado Global Resources Inc. |

| |

|

| |

By: |

/s/ Gerhard Ziems |

| |

Name: |

Gerhard Ziems |

| |

Title: |

Group Chief Financial Officer |

| |

|

| |

Date: |

September 23, 2024 |

v3.24.3

Cover

|

Sep. 23, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Sep. 23, 2024

|

| Entity File Number |

000-56044

|

| Entity Registrant Name |

Coronado

Global Resources Inc.

|

| Entity Central Index Key |

0001770561

|

| Entity Tax Identification Number |

83-1780608

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

Level

33, Central Plaza One

|

| Entity Address, Address Line Two |

345 Queen

Street

|

| Entity Address, City or Town |

Brisbane,

Queensland

|

| Entity Address, Country |

AU

|

| Entity Address, Postal Zip Code |

4000

|

| City Area Code |

61

|

| Local Phone Number |

7 3031 7777

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

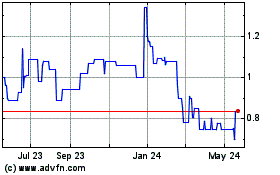

Coronado Global Resources (PK) (USOTC:CODQL)

Historical Stock Chart

From Feb 2025 to Mar 2025

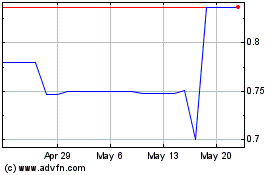

Coronado Global Resources (PK) (USOTC:CODQL)

Historical Stock Chart

From Mar 2024 to Mar 2025